Separation Notice By State

Description

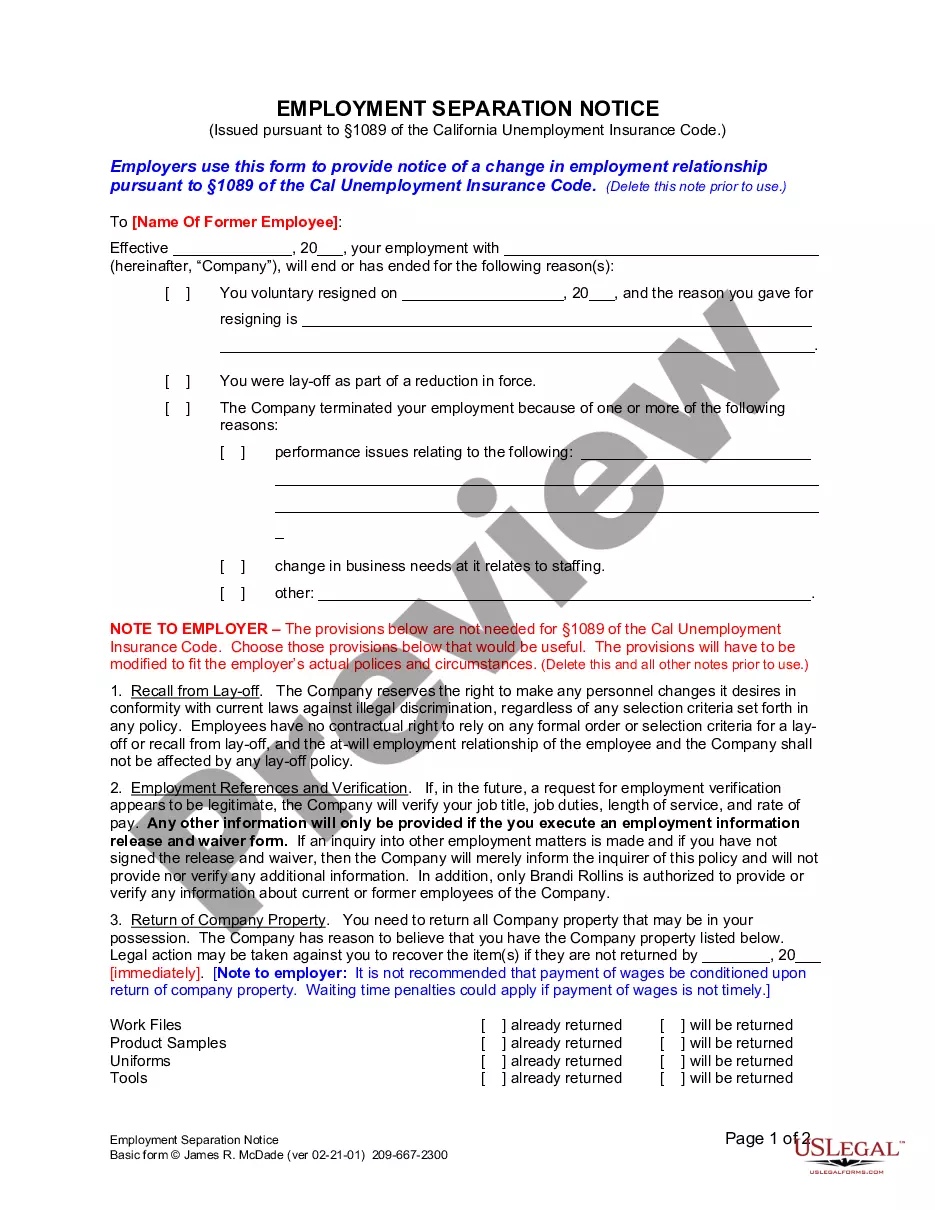

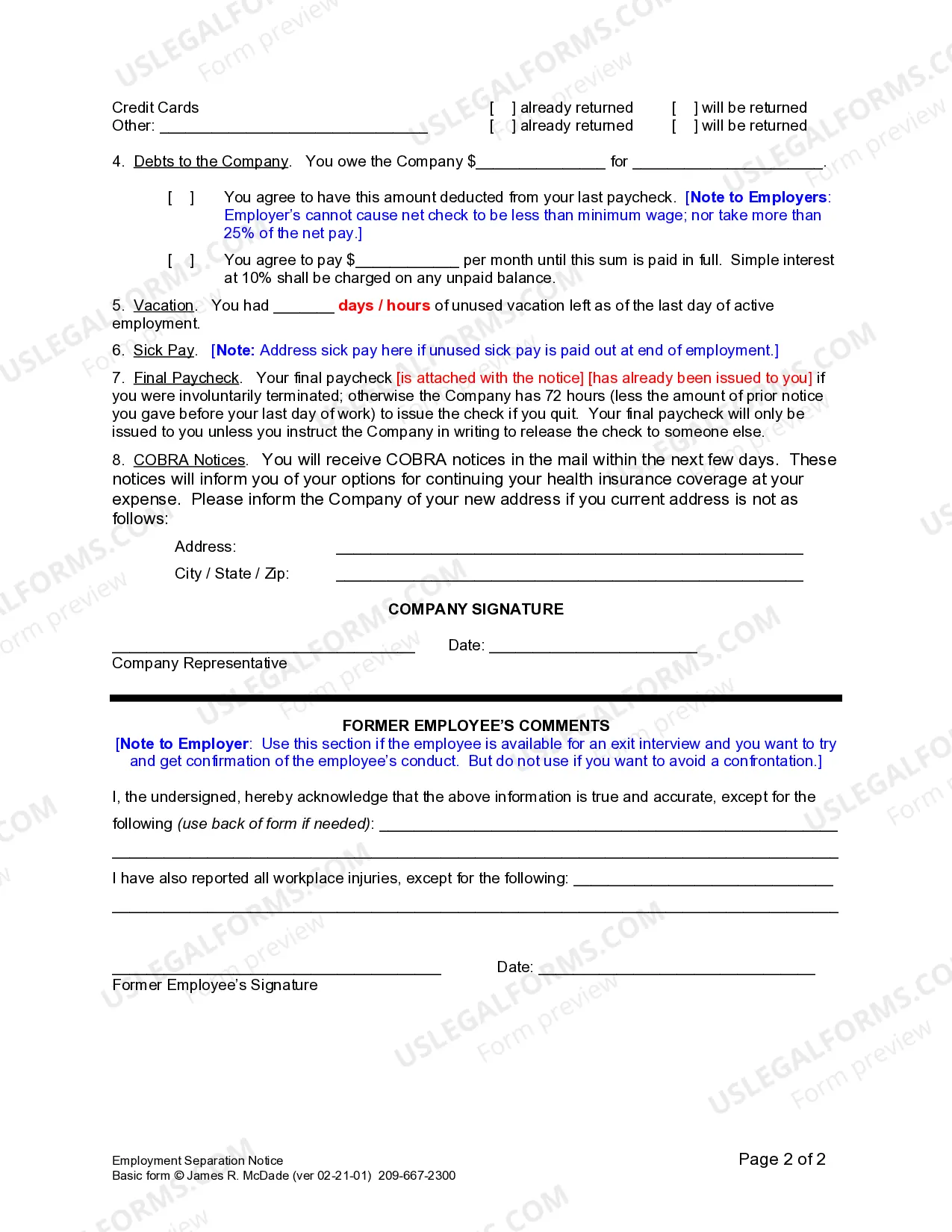

How to fill out California Employment Separation Notice?

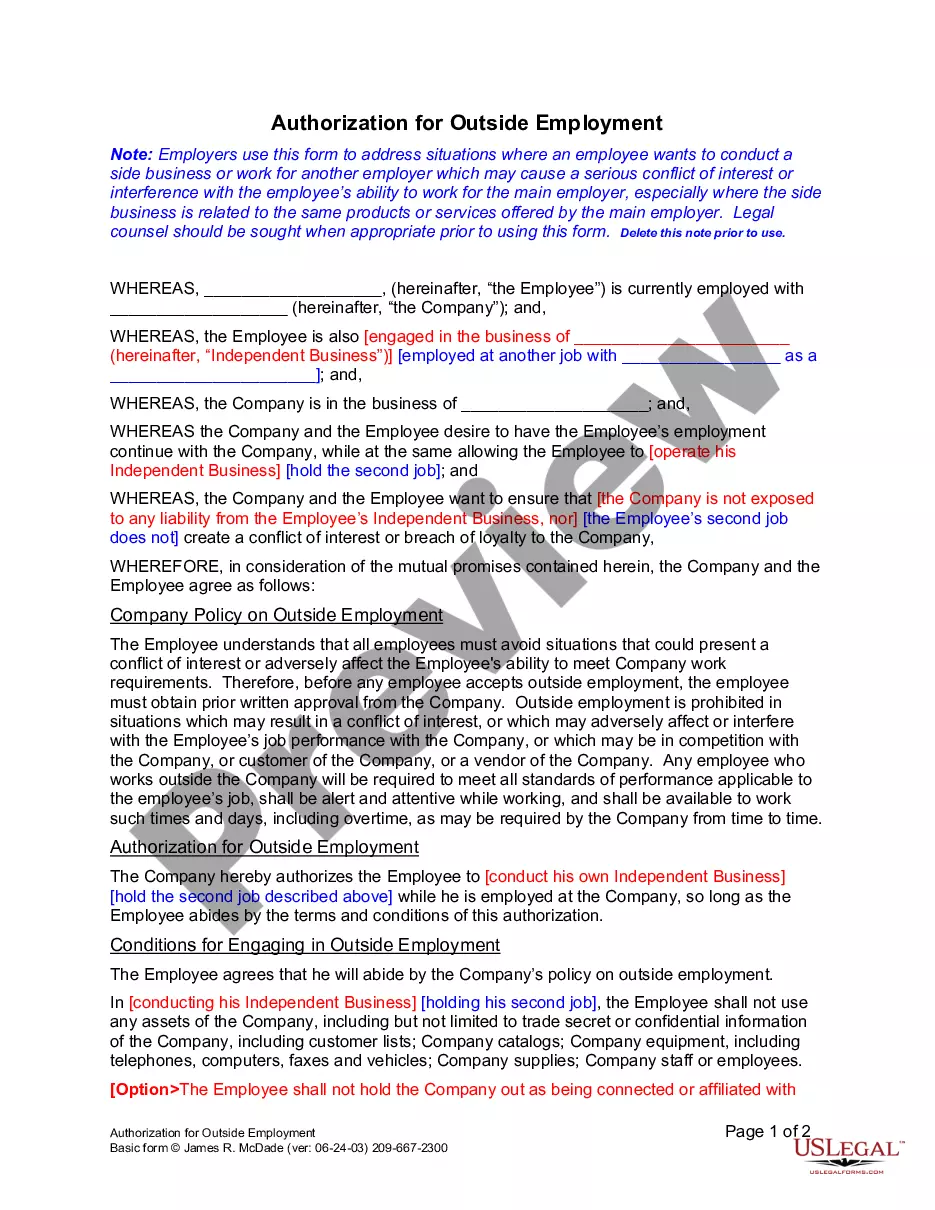

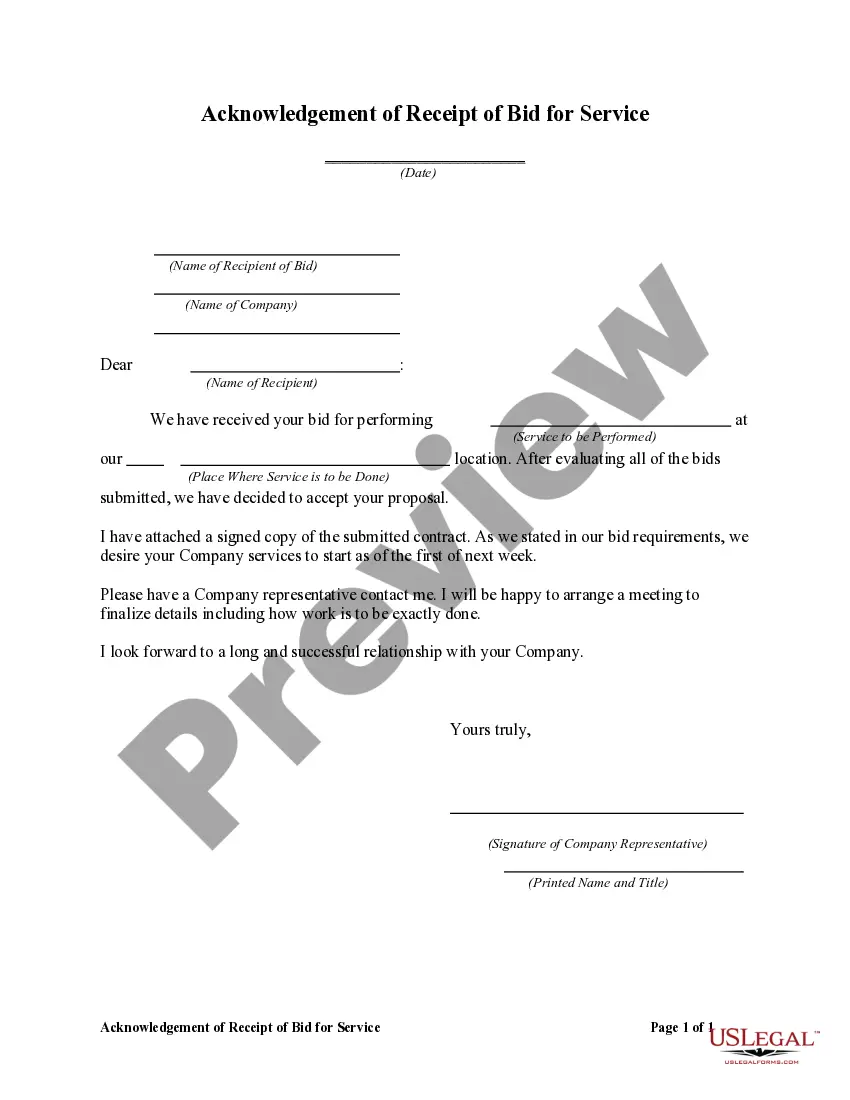

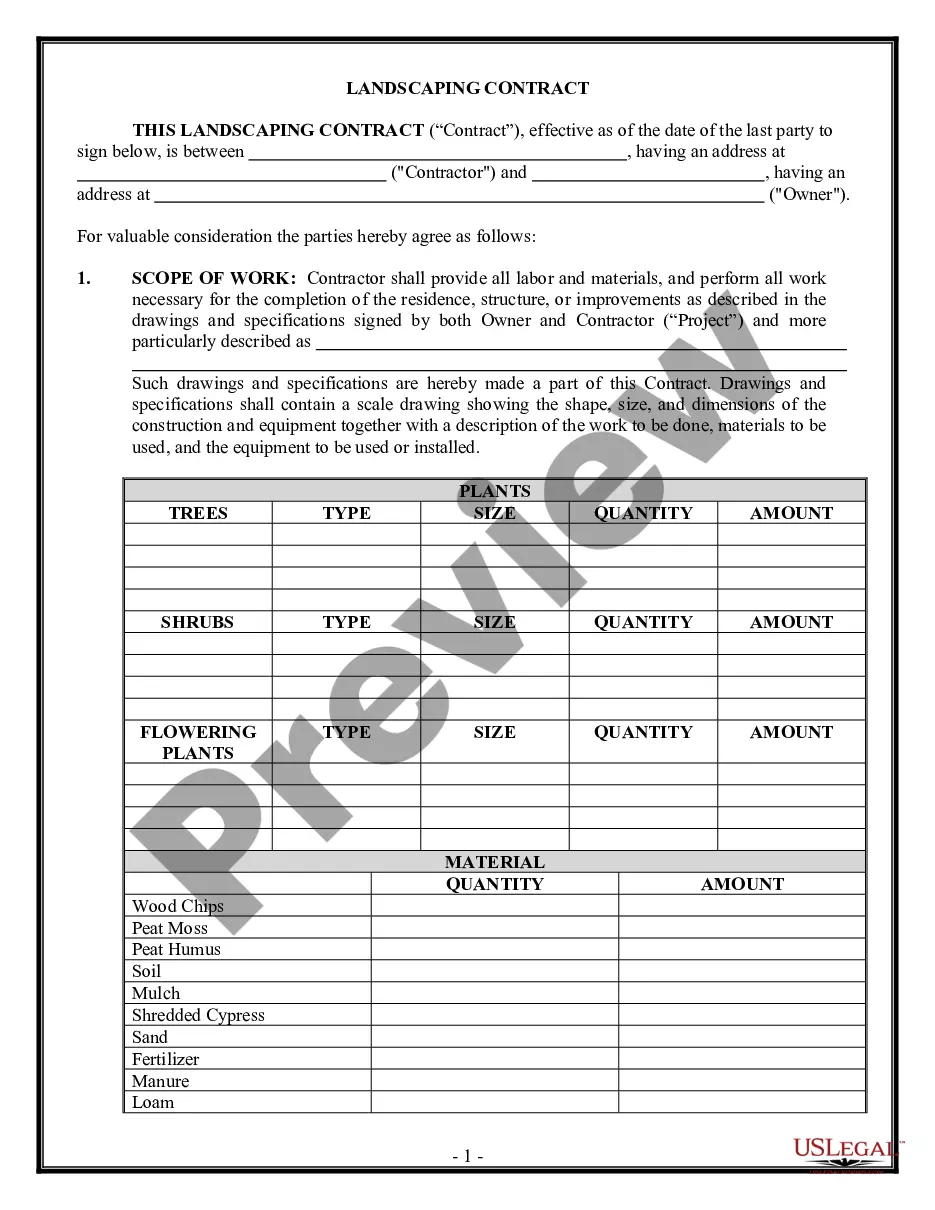

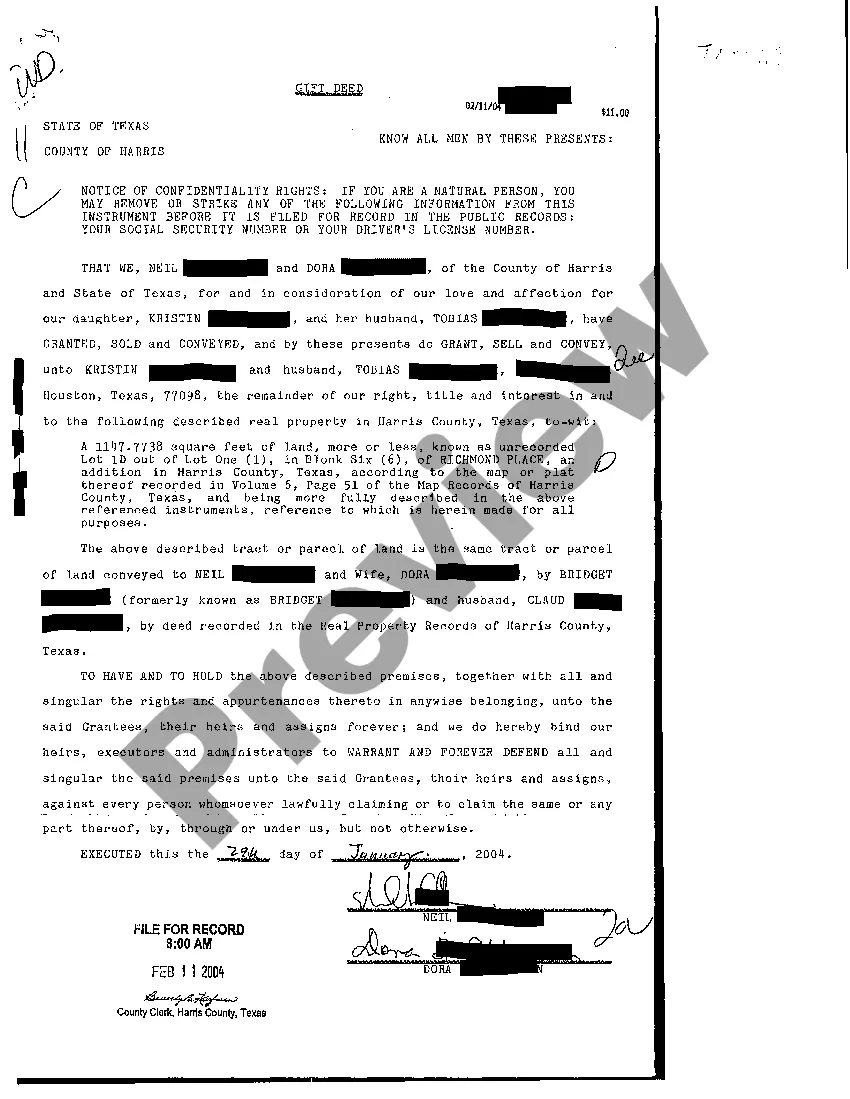

The Separation Notification By State you observe on this page is a versatile formal template created by expert attorneys in accordance with federal and state legislation and guidelines.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal experts more than 85,000 authenticated, state-specific forms for any commercial and personal circumstance. It is the swiftest, easiest, and most dependable method to acquire the documents you require, as the service ensures the utmost level of data security and anti-malware safeguards.

Choose the format you prefer for your Separation Notification By State (PDF, Word, RTF) and save the sample on your device.

- Search for the document you require and examine it.

- Browse through the sample you sought and preview it or check the form description to ensure it meets your requirements. If it doesn’t, use the search feature to find the appropriate one. Click Buy Now when you have found the template you require.

- Choose and Log In.

- Select the pricing plan that best fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Acquire the editable template.

Form popularity

FAQ

You amend your articles of organization by submitting the completed Oregon Articles of Amendment/Dissolution ? Limited Liability Company form to the Oregon Secretary of State Corporation Division by mail, in person or courier service or by fax. When fax filing, you pay your filing fee with the Fax Cover Sheet.

Download forms from the Oregon Department of Revenue website or request paper forms be mailed to you. Order forms by calling 1-800-356-4222. The IRS provides 1040 forms and instructions and schedules 1-3 for the library to distribute.

Use Form OR-W-4 to tell your employer or other payer how much Oregon income tax to withhold from your wages or other periodic income. Instructions for employer or other payer. Enter the business name, federal employer identification number (FEIN), and address in the ?Employer use only? section of Form OR-W- 4.

Purpose of Schedule OR-21-MD Pass-through entities (PTEs) electing to pay the PTE elective tax (PTE-E tax) use Schedule OR-21-MD to provide informa- tion about the members of the PTE. Schedule OR-21-MD must be included with Form OR-21 when the return is filed. Entities that are PTEs owned entirely by such individuals.

Full-year residents File Form OR-40 if you (and your spouse, if married and filing a joint return) are a full-year resident. You're a full-year resident if all of the following are true: You think of Oregon as your permanent home. Oregon is the center of your financial, social, and family life.

For tax years beginning on or after January 1, 2022, entities taxed as S corporations and partnerships may elect annually to be subject to the PTE-E tax at a rate of 9 percent tax on the first $250,000 of distributive proceeds and 9.9 percent tax on any amount exceeding $250,000.

(a) Residents: An Oregon resident is allowed a credit for taxes paid to another state on mutually taxed income if the other state does not allow the credit.

Purpose of Schedule OR-21 An upper-tier PTE that is a member of an electing PTE will also use Form OR-21 to pass its share of the lower-tier entity's distributive proceeds, addition, and tax credit through to the upper-tier PTE's individual owners. Form OR-21 is filed on a calendar-year basis only.