Colorado Llc Operating Agreement With Profits Interest

Description

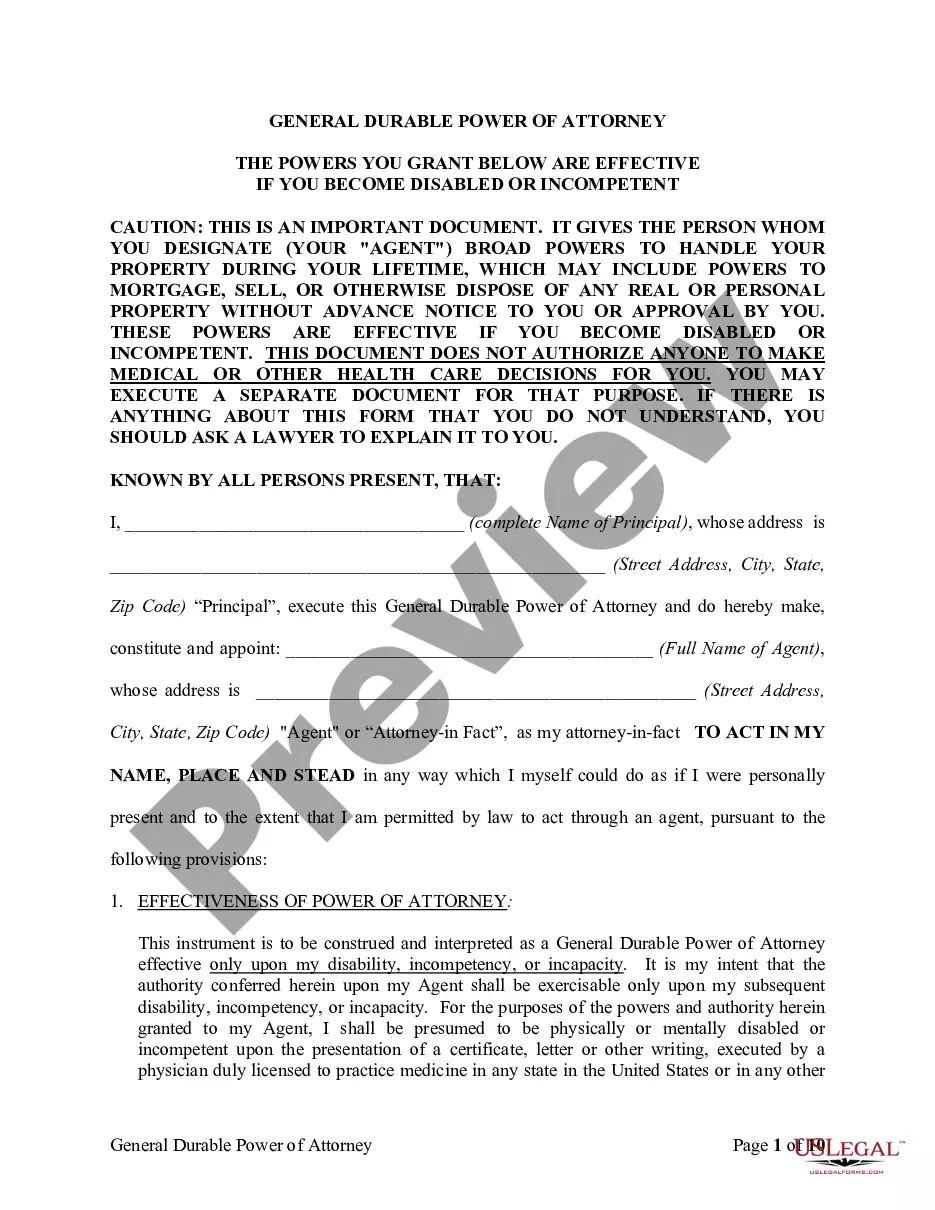

How to fill out Colorado Limited Liability Company LLC Operating Agreement?

Dealing with legal documents and procedures could be a lengthy addition to your routine.

Colorado Llc Operating Agreement With Profits Interest and similar forms generally necessitate you to hunt for them and figure out how you can finalize them efficiently.

Consequently, whether you are managing financial, legal, or personal issues, utilizing a comprehensive and user-friendly online catalog of forms at your disposal will be very beneficial.

US Legal Forms is the leading online platform for legal templates, featuring over 85,000 state-specific forms and an array of resources to help you fill out your documents effortlessly.

Is this your first experience with US Legal Forms? Register and set up your account in a few minutes and you’ll gain access to the document catalog and Colorado Llc Operating Agreement With Profits Interest. Afterwards, follow these steps to complete your form: Ensure you have the correct document by utilizing the Preview feature and reviewing the document description. Select Buy Now when ready, and choose the monthly subscription plan that meets your requirements. Click Download then fill out, sign, and print the document. US Legal Forms has 25 years of experience assisting clients manage their legal documents. Acquire the form you need now and streamline any process effortlessly.

- Explore the collection of relevant documents available to you with just one click.

- US Legal Forms offers you state- and county-specific forms accessible at any time for download.

- Protect your document management procedures with a premium service that enables you to prepare any form in a matter of minutes without extra or hidden fees.

- Simply Log In to your account, locate Colorado Llc Operating Agreement With Profits Interest and obtain it instantly from the My documents section.

- You can also access previously saved documents.

Form popularity

FAQ

A Colorado single-member LLC operating agreement is a legal document that establishes operating terms between the owner and the business itself. The state of Colorado does not require an agreement, however, it is highly recommended that all businesses have one in place, no matter what the size of the business.

Does my LLC Operating Agreement need to be notarized? No, your Operating Agreement doesn't need to be notarized. Each Member just needs to sign it. Once you (and the other LLC Members, if applicable) sign the Operating Agreement, then it becomes a legal document.

Colorado does not require you to submit an Operating Agreement to form your LLC. However, it is important for every LLC to have an Operating Agreement, establishing the rules and structure of the business.

LLC operating agreements usually provide much more information, and almost all the provisions for how the business will be managed, and the rights, duties, and liabilities of members and managers are contained in the operating agreement. An operating agreement is a private document.

A Colorado operating agreement is the legal document that contains the rules and policies your LLC will follow.