3 Day Right To Cancel California Withholding

Description

How to fill out California Waiver Of 3 Day Right To Cancel?

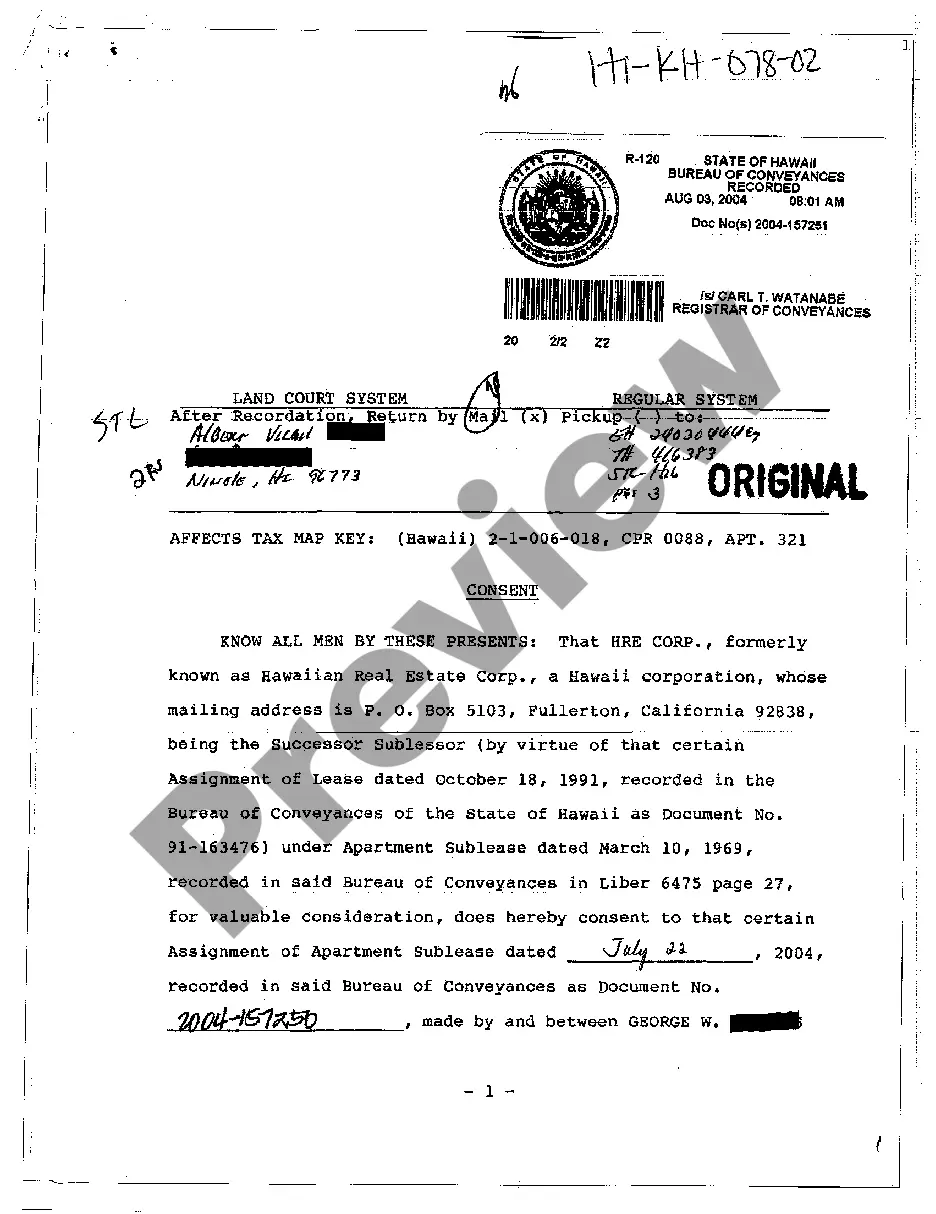

The 3 Day Right To Cancel California Withholding you see on this page is a multi-usable formal template drafted by professional lawyers in compliance with federal and local regulations. For more than 25 years, US Legal Forms has provided people, businesses, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the quickest, most straightforward and most reliable way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Obtaining this 3 Day Right To Cancel California Withholding will take you only a few simple steps:

- Look for the document you need and check it. Look through the file you searched and preview it or review the form description to confirm it satisfies your requirements. If it does not, make use of the search option to find the right one. Click Buy Now when you have located the template you need.

- Sign up and log in. Choose the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to continue.

- Get the fillable template. Pick the format you want for your 3 Day Right To Cancel California Withholding (PDF, Word, RTF) and save the sample on your device.

- Complete and sign the document. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a eSignature.

- Download your paperwork again. Make use of the same document once again whenever needed. Open the My Forms tab in your profile to redownload any earlier downloaded forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

To dissolve a California corporation, submit the appropriate form(s) to the California Secretary of State (SOS) by mail or in person. The dissolution forms are available on the SOS website and can be filled in online then printed out. You may type on the forms or write in black or blue ink.

Wages paid to nonresidents of California for services performed inside the state are subject to withholding for state income tax; only wages paid to nonresidents of California for services performed outside the state are exempt from withholding. California does not distinguish between U.S. citizens, U.S. residents, and ...

For the State, the law is written such that all real property being sold requires the payment of tax at the close of escrow in an amount equal to 3.33% of the Sales Price. An Alternative Calculated Amount can also be used.

Any remitter (individual, business entity, trust, estate, or REEP) who withheld on the sale/transfer of California real property must file Form 593 to report the amount withheld. If this is an installment sale payment after escrow closed, the buyer/transferee is the responsible person.

Steps to Dissolve, Surrender, or Cancel a Business Entity File all delinquent tax returns and pay all tax balances, including any penalties, fees, and interest. File the final/current year tax return. ... Must cease doing or transacting business in California after the final taxable year.