Job Description For Accountant

Description

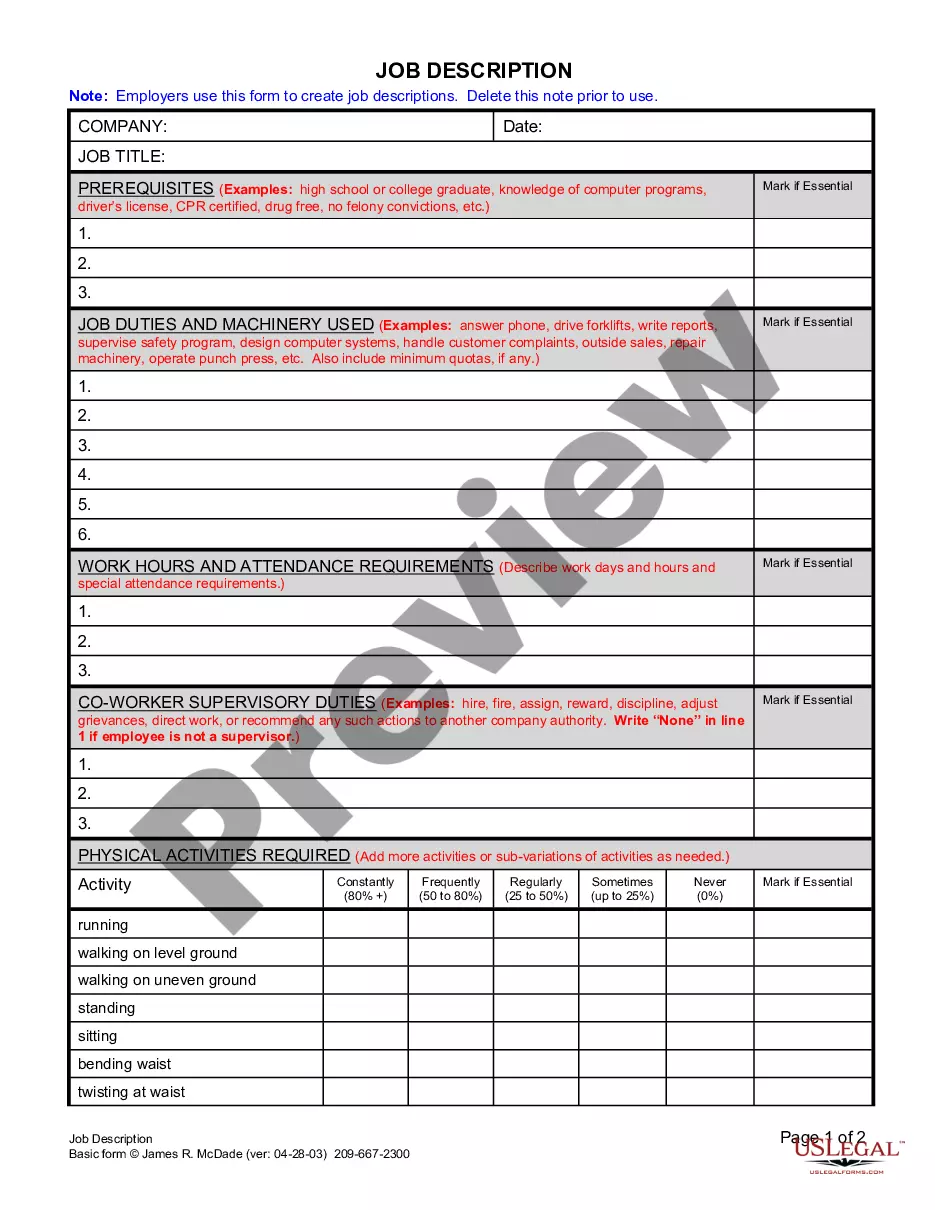

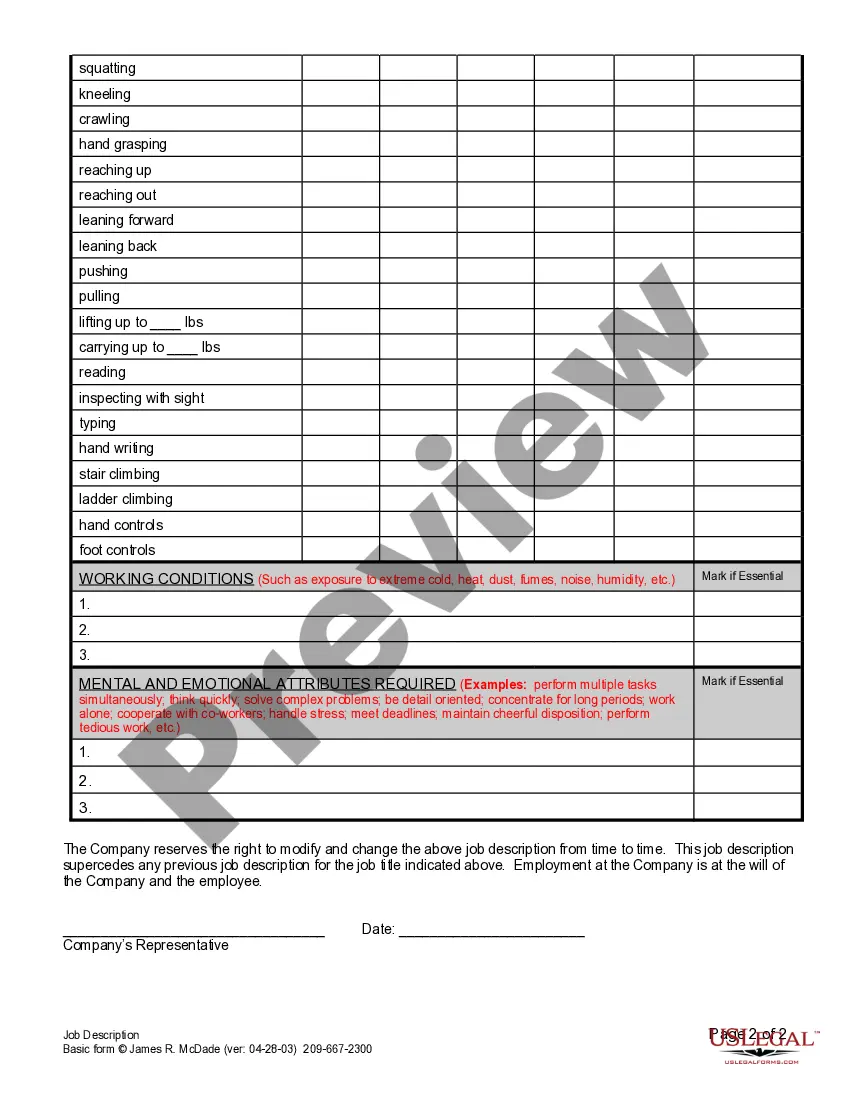

How to fill out California Job Description?

- If you're a returning user, log in and access your account to find the job description template by clicking the Download button; ensure your subscription is active, or renew if necessary.

- For first-time users, start by reviewing the Preview mode and form descriptions to ensure you select the job description that aligns with your needs and local regulations.

- If the template doesn’t meet your requirements, utilize the Search tab to find an alternative that fits your specifications.

- Once you’ve identified the correct document, click on the Buy Now button and choose your preferred subscription plan, creating an account to access the forms library.

- Complete your purchase using either credit card information or a PayPal account to secure your subscription.

- Finally, download your chosen job description template, saving it to your device, and you can access it anytime through the My Forms section.

Using US Legal Forms greatly simplifies the document acquisition process. With an extensive library of over 85,000 fillable and editable legal forms, users can easily find what they need while benefiting from access to premium legal experts for assistance.

Unlock your path to employment by ensuring you have the right job description. Start using US Legal Forms today for all your legal document needs!

Form popularity

FAQ

A staff accountant performs a variety of duties, such as preparing journal entries, reconciling accounts, and generating financial reports. They are responsible for ensuring financial records are up to date and accurately reflect the company's activities. Staff accountants also assist with budgeting, forecasting, and assisting with audits. This role is essential for maintaining the overall financial integrity of the organization.

The primary difference between an accountant and a staff accountant lies in their responsibilities and level of experience. While both handle financial data and records, a staff accountant typically has additional duties, such as complex financial reporting and analysis. Moreover, staff accountants are expected to take on more challenging tasks that contribute directly to a company’s finance strategy. Therefore, the job description for accountant roles varies significantly in complexity.

The job description for a staff accountant includes various responsibilities such as preparing and maintaining financial records, processing payroll, and assisting in audits. Staff accountants ensure the accuracy of financial statements and compliance with applicable laws and regulations. They often collaborate with other finance team members on budgeting and costing. This role is vital for maintaining a company’s financial health.

The lowest position in accounting is often that of an accounting clerk or accounts payable/receivable clerk. These entry-level roles serve as starting points for individuals new to the field. They involve basic data entry, file management, and support for higher-level accounting tasks. It's a foundational position that can eventually lead to advancement in the accounting profession.

The job description for a financial accountant focuses on managing and reporting a company's financial activities. This includes preparing financial statements, ensuring compliance with regulations, and analyzing financial data. Financial accountants work closely with auditors and other financial professionals. This role demands strong analytical skills and a thorough understanding of accounting principles.

A staff accountant is typically not considered an entry-level position. This role usually requires a few years of experience and a relevant degree in accounting or finance. Staff accountants handle significant tasks, which distinguishes them from entry-level roles like accounting clerks. Therefore, if you are looking at the job description for accountant roles, note that staff accountants are expected to demonstrate advanced skills and knowledge.

To effectively sell yourself as an accountant, showcase your skills and experiences clearly on your resume and during interviews. Highlight your expertise in financial reporting, tax preparation, and compliance. Additionally, demonstrate how your contributions can impact the financial success of potential employers.

To find an accountant, start by asking for recommendations from friends or colleagues. You can also search online, checking credentials and reviews. Consider platforms like US Legal Forms for templates that can help you draft contracts or agreements with potential accountants, ensuring you find a professional who meets your specific needs.

The job description for an accountant typically includes tasks such as preparing financial statements, managing budgets, and ensuring compliance with laws and regulations. Accountants analyze financial data, create reports, and advise clients on financial decisions. They play a crucial role in maintaining the financial health of organizations and individuals.

The job description of an accountant outlines the necessity of accurate record-keeping, financial reporting, and advisory services. It also details the importance of proficiency in accounting software and adherence to ethical standards. By providing a comprehensive description, organizations ensure they attract candidates who are not only skilled but also aligned with the company’s values and goals.