State Of Colorado Operating Agreement For Single Member Llc

Description

How to fill out Colorado Limited Liability Company LLC Operating Agreement?

Regardless of whether it's for professional reasons or personal issues, everyone must confront legal matters at some stage in their life.

Filling out legal documents requires meticulous attention, beginning with selecting the appropriate form template.

Once it is downloaded, you can complete the form using editing software or print it out and finish it manually. With a vast US Legal Forms library available, you won't need to waste time looking for the right template online. Take advantage of the library’s user-friendly navigation to find the appropriate template for any event.

- For instance, if you select an incorrect version of a State Of Colorado Operating Agreement For Single Member Llc, it will be denied when you submit it.

- Thus, it is crucial to acquire a trustworthy source of legal documents such as US Legal Forms.

- If you need to procure a State Of Colorado Operating Agreement For Single Member Llc template, follow these straightforward steps.

- Retrieve the template you require using the search bar or catalog navigation.

- Review the form’s details to ensure it aligns with your situation, state, and locality.

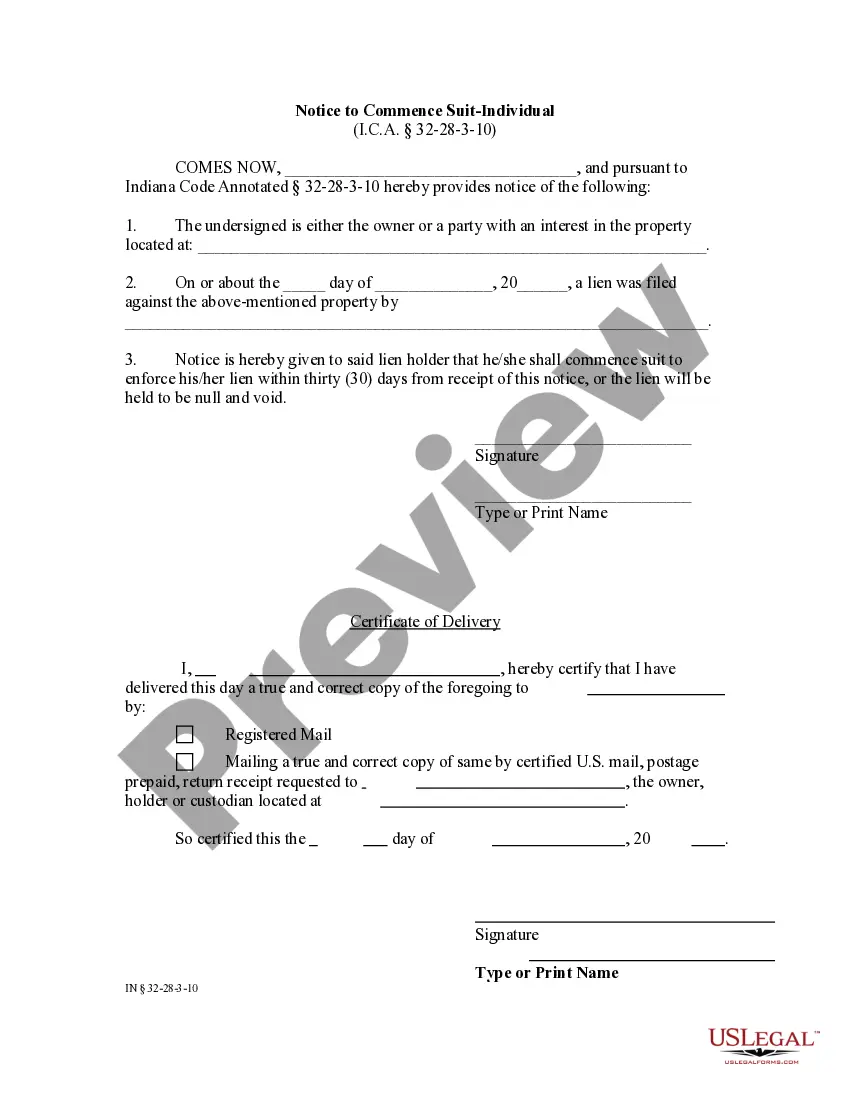

- Select the form’s preview to inspect it.

- If it is the wrong document, return to the search feature to locate the State Of Colorado Operating Agreement For Single Member Llc sample you need.

- Download the file if it meets your specifications.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you don’t have an account yet, you can download the form by clicking Buy now.

- Choose the correct pricing option.

- Fill out the account registration form.

- Select your payment method: either utilize a credit card or PayPal account.

- Choose the file format you prefer and download the State Of Colorado Operating Agreement For Single Member Llc.

Form popularity

FAQ

If your LLC does not have an operating agreement, you risk potential confusion regarding your business operations. Without this document, you may not have clear guidelines on how profits are distributed or how decisions are made. Additionally, lacking an operating agreement can lead to disputes and complications in legal situations. Therefore, drafting a State of Colorado operating agreement for single member LLC is a key step in establishing a solid foundation for your business.

While Colorado does not mandate an operating agreement for single-member LLCs, it is still an excellent practice to have one. An operating agreement helps protect your limited liability status by clearly defining your business operations. It also adds a layer of professionalism to your company. Consider developing a State of Colorado operating agreement for single member LLC to boost your business's credibility.

Yes, you can write your own operating agreement for your LLC. However, it is crucial to ensure that it covers all necessary legal and operational aspects. Crafting a comprehensive agreement can be challenging, so using a template or professional service is advisable. By utilizing a State of Colorado operating agreement for single member LLC template from platforms like US Legal Forms, you can save time and ensure completeness.

Colorado does not legally require an operating agreement for LLCs, but having one is highly recommended. This document helps define your business operations and limits liability risk. Additionally, in case of disputes or legal inquiries, an operating agreement provides a clear framework for resolving issues. It’s wise to create a State of Colorado operating agreement for single member LLC to ensure smooth business operations.

Filling out a single-member LLC operating agreement involves outlining the key elements of your business. Start by including the LLC's name, purpose, and the member's details. Next, clarify how profits and losses will be handled, along with the management structure. To simplify the process, consider using resources like US Legal Forms that offer templates specifically designed for the State of Colorado operating agreement for single member LLC.

Definitely, a single-member LLC can and should have an operating agreement. This document is essential for establishing your business's structure and operational guidelines. It reinforces your limited liability protection by separating your personal assets from business assets. Crafting a State of Colorado operating agreement for single member LLC can help clarify your business's direction.

Yes, there is an operating agreement for a single-member LLC. This document outlines the ownership and operating procedures of your LLC, providing clarity on how your business functions. Even if you are the only member, having a written agreement helps protect your limited liability status. The State of Colorado operating agreement for single member LLC sets the rules specific to your business.

Creating a State of Colorado operating agreement for single member LLC is straightforward. Start by defining your business's name and purpose, followed by outlining your responsibilities as the owner. You can use resources like US Legal Forms, which provides templates tailored for Colorado. Finally, review your agreement to ensure it covers all necessary provisions and aligns with state laws.

Yes, having an operating agreement for your LLC is essential, even if you are the sole member. This document outlines how your business operates and protects your personal assets. When you create a State of Colorado operating agreement for single member LLC, you define your business structure, clarify your rights, and set procedures for management. It also helps you avoid potential disputes and ensures compliance with state regulations.

Yes, a single-member LLC must file a Colorado tax return. Generally, the single-member LLC is treated as a pass-through entity for tax purposes. However, you still need to complete your State of Colorado operating agreement for single member LLC, as this document clarifies your business structure. To ensure compliance and make the process easier, consider using the US Legal Forms platform to access the necessary resources.