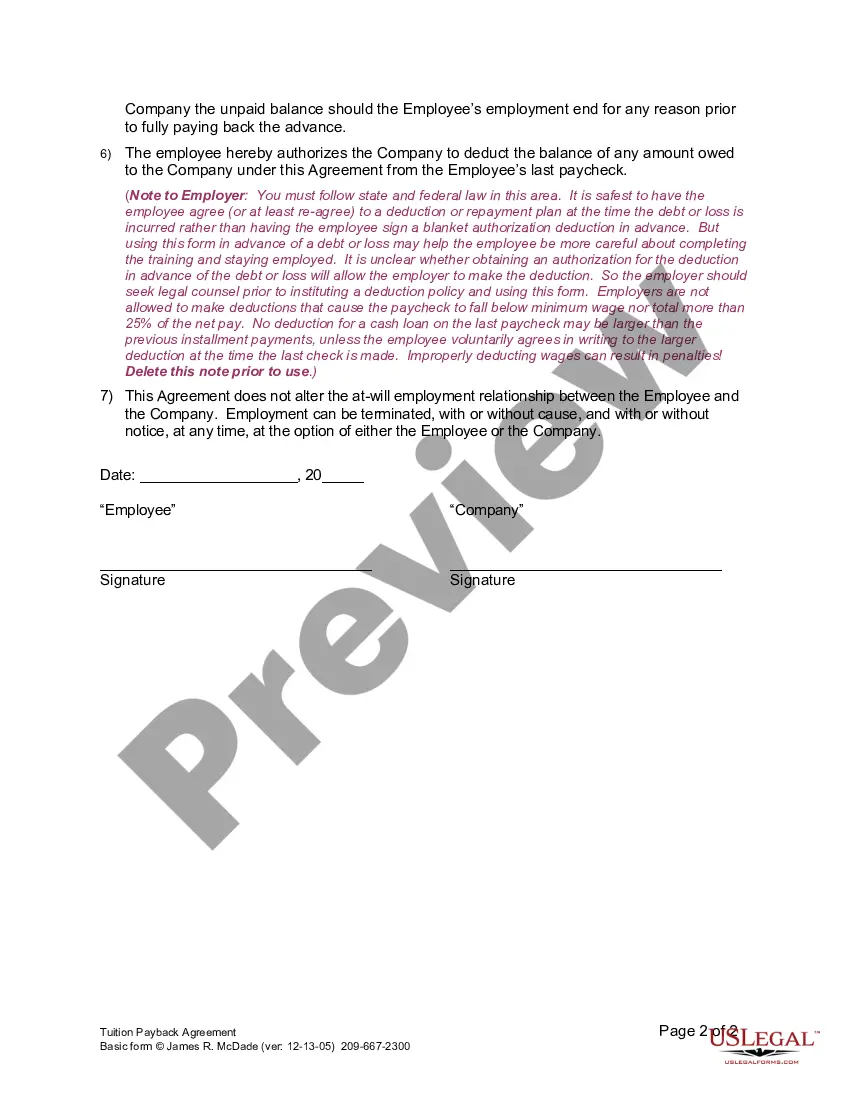

Tuition Reimbursement Payback Agreement Template For Employees

Description

How to fill out California Tuition Payback Agreement?

What is the most dependable service to obtain the Tuition Reimbursement Payback Agreement Template for Employees and other current versions of legal documents.

US Legal Forms is the solution! It is the largest compilation of legal forms for any scenario.

If you do not yet have an account with our repository, follow these instructions to create one: Form compliance verification. Before acquiring any template, ensure it meets your requirements and complies with your state or county's regulations. Review the form description and utilize the Preview feature if available. Alternative form search. If there are any discrepancies, use the search bar at the top of the page to find another document. Click Buy Now to select the appropriate one. Registration and subscription purchase. Choose the optimal pricing plan, sign in or create an account, and complete your subscription payment using PayPal or a credit card. Downloading the document. Select the format you wish to save the Tuition Reimbursement Payback Agreement Template for Employees (PDF or DOCX) and click Download to obtain it. US Legal Forms is an excellent option for anyone who needs to manage legal documents. Premium users have additional benefits as they can complete and electronically sign previously saved documents at any time using the built-in PDF editing tool. Explore it today!

- Each example is professionally crafted and verified for adherence to federal and state laws and rules.

- They are organized by area and jurisdiction, making it easy to find what you require.

- Experienced users of the platform simply need to sign in to the system, verify their subscription status, and click the Download button adjacent to the Tuition Reimbursement Payback Agreement Template for Employees to obtain it.

- Once downloaded, the document is accessible for future use within the My documents section of your account.

Form popularity

FAQ

If you are laid off, an employer will often not require you to repay training and education costs, since you did not breach the contract. By not requiring repayment, the company keeps the tax deduction it took for your tuition reimbursement.

Employers require tuition reimbursement payback agreements to avoid training employees who use their education to get a new job working elsewhere. Companies legally protect themselves by making employees pay back reimbursements if the employee leaves the company within a specific time frame of completing the education.

Most companies now require that tuition-reimbursement costs be paid back when the employee leaves. At least at the Master of Business Administration level, the requirement has been about two years of subsequent service.

If your employer pays more than $5,250 for educational benefits for you during the year, you must generally pay tax on the amount over $5,250. Your employer should include in your wages (Form W-2, box 1) the amount that you must include in income.

Begin the request by giving your name, employer and position within the company. List each course for which you would like to receive reimbursement. Provide course dates, the academic institution that offered the course, your grade for the course and the cost of the course plus any necessary books or supplies.