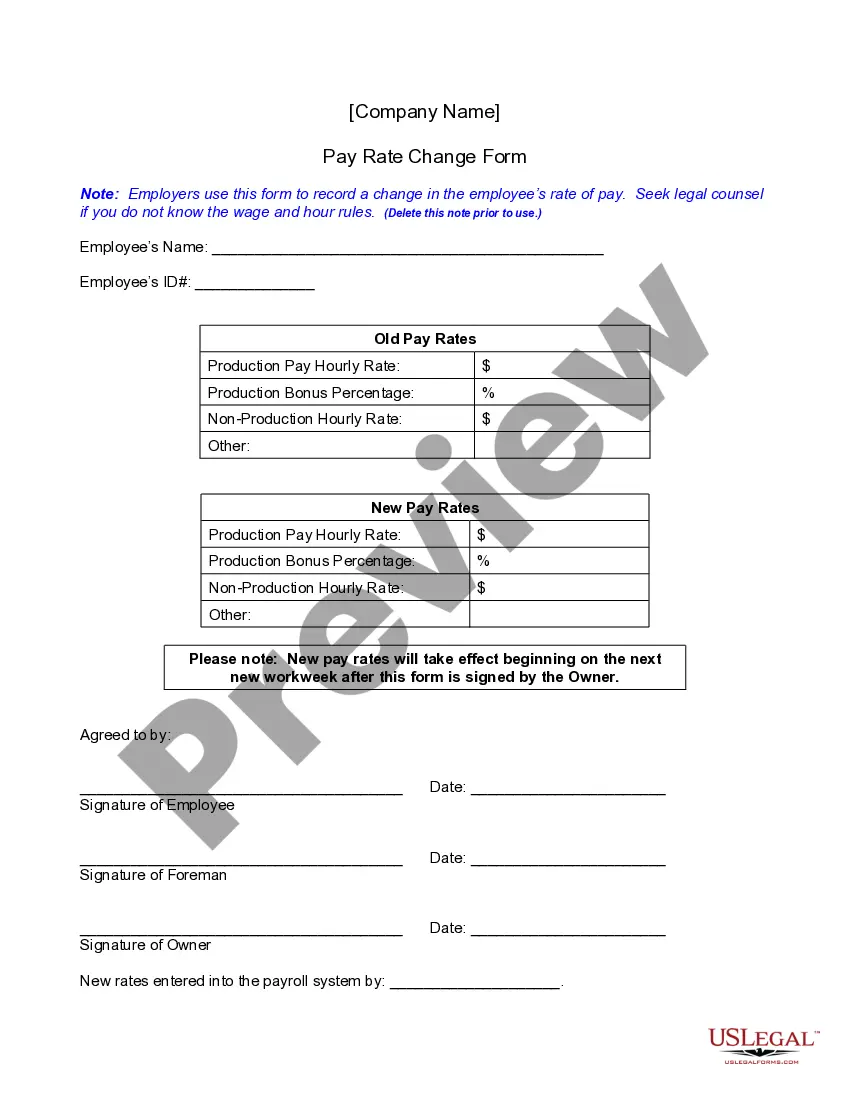

California Pay Requirements

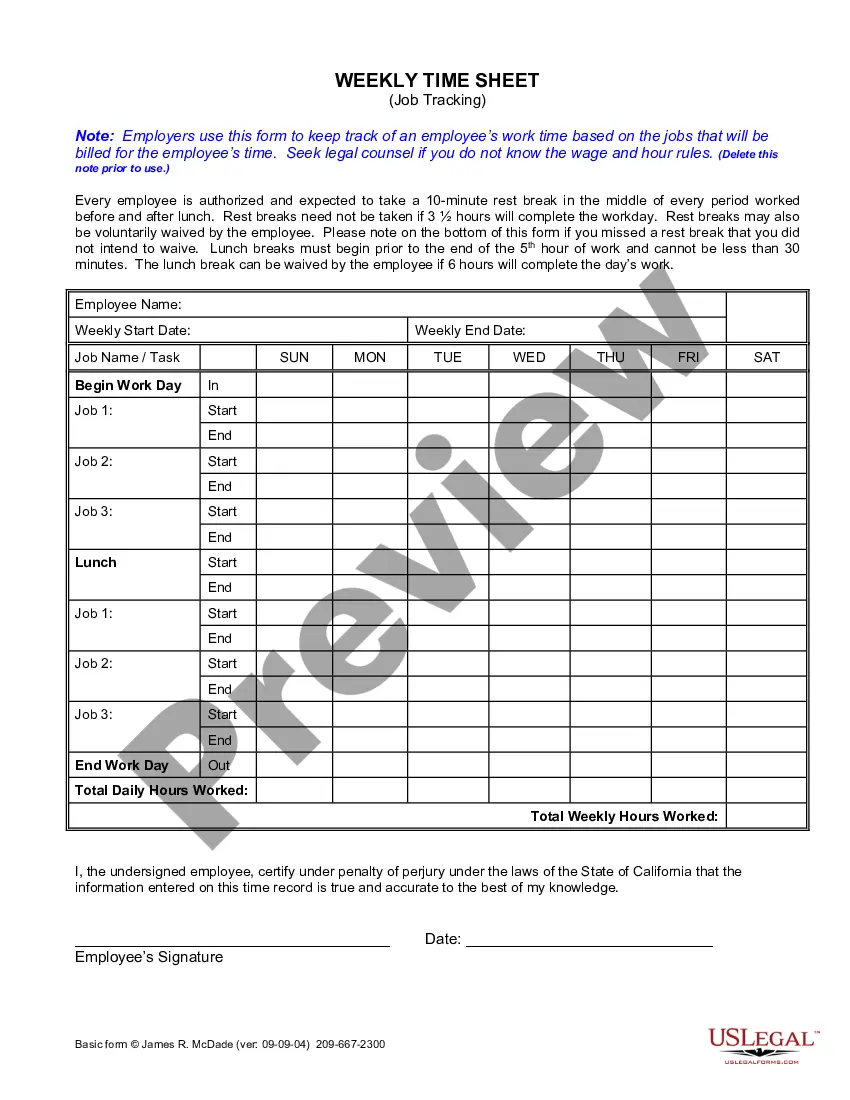

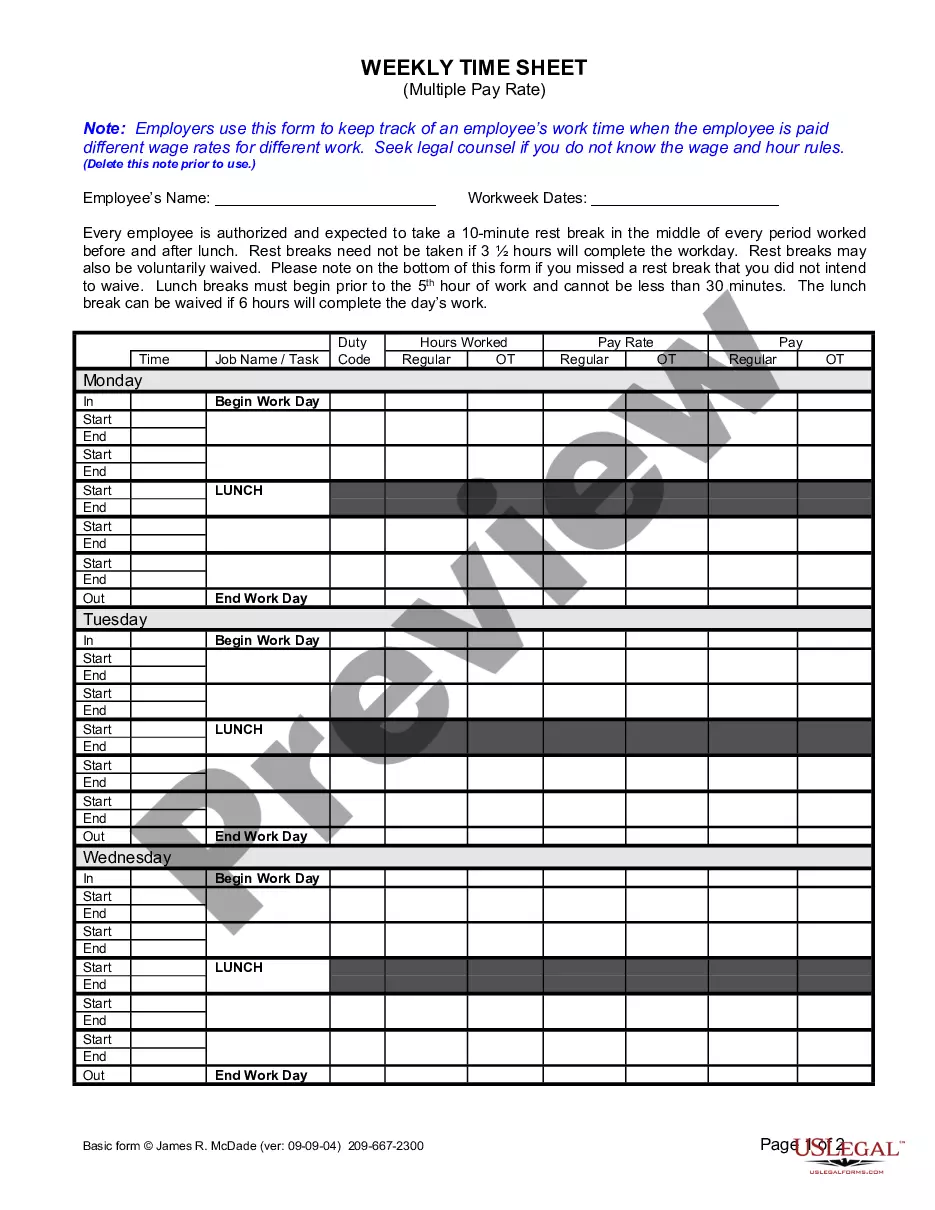

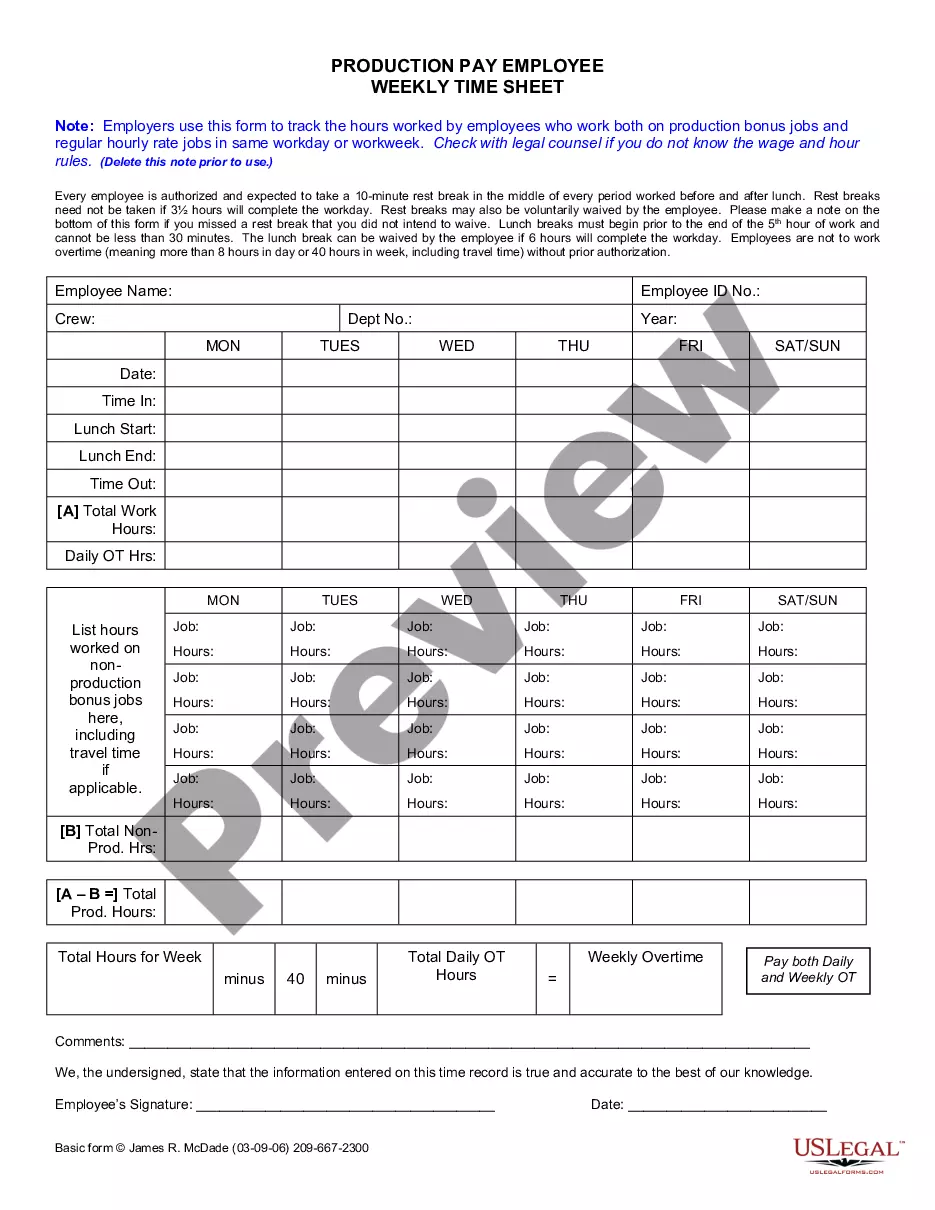

Description

How to fill out California Pay Rate Change Form?

Using legal templates that comply with federal and local laws is a matter of necessity, and the internet offers a lot of options to pick from. But what’s the point in wasting time searching for the right California Pay Requirements sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the largest online legal library with over 85,000 fillable templates drafted by lawyers for any professional and personal situation. They are easy to browse with all papers collected by state and purpose of use. Our professionals keep up with legislative updates, so you can always be sure your paperwork is up to date and compliant when getting a California Pay Requirements from our website.

Getting a California Pay Requirements is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the right format. If you are new to our website, adhere to the instructions below:

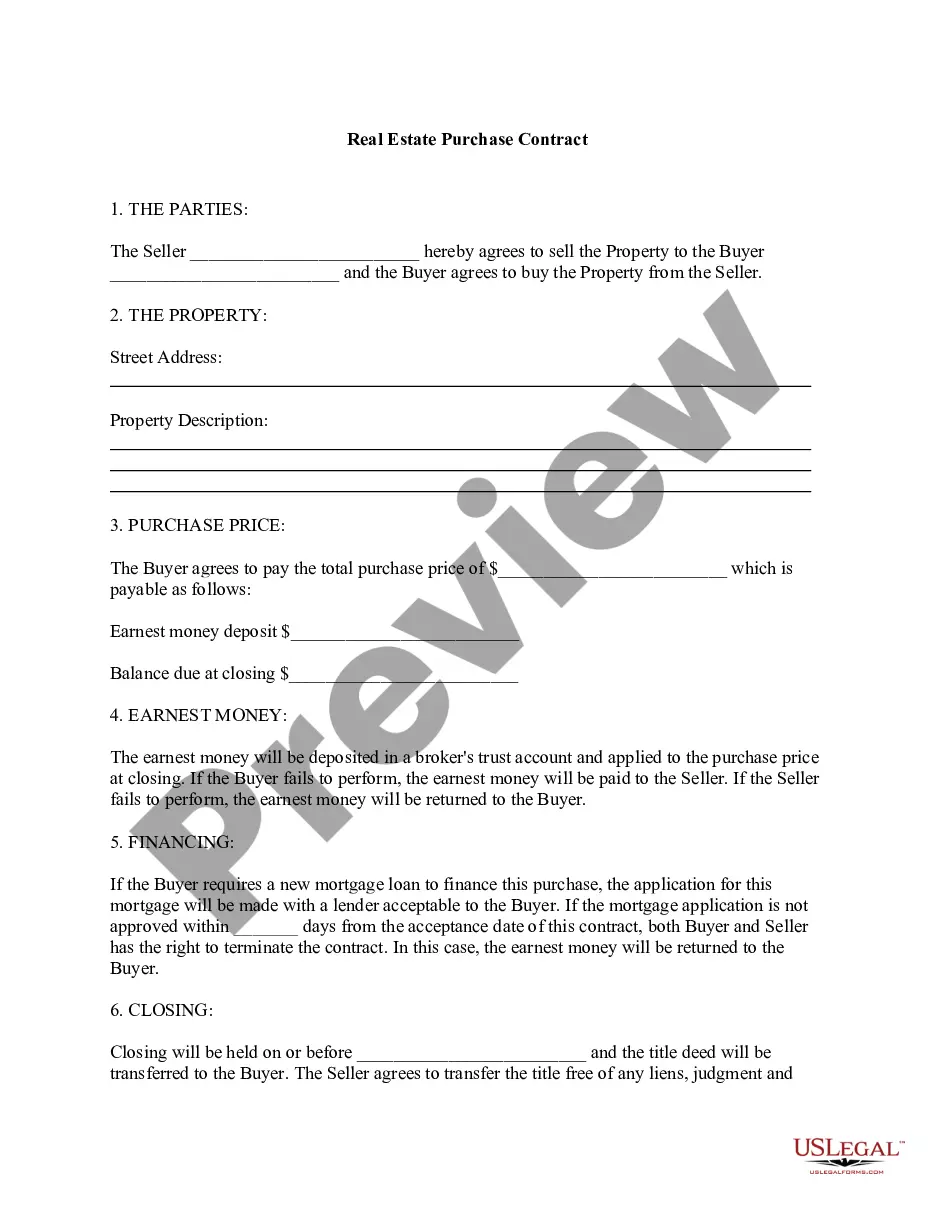

- Examine the template utilizing the Preview feature or via the text description to ensure it meets your requirements.

- Browse for a different sample utilizing the search tool at the top of the page if necessary.

- Click Buy Now when you’ve found the right form and choose a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your California Pay Requirements and download it.

All templates you find through US Legal Forms are reusable. To re-download and fill out earlier purchased forms, open the My Forms tab in your profile. Enjoy the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

California Paystub Requirements (2023) California labor law requires that paystubs be itemized, and include the following information: Employee name and last four digits of Social Security Number (SSN) or Employee ID Number (EIN) What pay period the paystub is for. Gross wages (without deductions) for the pay period.

California laws require most employers to pay employees at least twice a month by the 10th and the 26th. With regard to exempt employees, employers only need to pay once per month by the 26th.

Under California law, employers are required to pay employees at least twice per month, on specific paydays. For example, if an employee is paid on the 1st and 15th of each month, the employer must ensure that the employee receives their paychecks on those specific dates.

California law requires private employers of 100 or more employees and/or 100 or more workers hired through labor contractors to annually report pay, demographic, and other workforce data to the Civil Rights Department (CRD).

If you are paid a salary, the regular rate is determined as follows: Multiply the monthly remuneration by 12 (months) to get the annual salary. Divide the annual salary by 52 (weeks) to get the weekly salary. Divide the weekly salary by the number of legal maximum regular hours (40) to get the regular hourly rate.