A Grant Deed Form

Description

How to fill out Colorado Grant Deed From Individual To Individual?

Individuals often link legal documents with a notion of intricacy that can only be managed by an expert. In some respects, this is accurate, as formulating a Grant Deed Form necessitates considerable understanding of relevant criteria, encompassing state and local laws.

However, with US Legal Forms, everything has become more straightforward: pre-prepared legal documents for any personal and business scenario tailored to state regulations are compiled in a singular online repository and are now accessible to all.

US Legal Forms offers over 85k current documents organized by state and area of usage, so searching for a Grant Deed Form or any specific template takes just moments. Existing users with an active subscription need to Log In to their account and select Download to receive the form. New users will first need to register for an account and subscribe prior to downloading any files.

All templates in our library can be reused: once obtained, they are stored in your profile. You can access them whenever required via the My documents tab. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe today!

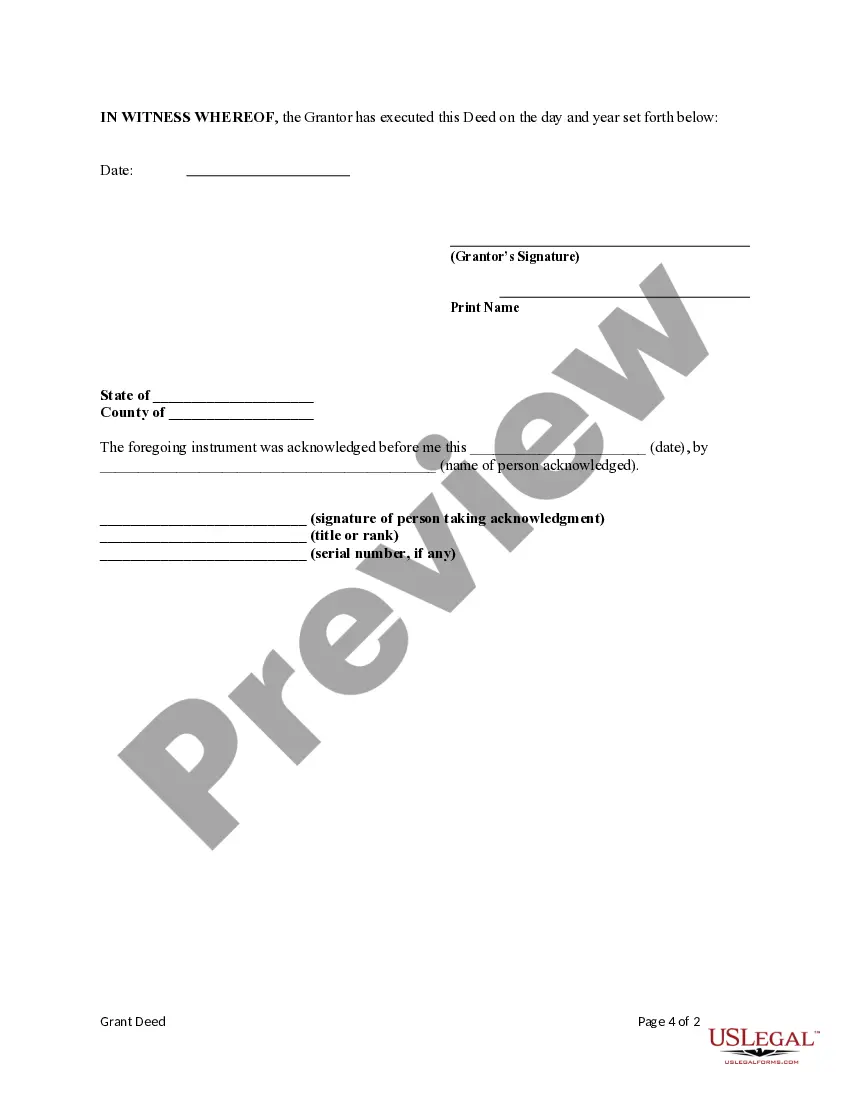

- Review the page details carefully to verify it meets your requirements.

- Examine the form description or view it through the Preview feature.

- Find another template using the Search bar located in the header if the initial one does not meet your preferences.

- Select Buy Now when you identify the appropriate Grant Deed Form.

- Pick a pricing plan that aligns with your needs and budget.

- Register for an account or Log In to continue to the payment page.

- Complete the payment for your subscription using PayPal or a credit card.

- Determine the format for your document and click Download.

- Print your document or upload it to an online editor for quicker completion.

Form popularity

FAQ

To remove someone from a grant deed in California, you must complete and sign a new grant deed form that reflects the change in ownership. The new deed must then be recorded at the county recorder’s office. For a streamlined process, utilize a grant deed form available from US Legal Forms to ensure your removal is legally binding.

Adding someone to a deed in California can have tax implications, particularly regarding property transfer taxes. When the deed is changed, it may trigger reassessment of the property’s value, affecting property taxes. To navigate this, using a grant deed form from US Legal Forms can aid in properly documenting the transfer and addressing any tax considerations.

Recording a deed in California typically takes a few days to a couple of weeks, depending on the county. Once submitted, the recorder’s office will process it and update public records. Using a grant deed form from US Legal Forms can help you prepare the document correctly, potentially speeding up the process.

It is often advisable for both spouses to be on the house title in California to protect each party's interests. Including both names ensures equal ownership and can simplify inheritance issues. A grant deed form can be a practical solution to facilitate the addition of a spouse to the title.

In the UK, a deed of grant is a legal document that conveys rights over property. It is typically used for transferring rights of way or other easements. While this is different from a grant deed in the U.S., understanding these concepts can be beneficial for comprehensive property management.

To add a spouse to a deed in California, you need to complete a grant deed form that specifies the new ownership structure. Ensure both spouses sign the document, and then record it at the county recorder's office. Utilizing a grant deed form from US Legal Forms can simplify this process and ensure proper documentation.

If your name is not on the deed, you may still have rights to the property under community property laws in California. The law generally treats property acquired during the marriage as jointly owned. For clarity and protection of your rights, consider using a grant deed form through US Legal Forms to ensure your interests are documented.

An interspousal grant deed is not legally required in California, but it can clarify property ownership between spouses. This form helps maintain your property interests during marriage. If you’re thinking about transferring property rights, consider using a grant deed form from US Legal Forms to simplify the process.

Recording a grant deed in California can take anywhere from a few days to a couple of weeks. The exact time depends on the processing speed of the county where the deed is submitted. To streamline the process, ensure your grant deed form is filled out accurately and completely.

To notarize a grant deed in California, you first need to complete the grant deed form with accurate information. You should then sign the document in front of a notary public, who will verify your identity and witness your signature. Notarization adds an additional layer of legitimacy to your deed.