Personal Representative Deed Example

Description

How to fill out Colorado Deed Of Distribution - Personal Representative To Two Individuals?

Working with legal papers and procedures might be a time-consuming addition to the day. Personal Representative Deed Example and forms like it typically require you to look for them and navigate how to complete them effectively. For that reason, whether you are taking care of financial, legal, or personal matters, having a comprehensive and convenient web catalogue of forms at your fingertips will help a lot.

US Legal Forms is the top web platform of legal templates, offering over 85,000 state-specific forms and numerous tools to assist you to complete your papers easily. Explore the catalogue of pertinent documents open to you with just one click.

US Legal Forms gives you state- and county-specific forms offered at any time for downloading. Protect your papers management operations with a high quality support that lets you make any form within a few minutes without any additional or hidden charges. Just log in in your profile, locate Personal Representative Deed Example and acquire it right away in the My Forms tab. You can also access previously downloaded forms.

Is it your first time making use of US Legal Forms? Register and set up up an account in a few minutes and you’ll have access to the form catalogue and Personal Representative Deed Example. Then, adhere to the steps listed below to complete your form:

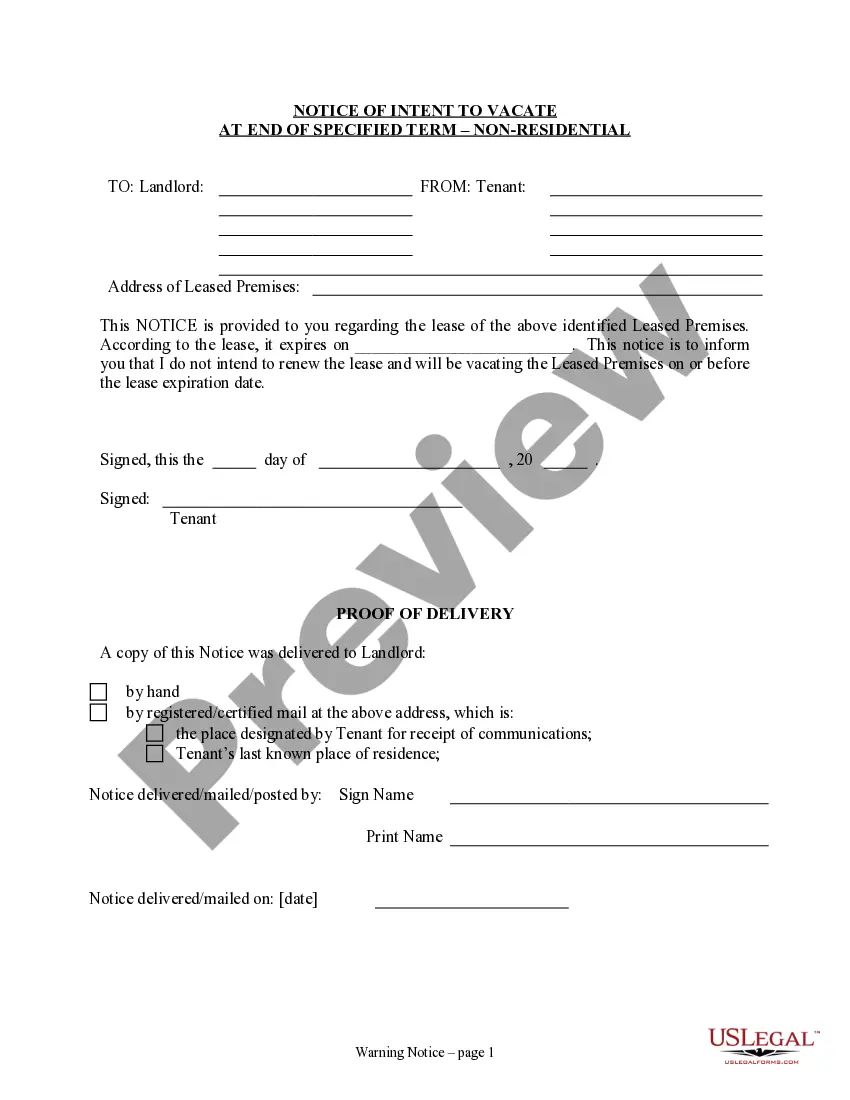

- Make sure you have discovered the right form using the Review feature and looking at the form information.

- Select Buy Now when all set, and select the subscription plan that fits your needs.

- Choose Download then complete, sign, and print out the form.

US Legal Forms has 25 years of expertise assisting users control their legal papers. Discover the form you require today and streamline any operation without breaking a sweat.

Form popularity

FAQ

Each estate is different, and a deed of distribution can be made pursuant to the Decedent's Will, South Carolina Intestacy laws, a disclaimer, family settlement agreement, or order from the Probate Court.

The Deed of Distribution transfers the real property from the decedent's name to those who inherit it.

A Personal Representative's deed, or PR deed, is a tool used to transfer title of real estate out of an estate. It is very similar to a quitclaim deed, only the person transferring the ownership of the property is the executor of an estate instead of the actual owner.

To obtain a copy of a plat or deed, contact the local Registers of Deeds office or Clerk of Court. Below is a list of counties with corresponding links to their Registers of Deeds office or Clerk of Court.

A Personal Representative's Deed is the form of deed commonly used in connection with the sale of real property owned by an estate.