Small Estate Forms Ny

Description

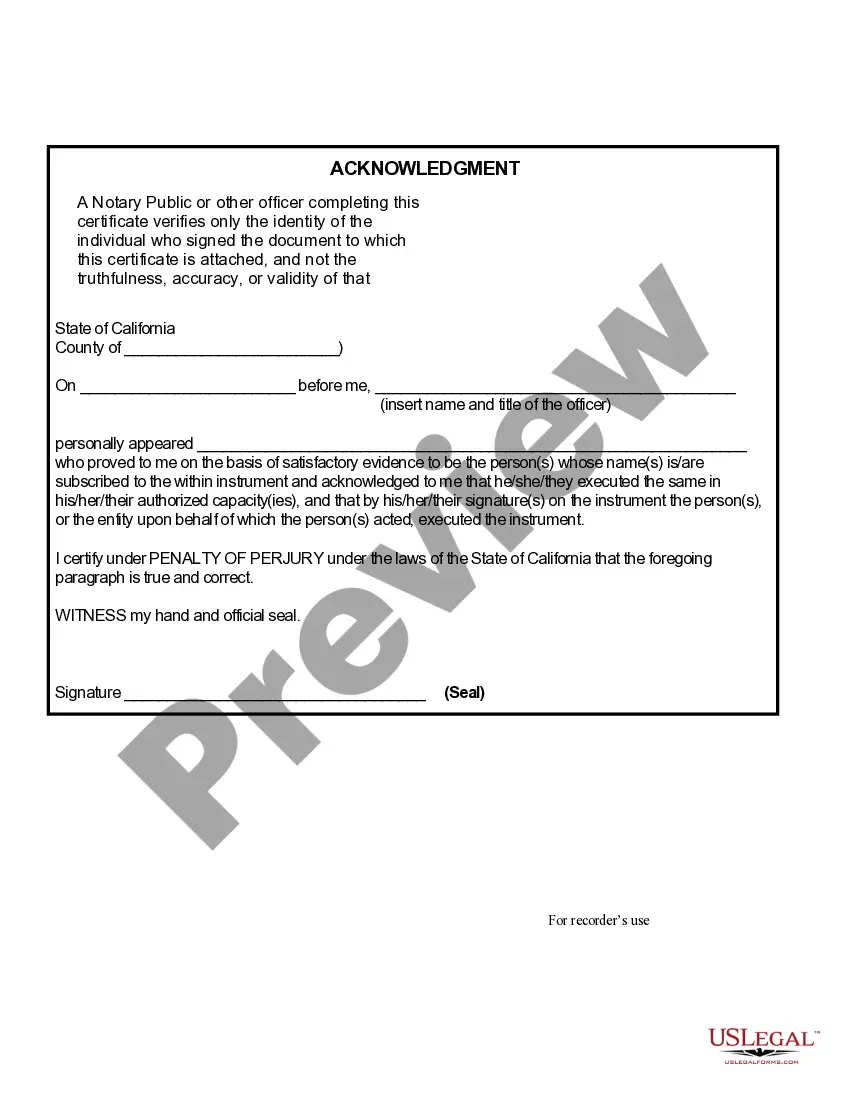

How to fill out California Affidavit For Collection Of Personal Property - Probate Code Section 13100 - Small Estates Under $208,850?

Regardless of whether for professional reasons or personal issues, everyone must confront legal matters at some point in their lives.

Filling out legal paperwork requires meticulous care, beginning with choosing the appropriate form template.

With an extensive collection of US Legal Forms at your disposal, you no longer need to waste time searching for the right template online. Take advantage of the library’s simple navigation to find the suitable template for any circumstance.

- Acquire the template you require by utilizing the search function or browsing the catalog.

- Review the form's details to confirm it corresponds with your situation, state, and locality.

- Select the form's preview to view it.

- If it is not the correct form, return to the search tool to find the Small Estate Forms Ny template you need.

- Download the template if it fulfills your needs.

- If you possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate payment option.

- Complete the account registration form.

- Choose your payment method: you can use a credit card or a PayPal account.

- Select the file format you prefer and download the Small Estate Forms Ny.

- Once downloaded, you may complete the form using editing software or print it out to fill it manually.

Form popularity

FAQ

A small estate in New York qualifies when the total value of the estate’s assets, minus debts and liabilities, is under $50,000 for individuals or $100,000 for married couples. This designation allows descendants to utilize small estate forms NY, easing the distribution of assets without extensive court involvement. To ensure that you meet the qualifications, it is beneficial to list and evaluate all estate assets properly. Knowing these thresholds can save time and additional costs.

Yes, in New York, a small estate affidavit is generally required to be filed with the court for estates that qualify as small estates. This document allows the individual named in the affidavit to claim assets without a full probate process. Utilizing small estate forms NY can simplify the preparation and submission of these affidavits, ensuring you fulfill all legal requirements smoothly. This expedites the process of accessing your loved one’s assets.

In New York, an estate includes all of a deceased person's assets, which can encompass real estate, personal property, and financial holdings. The total value of these assets defines whether the estate needs to go through the probate process. If the estate falls under the small estate threshold, you might find that small estate forms NY provide a straightforward means to manage the distribution of assets. Understanding what constitutes an estate will guide you in the necessary steps for settling affairs.

A small estate in New York state is defined as an estate where the total value of the assets is below a certain threshold, currently set at $50,000 for individuals. This allows for a simplified process when settling the estate. In these cases, you can often use small estate forms NY to handle the transfer of assets without going through probate. It is a more efficient option for those with limited assets.

In New York, an estate value exceeding $50,000 for personal property or $100,000 for real estate typically triggers the probate process. If your estate falls below these amounts, you can utilize small estate forms ny to streamline the process and avoid probate complexities. Knowing these thresholds is crucial for effective estate management. This knowledge empowers you to plan wisely and take necessary actions based on your estate’s value.

You can avoid probate in New York by using various strategies, such as establishing a living trust, naming beneficiaries on accounts, or transferring assets into joint ownership. By implementing small estate forms ny, you can also simplify how you manage smaller estates without triggering probate. Understanding these options allows you to keep control over your assets and reduce complications. Consider these alternatives as part of your estate planning.

A small estate in New York generally includes estates valued at $50,000 or less for personal property and $100,000 for real property. Utilizing small estate forms ny makes the process easier and faster for qualifying estates. This designation allows for a simplified approach to handling assets without going through a lengthy probate process. Ensure you meet these value criteria to benefit from a small estate designation.

The minimum estate value that necessitates probate in New York is around $50,000 for personal property and $100,000 for real property. If your estate value is below these amounts, you can consider filing small estate forms ny to streamline the process. Understanding these limits helps ensure you can take advantage of the small estate provisions. It’s a proactive step to simplify settling your affairs.

When filling out an affidavit, start by including the declarant’s name and a sworn statement of facts relevant to the inheritance. Be clear and thorough, ensuring you include all pertinent details to support your claim. Our platform provides examples and templates for small estate forms in NY, guiding you through this process with ease.

In New York, estates valued above $50,000 require full probate proceedings. If the estate includes real property and exceeds $100,000, it also enters the probate process. For smaller estates, you can utilize small estate forms in NY, which simplify asset transfer and provide a quicker resolution for heirs.