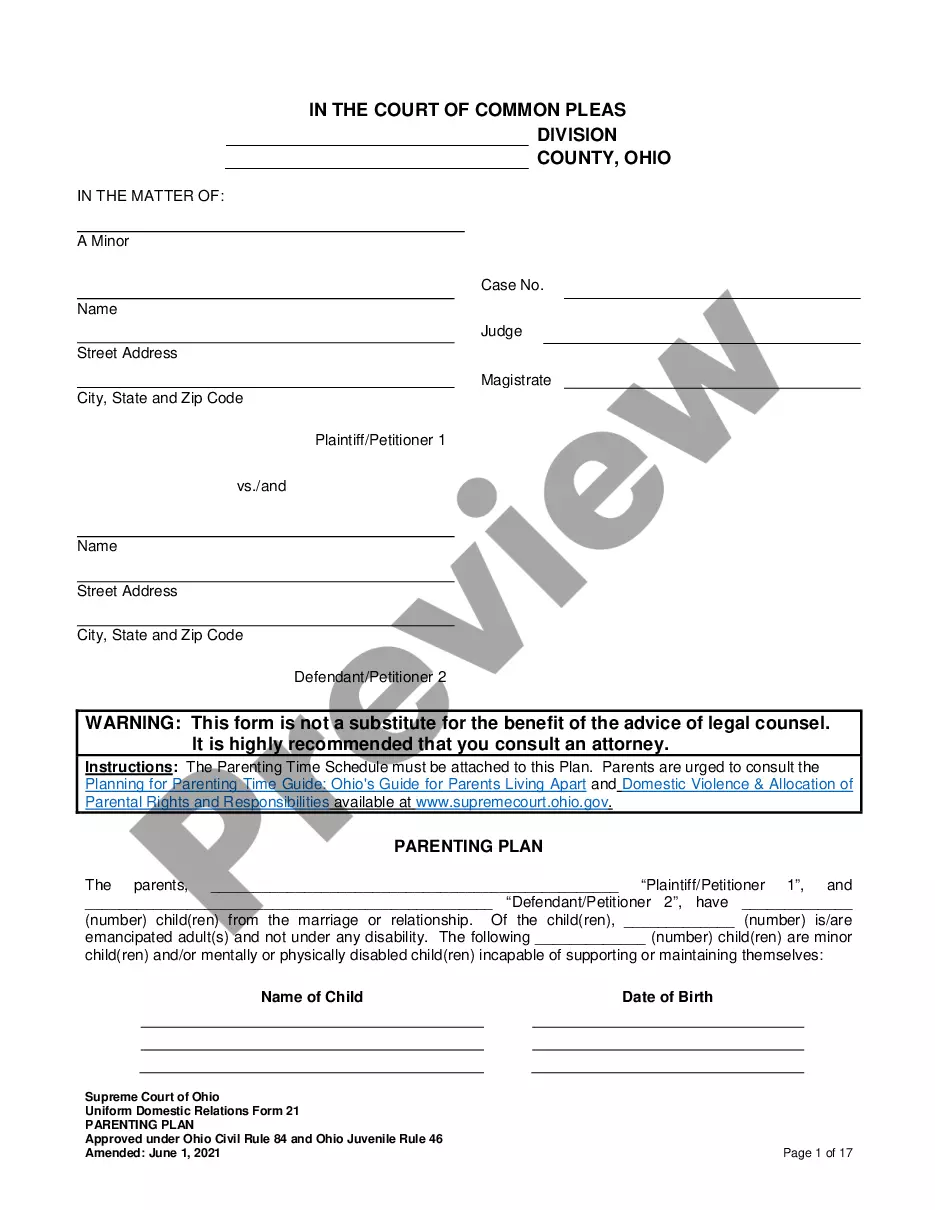

Deed Personal Representative Form For Estate

Description

How to fill out Colorado Deed Of Distribution - Personal Representative To Two Individuals?

Managing legal paperwork and processes can be a lengthy addition to your whole day.

Deed Personal Representative Form For Estate and similar forms usually require you to search for them and comprehend how to fill them out correctly.

Thus, whether you are dealing with financial, legal, or personal issues, having a comprehensive and efficient online repository of forms available will greatly assist.

US Legal Forms is the leading online platform for legal templates, boasting over 85,000 state-specific forms and numerous resources to help you complete your documents with ease.

Is this your first experience with US Legal Forms? Sign up and create your account in just a few minutes, and you will be granted access to the form library and Deed Personal Representative Form For Estate. Then, follow the steps outlined below to complete your form.

- Explore the collection of pertinent documents accessible to you with just one click.

- US Legal Forms provides state- and county-specific forms available at any time for download.

- Safeguard your document management processes with a premium service that enables you to prepare any form in moments without additional or hidden charges.

- Simply Log In to your account, locate Deed Personal Representative Form For Estate, and download it right away in the My documents section.

- You can also access previously saved forms.

Form popularity

FAQ

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.

Public Records Search With the map and parcel number, staff can provide a tax ticket. The tax ticket will identify the owner of the property, or the tax ticket may provide a deed book and page number that can be used to find the deed to the property.

Disadvantages of a trust deed If you do not cooperate with the trustee, they can try to make you bankrupt. You cannot continue to be the director of a limited company unless your trustee agrees and unless the rules of the limited company allow you to enter into a trust deed.

The County Clerk's Office records and maintains County records such as: deeds, leases, right of ways, plats, wills, deed of trusts, mortgages, releases, judgments, liens, abstracts, assignments, oath of office, power of attorneys, church trustees, bonds and DD-214- Military discharge.

To obtain these records, you will need to contact the sheriff's department directly and make a request. Some have outstanding arrests listed on their website. Local Court or County Clerk: You may also be able to find arrest records at the local court or county clerk's office.

Locate your own West Virginia recorded deeds, plats, and more filed with your county clerk or your property filed by your sheriff's tax office. Counties listed are those counties relative to West Virginia. WVOHOA Members have provided these important online database search links.

West Virginia has legalized TOD deeds by enacting the WV Real Property Transfer on Death Act. Previously, a property owner would most likely have named a beneficiary by creating a life estate with a remainder interest, a more complicated option usually involving a property lawyer.