Uniform Statutory Form Power Of Attorney Ca Withholding Tax

Description

How to fill out California Uniform Statutory Power Of Attorney - Property - Finances - Section 4401?

Whether for professional objectives or personal issues, everyone must confront legal circumstances at some stage in their life.

Finalizing legal documents necessitates meticulous focus, commencing with selecting the correct form template. For example, if you choose an incorrect version of a Uniform Statutory Form Power Of Attorney Ca Withholding Tax, it will be rejected once submitted.

With an extensive US Legal Forms catalog available, you don’t have to waste time searching for the right template online. Utilize the library’s user-friendly navigation to discover the suitable template for any circumstance.

- Locate the template you require by using the search bar or catalog browsing.

- Review the form’s description to confirm it aligns with your situation, state, and area.

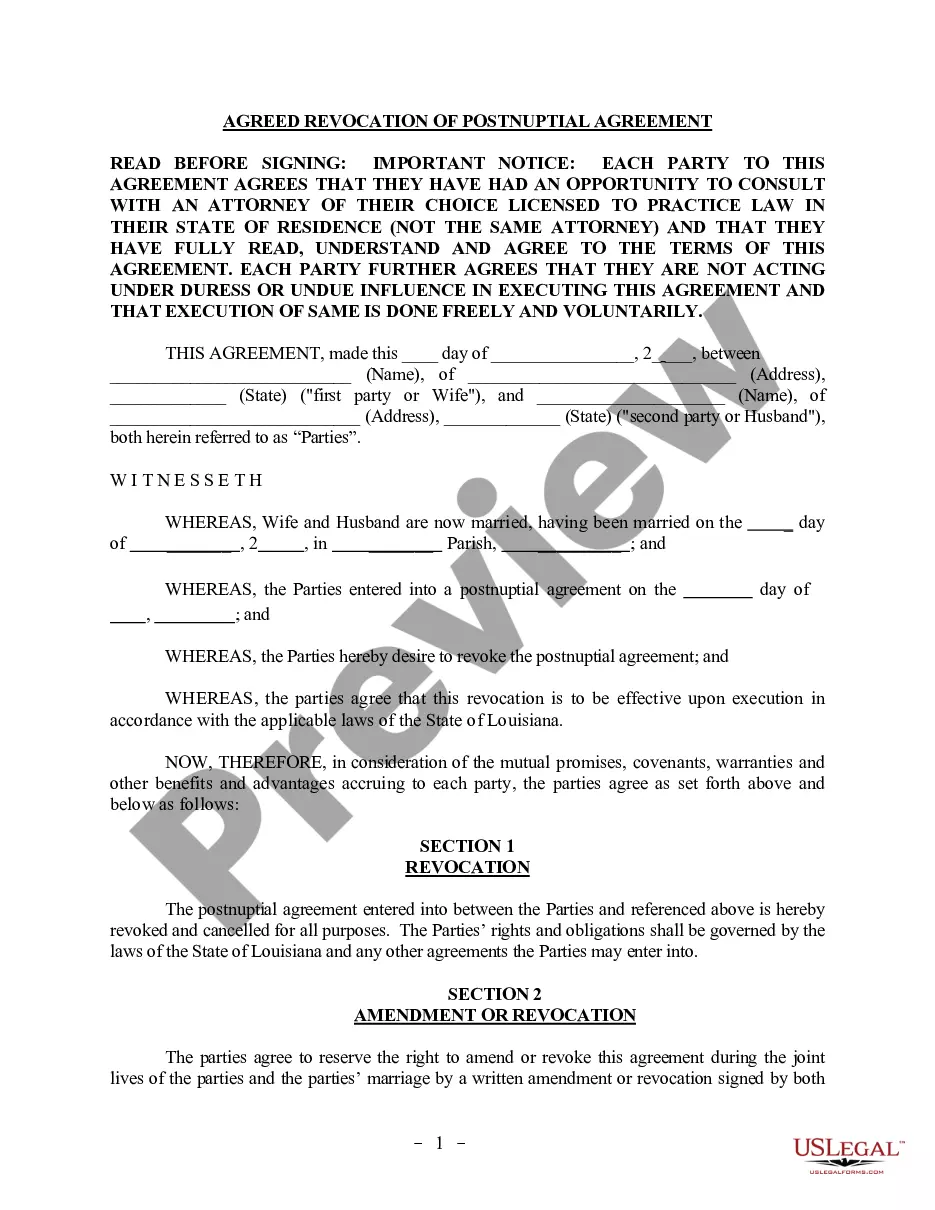

- Select the form’s preview to inspect it.

- If it is the incorrect document, return to the search feature to find the Uniform Statutory Form Power Of Attorney Ca Withholding Tax example you need.

- Download the file when it fits your specifications.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- In case you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you desire and download the Uniform Statutory Form Power Of Attorney Ca Withholding Tax.

- Once it is saved, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

The difference has to do with whether the powers remain effective after the onset of a disability. That is, the regular power of attorney ceases to be effective if you become disabled, whereas the ?durable? power of attorney continues to be effective despite your subsequent disability.

THE POWERS YOU GRANT BELOW ARE EFFECTIVE. EVEN IF YOU BECOME DISABLED OR INCOMPETENT. CAUTION: A DURABLE POWER OF ATTORNEY IS AN IMPORTANT LEGAL DOCUMENT. BY SIGNING THE DURABLE POWER OF ATTORNEY, YOU ARE AUTHORIZING ANOTHER PERSON TO ACT FOR YOU, THE PRINCIPAL.

Uniform Statutory Form Power of Attorney Act¹ provides a. short statutory form that gives the agent (attorney in fact) authority to act with respect to one or more of 13 categories of. transactions or matters, such as "real property transactions" or. "banking and other financial institution transactions."

Uniform Statutory Form Power of Attorney (Statutory POA) The Statutory POA is a form the State of California provides in Probate Code (PC) § 4401 that can be completed as either a durable or non-durable POA.

In California, you must use a specific power of attorney form as dictated by the state code. You can find financial POAs in California Probate Code Section 4401, called a Uniform Statutory Form Power of Attorney. This is used to create general or limited POAs.