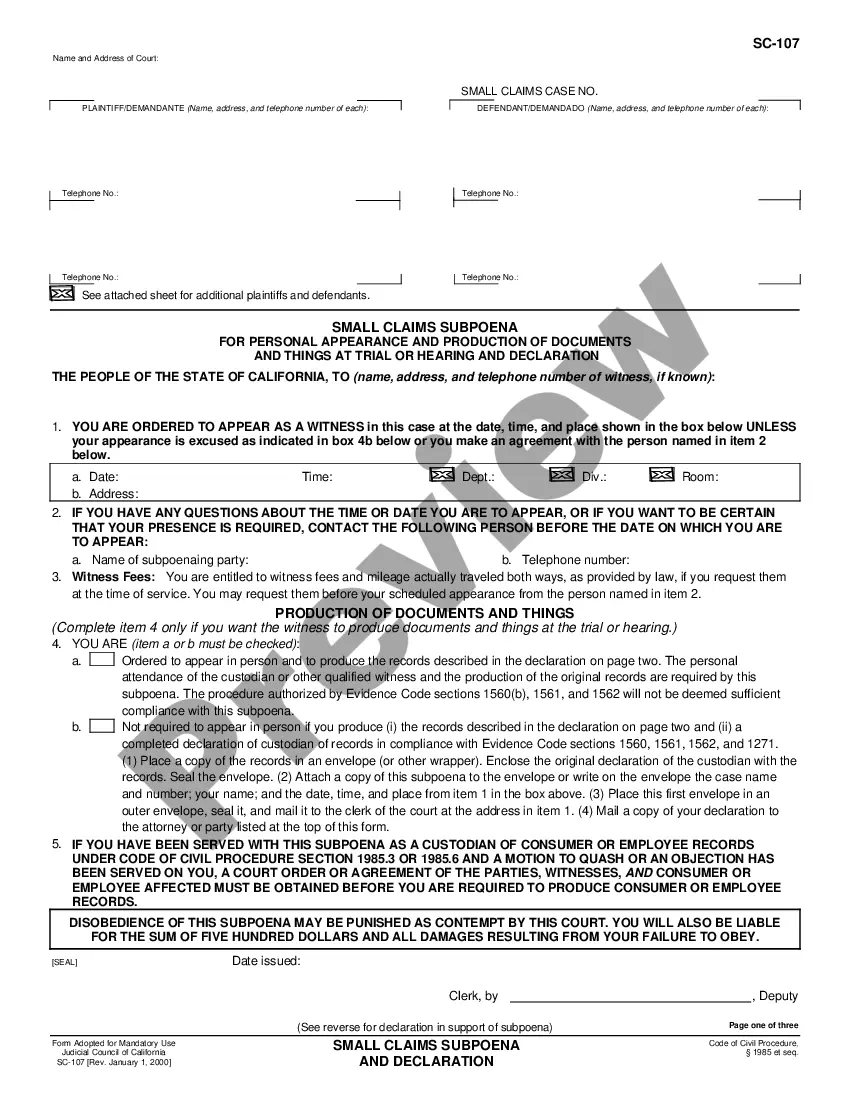

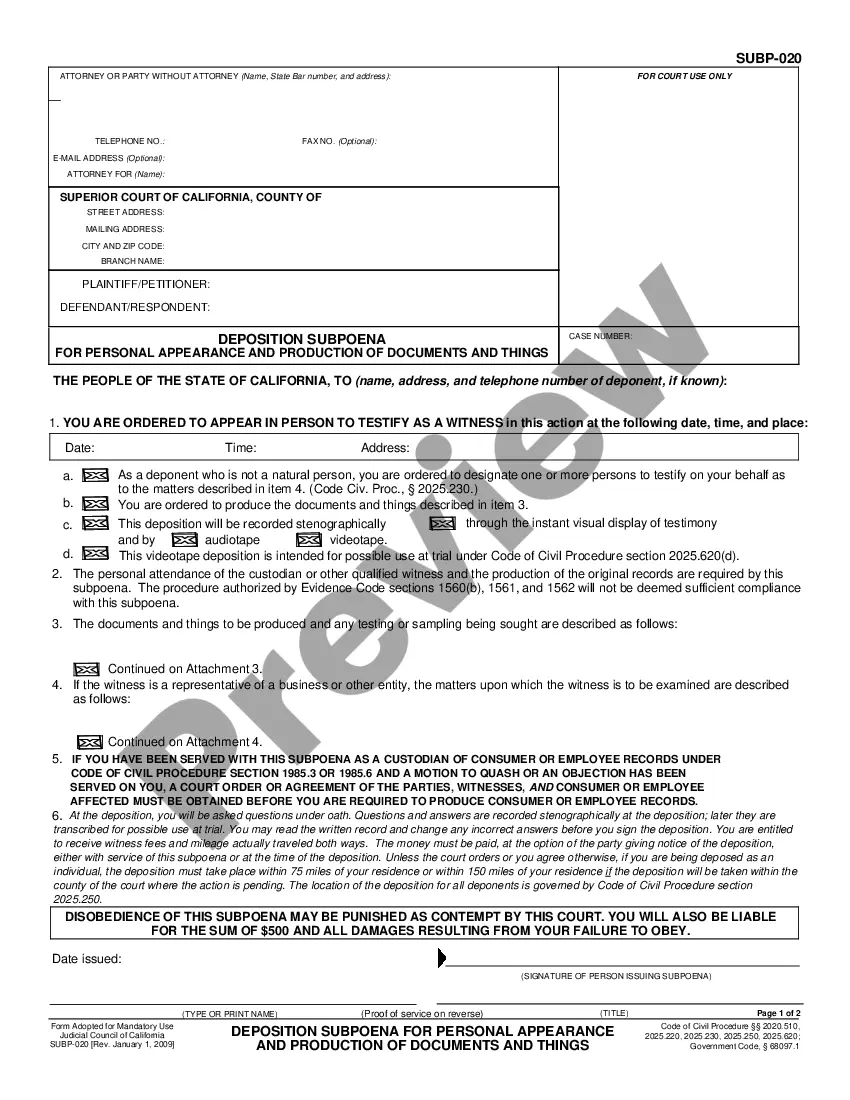

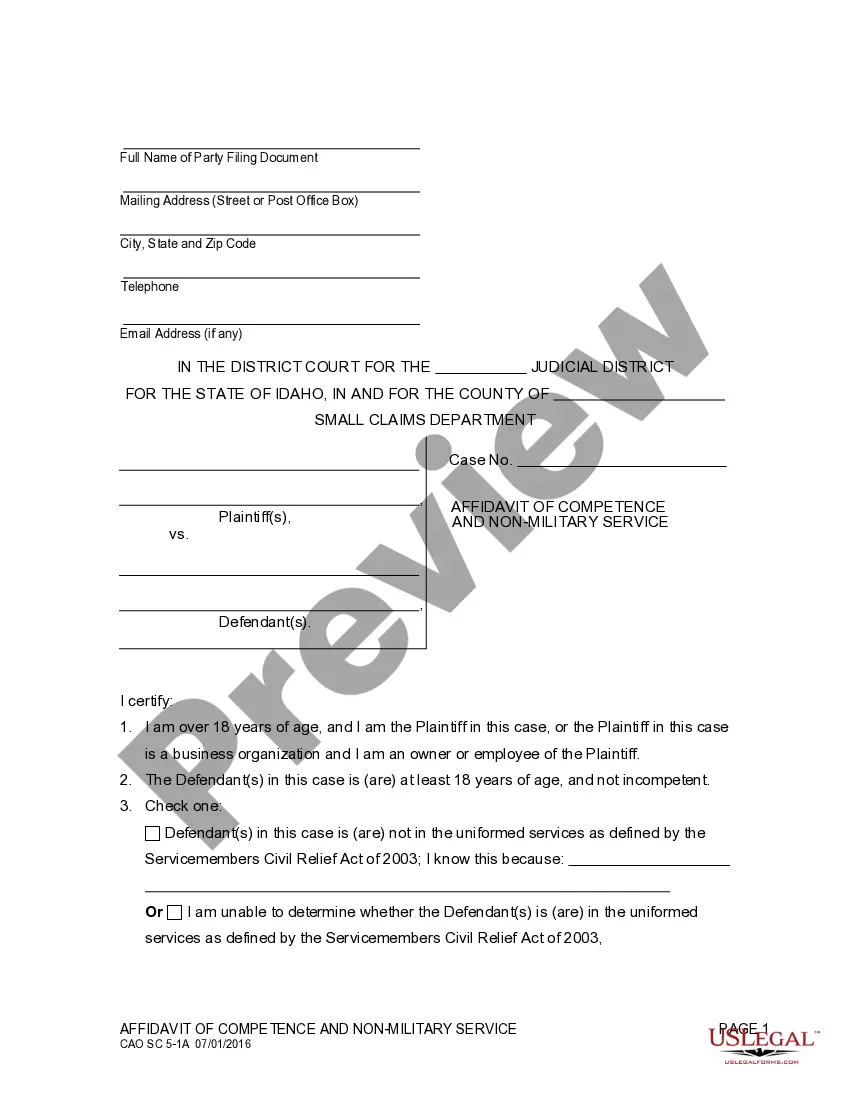

Subpoena Duces Tecum California Notice To Consumer

Description

How to fill out California Civil Subpoena - Duces Tecum For Personal Appearance And Production Of Documents Electronically Stored Information And Things At Trial Or Hearing And Declaration?

Creating legal documents from the ground up can frequently be somewhat daunting. Some situations may require extensive investigation and significant expenditures.

If you seek a simpler and more economical method of producing Subpoena Duces Tecum California Notice To Consumer or other documents without unnecessary complications, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal concerns. With just a few clicks, you can promptly access state- and county-compliant forms meticulously prepared for you by our legal professionals.

Utilize our platform whenever you require trusted and dependable services through which you can easily find and download the Subpoena Duces Tecum California Notice To Consumer. If you are already familiar with our website and have established an account with us, simply Log In to your account, select the template and download it or re-download it anytime in the My documents section.

Ensure the form you choose meets the standards of your state and county. Select the appropriate subscription option to obtain the Subpoena Duces Tecum California Notice To Consumer. Download the form, then fill it out, sign it, and print it. US Legal Forms enjoys a solid reputation and over 25 years of expertise. Join us now and make document execution straightforward and efficient!

- Not yet registered? No worries.

- It requires minimal time to sign up and explore the library.

- But before rushing to download Subpoena Duces Tecum California Notice To Consumer, adhere to these recommendations.

- Examine the form preview and descriptions to ensure you are viewing the document you are looking for.

Form popularity

FAQ

The wage garnishment process in Oklahoma has several steps: Step 1: The creditor files an affidavit to begin the garnishment proceedings. ... Step 2: The creditor serves you with a notice of garnishment. ... Step 3: You can make objections to the garnishment. ... Step 4: The employer gets a garnishment summons.

Oklahoma allows two types of garnishment: continuing or wage garnishment, and non-continuing, which is bank account levy. For wage garnishment, Oklahoma follows federal rules, and exempts 75% of the judgment-debtor's disposable earnings (OK Stat.

Payroll garnishments ? ?continuing earnings garnishments? ? are court-ordered procedures that require an employer to withhold certain amounts from an employee's paycheck and send those amounts directly to a third-person individual or entity to whom the employee owes a debt.

Garnishing a Bank Account The procedure involves filing a Garnishment Affidavit with the court clerk. The Garnishment Affidavit should state who the parties are and the outstanding balance of the judgment.

Oklahoma law limits the amount that can be garnished from a debtor's wages. Generally, creditors can garnish up to 25% of the debtor's disposable income after legally required deductions (like taxes and Social Security) have been made.

These periods are more-or-less comparable to those in other states. Once an Oklahoma creditor has obtained a favorable judgment, the creditor has 5 years to enforce it by garnishment?only three years if the creditor is trying to enforce a judgment which had rendered by a non-Oklahoma court.

Up to 50% of a worker's disposable earnings if the worker is supporting another spouse or child, or up to 60% if the worker is not. The IRS factors in the employees standard deductions and number of dependents. The maximum amount is 50%. Wage garnishment rates vary from state to state.

A creditor MUST have a judgment against you before it can get a garnishment. There are two basic limits on the amount creditors can take from your wages. First, they cannot take more than 25% of your take-home pay. Second, a creditor must leave you with at least $217.50 a week or $870 a month in net (take-home) pay.