Foreclosure In California 2022

Description

How to fill out California Eviction In Foreclosure Package?

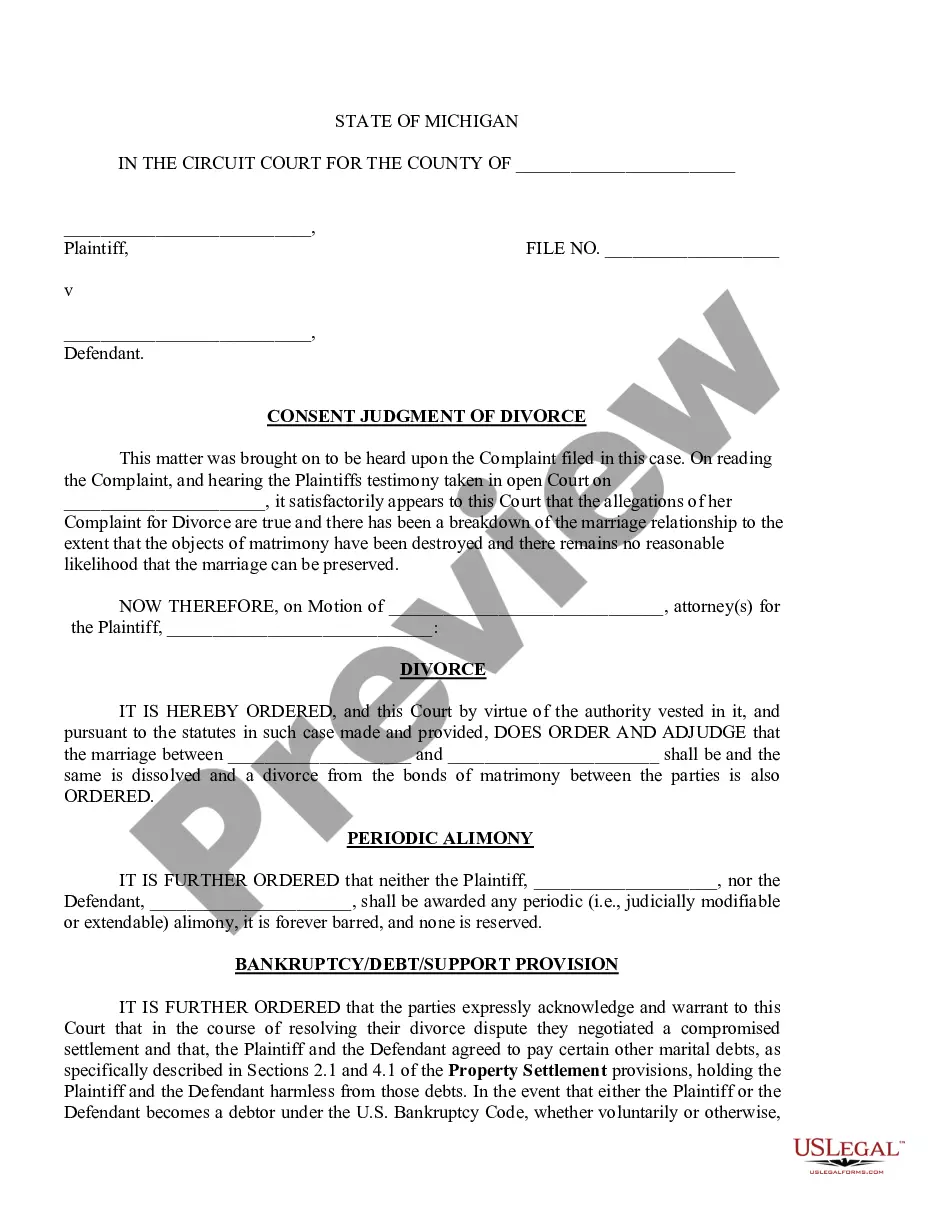

The Foreclosure In California 2022 you observe on this page is a versatile legal template crafted by expert attorneys in accordance with federal and municipal regulations.

For over 25 years, US Legal Forms has supplied individuals, enterprises, and legal professionals with more than 85,000 authenticated, state-specific forms for any business and personal circumstance. It’s the quickest, easiest, and most reliable way to acquire the documentation you require, as the service guarantees bank-level data security and anti-malware safeguards.

Subscribe to US Legal Forms to have verified legal templates for all of life's occurrences at your fingertips.

- Explore the document you require and verify it.

- Select the pricing plan that best fits your needs and create an account. Use PayPal or a credit card for immediate payment. If you are already a member, Log In and check your subscription to continue.

- Select the format you prefer for your Foreclosure In California 2022 (PDF, Word, RTF) and save the template on your device.

- Complete and sign the paperwork.

- Re-download your documentation as needed.

Form popularity

FAQ

Under California laws, lenders can pursue a foreclosure case through the courts, but they almost always use non-judicial foreclosure instead. The non-judicial process can be completed in approximately 120 days (4 months). However, the timeline can sometimes be 200 days or more.

To start a judicial foreclosure, the lender files the appropriate court action against the owner in default. Usually this is in the form of a lis pendens (pending lawsuit) against the owner. If it rules against the owner, the court will order a public sale of the property.

The nonjudicial foreclosure process is used most commonly in our state. This process takes some time, but if you act quickly, you have better chances.

The California foreclosure process can last up to 200 days or longer. Day 1 is when a payment is missed; your loan is officially in default around day 90. After 180 days, you'll receive a notice of trustee sale. About 20 days later, your bank can then set the auction.

California changed its law at the beginning of the 2023 to require that certain sellers of foreclosed properties containing one to four residential units only accept offers from eligible bidders during the first 30 days after a property is listed.