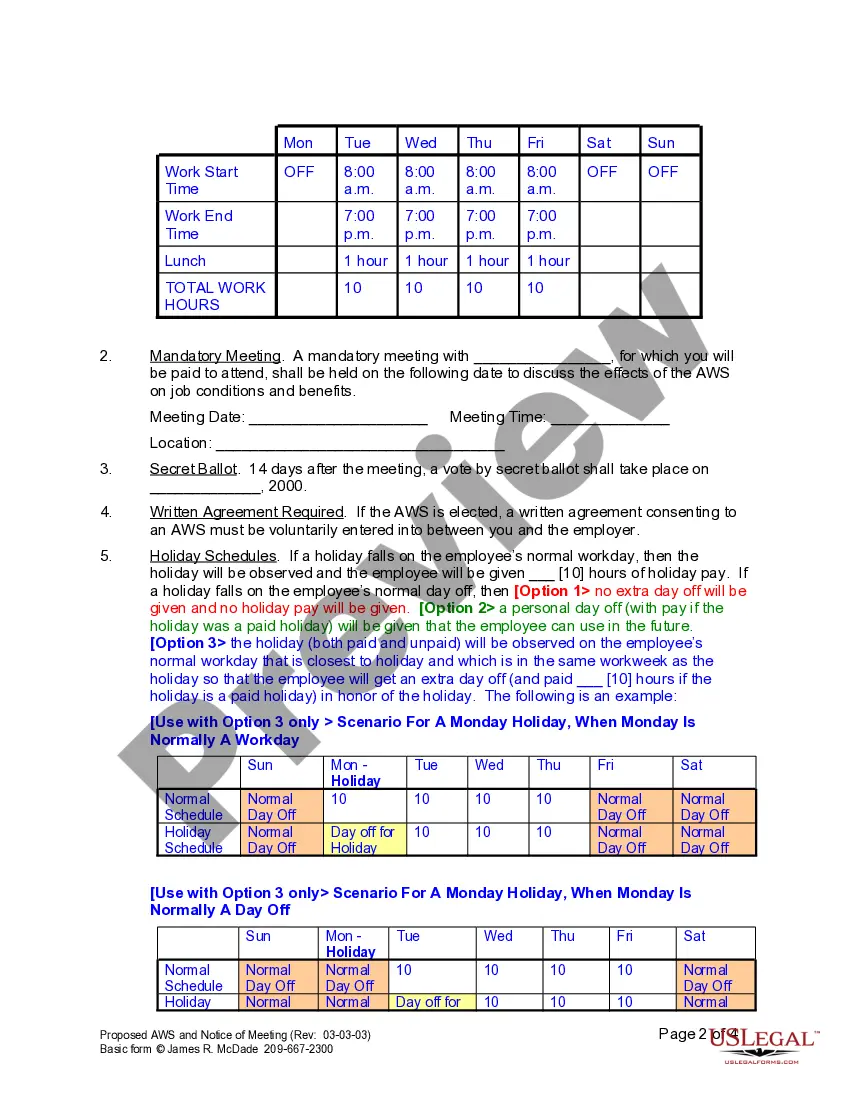

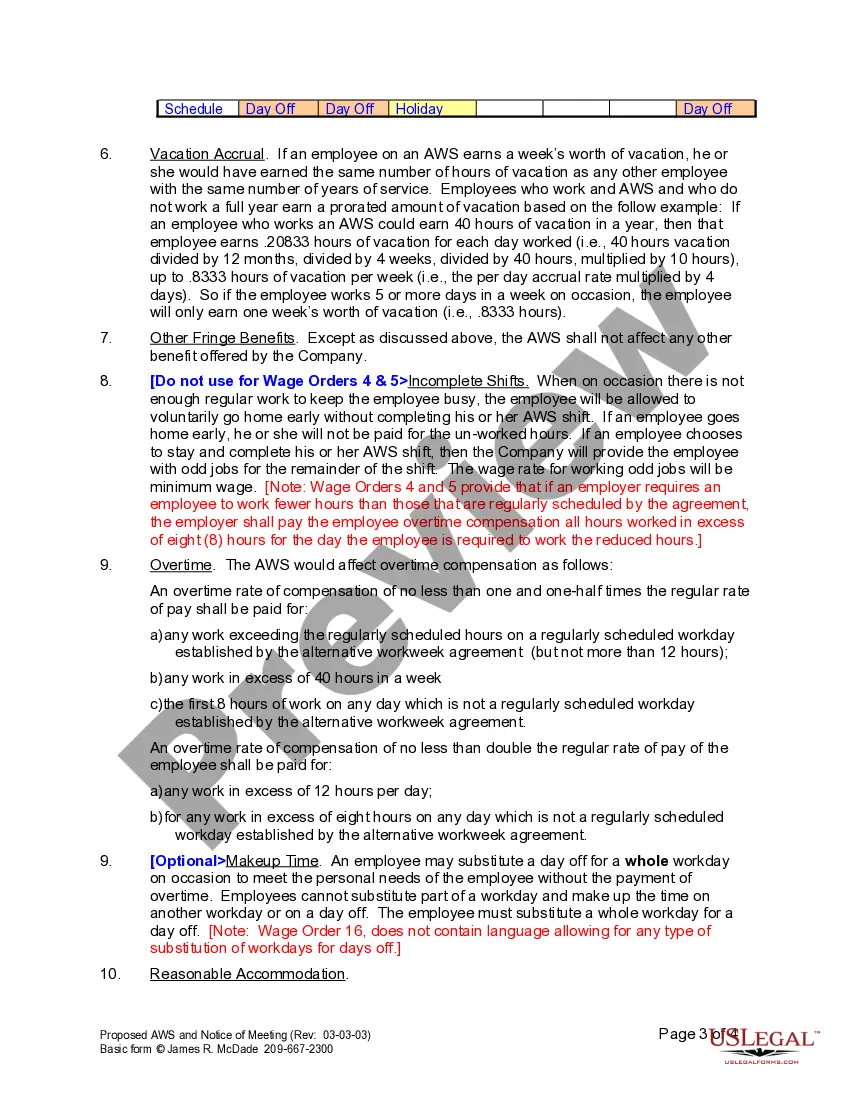

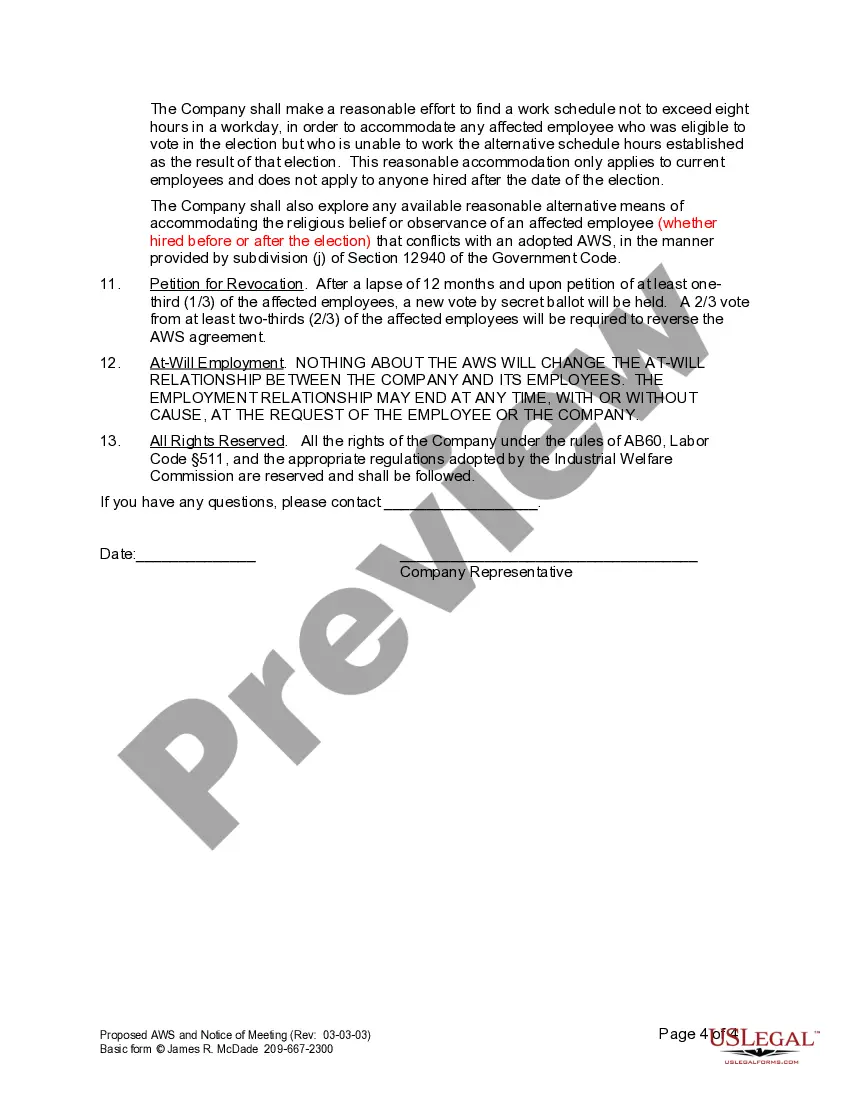

Employers use this form to inform employees of the proposed Alternative Workweek Schedule. It addresses the options available to employees, as well as holiday schedules, vacation schedules and overtime policies.

Notice Meeting Form Withholding

Description

How to fill out Notice Meeting Form Withholding?

Administration requires exactness and correctness.

If you neglect to manage the completion of documents such as the Notice Meeting Form Withholding on a daily basis, it may lead to some misunderstanding.

Selecting the appropriate example from the outset will ensure that your document submission proceeds smoothly and avert any issues of resending a document or starting the same task from the beginning.

If you do not possess a subscriber's account, locating the needed example may require a few additional steps: Find the template using the search bar, verify if the Notice Meeting Form Withholding you’ve discovered is valid for your state or county, examine the preview or read the description containing the details regarding the template usage. When the outcome aligns with your inquiry, click the Buy Now button, select the appropriate option among the available pricing plans, Log Into your account or register a new one, complete the purchase via credit card or PayPal, and download the form in your preferred format. Identifying the correct and up-to-date examples for your documentation takes just a few minutes with an account at US Legal Forms. Eliminate any bureaucratic uncertainties and simplify your form management.

- You can consistently find the suitable example for your paperwork in US Legal Forms.

- US Legal Forms constitutes the largest online forms repository that provides over 85 thousand samples across various fields.

- You can locate the most recent and the most fitting version of the Notice Meeting Form Withholding by simply searching it on the website.

- Locate, save, and download templates in your account or refer to the description to verify you possess the right one at your disposal.

- With an account at US Legal Forms, it becomes straightforward to gather, store in one location, and browse through the templates you save for easy access.

- Upon visiting the site, click the Log In button to authenticate.

- Then, go to the My documents page, where your collection of forms is maintained.

- Review the form descriptions and download the ones you require at any moment.

Form popularity

FAQ

ECI income tax refers to the taxation imposed on income that is effectively connected with a trade or business in the United States. This type of income is generally taxed at the same rates as U.S. residents. To prepare appropriately, using the Notice meeting form withholding helps clarify your obligations and ensures you meet all regulatory requirements.

Form 8288 should be filed with the Internal Revenue Service (IRS) for payments subject to withholding tax, specifically related to the disposition of U.S. real property interests by foreign persons. Ensure you include the appropriate remittance along with your filing. For guidance on handling this process, the Notice meeting form withholding can be a valuable resource.

Determining your withholding rate depends on several factors, including the type of income and whether the recipient is a foreign entity or U.S. resident. It's crucial to analyze the specifics of your situation to select the correct rate. Employing the Notice meeting form withholding can assist you in reviewing your options and ensuring accurate withholding.

The 20% mandatory withholding refers to the requirement that certain types of payments made to foreign persons are subject to a flat withholding rate of 20%. This rate applies to various forms of ECI and is essential for compliance. Adopting the Notice meeting form withholding can clarify how you should apply this rate and what documentation might be necessary.

To file an employee withholding, you'll need to complete the appropriate tax forms, such as the W-4 for U.S. employees. After collecting the required information, submit the forms to your payroll department. Utilizing the Notice meeting form withholding may guide you in managing these filings correctly and efficiently.

Yes, ECI is income based, meaning it is derived from trade or business activities conducted in the United States. The income must be connected to a U.S. source to qualify as ECI. To accurately handle ECI, using the Notice meeting form withholding can help you assess the applicable taxes and ensure proper reporting.

The withholding rate for effectively connected income (ECI) varies depending on the type of payment made to the foreign person. Generally, it can align with the graduated income tax rates applicable to U.S. residents. It's essential to utilize the Notice meeting form withholding to determine the specific rate pertinent to your situation, ensuring compliance with IRS regulations.

Requesting a release from the withholding compliance program involves submitting a formal request to the IRS along with any required documentation that supports your case. Make sure to provide clear reasons for your request to improve your chances of acceptance. Using a Notice meeting form withholding can make this process easier and more structured.

To have the IRS release a lock-in letter, you need to provide sufficient evidence that your financial situation has changed since the letter was issued. This often requires submitting Form 1040 along with the appropriate documentation. Engaging with a Notice meeting form withholding will help organize your request effectively.

Financial organizations are generally required to provide a withholding notice at least once per year or whenever there are changes to your withholding status. This ensures that you are fully informed about any withholding amounts that may apply. Staying updated helps you avoid surprises during tax season, and a Notice meeting form withholding can aid in your understanding.