Trust Revocation Declaration Form California Withdrawal

Description

How to fill out California Revocation Of Living Trust?

Whether for professional objectives or for personal matters, everyone must handle legal circumstances sooner or later in their lifetime. Completing legal documents requires careful consideration, starting with choosing the appropriate form template.

For instance, if you choose an incorrect version of a Trust Revocation Declaration Form California Withdrawal, it will be rejected upon submission. It is therefore crucial to have a trustworthy source of legal documents like US Legal Forms.

With a vast US Legal Forms catalog available, you do not need to waste time searching for the right template across the internet. Use the library’s intuitive navigation to find the correct template for any situation.

- Locate the template you require using the search bar or catalog browsing.

- Review the form’s details to confirm it aligns with your situation, state, and area.

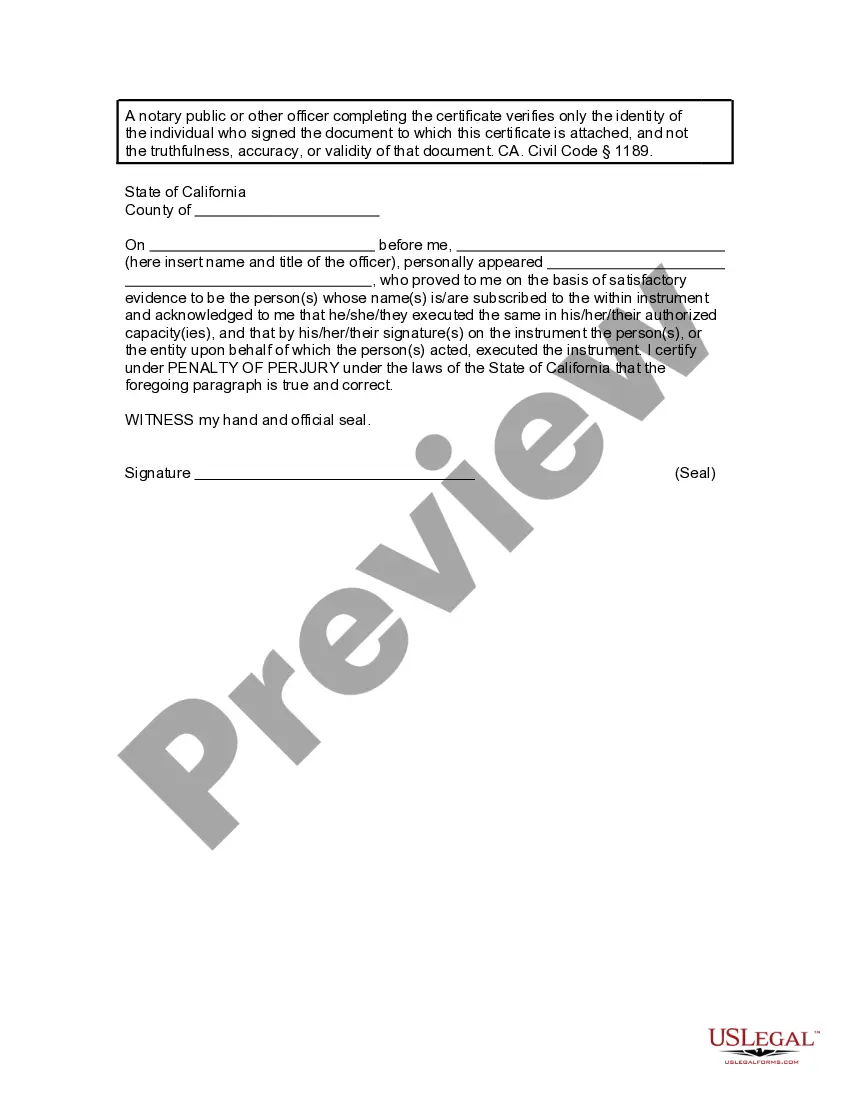

- Click on the form’s preview to inspect it.

- If it is the wrong document, return to the search feature to find the Trust Revocation Declaration Form California Withdrawal sample you need.

- Download the template if it satisfies your criteria.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- In the case that you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the suitable pricing option.

- Fill out the account registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you desire and download the Trust Revocation Declaration Form California Withdrawal.

- Once it is downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

Withdrawing assets from a trust is possible, but must be done with care. You should follow the procedures established in the trust agreement and may need to submit a Trust revocation declaration form California withdrawal to document your intentions. This process helps maintain transparency and fairness among the beneficiaries. Working with a knowledgeable attorney can assist you in ensuring that this withdrawal is handled correctly.

The 5 year rule for trusts generally refers to the period during which certain transfers to a trust are scrutinized for tax implications or eligibility for government benefits. If you withdraw assets from a trust during this time, you may face penalties or tax liabilities. Utilizing a Trust revocation declaration form California withdrawal properly can help manage your assets within this timeframe. Understanding the specifics of this rule is important, so consulting a legal expert can provide clarity.

Yes, you can remove an asset from a trust, but it requires the correct legal steps. Depending on the type of trust, you might need to fill out a Trust revocation declaration form California withdrawal to ensure the removal is documented. This form serves as a formal record of your decision and is crucial for compliance with trust laws. It’s advisable to seek professional help in this matter to safeguard your interests.

To remove assets from a trust, you need to follow the specific procedures outlined in the trust document. Typically, this may involve drafting a Trust revocation declaration form California withdrawal to formally declare your intent. It is essential to ensure that the removal is executed properly to avoid any legal complications in the future. Consulting with an attorney can provide you with the guidance needed to navigate this process.

A revocation clause typically states that any previous trusts are nullified upon the creation of a new trust. It acts as a safeguard to prevent conflicting instructions from multiple documents. In practice, including this in your trust documents reinforces the authority of a newly established trust while removing the weight of outdated directives. Utilizing a trust revocation declaration form in California effectively formalizes this process and simplifies estate planning.

Parents often overlook updating their trust fund after major life events, which is a significant mistake. When they do not adjust the trust terms or beneficiaries accordingly, it may lead to unintended consequences during asset distribution. Additionally, failing to use a trust revocation declaration form in California when necessary to modify or withdraw trust provisions complicates matters further. Staying proactive in updating legal documents helps ensure that intentions reflect current family dynamics.

A trust revocation occurs when the trust maker submits a trust revocation declaration form in California, effectively dissolving the trust. This process includes stating that the trust is no longer valid and detailing any subsequent arrangements. It helps clarify the disposition of assets and alleviates potential misunderstandings among beneficiaries. Therefore, understanding this document is essential when considering changes to your estate plan.

An example of revocation is when a person decides to cancel a previously established trust. This can happen through a formal trust revocation declaration form in California, which documents the withdrawal of the trust’s authority. By completing this form, the person ensures that any instructions or beneficiaries previously designated no longer hold legal weight. Thus, utilizing a proper process for revocation is vital to avoid confusion in the future.

Revoking a revocable trust is generally straightforward. You can cancel the trust by simply filling out the Trust revocation declaration form California withdrawal. This process can be done with minimal complexity, as the law supports your right to change your decisions regarding the trust. Utilizing platforms like US Legal Forms can streamline this process, making it easier for you to handle your estate planning needs.

Yes, you can withdraw from a revocable trust at any time. A revocable trust allows you the flexibility to manage your assets and make changes according to your needs. To withdraw, you will need to complete the Trust revocation declaration form California withdrawal. This form formally documents your intent and ensures all parties are aware of the changes.