Ca Probate Form For Trust

Description

How to fill out California Uniform Statutory Power Of Attorney - Property - Finances - Section 4401?

Handling legal documents and procedures can be a time-consuming addition to your entire day. Ca Probate Form For Trust and forms like it typically need you to look for them and navigate the way to complete them appropriately. Consequently, whether you are taking care of financial, legal, or personal matters, using a comprehensive and convenient web catalogue of forms when you need it will go a long way.

US Legal Forms is the top web platform of legal templates, offering more than 85,000 state-specific forms and a number of resources that will help you complete your documents easily. Check out the catalogue of appropriate documents available to you with just one click.

US Legal Forms provides you with state- and county-specific forms available at any time for downloading. Protect your papers administration operations having a high quality service that allows you to prepare any form in minutes without any extra or hidden fees. Just log in in your profile, locate Ca Probate Form For Trust and download it right away within the My Forms tab. You can also gain access to previously saved forms.

Would it be the first time using US Legal Forms? Sign up and set up up your account in a few minutes and you will get access to the form catalogue and Ca Probate Form For Trust. Then, stick to the steps below to complete your form:

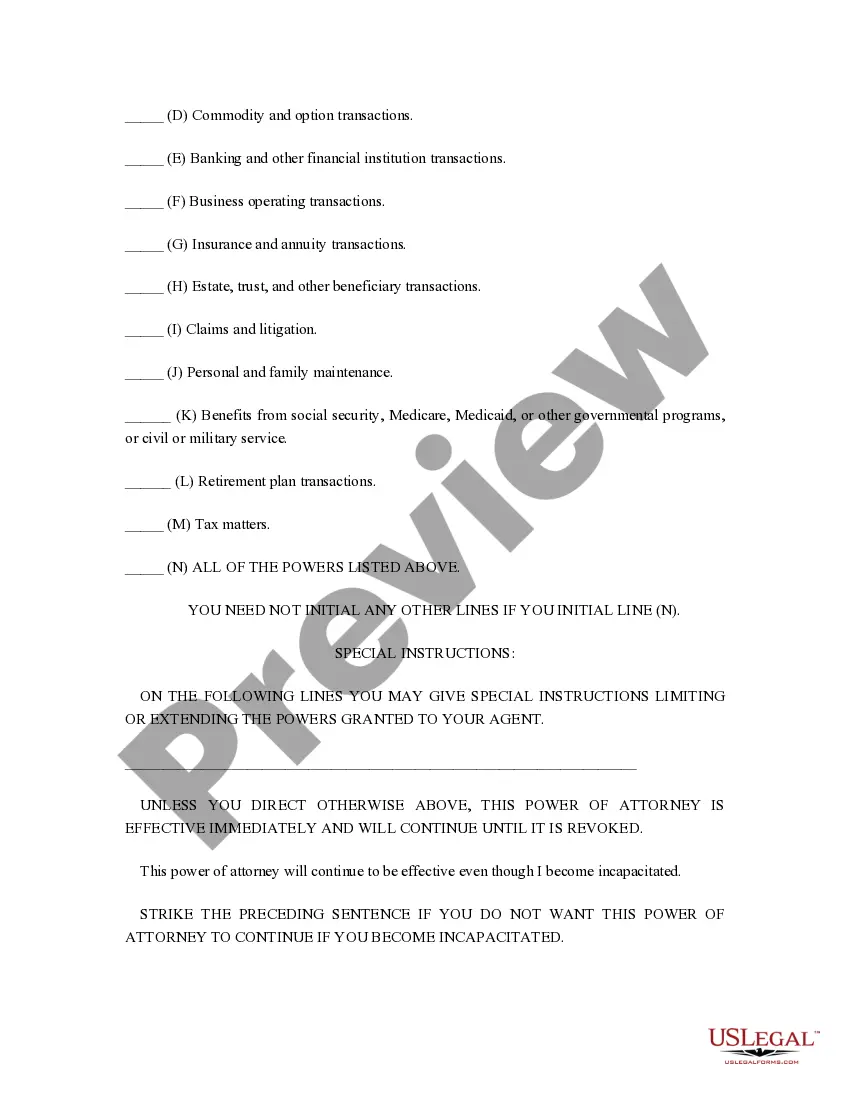

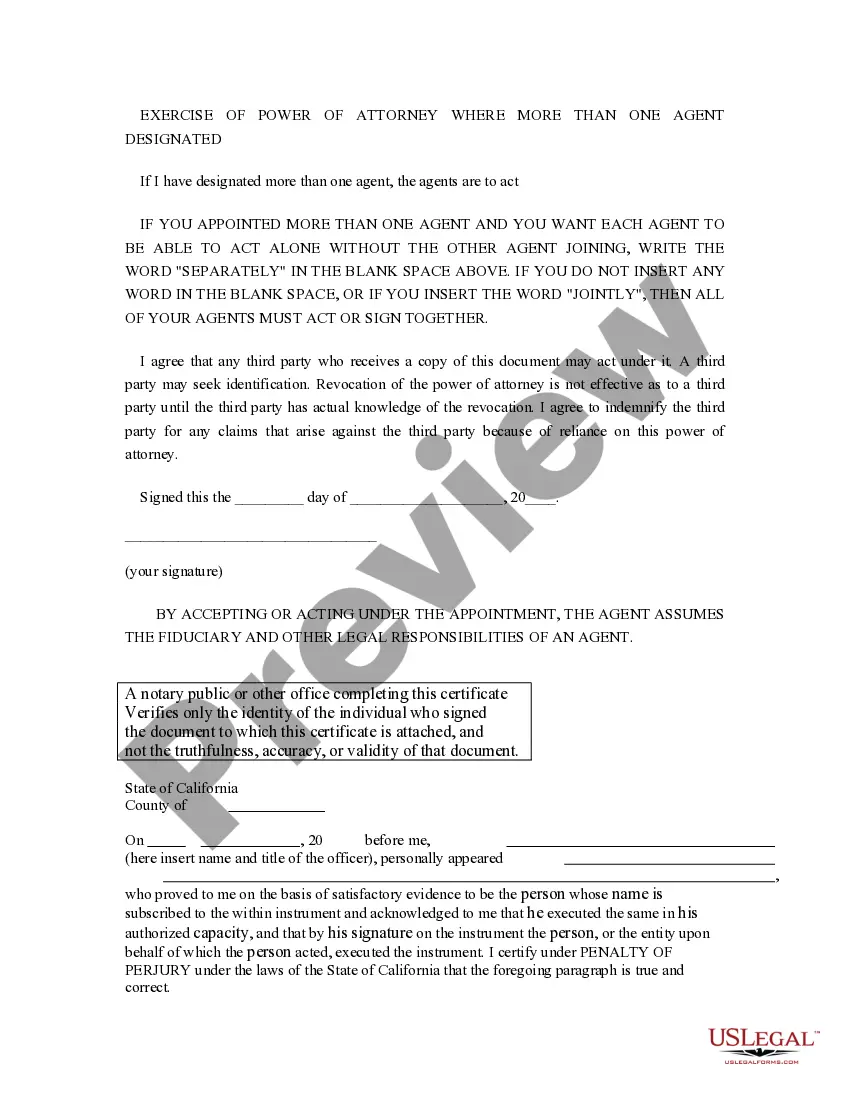

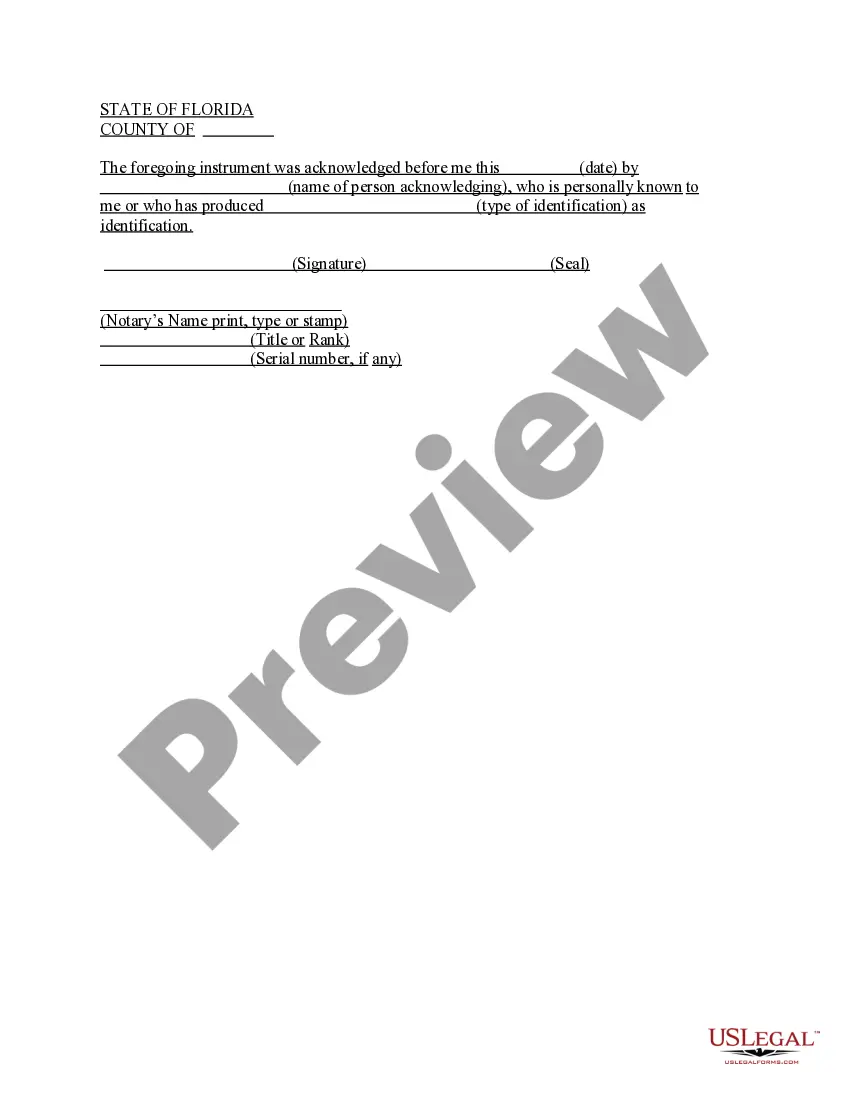

- Make sure you have the correct form using the Review option and reading the form information.

- Pick Buy Now as soon as ready, and select the subscription plan that fits your needs.

- Choose Download then complete, eSign, and print the form.

US Legal Forms has twenty five years of expertise helping consumers handle their legal documents. Obtain the form you require today and streamline any process without breaking a sweat.

Form popularity

FAQ

In California, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

When a trustee dies leaving real property to beneficiaries, the successor trustee can use an Affidavit Death of Trustee and a Quitclaim Deed to transfer the real property to the new owners. The instructions explain exactly what to do, including how to complete, notarize, and record both forms.

If all your property is in trust when you die (or become incompetent), then legally you don't own anything in your name. This means, if you die, no probate (formal court administration of a decedent's estate) is needed to pass your property on to your beneficiaries.

How long does probate take? California law says the personal representative must complete probate within one year from the date of appointment, unless s/he files a federal estate tax. In this case, the personal representative can have 18 months to complete probate.

You can complete probate on your own, but an attorney can make the process easier.