Pld Pi 003 Withdrawal

Description

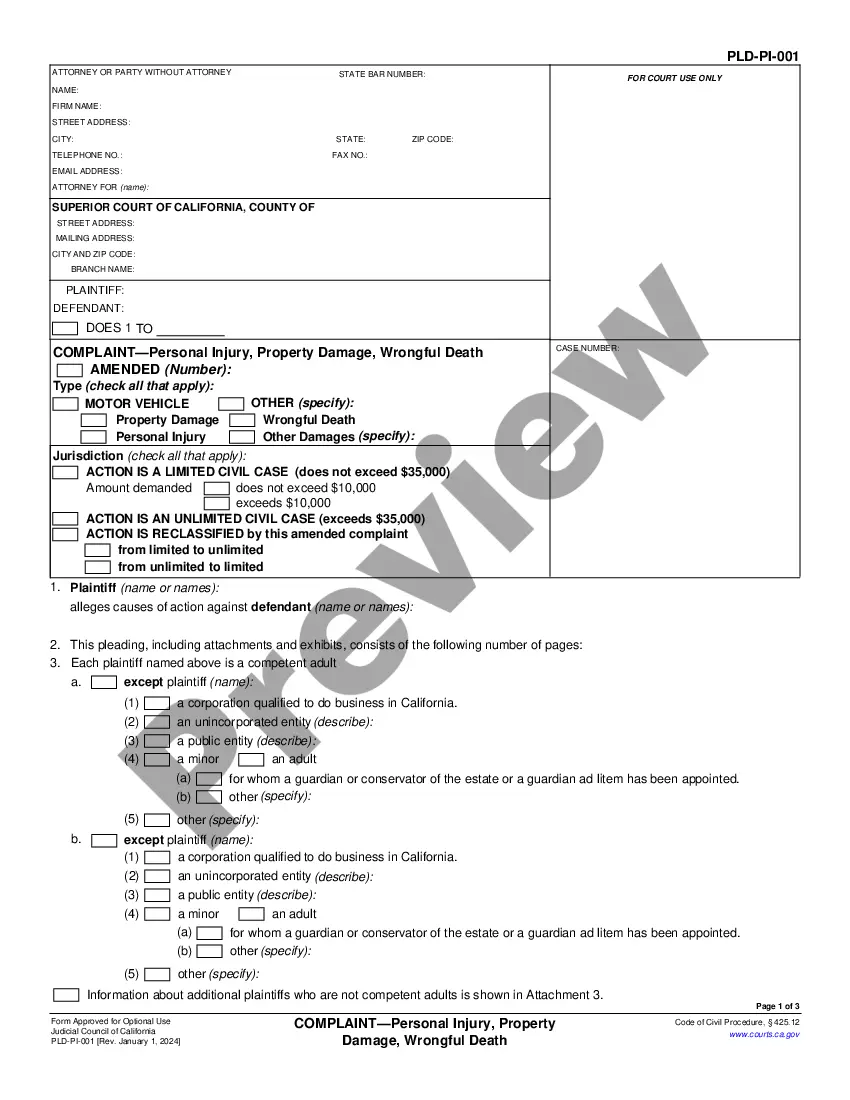

How to fill out California Answer To Complaint For Personal Injury, Property Damage, Wrongful Death?

Finding a go-to place to access the most recent and relevant legal templates is half the struggle of working with bureaucracy. Finding the right legal papers needs precision and attention to detail, which is the reason it is crucial to take samples of Pld Pi 003 Withdrawal only from reputable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to worry about. You may access and see all the details concerning the document’s use and relevance for the situation and in your state or region.

Take the listed steps to finish your Pld Pi 003 Withdrawal:

- Use the library navigation or search field to locate your template.

- View the form’s description to check if it fits the requirements of your state and region.

- View the form preview, if available, to ensure the template is the one you are searching for.

- Return to the search and locate the proper template if the Pld Pi 003 Withdrawal does not fit your requirements.

- If you are positive about the form’s relevance, download it.

- When you are an authorized customer, click Log in to authenticate and access your picked templates in My Forms.

- If you do not have an account yet, click Buy now to obtain the form.

- Choose the pricing plan that fits your preferences.

- Go on to the registration to complete your purchase.

- Complete your purchase by choosing a transaction method (bank card or PayPal).

- Choose the document format for downloading Pld Pi 003 Withdrawal.

- When you have the form on your gadget, you can alter it using the editor or print it and finish it manually.

Get rid of the headache that comes with your legal paperwork. Discover the extensive US Legal Forms catalog to find legal templates, examine their relevance to your situation, and download them on the spot.

Form popularity

FAQ

It has three sections where you must provide all details to complete the process: Section 1: The Declaration section is the first section. ... Section 2: Section 2 is for official use. ... Section 3: The third section is for filling in bank details where you want the bank to credit your withdrawal amount.

For instance, if you make a premature withdrawal request in August 2023 and your PPF account has completed at least 5 financial years, you will get either 50% of the corpus at the end of FY23 or at the end of FY20, whichever is lower. What if you need to make a withdrawal before 5 years? Well, that's not possible.

Here are the steps of withdrawing money from your PPF account: Step 1: Download the PPF Withdrawal Form (Form C) from your bank's website online or you can get it from the bank branch. ... Step 2: Enclose a copy of PPF passbook along with Form C. Step 3: Submit the same at your respective bank branch.

To claim PPF amount, Form G has to be filled up. Form G is a must for any claimant, be it a nominee or a legal heir. The form can be downloaded online from bank or post office websites. It is a simple form that asks for information pertaining to the claim like account number, nominee details, place etc.

You can make only one partial withdrawal each year. To make the withdrawal, you will have to submit the PPF passbook and an application to the bank/ post office. The amount withdrawn is exempt from income tax.