Estate Planning Personal Information Form

Description

How to fill out California Estate Planning Questionnaire And Worksheets?

There is no longer a need to squander time looking for legal documents to meet your local state obligations. US Legal Forms has gathered all of them in one spot and enhanced their availability.

Our website offers over 85,000 templates for various business and personal legal situations organized by state and area of application. All forms are correctly drafted and confirmed for authenticity, ensuring you receive an up-to-date Estate Planning Personal Information Form.

If you are familiar with our service and possess an account, please make sure your subscription is current before accessing any templates. Log In to your account, choose the document, and click Download. You can also revisit all saved documents at any time by navigating to the My documents tab in your profile.

Print your form to finish it by hand or upload the sample if you prefer to use an online editor. Drafting legal documents under federal and state regulations is quick and easy with our library. Give US Legal Forms a try now to keep your paperwork organized!

- If this is your first time using our service, the procedures will require a few additional steps to finalize.

- Examine the page content thoroughly to confirm it includes the sample you need.

- To do this, leverage the form description and preview options if available.

- Make use of the search bar above to look for an alternative template if the previous one is not to your liking.

- Press Buy Now alongside the template title once you locate the right one.

- Select your desired pricing plan and either create an account or Log In.

- Complete your subscription payment with a credit card or via PayPal to move forward.

- Select the file format for your Estate Planning Personal Information Form and download it to your device.

Form popularity

FAQ

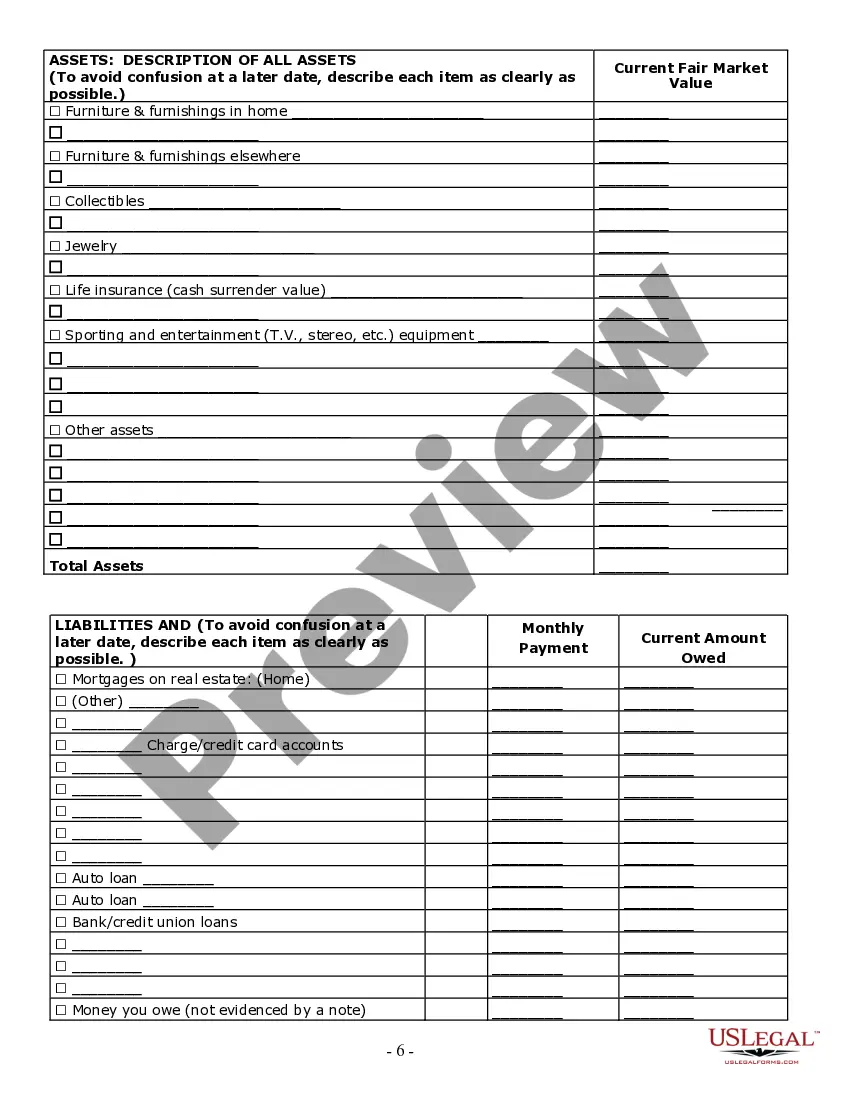

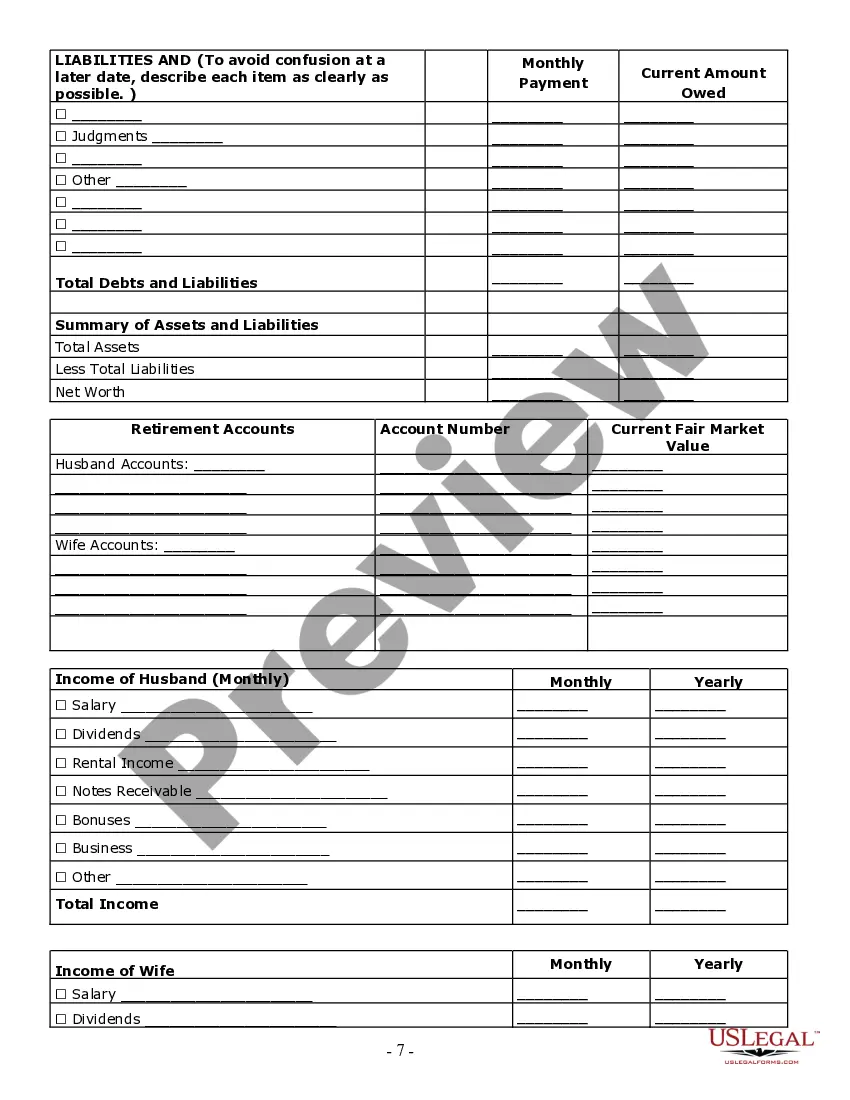

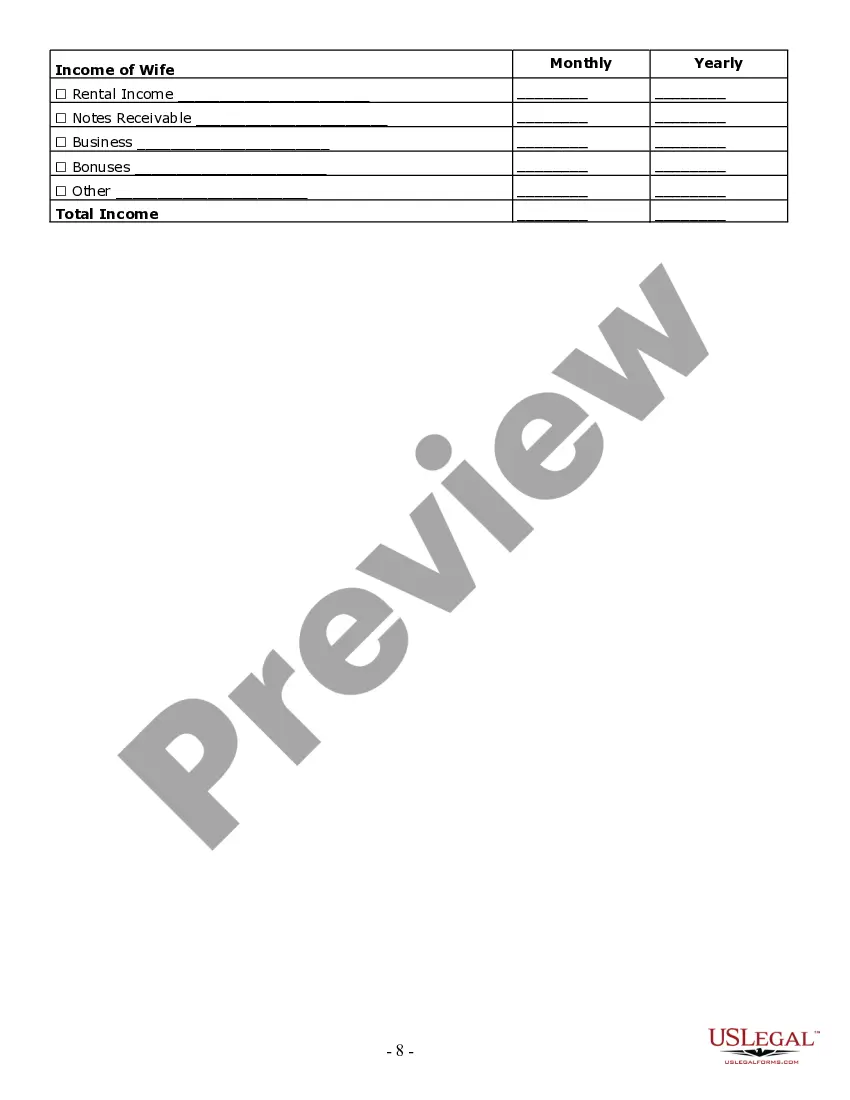

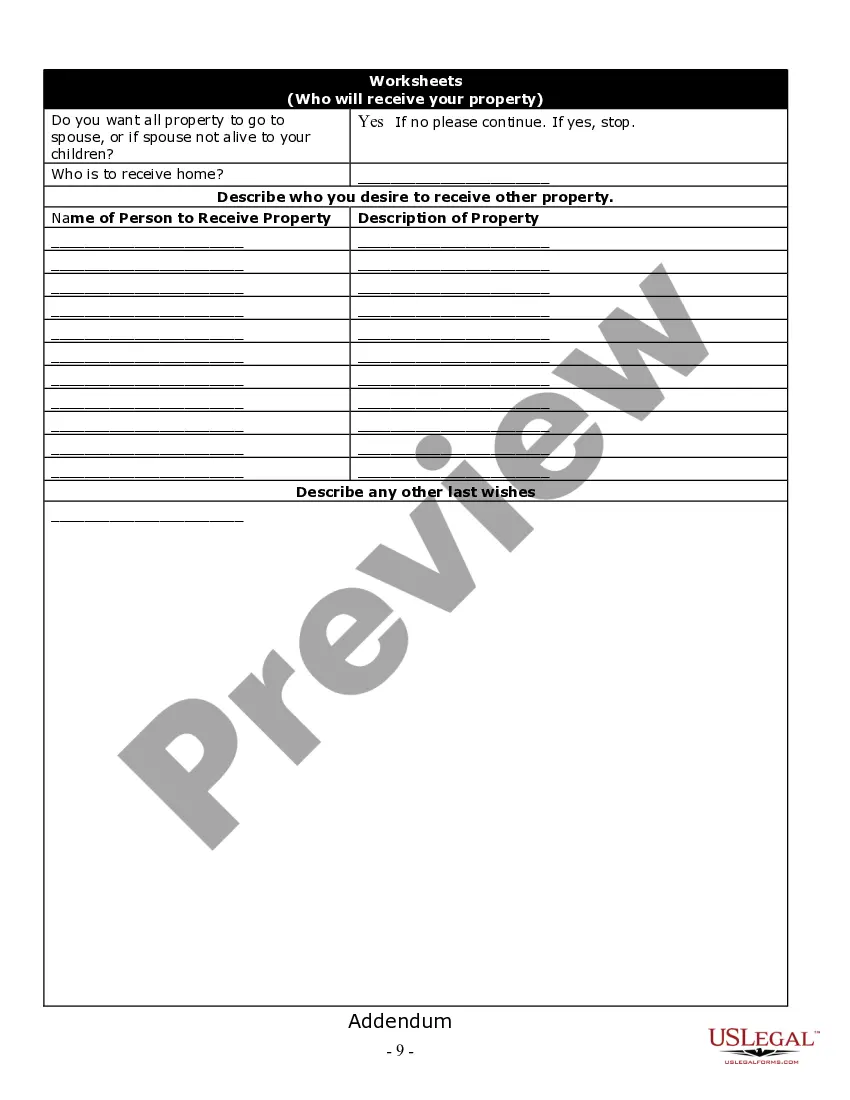

The estate planning process typically involves several key steps: assessing your assets, determining your goals, choosing beneficiaries, selecting executors or trustees, preparing necessary documents, reviewing your plan regularly, and communicating your wishes to your family. Each step is crucial in ensuring your estate is managed according to your desires. Using an estate planning personal information form can significantly help you in documenting all essential details throughout these steps. Achieving a well-organized estate plan becomes attainable with the right approach.

Yes, AARP provides resources and guidance tailored for individuals looking to navigate the complexities of estate planning. They offer informative articles, templates, and even workshops to help members understand the process. Additionally, resources such as an estate planning personal information form can streamline your planning experience. Consider checking AARP's resources for valuable insights and tools.

Estate planning documents are commonly referred to as legal documents involved in managing your estate after your passing. These include wills, trusts, powers of attorney, and healthcare directives among others. Each document serves a unique purpose, helping ensure that your wishes are followed. Completing an estate planning personal information form can aid in identifying which documents you need for your plan.

You can start estate planning by gathering essential documents and information related to your assets, debts, and personal wishes. Creating an estate planning personal information form will help you organize these details, making the process smoother. Consider outlining your wishes regarding guardianship, distribution of assets, and any specific requests you wish to include. By using available templates, you can confidently move forward with your planning.

The four foundational documents of an estate plan are typically a will, a trust, a durable power of attorney, and a healthcare directive. These documents work together to provide a comprehensive strategy for managing your assets and healthcare decisions. Using an estate planning personal information form enhances this process by helping you collect and structure pertinent details, ensuring that your plans are as clear and effective as possible.

Suze Orman emphasizes the importance of having four essential documents: a will, a power of attorney, a living will, and healthcare proxy. These documents not only protect your assets but also ensure your wishes are followed during critical moments. To gather and organize the necessary information for these documents, an estate planning personal information form can be incredibly helpful. It streamlines the process and ensures nothing is overlooked.

The 5 by 5 rule is a practical guideline in estate planning that allows a beneficiary to access up to $5,000 or 5% of the trust's total value each year without tax implications. This rule provides flexibility while ensuring that the trust remains funded for future needs. Utilizing an estate planning personal information form can help outline these benefits clearly, ensuring you understand how distributions can be structured.

When you embark on estate planning, several key documents come into play. Most notably, a will outlines how you want your assets distributed. Additionally, a power of attorney appoints someone to make decisions on your behalf if you become unable to do so. Lastly, a trust might help manage your assets even while you are alive, providing clarity and efficiency that an estate planning personal information form can facilitate.

The 5 by 5 rule is a tax provision that permits trust beneficiaries to withdraw a maximum of 5% of the trust's value each year, ensuring they can access funds when needed. This rule is particularly useful in estate planning, as it allows for flexibility while staying within tax limits. When you are completing your estate planning personal information form, keep this rule in mind to structure your trust effectively.

The 5 and 5 limitation refers to a restriction in estate planning that allows beneficiaries to withdraw amounts from a trust without incurring gift taxes. Specifically, it allows for withdrawals of up to 5% of the trust value each year, limited to a total of 5% over five years. Understanding this limitation can help you effectively use your estate planning personal information form when setting up your financial strategy for the future.