California Trust Printable For Instructions

Description

How to fill out California Revocation Of Living Trust?

Working with legal documents and operations could be a time-consuming addition to your entire day. California Trust Printable For Instructions and forms like it usually need you to look for them and navigate the way to complete them correctly. Therefore, regardless if you are taking care of economic, legal, or personal matters, using a extensive and practical online library of forms close at hand will help a lot.

US Legal Forms is the best online platform of legal templates, boasting over 85,000 state-specific forms and a variety of resources to assist you to complete your documents quickly. Check out the library of relevant documents open to you with just one click.

US Legal Forms offers you state- and county-specific forms offered by any moment for downloading. Safeguard your papers administration operations with a top-notch service that lets you prepare any form within minutes without having extra or hidden fees. Simply log in to the account, find California Trust Printable For Instructions and acquire it immediately within the My Forms tab. You may also gain access to previously downloaded forms.

Could it be your first time making use of US Legal Forms? Sign up and set up a free account in a few minutes and you will have access to the form library and California Trust Printable For Instructions. Then, stick to the steps listed below to complete your form:

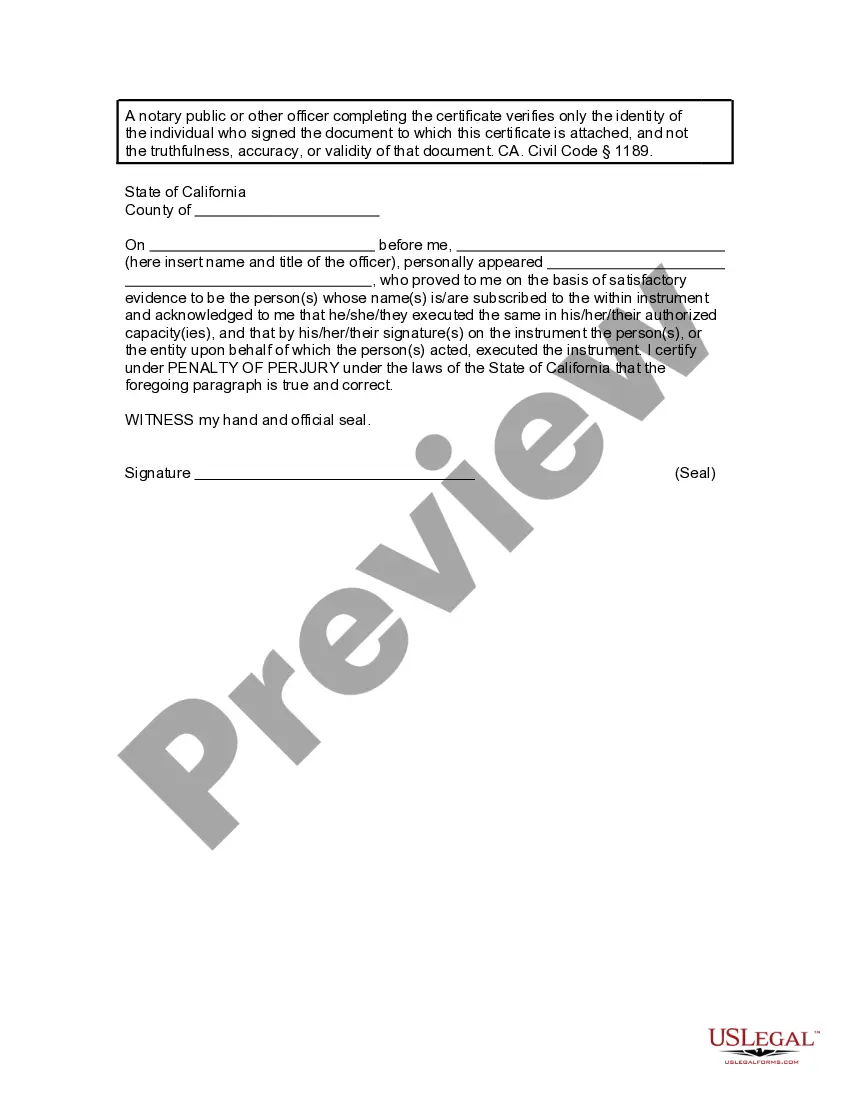

- Ensure you have discovered the correct form by using the Preview feature and looking at the form description.

- Choose Buy Now once all set, and choose the subscription plan that is right for you.

- Press Download then complete, eSign, and print out the form.

US Legal Forms has 25 years of expertise supporting consumers deal with their legal documents. Find the form you need today and improve any process without having to break a sweat.

Form popularity

FAQ

Given that California taxes net capital gains at the same rates as ordinary income-with a maximum rate of 12.3 percent (or 13.3 percent with respect to taxable income in excess of $1,000,000)-an otherwise out-of-state trust may have significant California income tax liabilities.

The trustee may have to file a return if the trust meets any of these: The trustee or beneficiary (non-contingent) is a California resident. The trust has income from a California source. Income is distributed to a California resident beneficiary.

Decedent's Estate. The fiduciary (or one of the fiduciaries) must file Form 541 for a decedent's estate if any of the following apply: Gross income for the taxable year of more than $10,000 (regardless of the amount of net income) Net income for the taxable year of more than $1,000.

During escrow, the remitter would be the REEP as they are the one submitting the payment and Form 593. The remitter is the person who will remit the tax withheld on any disposition from the sale or exchange of CA real estate and file the prescribed forms on the buyer's/transferee's behalf.

Any remitter (individual, business entity, trust, estate, or REEP) who withheld on the sale/transfer of California real property must file Form 593 to report the amount withheld. If this is an installment sale payment after escrow closed, the buyer/transferee is the responsible person.