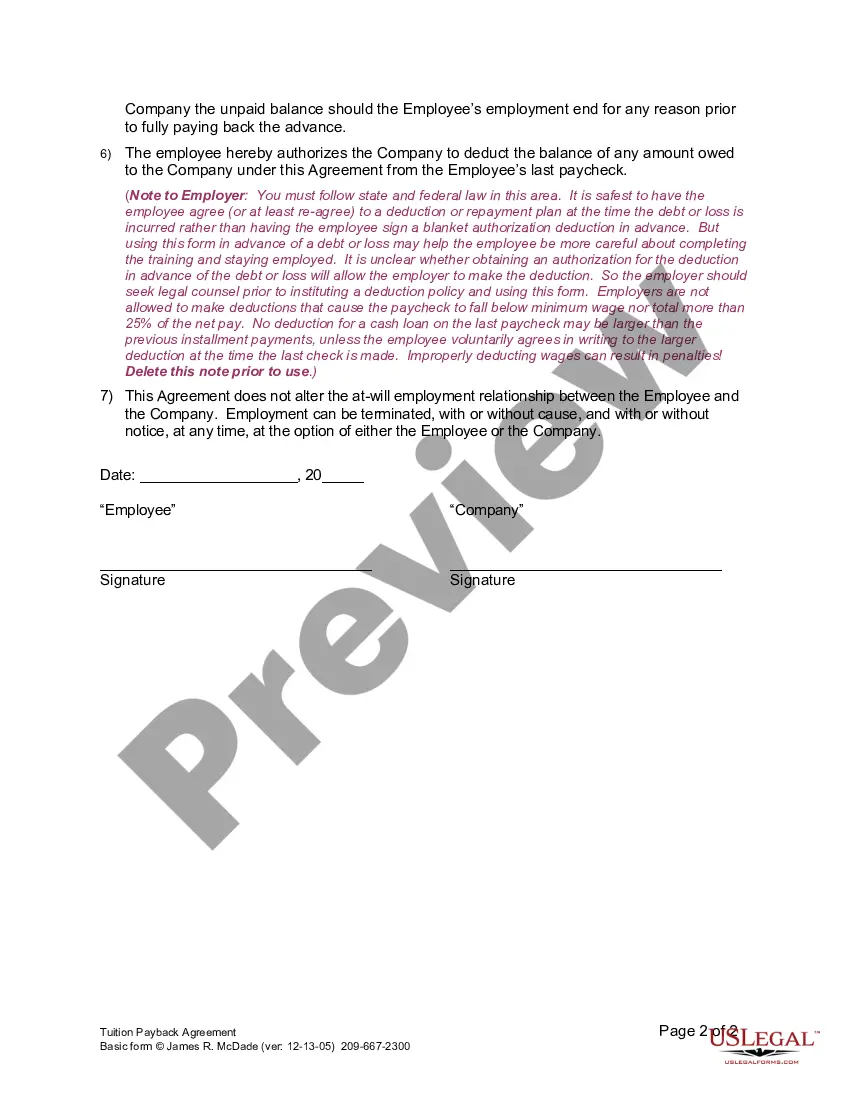

Employers use this form to recover the cost of voluntary training if the employee leaves prior to fulfilling an agreed-upon term of service.

Company Pay Advance Withdrawal

Description

How to fill out California Tuition Payback Agreement?

Legal papers managing may be frustrating, even for knowledgeable professionals. When you are looking for a Company Pay Advance Withdrawal and don’t have the a chance to devote looking for the right and updated version, the processes may be stressful. A robust online form catalogue could be a gamechanger for anybody who wants to handle these situations efficiently. US Legal Forms is a industry leader in web legal forms, with more than 85,000 state-specific legal forms available whenever you want.

With US Legal Forms, you can:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms covers any demands you might have, from individual to enterprise papers, in one spot.

- Employ advanced tools to complete and handle your Company Pay Advance Withdrawal

- Gain access to a useful resource base of articles, tutorials and handbooks and resources highly relevant to your situation and needs

Save effort and time looking for the papers you need, and make use of US Legal Forms’ advanced search and Review feature to locate Company Pay Advance Withdrawal and acquire it. In case you have a subscription, log in to the US Legal Forms profile, search for the form, and acquire it. Take a look at My Forms tab to view the papers you previously saved as well as handle your folders as you see fit.

Should it be the first time with US Legal Forms, make an account and get unrestricted use of all advantages of the library. Here are the steps to consider after downloading the form you need:

- Verify it is the proper form by previewing it and reading its information.

- Be sure that the sample is accepted in your state or county.

- Choose Buy Now when you are all set.

- Choose a subscription plan.

- Pick the formatting you need, and Download, complete, eSign, print and send your document.

Benefit from the US Legal Forms online catalogue, supported with 25 years of expertise and trustworthiness. Transform your everyday document managing into a smooth and easy-to-use process right now.

Form popularity

FAQ

To qualify for a hardship distribution, a 401(k) participant must meet two criteria. First, they must have an ?immediate and heavy financial need.? Second, the distribution must be limited to the amount ?necessary to satisfy? the financial need.

However, you should know these consequences before taking a hardship distribution: The amount of the hardship distribution will permanently reduce the amount you'll have in the plan at retirement. You must pay income tax on any previously untaxed money you receive as a hardship distribution.

A hardship distribution is a withdrawal from a participant's elective deferral account made because of an immediate and heavy financial need, and limited to the amount necessary to satisfy that financial need. The money is taxed to the participant and is not paid back to the borrower's account.

Key Takeaways. If you're younger than 59½ and suffering financial hardship, you may be able to withdraw funds from your retirement accounts without incurring the usual 10% penalty. Not all hardships qualify, however, and you're still responsible for paying income tax on the withdrawal.

How to Make a 401(k) Hardship Withdrawal. To make a 401(k) hardship withdrawal, you will need to contact your employer and plan administrator and request the withdrawal. The administrator will likely require you to provide evidence of the hardship, such as medical bills or a notice of eviction.