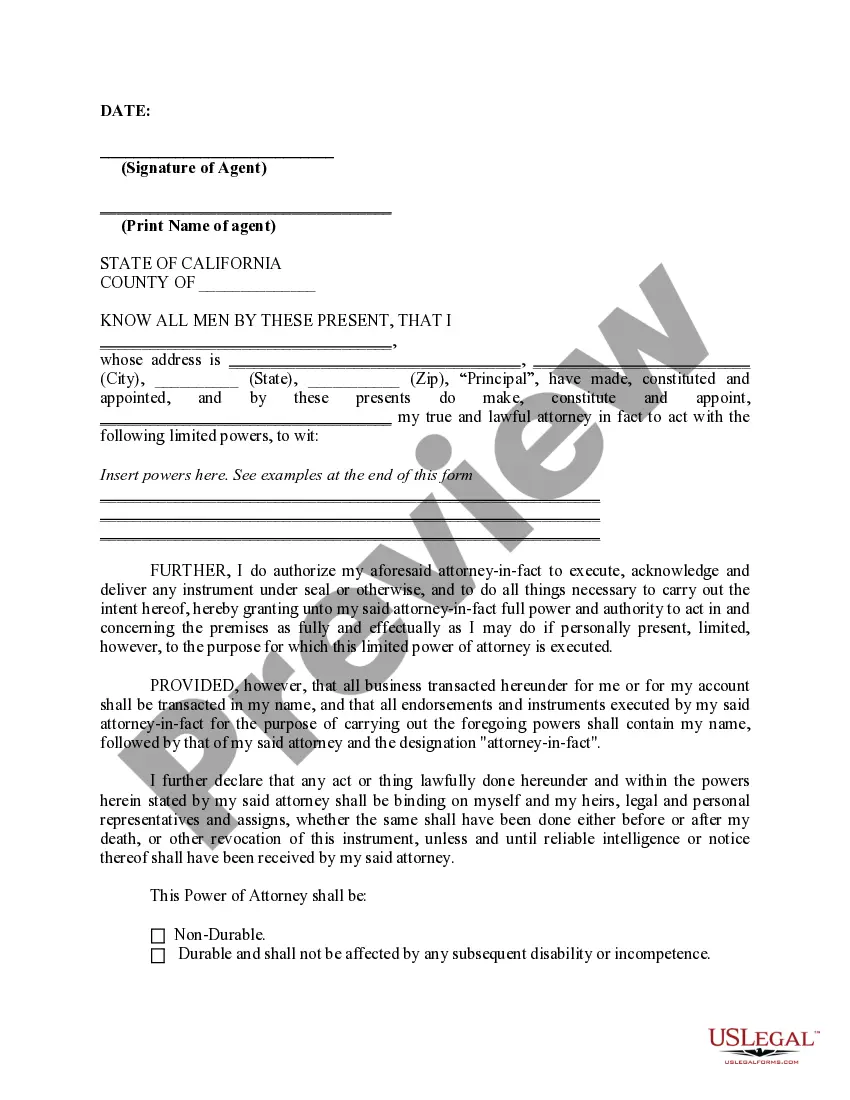

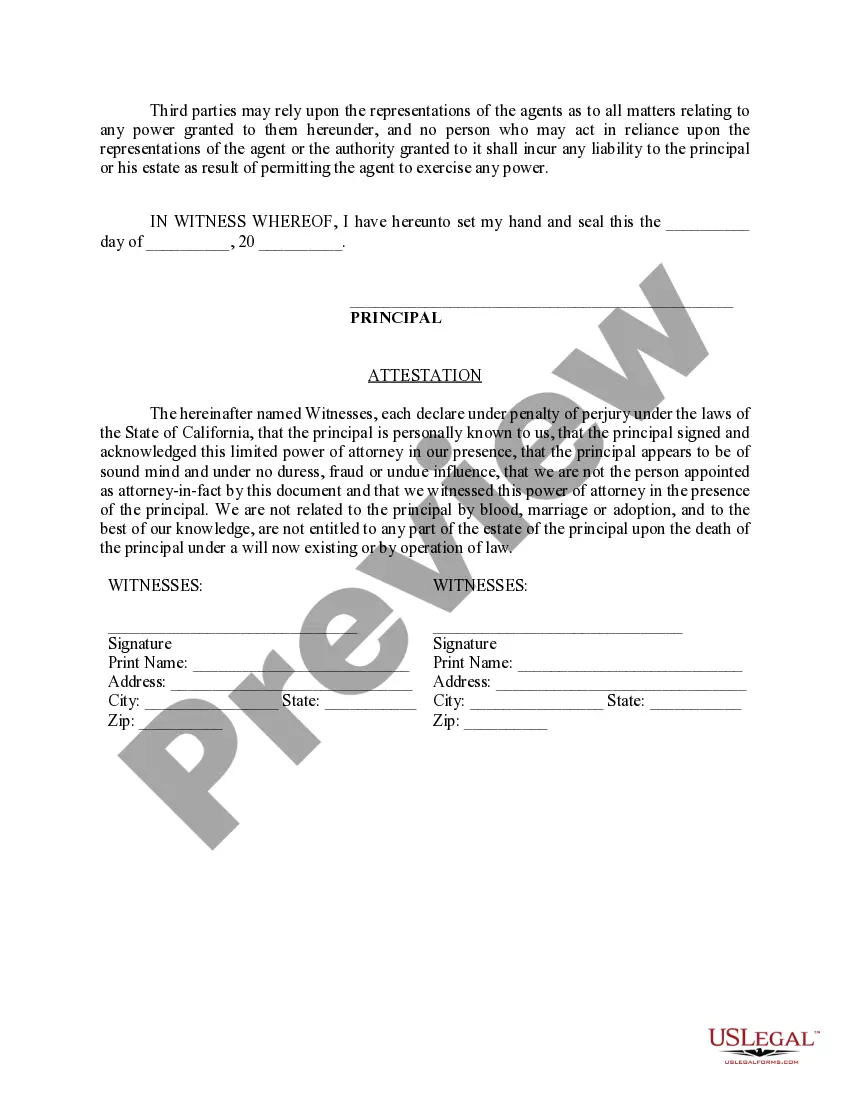

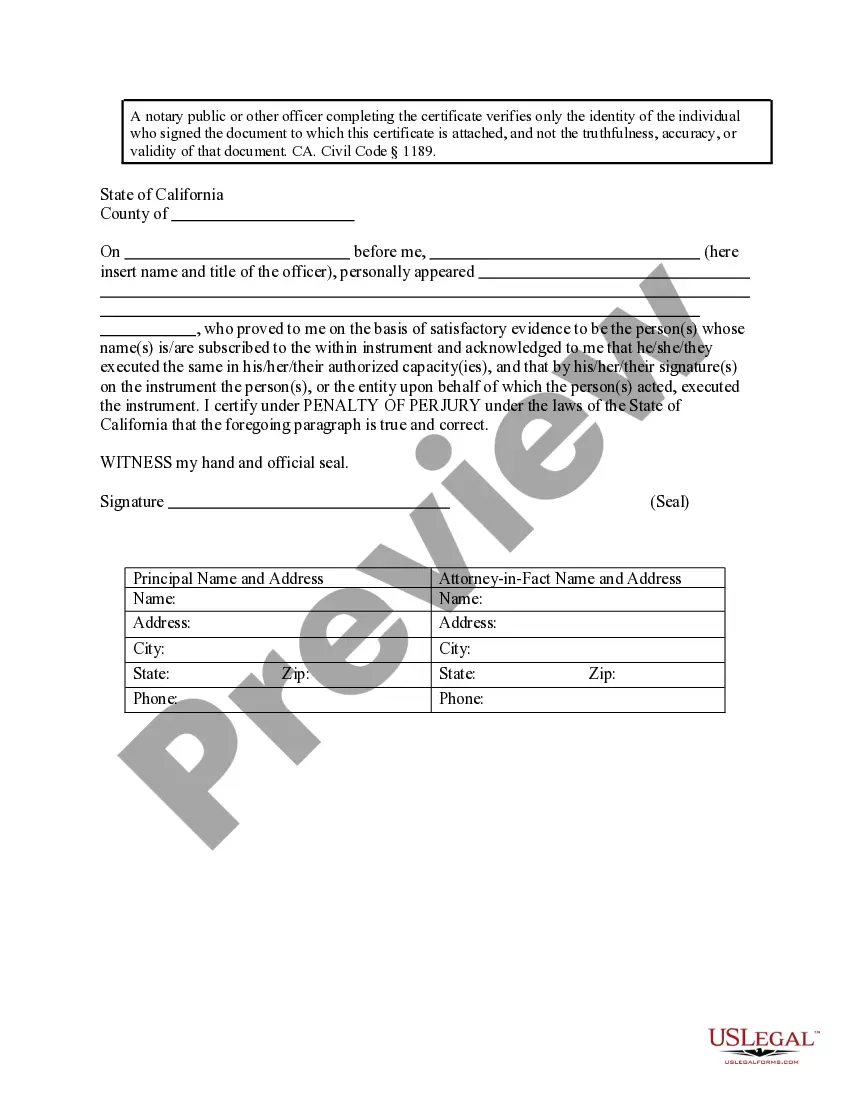

This is a limited power of attorney for California. You specify the powers you desire to give to your agent. Sample powers are attached to the form for illustration only and should be deleted after you complete the form with the powers you desire. The form contains an acknowledgment in the event the form is to be recorded.

A power of attorney for property is a legal document that grants someone the authority to act on behalf of another person in managing their financial affairs and property. It is a crucial legal tool that allows individuals to designate a trusted person, typically referred to as the agent or attorney-in-fact, to make important financial decisions and handle property matters when they are unable to do so themselves due to illness, absence, or incapacitation. Property power of attorney enables individuals to plan for the possibility of losing the ability to manage their own financial affairs or property in the future. By executing this legal document, they can ensure that their financial matters will be properly handled and decisions will be made according to their instructions, even if they become mentally or physically unable to handle them themselves. Some relevant keywords that pertain to power of attorney for property include: 1. Legal document 2. Financial affairs 3. Property management 4. Agent or attorney-in-fact 5. Financial decisions 6. Incapacitation 7. Illness 8. Absence 9. Trust 10. Instructions 11. Mentally or physically unable 12. Future planning There are different types of power of attorney for property that cater to specific needs and circumstances. They include: 1. General Power of Attorney: This grants broad authority to the agent to manage all financial and property matters on behalf of the principal. It remains in effect until it is revoked by the principal or upon their death. 2. Limited Power of Attorney: Also known as a special power of attorney, this type grants the agent specific authority to handle only certain financial or property matters for a defined period or purpose. 3. Durable Power of Attorney: This type remains in effect even if the principal becomes mentally or physically incapacitated. It ensures the agent can continue managing financial affairs and property on their behalf. 4. Springing Power of Attorney: This becomes effective only upon the occurrence of a specified event or condition, such as the principal's incapacitation. Until then, the principal retains control over their financial matters and property. In conclusion, a power of attorney for property is a legal document that authorizes an agent to make financial decisions and handle property matters on behalf of the principal. It ensures proper management of assets and finances, even in cases of incapacitation. Different types of powers of attorney for property exist, allowing individuals to tailor the authority and conditions to their specific needs.