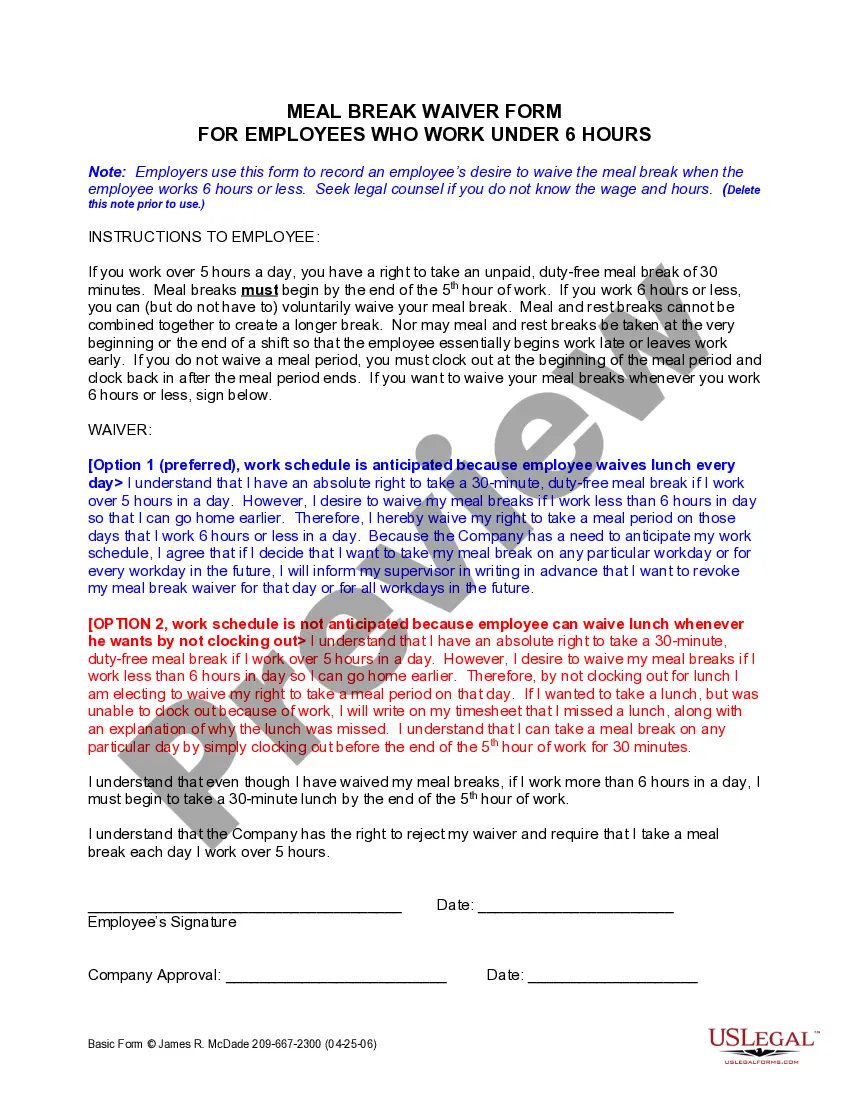

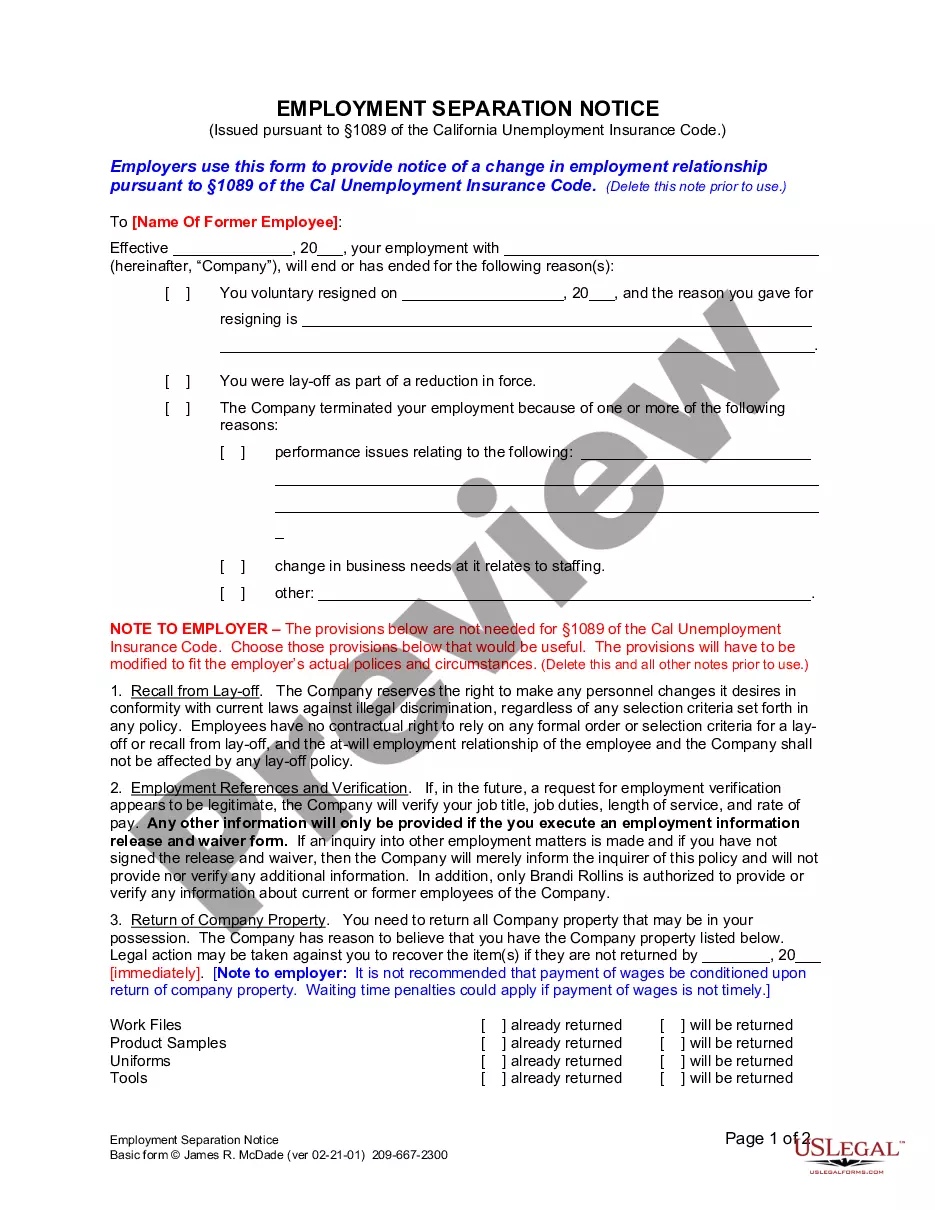

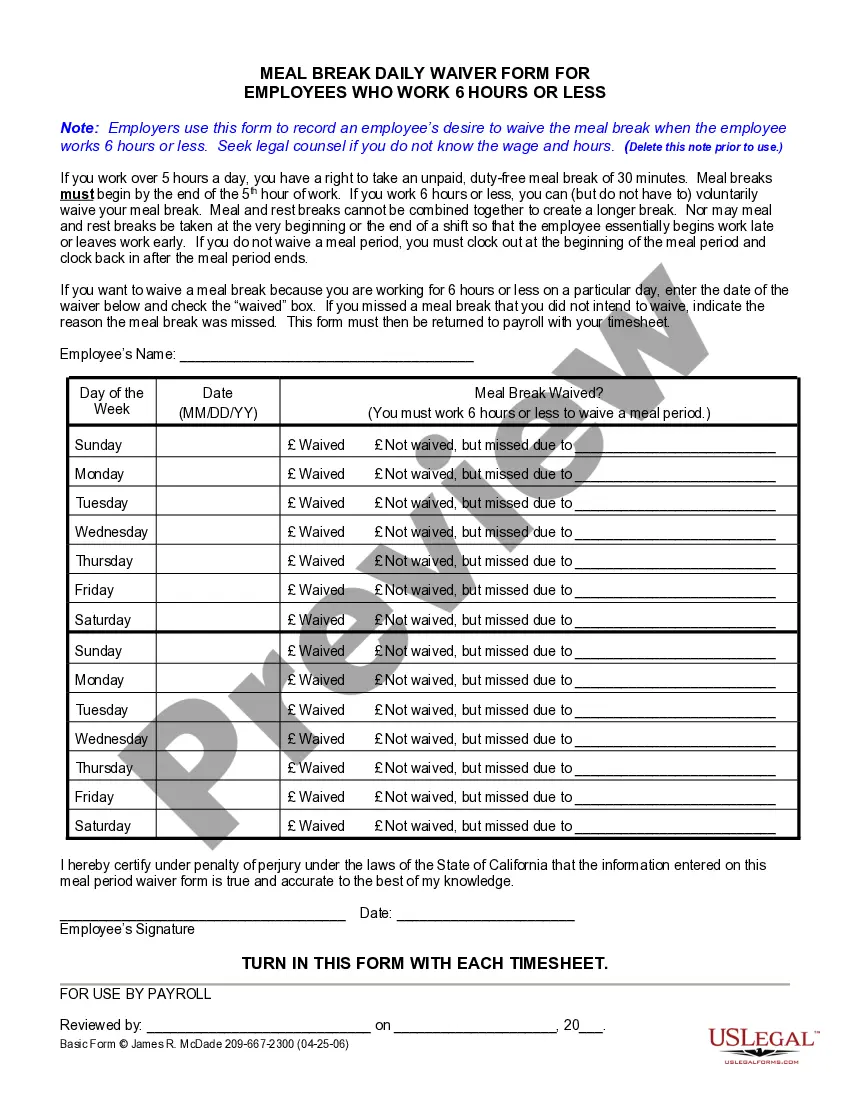

Employers use this form to record an employee’s desire to waive the meal break when the employee works 6 hours or less.

Break Employees California Withholding

Description

How to fill out California Meal Break Daily Waiver For 6 Hour Employees?

Whether for business purposes or for personal matters, everybody has to deal with legal situations sooner or later in their life. Filling out legal paperwork needs careful attention, starting with picking the right form template. For example, when you select a wrong edition of a Break Employees California Withholding, it will be rejected once you submit it. It is therefore essential to get a dependable source of legal documents like US Legal Forms.

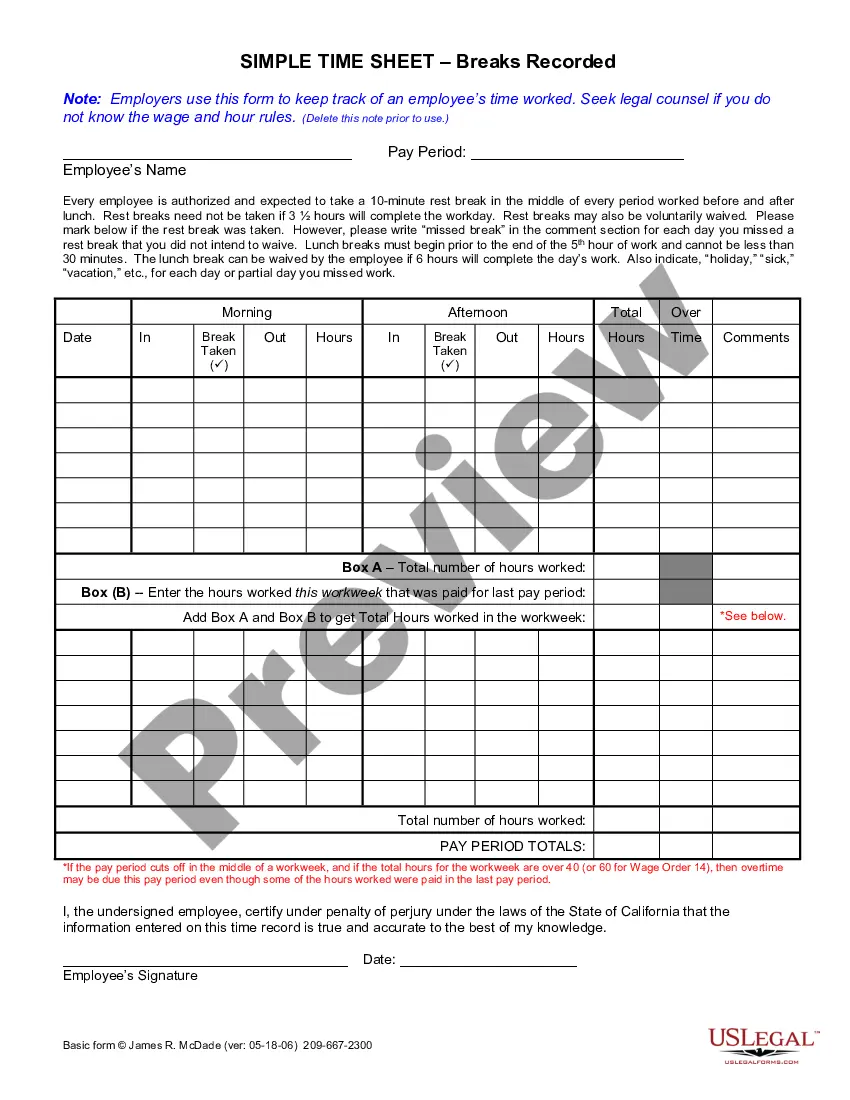

If you have to obtain a Break Employees California Withholding template, follow these simple steps:

- Find the sample you need using the search field or catalog navigation.

- Examine the form’s information to make sure it fits your situation, state, and county.

- Click on the form’s preview to see it.

- If it is the wrong form, get back to the search function to locate the Break Employees California Withholding sample you need.

- Download the file when it meets your needs.

- If you have a US Legal Forms profile, just click Log in to gain access to previously saved files in My Forms.

- In the event you don’t have an account yet, you may download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the document format you want and download the Break Employees California Withholding.

- After it is saved, you are able to fill out the form with the help of editing software or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you don’t have to spend time seeking for the right sample across the web. Make use of the library’s simple navigation to find the right template for any occasion.

Form popularity

FAQ

Here's a quick overview of to fill out a Form W-4 in 2023. Step 1: Enter your personal information. Fill in your name, address, Social Security number and tax-filing status. ... Step 2: Account for multiple jobs. ... Step 3: Claim dependents, including children. ... Step 4: Refine your withholdings. ... Step 5: Sign and date your W-4.

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

You must file the state form Employee's Withholding Allowance Certificate (DE 4) to determine the appropriate California PIT withholding. If you do not provide your employer with a withholding certificate, the employer must use Single with Zero withholding allowance.

In order to claim exemption from state income tax withholding, employees must submit a W-4 (PDF Format, 100KB)*. or DE-4 (PDF Format, 147KB)* certifying that they did not have any federal tax liability for the preceding year and that they do not anticipate any tax liability for the current taxable year.

Determine the additional withholding allowance for itemized deductions (AWAID) by applying the following guideline and subtract this amount from the gross annual wages: AWAID = $1,000 x Number of Itemized Allowances Claimed for Itemized Deductions on DE-4.