Tennessee Quitclaim Deed from a Trust to an Individual

What is this form?

This form is a Quitclaim Deed from a Trust to an Individual. It allows the Grantor, which is a Trust, to convey ownership of a specified property to the Grantee, an individual. Unlike other types of deeds, a quitclaim deed transfers whatever interest the Grantor has in the property without making any guarantees about the title. This makes it important for straightforward property transfers where the parties trust each other's claims to the property.

Main sections of this form

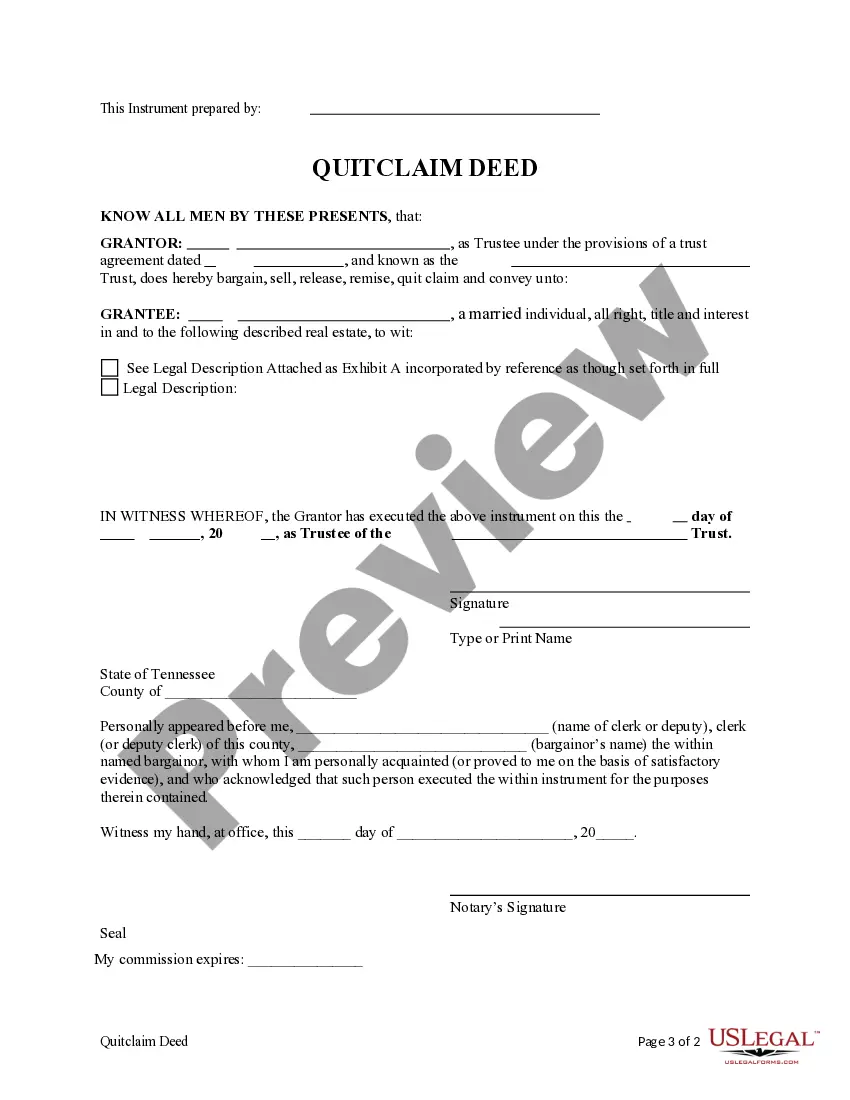

- Identification of the Grantor (Trust) and Grantee (Individual)

- Description of the property being transferred

- Statement of the transfer including "quitclaims" clause

- Signature fields for both parties

- Notary acknowledgment section for legal validation

Jurisdiction-specific notes

This Quitclaim Deed from a Trust to an Individual is designed in accordance with the statutory laws of Tennessee. Users should verify local laws and regulations to ensure compliance.

Situations where this form applies

This form is typically used when a Trust wants to transfer real estate property to an individual. Scenarios for use include the following: when a property is being removed from the Trust for the benefit of a named beneficiary, a change in ownership is needed without the complexity of proving the title, or in cases where a simple property transfer is involved between the Trust and an individual.

Who this form is for

- Trustees acting on behalf of a Trust

- Individuals receiving property from a Trust

- Beneficiaries of a Trust who need to formalize their property rights

- Legal professionals assisting with the property transfer process

Steps to complete this form

- Identify the parties involved: Enter the full name of the Trust as Grantor and the full name of the individual as Grantee.

- Provide a detailed description of the property being transferred, including its address and any relevant legal descriptions.

- Include the date of the transfer.

- Ensure both Grantor and Grantee sign the document in the appropriate spaces provided.

- Obtain notarization for the deed by signing in the presence of a notary public.

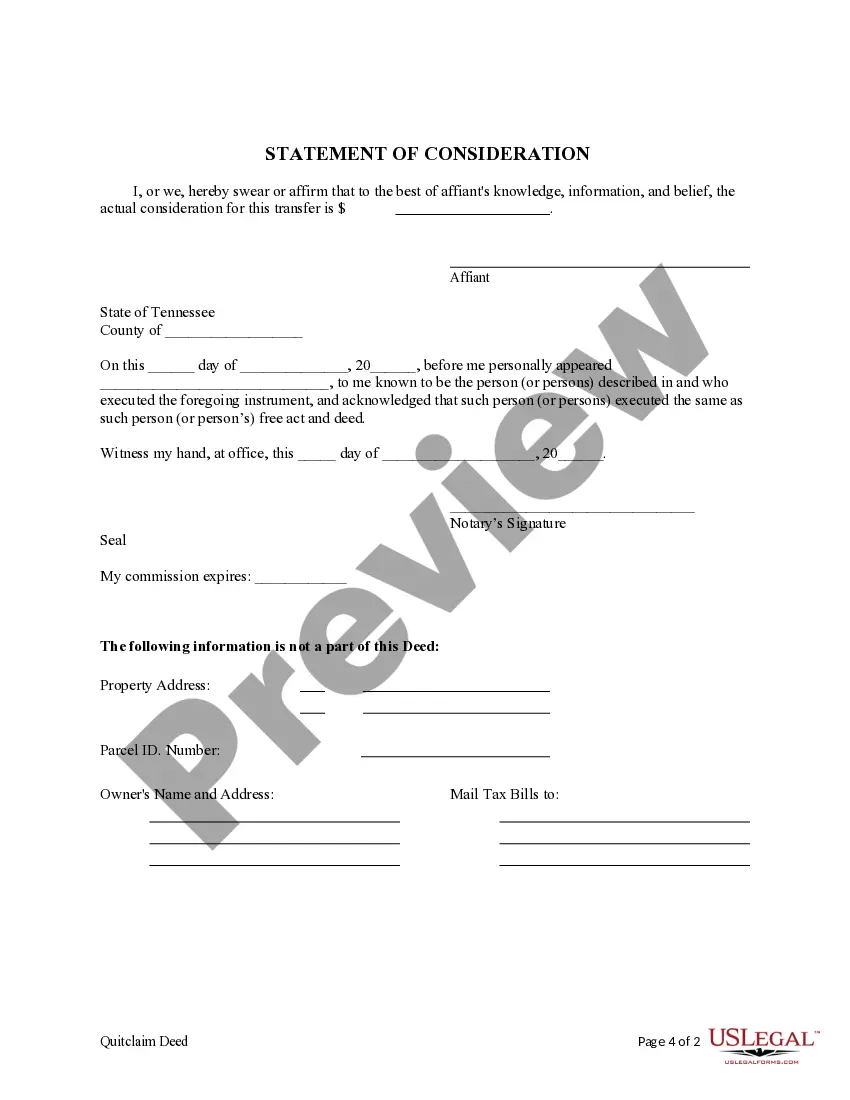

Notarization requirements for this form

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Common mistakes to avoid

- Failing to provide a complete legal description of the property.

- Not having the document notarized, if required by local laws.

- Leaving out signatures or dates.

- Not verifying the legitimacy of the property title being conveyed.

Benefits of using this form online

- Immediate access to legal forms simplifies the property transfer process.

- Edit or complete the form at your convenience, ensuring accuracy.

- Complies with state-specific requirements, minimizing errors.

- Printable and fillable formats improve usability for all users.

Form popularity

FAQ

A Tennessee Quit Claim Deed may be filled out and filed with the Tennessee Register of Deeds of the same County the Property being transferred is in. Laws § 66-5-103(2) Recording (A§ 66-5-106) Submit the quit claim along with the filing fee to the Register's Office in your County.

To use a Quitclaim Deed to add someone to a property deed or title, you would need to create a Quitclaim Deed and list all of the current owners in the grantor section. In the grantee section, you would list all of the current owners as well as the person you would like to add.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

California Property TaxesTransferring real property to yourself as trustee of your own revocable living trust -- or back to yourself -- does not trigger a reassessment for property tax purposes. (Cal. Rev. & Tax Code § 62(d).)

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.