Attorney Property Probate Without A Will

Description

How to fill out California Uniform Statutory Power Of Attorney - Property - Finances - Section 4401?

Locating a reliable source to obtain the latest and suitable legal documents is a significant part of dealing with bureaucracy. Selecting the correct legal forms requires accuracy and attention to detail, which is why it is essential to obtain Attorney Property Probate Without A Will exclusively from reputable sources, such as US Legal Forms. An incorrect template can consume your time and prolong your situation. With US Legal Forms, you have minimal concerns. You can access and verify all the information regarding the document’s applicability and relevance to your situation and within your state or locality.

Follow the outlined steps to complete your Attorney Property Probate Without A Will.

Eliminate the complications associated with your legal documentation. Explore the extensive US Legal Forms library to locate legal samples, assess their relevance to your situation, and download them instantly.

- Utilize the catalog navigation or search bar to find your template.

- Review the form’s description to determine if it meets the criteria for your state and locality.

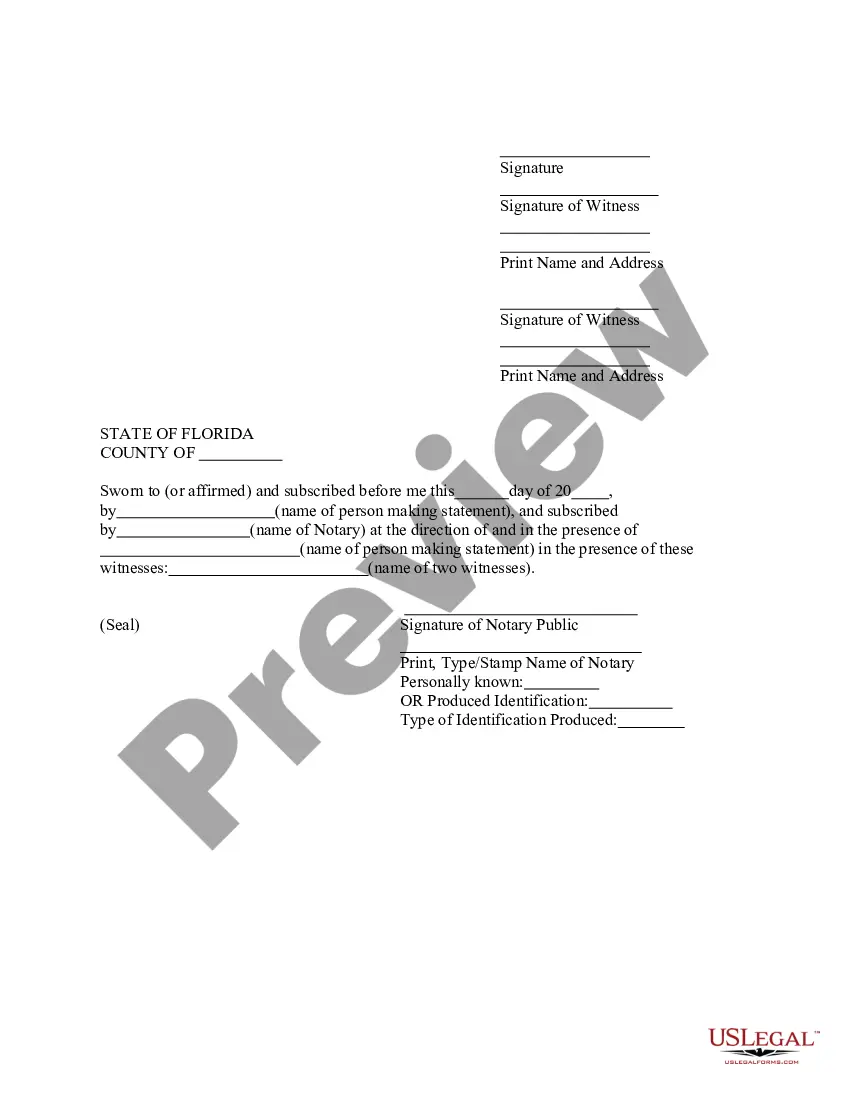

- Access the form preview, if available, to confirm that the template is indeed what you are looking for.

- Return to the search and seek the correct template if the Attorney Property Probate Without A Will does not meet your needs.

- Once you are certain about the form’s relevance, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you do not yet have an account, click Buy now to obtain the form.

- Select the pricing package that aligns with your requirements.

- Proceed to registration to finalize your purchase.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Attorney Property Probate Without A Will.

- Once you have the form on your device, you may edit it with the editor or print it and complete it manually.

Form popularity

FAQ

Not all estates need to go through the probate process. If the decedent only owned non-probate assets or community property at the time of death, then settling the estate may be quite simple. These types of assets automatically transfer to the named beneficiary or co-owner at death, so having a will is not necessary.

Technically speaking, probate is not always necessary in Texas when someone dies without a will. Only in certain situations, alternative processes can be used to distribute the deceased person's assets without the need for a dependent administration.

Even in the simplest situation, however, your family is looking at a minimum of $2,500 to $3,000 in fees and expenses. In general, for more complicated estates, the fees and expenses will likely exceed $5,000.

How to transfer property of the deceased in Texas without a will Identifying the heirs based on Texas intestate succession laws. ... Submitting the Affidavit of Heirship to the County Clerk. ... Drafting and Recording a New Deed. ... Example: Transferring a Family Home to the Surviving Spouse and Children.

Typical Intestate Succession Rules Generally, a surviving spouse receives the largest share of a decedent's property, followed by the decedent's children. Children commonly include adopted children but not step-children or foster children.