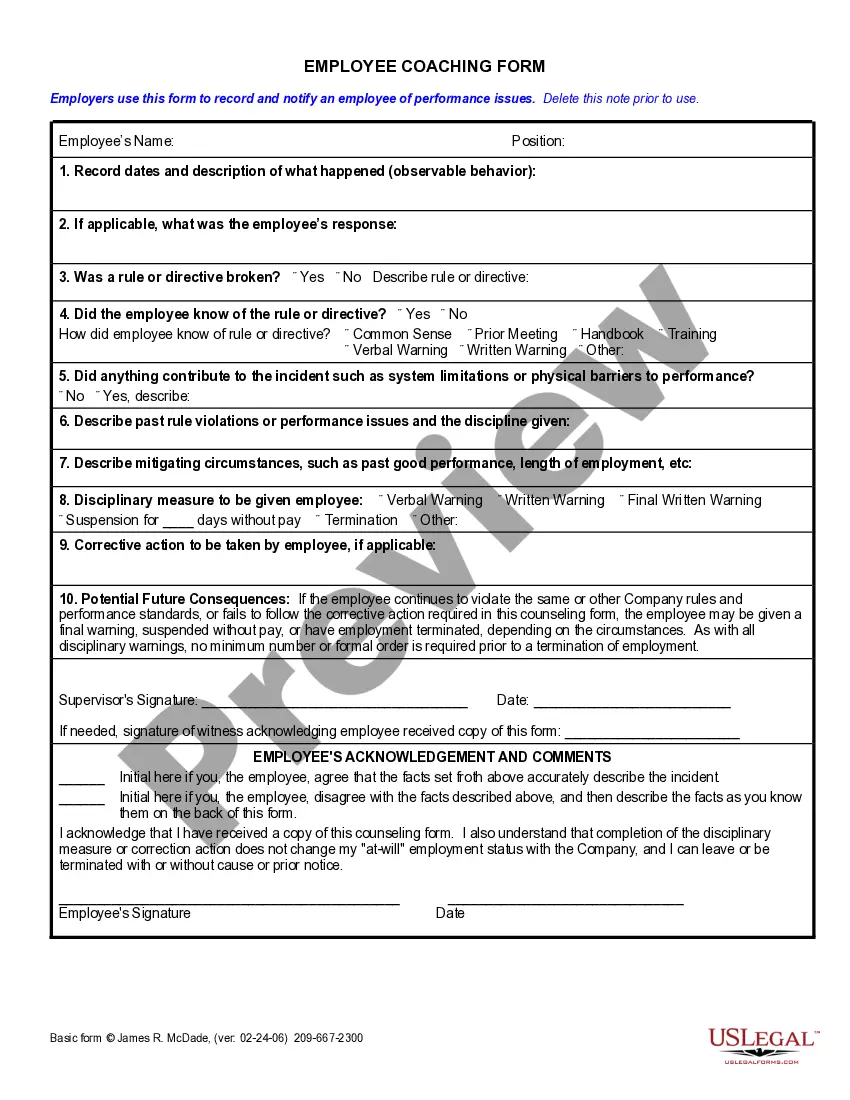

Employers use this form to record and notify an employee of negative performance issues.

Employee Coaching Form For W2

Description

Form popularity

FAQ

Volunteer coaching typically does not qualify for tax deductions unless you have out-of-pocket expenses that directly relate to your coaching role. If you incur costs while volunteering, such as travel or materials, you may be able to deduct these expenses. Documenting your volunteer efforts and any associated costs using an Employee coaching form for W2 can simplify this process. Speak with a tax advisor for clarity on what can be claimed.

To claim coaching expenses on your taxes, you need to itemize your deductions on your tax return. Be sure to keep all receipts and documentation, including any Employee coaching form for W2 that outlines the expenses incurred for coaching. This documentation is crucial when you file your taxes, as it provides evidence of your investment in professional development. A tax consultant can provide valuable insights into maximizing your deductions.

Yes, you may be able to deduct expenses related to a mentor or coaching program if they directly relate to your current job or improve your skills. Keep in mind that these deductions may vary based on your employment status and income level. Using an Employee coaching form for W2 can help document and validate your coaching expenses when filing your taxes. Consult with a tax professional for personalized guidance.

You can typically obtain your W2 form through your employer's payroll portal. Most employers offer electronic access, making it simple to download your W2 directly. If you have trouble accessing your form, consider reaching out to your HR department for assistance. Remember to keep an Employee coaching form for W2 handy if you need to track expenses related to your coaching.

Coaching stipends may be subject to taxes as they often fall under taxable income. When you receive a stipend, it can affect your total earnings reported on your W2. It is important to consult with a tax professional to understand how these stipends will impact your tax liability. Ensuring proper documentation through an Employee coaching form for W2 will help clarify any taxable amounts.

Employee coaching refers to the process of guiding and mentoring individuals to foster their professional growth. It involves regular discussions about goals, performance, and opportunities for improvement. Effectively using an employee coaching form for W2 ensures that both the coach and the employee remain focused on development, ultimately enhancing workplace performance and satisfaction.

A coaching document is any written record that details the goals, discussions, and action items resulting from coaching sessions. This could include feedback on performance, resources for improvement, and follow-up tasks. An employee coaching form for W2 acts as a comprehensive coaching document that keeps all relevant information in one place, promoting consistency and clarity.

A coaching plan for employees serves as a roadmap to guide individuals through their professional development journey. It includes specific objectives, timelines, and expected outcomes, ensuring that both the employee and the manager are aligned in their goals. By using an employee coaching form for W2 as part of this plan, organizations can enhance accountability and track progress effectively.

An employee coaching form is a document that outlines the key components of the coaching relationship between a manager and an employee. It typically includes areas for goal setting, performance feedback, and action plans for improvement. Utilizing an employee coaching form for W2 helps streamline conversations and create a clear path for employee growth.

The purpose of a coaching form is to provide a structured method for documenting the coaching process. This tool allows supervisors to outline goals, track progress, and ensure accountability during employee development. By consistently utilizing an employee coaching form for W2, organizations can foster a culture of continuous improvement and engagement.