Conservation Easement For Tax Purposes

Description

How to fill out California Conservation Easement For Specific Resource Preservation?

Creating legal documents from the ground up can frequently be somewhat daunting.

Certain situations may require extensive research and substantial expenses.

If you’re seeking a more straightforward and affordable method of drafting Conservation Easement For Tax Purposes or any other forms without unnecessary complications, US Legal Forms is consistently available to assist you.

Our digital repository of over 85,000 current legal documents covers almost every aspect of your financial, legal, and personal matters. With just a few clicks, you can swiftly obtain state- and county-specific forms meticulously prepared for you by our legal experts.

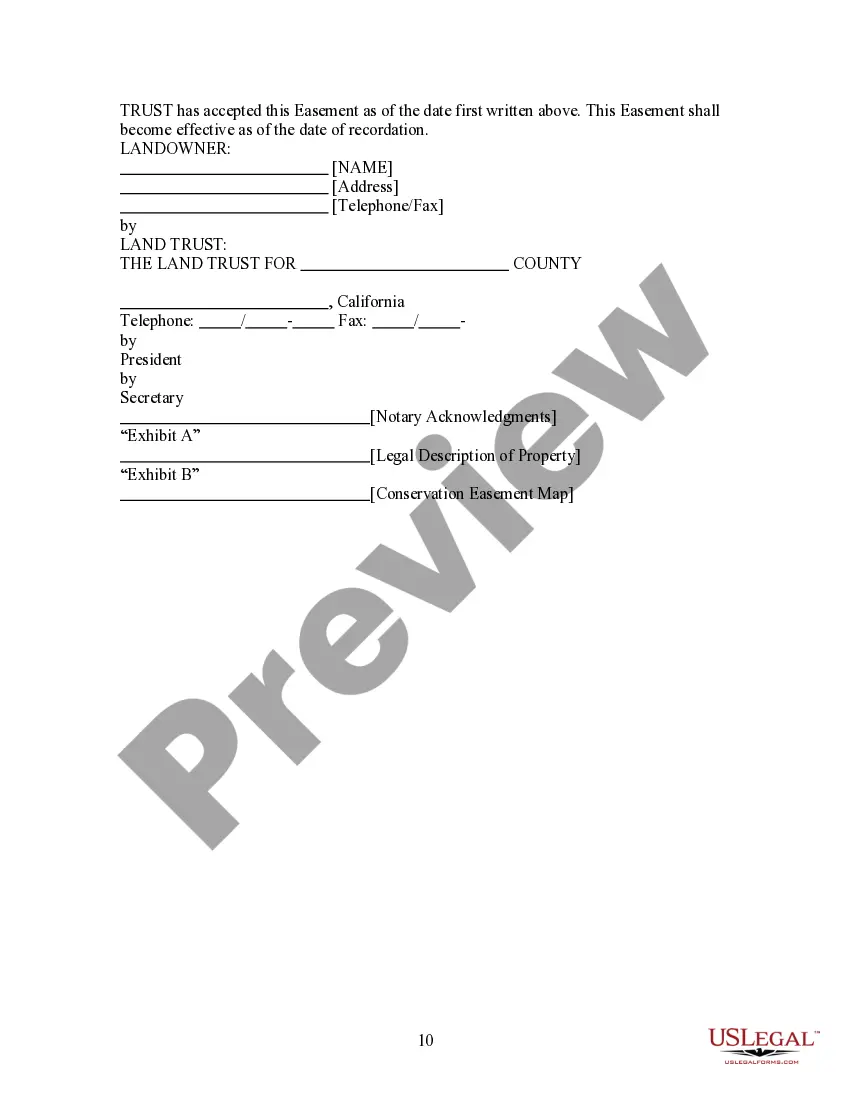

Examine the form preview and descriptions to ensure you are on the correct document you are looking for.

- Utilize our platform whenever you require dependable and trustworthy services to quickly find and download the Conservation Easement For Tax Purposes.

- If you are already familiar with our site and have previously created an account with us, simply Log In to your account, find the form, and download it or re-download it anytime from the My documents section.

- Don’t have an account? No worries. Setting it up and navigating the library takes only a few minutes.

- However, before rushing to download the Conservation Easement For Tax Purposes, consider these suggestions.

Form popularity

FAQ

Form 8283, Noncash Charitable Contributions, which must be filed by individual taxpayers who claim itemized deductions for donations of easements.

Grants or sales of limited easements are usually not treated as taxable sales of property. Instead, amounts received from such transfers are subtracted from the basis of the property. Any amounts received in excess of basis are treated as taxable gain.

Conservation easements facilitate other conservation tools Federal law allows an annual exclusion from the gift tax. In 2022 the exclusion amount is $16,000 per donor per donee. By reducing the value of land, a conservation easement allows more land to pass, tax free, to the next generation.

The value of the donated easement for purposes of claiming a federal income tax deduction is calculated as the difference between the fair value of the eased property before the easement is granted minus the value of the eased property after the easement is granted.

Such an easement usually limits the usefulness of the property and lowers its value. When a conservation easement meets criteria spelled out in the Internal Revenue Code, the owner may qualify for a tax deduction based on the property's reduction in value.