Trust Revocation Declaration Form For Canada

Description

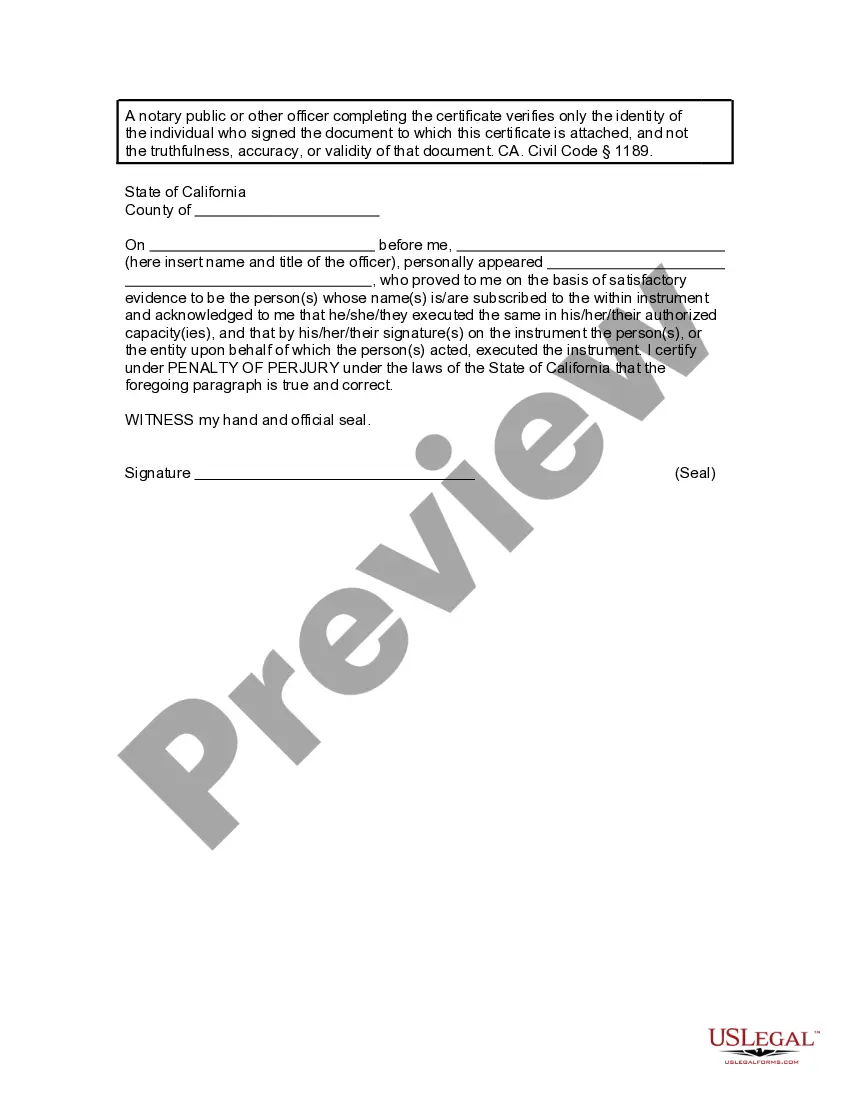

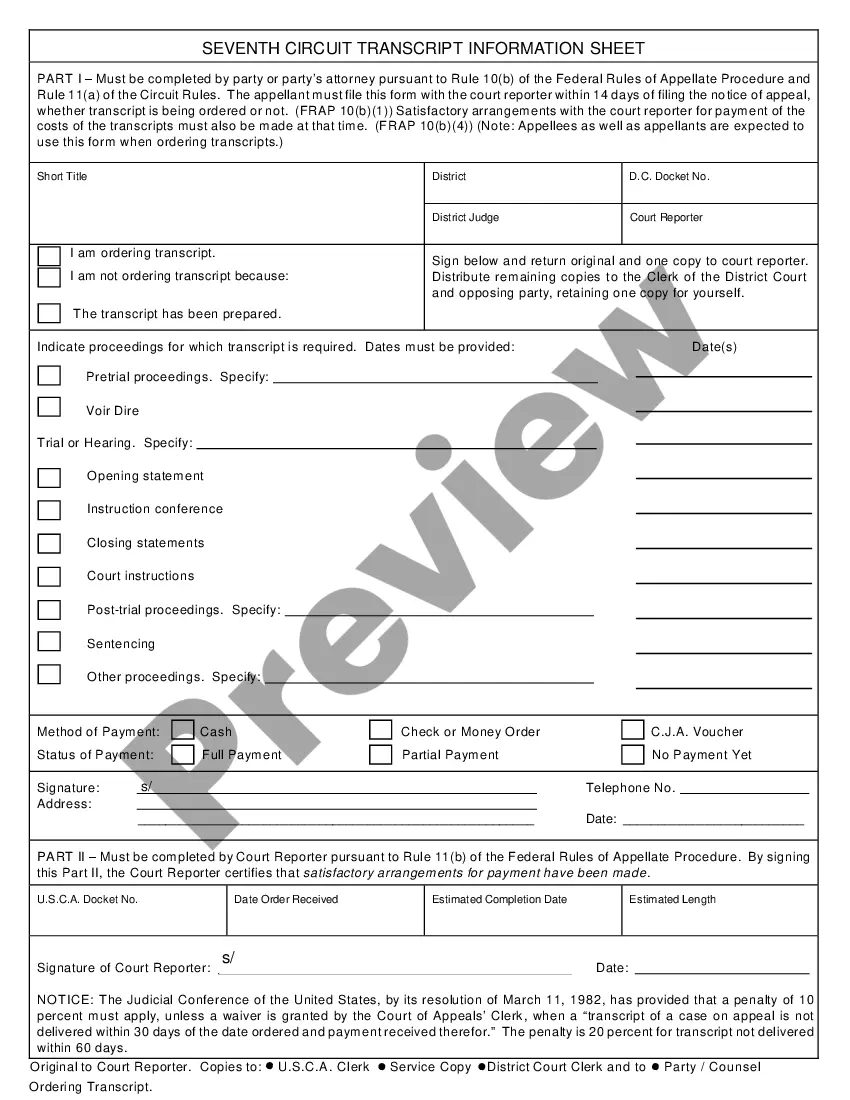

How to fill out California Revocation Of Living Trust?

Creating legal documents from the ground up can frequently be overwhelming.

Certain cases may require extensive research and significant financial investment.

If you're looking for a simpler and more budget-friendly method of preparing the Trust Revocation Declaration Form For Canada or other documents without unnecessary complications, US Legal Forms is always within your reach.

Our online repository of over 85,000 current legal forms covers nearly all facets of your financial, legal, and personal matters. With just a few clicks, you can swiftly access state- and county-specific forms carefully crafted for you by our legal experts.

US Legal Forms has a solid reputation and over 25 years of expertise. Join us today and make the process of completing forms effortless and efficient!

- Utilize our website whenever you require trustworthy and dependable services that allow you to easily find and download the Trust Revocation Declaration Form For Canada.

- If you’re familiar with our services and have previously set up an account with us, simply sign in to your account, locate the template, and download it, or retrieve it anytime from the My documents section.

- Not registered yet? That's not an issue. It only takes a few minutes to register and browse the library.

- Before you download the Trust Revocation Declaration Form For Canada, consider these suggestions.

- Review the form preview and descriptions to ensure you've found the document you're looking for.

Form popularity

FAQ

Revoking charitable status in Canada requires submitting a formal application to the Canada Revenue Agency, detailing your intentions. If your organization no longer meets the requirements for registration, you will also need to prepare a trust revocation declaration form for Canada. This process involves governing documents and possibly dealing with any residual assets. It is advisable to consult with a legal expert to navigate the regulations effectively.

The 21-year rule for trusts in Canada states that most trusts must be reviewed and potentially terminated 21 years after their creation. This rule is designed to prevent trusts from indefinitely existing without reassessment. If you are considering a trust revocation declaration form for Canada, it's crucial to be aware of this timeline to avoid unwanted tax consequences or administrative burdens. Regularly monitoring your trust can ensure compliance with this regulation.

What is the 21-year rule? Family trusts created during someone's lifetime are deemed to dispose of their property every 21 years. Although the trust is deemed to have disposed of property for tax purposes, an actual disposition typically does not occur.

DTD is just an abbreviation for "dated," meaning the date the trust was signed. When referring to a trust, one should always use the date of the trust.

Other rules attribute the income to a transferor who can effectively control, or reclaim, the assets in the trust. There are exceptions including alter-ego trusts and joint partner trusts. But otherwise, the rules make revocable trusts increasingly common in the U.S., while difficult to use in Canada.

A trust can be wound up early if all the beneficiaries unanimously agree to the wind up and the distribution of the remaining assets of the trust or estate. This unanimous consent is sufficient to wind up a trust even if it would contradict the trust creator's intention that the trust be distributed at a future date.

It can be revocable or irrevocable. With a revocable trust, you can alter it in the future. While with an irrevocable trust, you cannot make changes. When you set up a living trust, the settlor changes the title of the assets from their name to the name of the trust.