Employee Tracking Form For Irs

Description

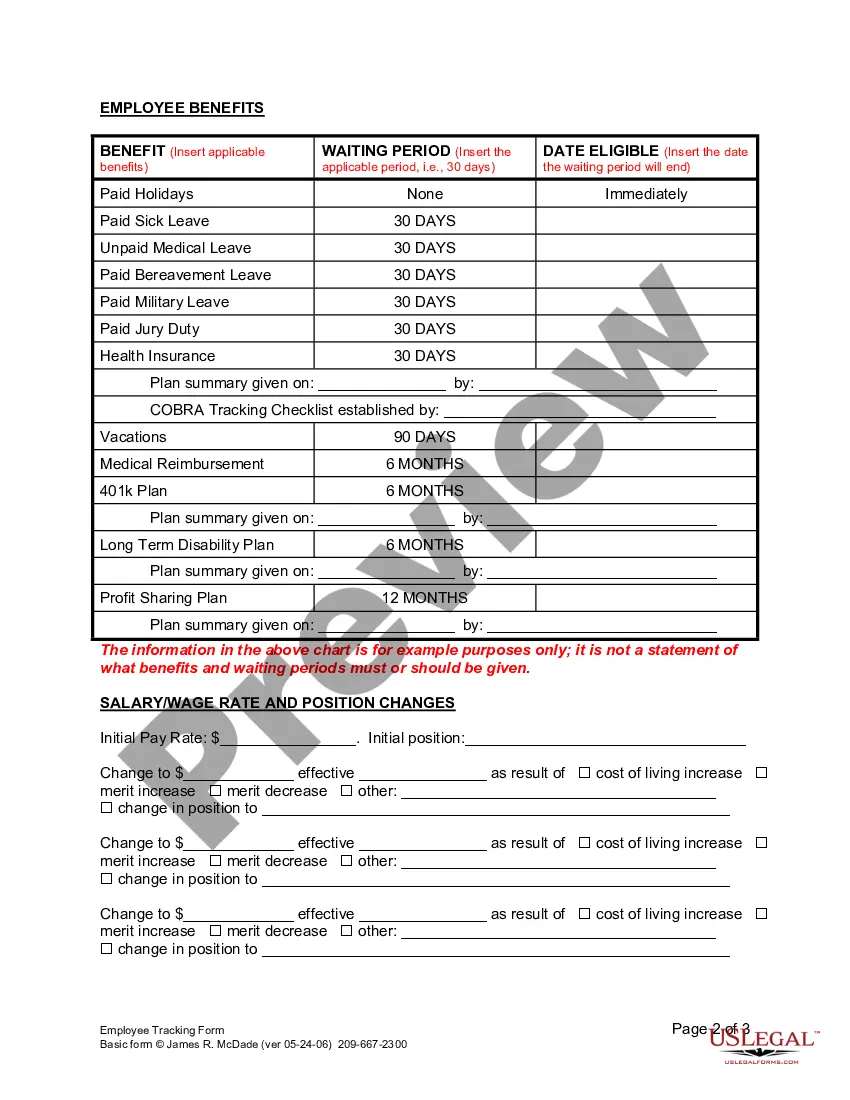

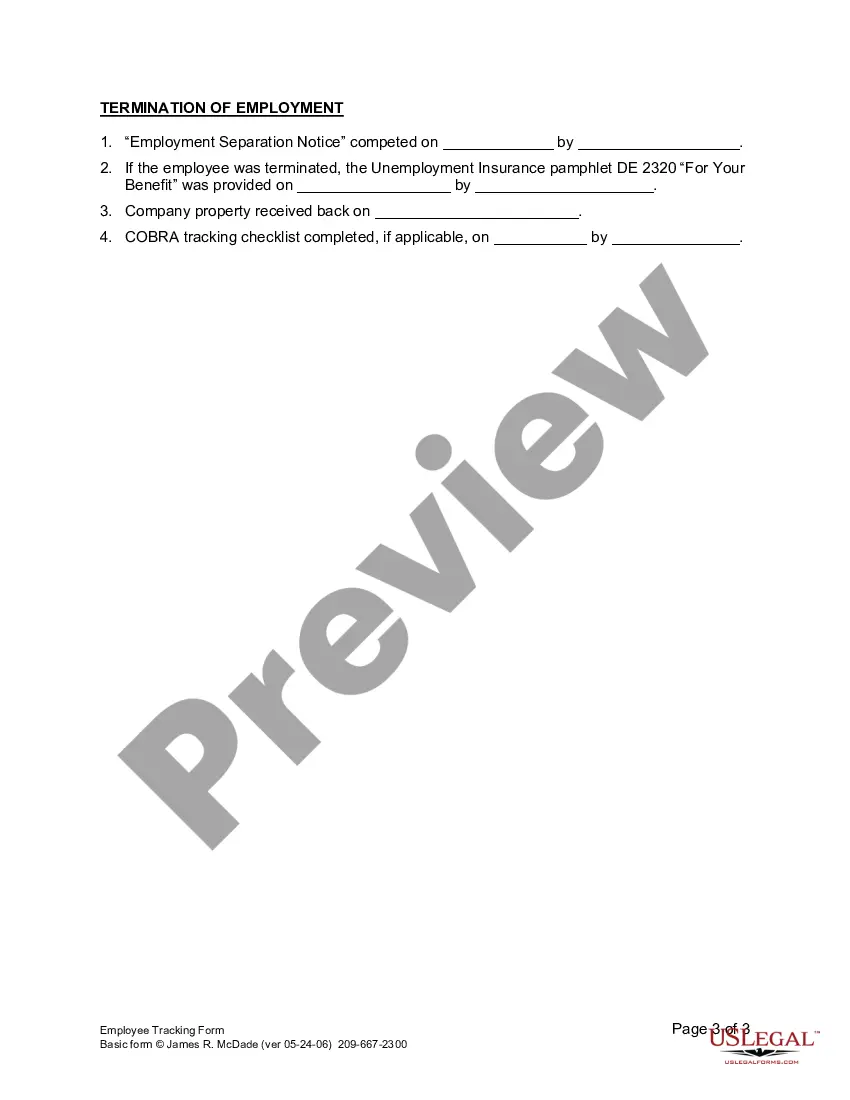

How to fill out California Employee Tracking Form?

Legal documents management can be daunting, even for seasoned professionals.

When seeking an Employee Tracking Form For Irs and lacking the time to find the correct and up-to-date version, the process can be overwhelming.

US Legal Forms caters to all your needs, from personal to business documents, all in one place.

Leverage advanced tools to complete and manage your Employee Tracking Form For Irs.

Here are the steps to follow after obtaining the form you require: Verify that this is the correct form by previewing it and reviewing its details. Confirm that the template is valid in your state or county. Click Buy Now when you are ready. Select a monthly subscription plan. Choose the format you need, and Download, complete, eSign, print, and send your document. Take advantage of the US Legal Forms web library, backed by 25 years of experience and reliability. Streamline your daily document management into a simple and user-friendly process today.

- Access a repository of articles, guides, handbooks, and resources relevant to your situation and requirements.

- Save time and effort searching for the documents you need by utilizing US Legal Forms’ advanced search and Review feature to find and obtain the Employee Tracking Form For Irs.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Visit the My documents tab to view the documents you have previously downloaded and manage your files as desired.

- If it's your first time using US Legal Forms, create an account for unlimited access to all the library's benefits.

- A comprehensive web form library can be transformative for anyone looking to navigate these circumstances effectively.

- US Legal Forms is a leader in online legal documents, offering over 85,000 state-specific legal forms accessible at all times.

- With US Legal Forms, you can access legal and business forms tailored to your state or county.

Form popularity

FAQ

If the IRS sent the refund, but it was never received, use Form 3911 to request a ?refund trace.? Fill out Section I and Section II, then sign and date in Section III. Mail in the form, or fax it, to the appropriate office listed on the IRS website.

Instructions on How to Fill Out Form 8802 Enter the applicant's name and TIN exactly as they appear on the U.S. return filed for the tax period(s) for which you are requesting the certificate. Line 2: Fill out the applicant's address. Line 3a: Fill out the applicant's mailing address where Form 6166 can be sent to.

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

4 employee tax forms to complete during the onboarding process EIN application. To hire an employee, your business must have an employer identification number (EIN). ... Form I-9. ... Form W-4. ... State withholding certificate. ... Form 941 or Form 944. ... Form 940. ... Form W-2.

If you want the IRS to determine if a specific individual is an independent contractor or an employee, file Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding.