Duty A

Description

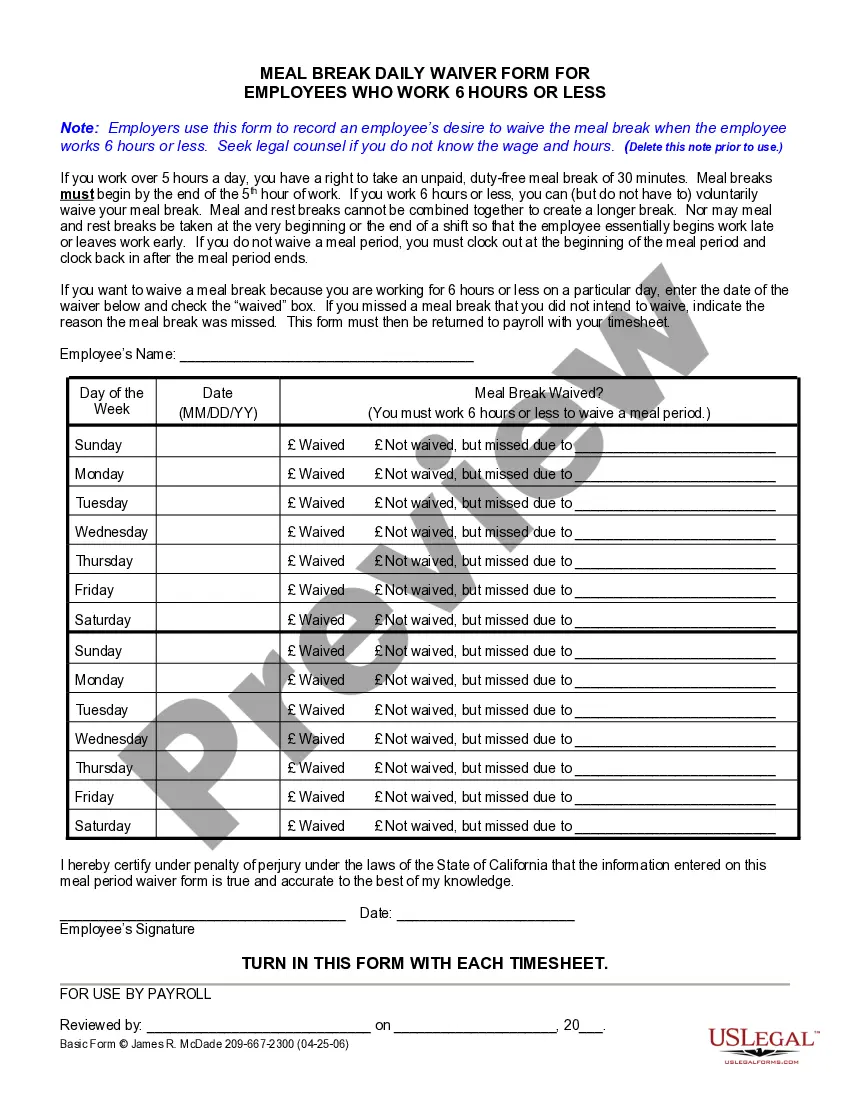

How to fill out California On Duty Meal Period Agreement?

- If you're an existing user, log in to your account and ensure your subscription is active. Download your desired form template by clicking the Download button.

- For first-time users, start by reviewing the form description and Preview mode. Confirm it's the right document for your specific needs and jurisdiction.

- If necessary, utilize the Search tab to find another template that better fits your requirements before proceeding.

- Select your document by clicking the Buy Now button. Choose your preferred subscription plan and create an account for full access.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Download your form and save it to your device. You can always access it later in the My Forms section of your profile.

By following these steps, you can take full advantage of US Legal Forms’ vast resources, ensuring your legal needs are met efficiently.

Don't let legal complexities overwhelm you—get started with US Legal Forms today and experience the convenience of having over 85,000 templates at your fingertips.

Form popularity

FAQ

Duty tax in the US refers to a tariff or tax imposed on goods imported into the country. It helps regulate trade and protect domestic industries by making foreign products more expensive. When you partner with uslegalforms, you can navigate the complexities of duty taxes more efficiently by accessing the right forms and guidance tailored to your needs.

Several factors can disqualify you at MEPS. Health conditions, legal issues, or failure to meet educational standards play a significant role in this. Be aware of what to expect in the evaluation and how to present your personal history accurately. Knowing these requirements will help you avoid common pitfalls.

Getting into the National Guard can be competitive, yet achievable with proper preparation. You will need to meet physical fitness standards, pass tests, and fulfill duty a commitments. Understanding the requirements and being proactive in your preparations can increase your chances significantly. Utilize resources to familiarize yourself with the process.

During a MEPS background check, various aspects of your history are reviewed, including criminal records, employment history, and prior military service. This thorough review ensures that you meet the duty a standards required for military service. It's vital to be transparent and prepared, as discrepancies can lead to disqualification.

Disqualifications at MEPS often stem from medical issues, legal troubles, or educational shortcomings. For instance, certain health conditions can impede your ability to serve. Additionally, a criminal record or not meeting educational requirements can prevent one from advancing. Understanding these factors will help you navigate your path more effectively.

Many individuals fail MEPs due to lack of preparation. Common reasons include not meeting the required health standards or failing the aptitude tests. It's crucial to understand that duty a involves physical and mental readiness, as well as providing accurate information during the evaluation. Preparation can significantly enhance your chances of success.

To qualify for duty drawback, you must meet specific conditions which often include exporting the goods or destroying them as stipulated by U.S. law. The products must have incurred duties initially, and you must have proper documentation to support your claim. Staying informed about these conditions can enhance your chance of a successful claim. Utilizing legal resources can help ensure you meet all requirements effectively.

Duty tax rates in the USA vary based on the type of goods imported. These rates are determined by the Customs and Border Protection agency and can range widely. Understanding the duty tax applicable to your specific items is crucial for budgeting effectively. Always check the latest tariff schedules to ensure you have the most accurate information.

If you have not received your duty drawback, first, check the status of your claim through the official channels. Sometimes, delays can occur due to paperwork issues or additional reviews by customs. If problems persist, consider reaching out for professional assistance, like services from U.S. Legal Forms, to help you navigate through the process effectively. They can provide valuable support in ensuring you receive your refund.

Generally, the time limit for claiming duty drawback is three years from the date of exportation or destruction of the goods. However, in some cases, you may have up to five years depending on the circumstances. Staying informed of these timelines can help you maximize your potential returns. If you're unsure about your eligibility, consulting with professionals can provide clarity.