Living Trust Form Printable For Nevada

Description

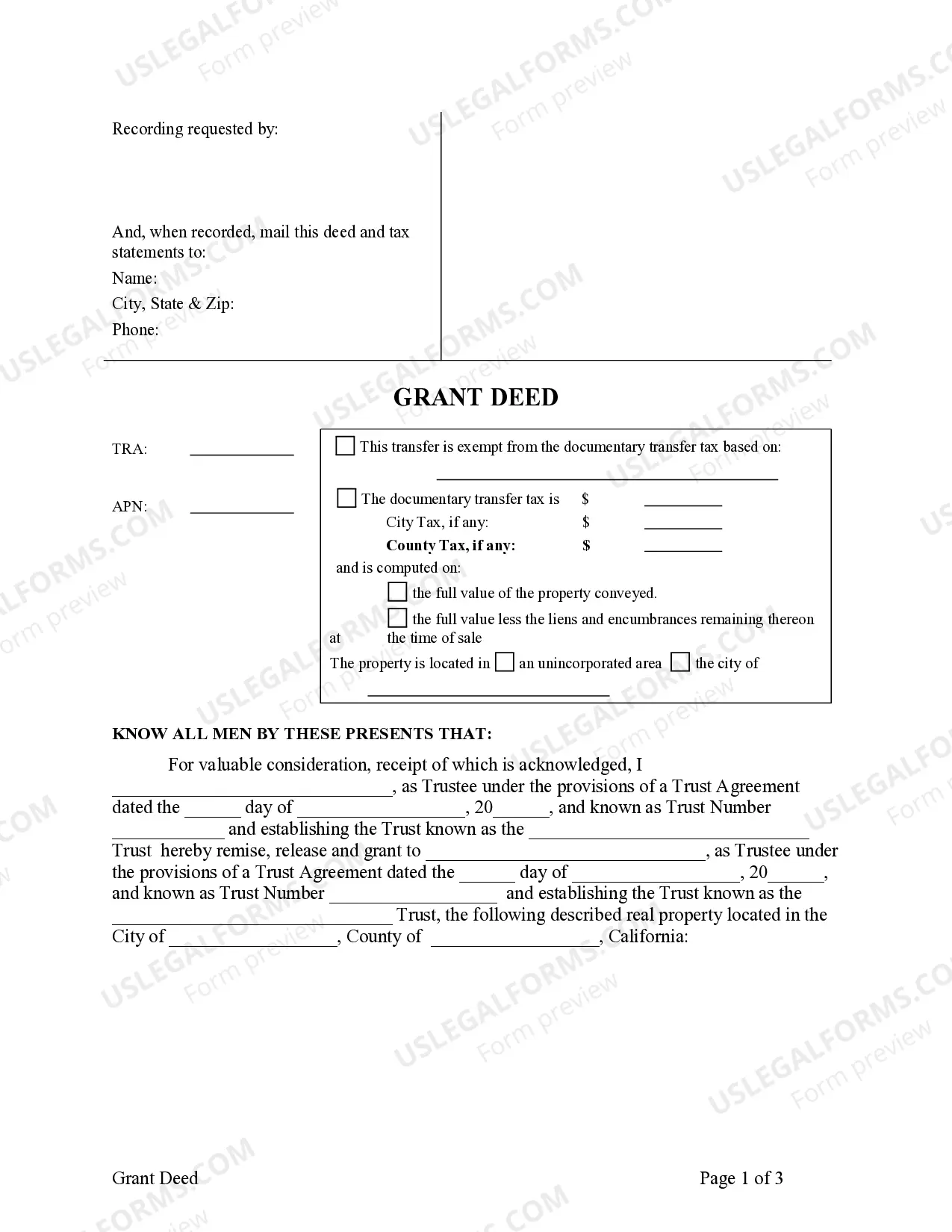

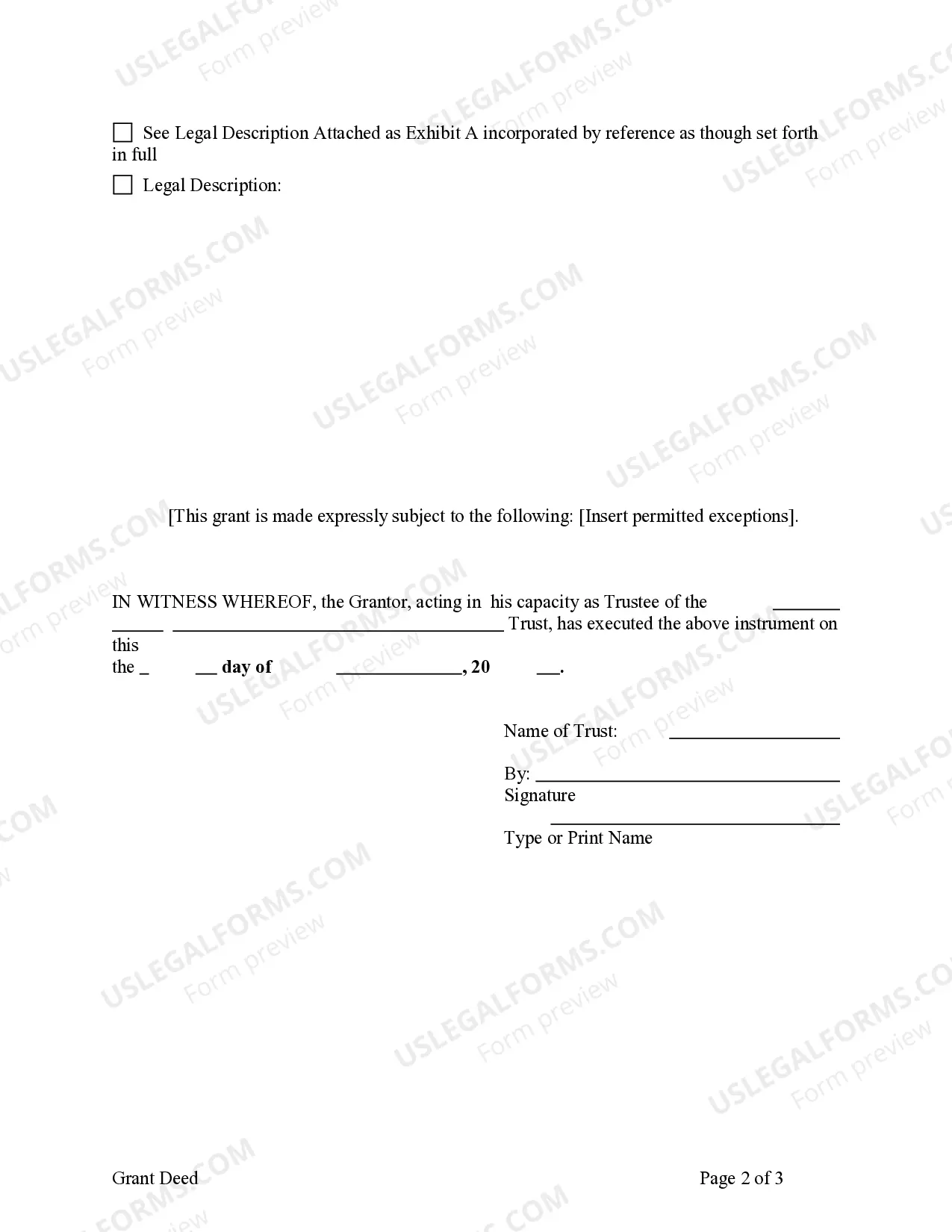

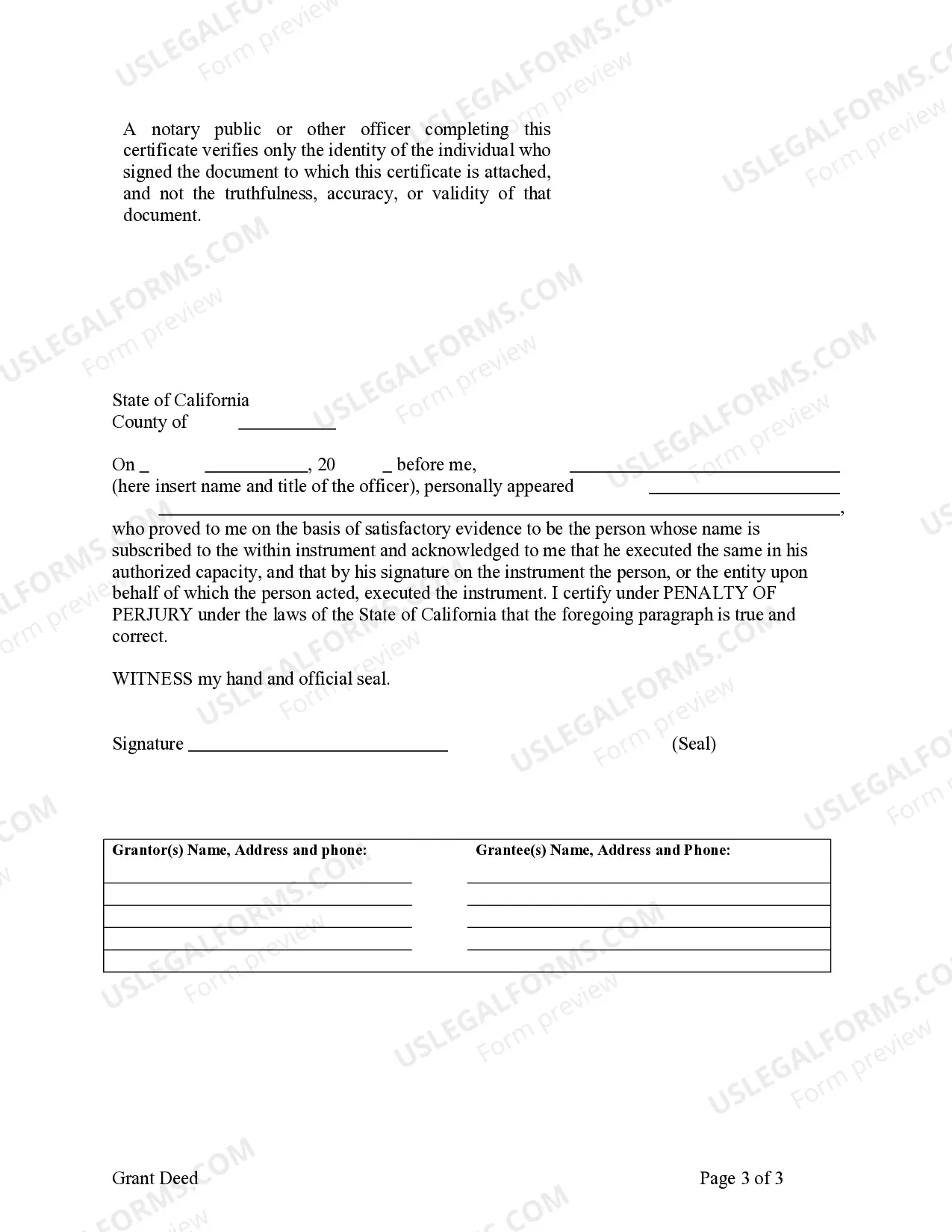

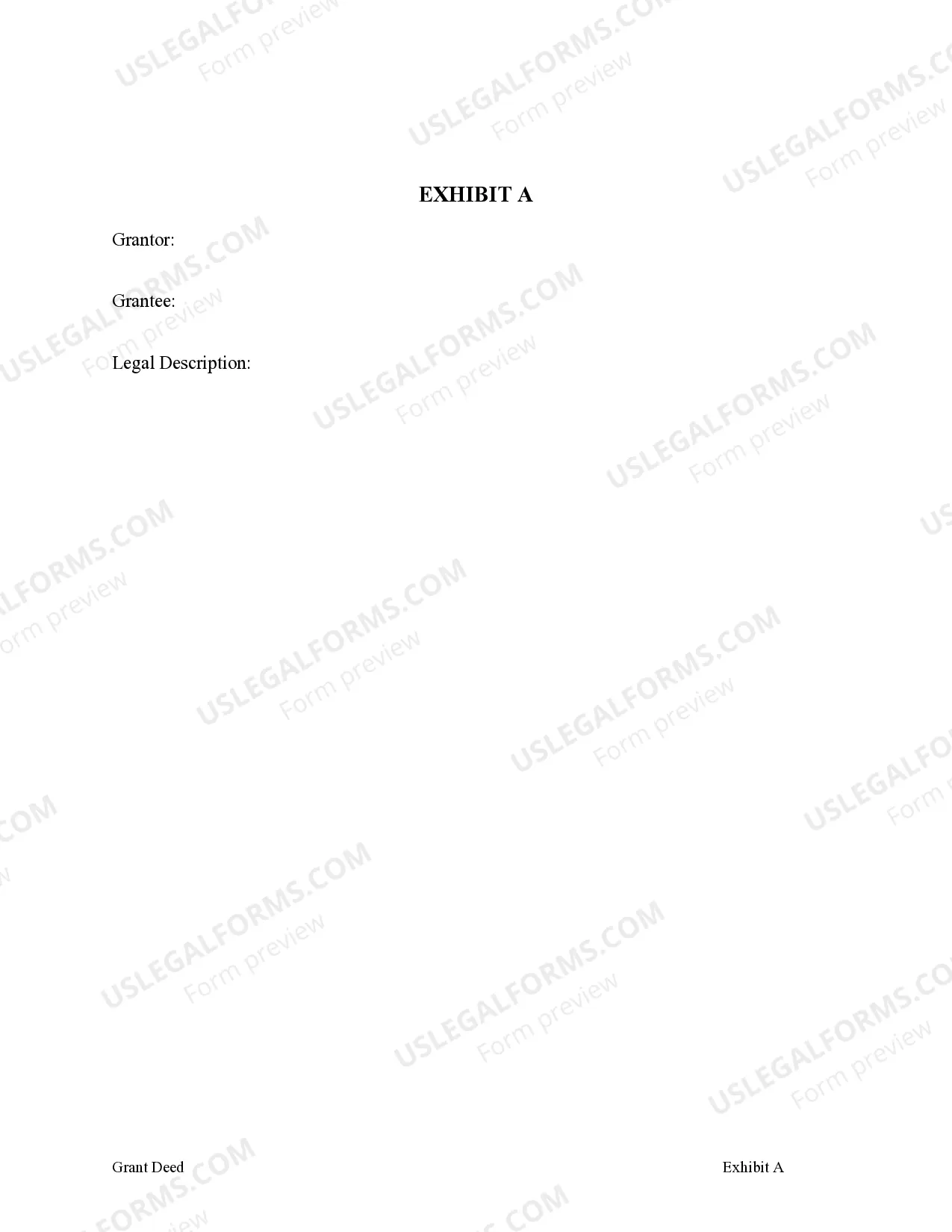

How to fill out California Grant Deed - Living Trust To Living Trust?

Locating a reliable source for the most up-to-date and pertinent legal templates is a significant part of managing bureaucracy. Selecting the appropriate legal documents demands accuracy and careful consideration, which is why it is crucial to obtain samples of Living Trust Form Printable For Nevada exclusively from trusted providers, such as US Legal Forms. An incorrect template can squander your time and prolong your current situation. With US Legal Forms, you have minimal concerns. You can access and verify all the details regarding the document’s applicability and significance for your situation and within your state or county.

Follow these steps to complete your Living Trust Form Printable For Nevada.

Eliminate the complications associated with your legal documentation. Discover the extensive US Legal Forms library where you can locate legal templates, assess their relevance to your situation, and download them immediately.

- Utilize the catalog navigation or search option to find your template.

- Review the form’s description to determine if it meets the requirements of your state and locality.

- Examine the form preview, if available, to confirm the form is indeed the one you require.

- Return to the search and look for the correct template if the Living Trust Form Printable For Nevada does not meet your needs.

- If you are confident about the form’s applicability, download it.

- If you are a registered customer, click Log in to verify and access your chosen templates in My documents.

- If you haven't created an account yet, click Buy now to acquire the form.

- Select the pricing option that aligns with your preferences.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading the Living Trust Form Printable For Nevada.

- Once you have the form on your device, you can edit it with the software or print it and fill it out manually.

Form popularity

FAQ

Creating a living trust in Nevada is accomplished when you do two things. You must sign the trust document before a notary. Secondly, you must fund the trust by transferring ownership of your assets to its name. This last step is crucial for the trust to be effective.

To make a revocable living trust in Nevada, you need to do the following steps: 1) Decide the Type. ... 2) Decide Your Assets. ... 3) Choose a Designated Successor trustee. ... 4) Decide on Trust Beneficiaries. ... 5) Decide on Death Beneficiaries' ... 6) Create a Trust Document. ... 7) Sign Documents in Front of a Notary Public.

The short answer is no. One of the great benefits of a living trust in this era ? where is it difficult to keep anything private and out of the public domain ? is that a living trust is confidential. It does not need to be recorded, filed, or registered except in certain circumstances discussed below.

How to Write ( Fill Out ) a Living Trust Form Step 1: Fill out the grantor information. ... Step 2: Indicate the purpose of the trust. ... Step 3: Include trustee information. ... Step 4: List beneficiaries and make specific gifts. ... Step 5: Sign and notarize the completed document.