Llc Documents

Description

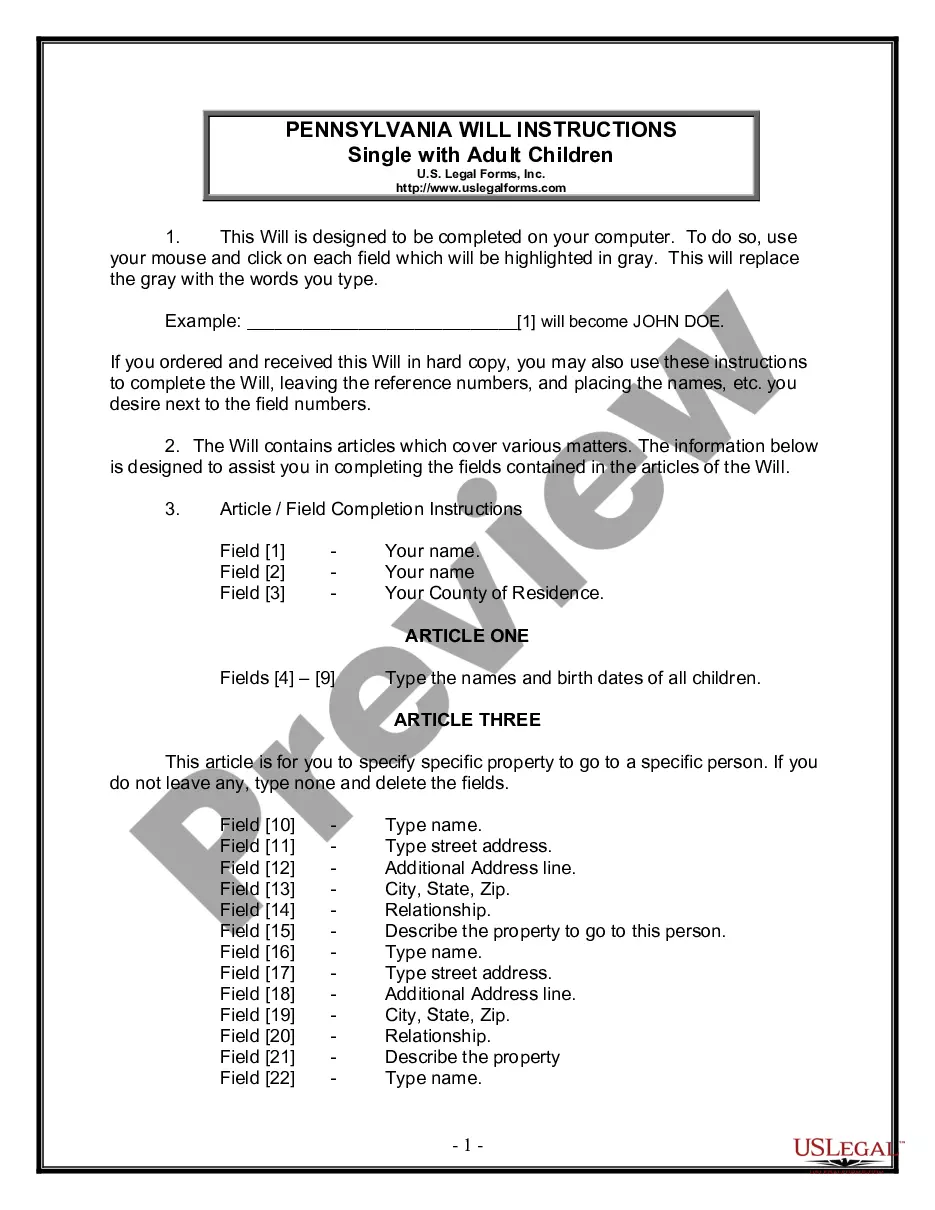

How to fill out Colorado Quitclaim Deed - Individual To Limited Liability Company?

- If you're a returning user, log in to your account and verify your subscription status. If current, find the required form template and click Download.

- For first-time users, begin by browsing the extensive library. Use the Preview mode to ensure the chosen document meets your specific jurisdiction's needs.

- If the document doesn't fit, utilize the Search feature to locate an appropriate template. Once found, confirm it aligns with your requirements.

- Proceed to purchase by selecting the Buy Now button. Choose a subscription plan that best fits your needs and create an account if necessary.

- Complete your transaction by entering payment details, either through a credit card or PayPal. Access your completed transaction in your profile.

- Finally, download your LLC document to your device. You can retrieve it anytime from the My Forms section.

By following these straightforward steps, you can easily acquire the LLC documents you need. US Legal Forms not only provides a robust collection of legal forms but also ensures access to premium experts for guidance on completing these documents accurately.

Start utilizing US Legal Forms today to empower your legal document needs efficiently!

Form popularity

FAQ

To document ownership of an LLC, it is essential to create an Operating Agreement. This document clearly outlines the ownership structure, roles, and responsibilities of each member. By formalizing this agreement, you can prevent disputes and ensure that all parties understand their rights concerning the LLC documents.

The document that officially creates the LLC is called the Articles of Organization. This critical document outlines your LLC's name, purpose, and the registered agent's details. Filing this document with your state is the first step toward establishing your LLC legally and ensuring that you adhere to regulatory requirements.

An LLC itself is not a Schedule C; however, its income may be reported on Schedule C if you are a single-member LLC. This tax treatment allows the profits and losses of your LLC to flow directly to your personal tax return. Understanding your tax obligations is crucial, and consulting with a tax professional can provide clarity on this aspect of LLC documents.

The primary document that forms an LLC is the Articles of Organization. This document is usually filed with the Secretary of State in your jurisdiction. By submitting this form, you officially create your LLC, allowing you to benefit from the legal protections and operational flexibility associated with LLCs.

When forming an LLC, several key documents are involved. These LLC documents typically include the Articles of Organization, Operating Agreement, and IRS Form SS-4 for obtaining an EIN. Each document plays a distinct role in establishing and maintaining your LLC, ensuring compliance with state regulations.

An operating agreement for an LLC example typically includes common sections such as management structure, member responsibilities, and profit distribution. By outlining these critical areas, this document helps establish clear operational guidelines. You can find useful examples of LLC documents, including operating agreements, on US Legal Forms, making it easier to draft your own.

If an LLC has no operating agreement, state laws will dictate the governance structure, which may not align with your vision for the business. This lack of an agreement could lead to misunderstandings among members and complications in decision-making. To avoid these issues, it's essential to create clear operating agreements as part of your LLC documents.

To write an LLC example, draft a simple outline that includes key components like the business name, purpose, and member roles. Consider including sample clauses that reflect how you plan to operate the LLC. For better guidance, you can refer to pre-existing templates available on US Legal Forms, which can serve as effective LLC documents.

Yes, you can write your own operating agreement for your LLC. This document is customizable to fit the specific needs and preferences of your business. Many people find that using guided templates, such as those on US Legal Forms, helps ensure they include all necessary elements in their LLC documents.

Filling out an LLC operating agreement involves outlining the structure and management of your LLC. You should include details like management roles, financial arrangements, and procedures for adding new members. Using resources available on US Legal Forms can simplify creating these essential LLC documents.