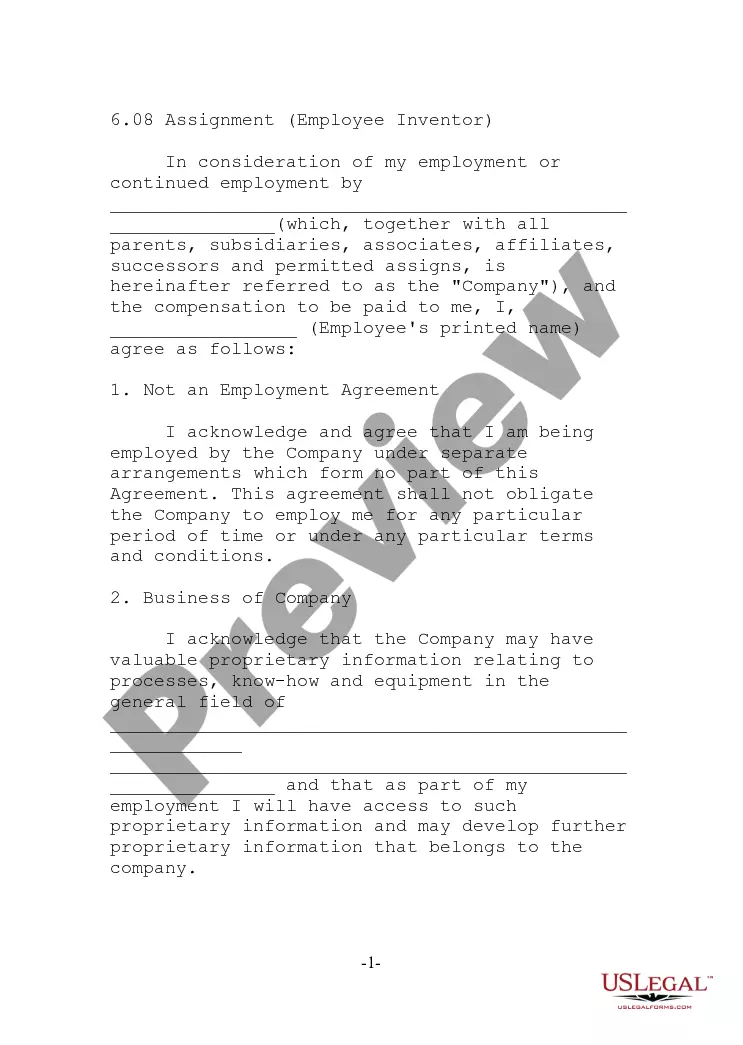

Attorney Property Probate With Trust

Description

How to fill out California Uniform Statutory Power Of Attorney - Property - Finances - Section 4401?

Locating a reliable source to obtain the latest and pertinent legal templates is a significant part of managing bureaucracy. Selecting the appropriate legal documents requires precision and meticulousness, which is why it is crucial to procure samples of Attorney Property Probate With Trust exclusively from credible providers, such as US Legal Forms. An incorrect template can squander your time and delay your situation. With US Legal Forms, you have minimal cause for concern. You can access and review all the information concerning the document’s application and relevance for your situation and in your state or locality.

Consider the following steps to complete your Attorney Property Probate With Trust.

Eliminate the hassle that comes with your legal documentation. Explore the extensive US Legal Forms library where you can discover legal templates, assess their relevance to your situation, and download them immediately.

- Use the catalog navigation or search bar to locate your sample.

- Open the form’s description to verify if it meets the needs of your state and region.

- Preview the form, if available, to confirm that the template is what you are looking for.

- Continue searching and find the suitable template if the Attorney Property Probate With Trust does not meet your needs.

- When you are confident about the form’s relevance, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you do not yet have an account, click Buy now to acquire the template.

- Choose the pricing plan that fits your requirements.

- Proceed to the registration to complete your purchase.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Attorney Property Probate With Trust.

- Once you have the form on your device, you may modify it using the editor or print it and complete it manually.

Form popularity

FAQ

The key disadvantages of placing a house in a trust include the following: Extra paperwork: Moving property in a trust requires the house owner to transfer the asset's legal title. This involves preparing and signing an additional deed, and some people may consider this cumbersome.

Assets that should not be used to fund your living trust include: Qualified retirement accounts ? 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

A trust avoids probate on any assets that are titled in the name of the trust. The terms of the trust must be revealed to the beneficiaries and heirs when the terms become irrevocable. The terms usually become irrevocable when the creator of the trust dies.

Any assets that are titled in the decedent's sole name, not jointly owned, not payable-on-death, don't have any beneficiary designations, or are left out of a Living Trust are subject to probate. Such assets can include: Bank or investment accounts. Stocks and bonds.

Probate assets include: Real estate, vehicles, and other titled assets owned solely by the deceased person or as a tenant in common with someone else. Tenants in common don't have survivorship rights. The owners can bequeath their share of the property to someone else.