Revocation Living Trust Form For Florida

Description

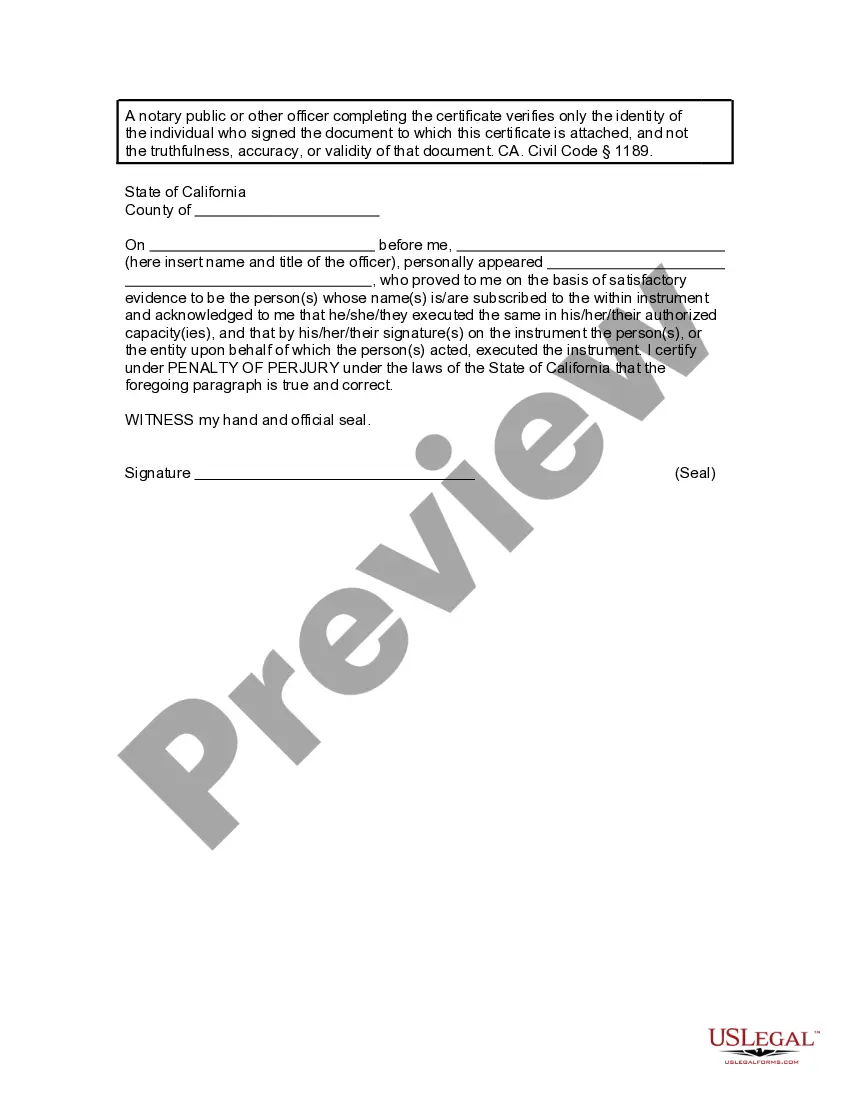

How to fill out California Revocation Of Living Trust?

Managing legal documents can be daunting, even for the most experienced professionals.

When you're seeking a Revocation Living Trust Form for Florida and don’t have the time to search for the correct and current version, the journey can be overwhelming.

Access state- or county-specific legal and business documents. US Legal Forms fulfills any needs you may have, from personal to corporate paperwork, all under one roof.

Utilize advanced tools to complete and manage your Revocation Living Trust Form for Florida.

Here are the steps to follow after locating the form you seek: Confirm it’s the right form by reviewing and checking its description. Ensure the sample is valid in your state or county. Click Buy Now when ready. Choose a monthly subscription plan. Select the desired format, and Download, complete, eSign, print, and submit your documents. Benefit from the US Legal Forms online catalog, backed by 25 years of expertise and reliability. Transform your daily document management into a seamless and user-friendly experience today.

- Access a valuable repository of articles, guides, and resources relevant to your situation and requirements.

- Save time and effort searching for the documents you need, and take advantage of US Legal Forms' advanced search and Review tool to find and download the Revocation Living Trust Form for Florida.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to review the documents you have previously saved and arrange your folders as desired.

- If you are a new user of US Legal Forms, create an account and enjoy unlimited access to all the library's features.

- A comprehensive online form library could revolutionize how anyone navigates these situations effectively.

- US Legal Forms stands out as a frontrunner in digital legal documents, boasting over 85,000 state-specific legal forms available at any moment.

- With US Legal Forms, you can.

Form popularity

FAQ

Form 8879 is used for Form 1040, U.S. Individual Income Tax Return; Form 8879-PE, IRS efile Signature Authorization for Form 1065; Form 8879-C, IRS efile Signature Authorization for Form 1120;and Form 8879-S, IRS efile Signature Authorization for Form 1120S.

You qualify as a Vermont resident for that part of the taxable year during which: You are domiciled in Vermont, or. You maintain a permanent home in Vermont, and you are present in Vermont for more than 183 days of the taxable year.

As of 2023, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax.

Vermont has a graduated individual income tax, with rates ranging from 3.35 percent to 8.75 percent. Vermont also has a graduated corporate income tax, with rates ranging from 6.00 percent to 8.5 percent.

You must file an income tax return in Vermont: if you are a resident, part-year resident of Vermont, or a nonresident but earned Vermont income, and. if you are required to file a federal income tax return, and. you earned or received more than $100 in Vermont income, or.

Individuals who fall below the minimum may still have to file a tax return under certain circumstances; for instance, if you had $400 in self-employment earnings, you'll have to file and pay self-employment tax. If you have no income, however, you aren't obligated to file.

Order the package online at canada.ca/get-cra-forms. order a package by calling the CRA at 1-855-330-3305 (be ready to give your social insurance number)

Download fillable PDF forms from the web. Free, unlimited downloads! Order forms online. . Order forms by email. tax.formsrequest@vermont.gov.