California Deduction Pay For

Description

How to fill out California Authorization For Deduction From Pay For A Specific Debt?

Creating legal documents from the ground up can occasionally be daunting.

Specific situations may require extensive research and considerable expenses.

If you seek a simpler and more economical method of preparing California Deduction Pay For or any other forms without unnecessary complications, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal documents covers nearly every dimension of your financial, legal, and personal matters.

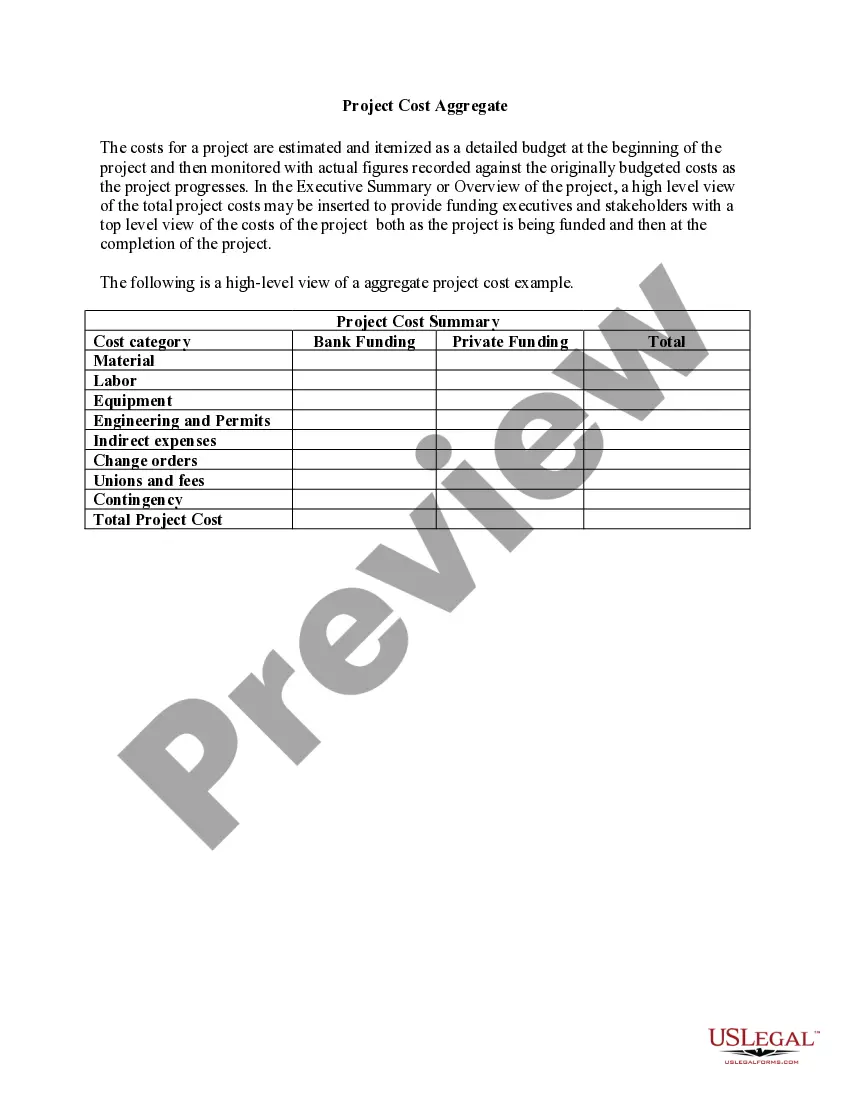

Review the document preview and descriptions to confirm that you are on the correct document you are seeking. Ensure that the form you select meets the criteria of your state and county. Select the appropriate subscription option to acquire the California Deduction Pay For. Download the form, then complete, validate, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of expertise. Join us today and make form completion an effortless and streamlined process!

- With just a few clicks, you can swiftly access state- and county-specific templates meticulously crafted by our legal professionals.

- Utilize our platform whenever you require trustworthy and dependable services through which you can effortlessly locate and download the California Deduction Pay For.

- If you’re familiar with our services and have previously registered an account with us, simply Log In to your account, find the form, and download it or re-download it anytime from the My documents section.

- Not registered yet? No worries. It takes minutes to set it up and browse the catalog.

- However, before diving straight into downloading California Deduction Pay For, consider these recommendations.

Form popularity

FAQ

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

California has a progressive income tax system, with nine tax rates ranging from 1% to 12.3%. Income over $1 million is subject to an additional 1% tax surcharge. The 2022 California state standard deduction is $5,202 for single filers and those married filing separately, and $10,404 for all other filing statuses.

A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances. You can also claim your children as dependents if you support them financially and they're not past the age of 19.

Indexing Filing Status2022 Amounts2023 AmountsStandard deduction for single or married filing separate taxpayers$5,202$5,363Standard deduction for joint, surviving spouse, or head of household taxpayers$10,404$10,726Personal exemption credit amount for single, separate, and head of household taxpayers$140$1444 more rows ?

Determine the additional withholding allowance for itemized deductions (AWAID) by applying the following guideline and subtract this amount from the gross annual wages: AWAID = $1,000 x Number of Itemized Allowances Claimed for Itemized Deductions on DE-4.