Bonus Per Employee Formula

Description

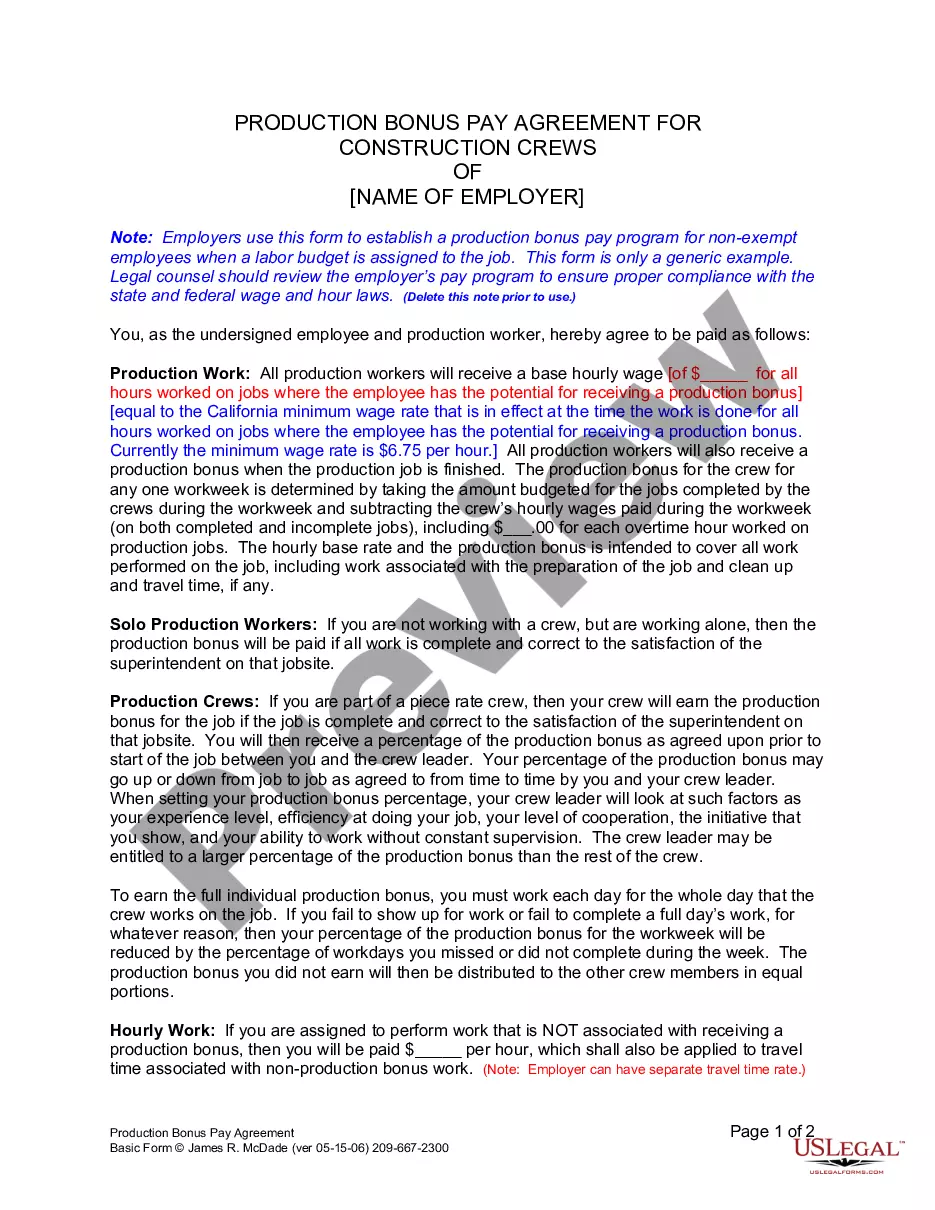

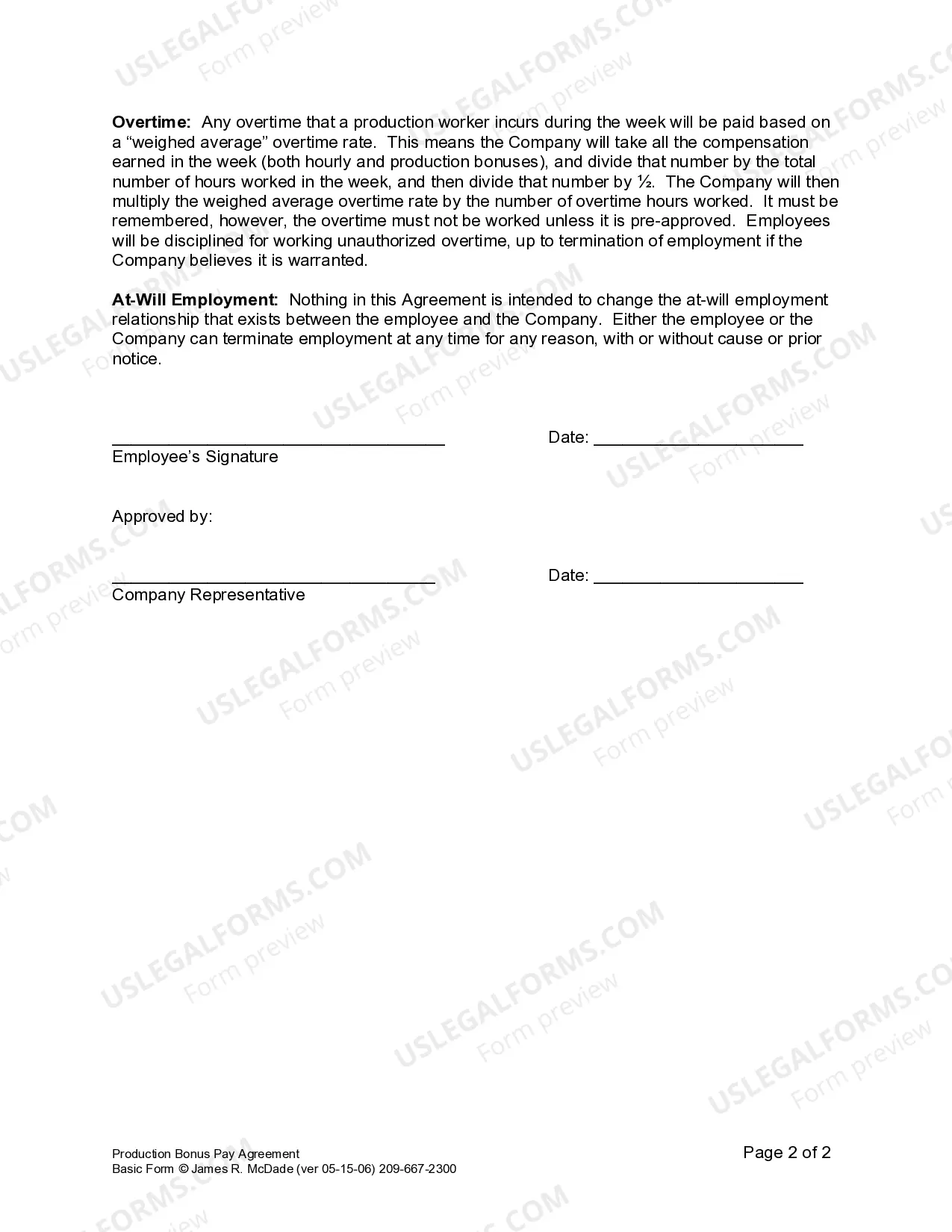

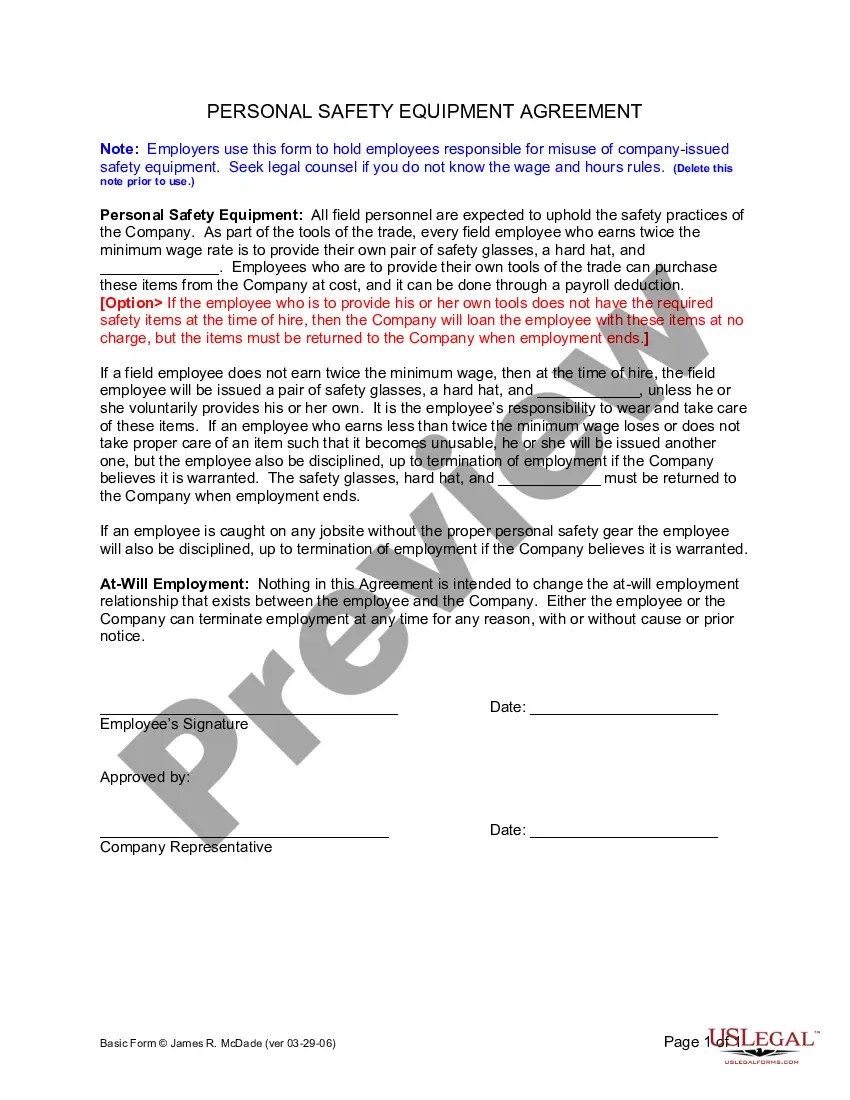

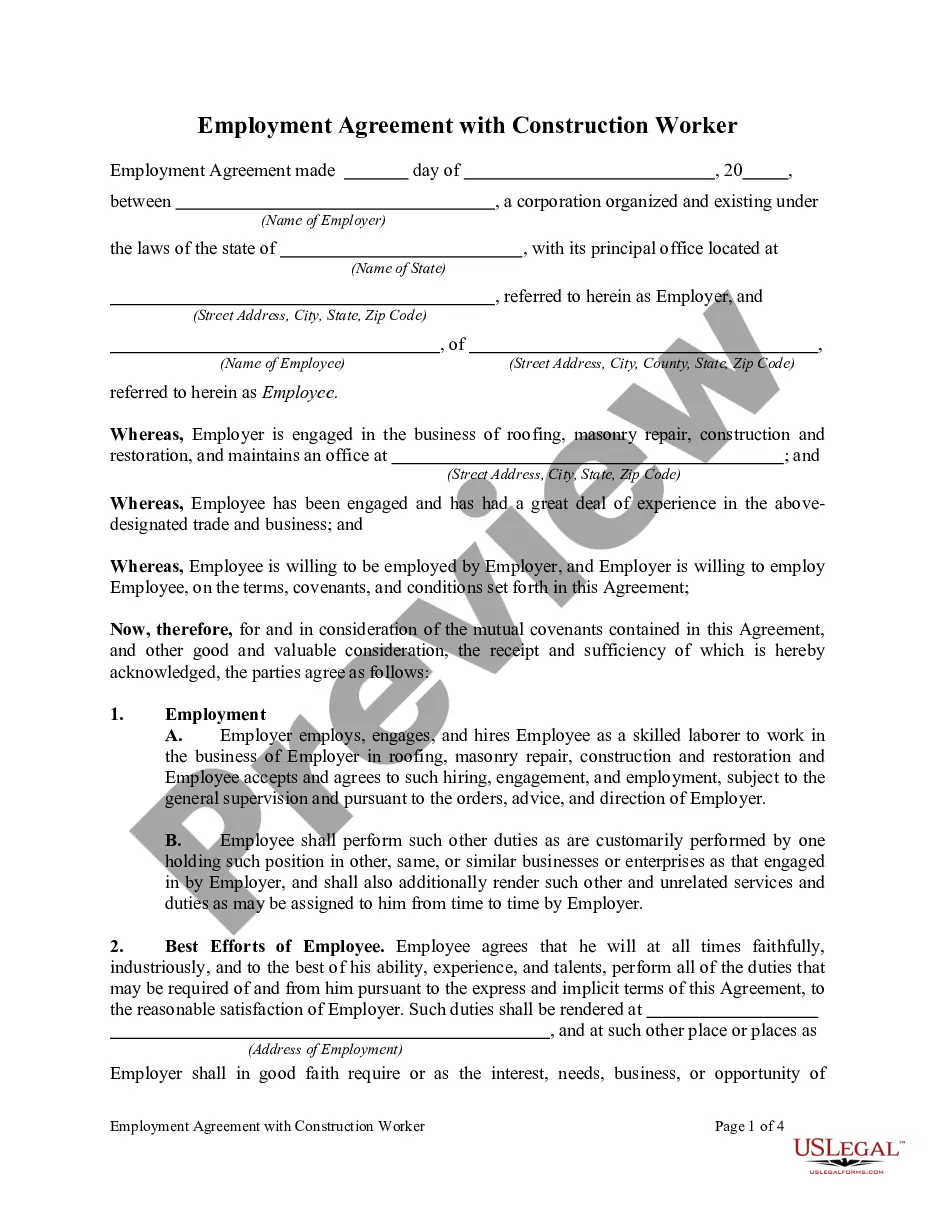

How to fill out California Production Bonus Pay Agreement For Construction?

Managing legal documents can be daunting, even for seasoned experts.

When you are looking for a Bonus Per Employee Formula and don’t have the opportunity to invest time in finding the accurate and updated version, the tasks may become anxiety-inducing.

US Legal Forms addresses any needs you might have, from personal to business documents, all in one location.

Utilize cutting-edge tools to complete and manage your Bonus Per Employee Formula.

Here are the steps to follow after acquiring the form you need: Verify that this is the correct form by previewing it and reviewing its description. Ensure that the template is authorized in your state or county. Click Buy Now when you are ready. Select a subscription option. Choose the file format you desire, and Download, fill out, sign, print, and send your document. Enjoy the US Legal Forms online library, which is supported by 25 years of expertise and trustworthiness. Transform your routine document management into a simple and user-friendly process today.

- Access a valuable repository of articles, guides, and manuals related to your circumstances and needs.

- Save time and energy searching for the documents you require, and utilize US Legal Forms’ sophisticated search and Preview tool to locate and download the Bonus Per Employee Formula.

- If you have a monthly subscription, Log Into your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to view the documents you have previously downloaded and to manage your folders as needed.

- If it’s your first experience with US Legal Forms, create an account and gain unlimited access to all the advantages of the library.

- An extensive online form library could be a transformative solution for anyone aiming to handle these matters effectively.

- US Legal Forms stands as a frontrunner in online legal documents, offering over 85,000 state-specific legal forms accessible to you at any moment.

- With US Legal Forms, you can access tailored legal and business forms specific to your state or county.

Form popularity

FAQ

Once you have both performance percentage and salary percentage for each individual, you can multiply them together by an individual. Add up all individuals to get a total ratio. Divide each individual's share by the full rate, and that's the portion of the bonus pool that an individual receives.

To calculate a prorated bonus, you divide the number of days, weeks, or months the employee worked by 365, 52, or 12, respectively, then multiply the answer by the total bonus amount you would've paid for a full year's work.

Companies use this method to reward salespeople. The bonus amount is calculated by multiplying the total sales made by a predetermined bonus percentage. For example, if you made $10,000 in sales and the commission rate is 5%, the calculation would be: $10,000 x 0.05 = $500. Bonus Pay Calculation for Work Bonuses & Tax in 2023 joinhomebase.com ? Manage a team joinhomebase.com ? Manage a team

The bonus is calculated as follows: If the salary of an employee is less than or equal to Rs. 7000, the bonus calculation is calculated using the formula: Bonus = Salary x 8.33/100.

Basic Salary x 20% = Bonus p.m. 7000 x 20% = 1400 (16800 p.a.) 7000 x 8.33% = 583 ( 6996 p.a.)