California Law On Property Tax

Description

How to fill out Summary Of California Law Covering Tenants Of Property In Foreclosure?

Using legal templates that meet the federal and local regulations is essential, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the right California Law On Property Tax sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and life situation. They are simple to browse with all files collected by state and purpose of use. Our professionals keep up with legislative updates, so you can always be sure your form is up to date and compliant when getting a California Law On Property Tax from our website.

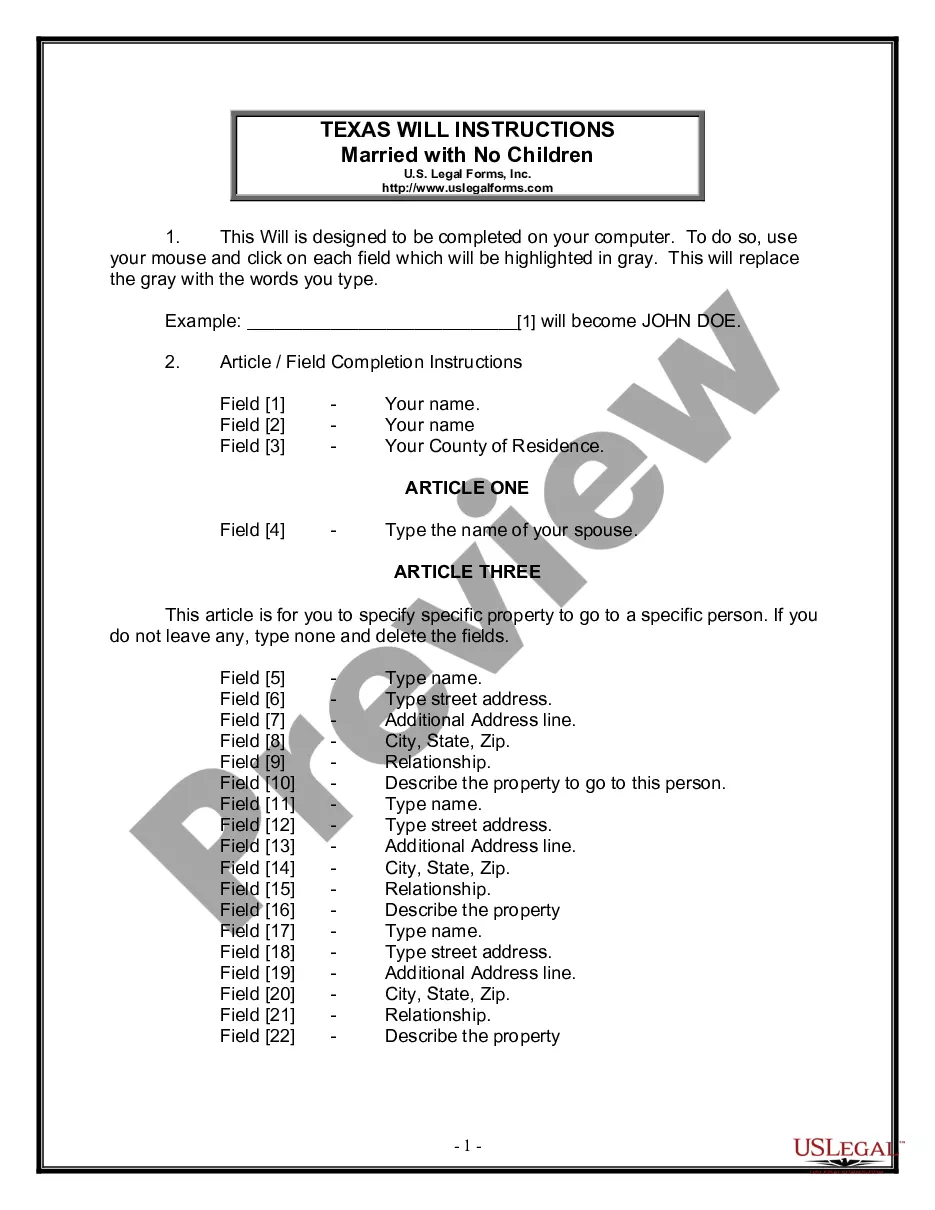

Getting a California Law On Property Tax is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, follow the instructions below:

- Analyze the template using the Preview option or via the text outline to ensure it fits your needs.

- Look for another sample using the search tool at the top of the page if needed.

- Click Buy Now when you’ve found the right form and choose a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your California Law On Property Tax and download it.

All templates you find through US Legal Forms are reusable. To re-download and complete earlier obtained forms, open the My Forms tab in your profile. Benefit from the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

19 would narrow California's property tax inheritance loophole, which offers Californians who inherit certain properties a significant tax break by allowing them to pay property taxes based on the property's value when it was originally purchased rather than its value upon inheritance. Prop. 19 Would Make Changes to California's Residential Property ... calbudgetcenter.org ? resources ? prop-19-would-... calbudgetcenter.org ? resources ? prop-19-would-...

Proposition 19 is constitutional amendment that limits people who inherit family properties from keeping the low property tax base unless they use the home as their primary residence, but it also allows homeowners who are over 55 years of age, disabled, or victims of a wildfire or natural disaster to transfer their ...

Owner must be at least 55 years of age. Both original and replacement properties must be utilized as a principal residence. Replacement residence must be purchased or newly constructed within two years of the sale of the original property. Location of replacement home can be anywhere in California. Persons 55+ Tax base transfer - Placer County - CA.gov ca.gov ? Persons-55-Tax-Base-Transfer ca.gov ? Persons-55-Tax-Base-Transfer

If you own real property in California, you will be required to pay real property taxes. So, if you own any real property as an individual or business, you pay real property tax on it. Even if the real property was gifted to you through an estate or you own a rental real property, you are still required to pay it. Property Tax - California - H&R Block hrblock.com ? tax-center ? filing ? states ? p... hrblock.com ? tax-center ? filing ? states ? p...

The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place of residence of the owner on the lien date, January 1st. Homeowners' Exemption - California State Board of Equalization ca.gov ? proptaxes ? homeowners_exe... ca.gov ? proptaxes ? homeowners_exe...