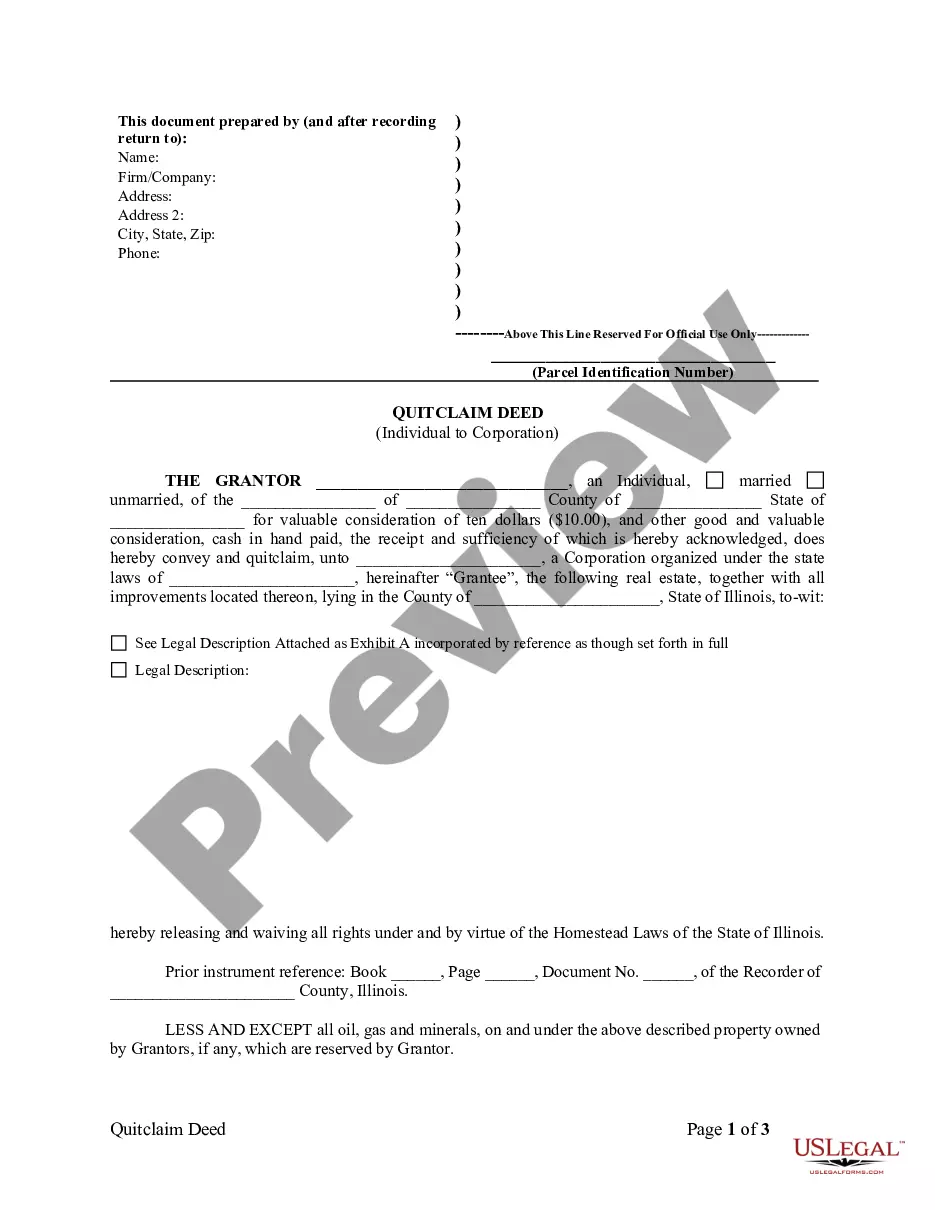

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Notice Trust Sample For Religious Purpose

Description

Form popularity

FAQ

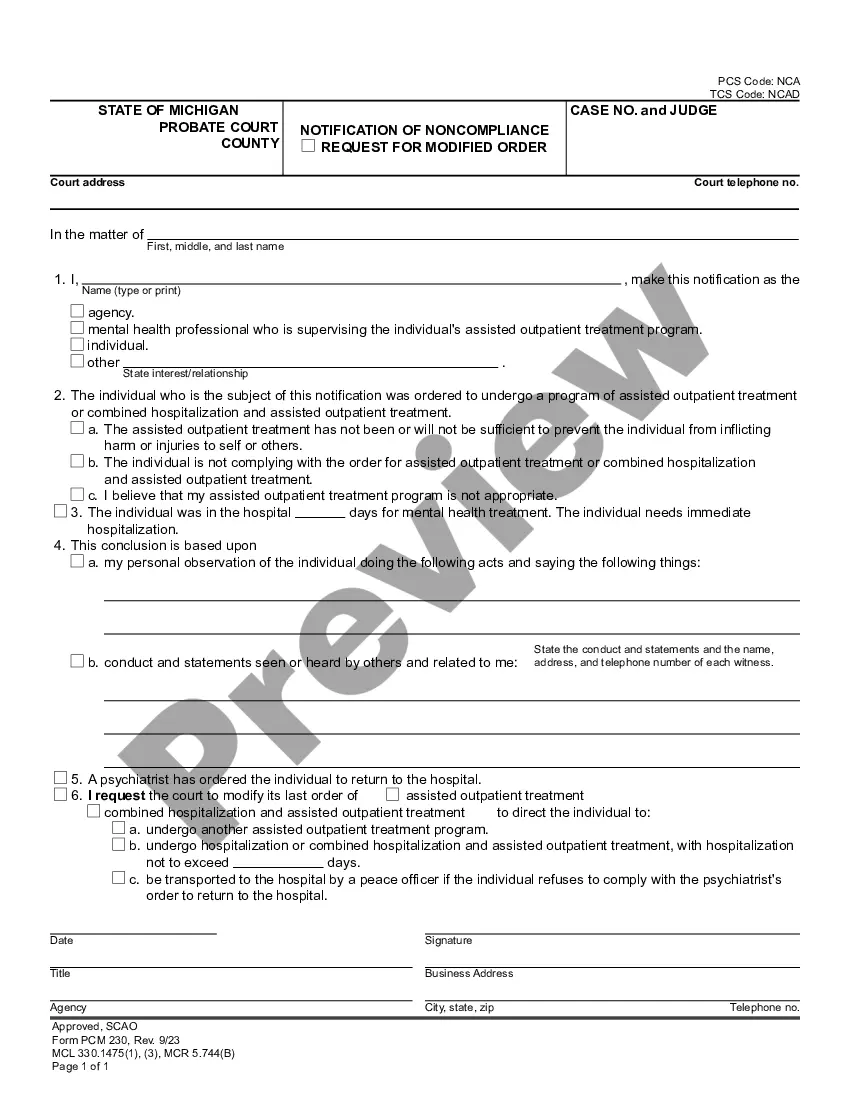

A charitable purpose trust is an arrangement that holds assets for charitable purposes, such as education, religion, or relief of poverty. This type of trust supports causes that benefit the public and can provide tax advantages for donors. When setting up such a trust, it may be helpful to reference a notice trust sample for religious purpose to ensure proper structuring. Utilizing platforms like USLegalForms can streamline the process by providing necessary documentation.

The IRS form used for a charitable trust is Form 1023. This form allows individuals or organizations to apply for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. By obtaining this status, your charitable trust can contribute to religious purposes more effectively. For a comprehensive understanding, you might consider reviewing a notice trust sample for religious purpose to ensure compliance.

Some assets, like retirement accounts and life insurance policies, should typically not be placed in a revocable trust due to tax implications and beneficiary designations. If you are exploring a notice trust sample for religious purpose, make sure to keep these assets outside of the trust but ensure that other relevant assets are appropriately included to fulfill your goals.

To write up a revocable trust, begin with a declaration of trust that states your intentions. Include important details such as the trustee, beneficiaries, and specific terms for asset distribution. When drafting a notice trust sample for religious purpose, highlight the mission and goals of the trust, ensuring your charitable intentions are crystal clear.

Filling out a revocable living trust involves providing detailed information about your assets and intended beneficiaries. Start by listing all your properties, accounts, and investments, then clearly outline how they should be distributed. If you include a notice trust sample for religious purpose, ensure you explain how those funds will be allocated for your charitable intent.

A revocable trust offers flexibility, but it does have downsides, especially regarding asset protection. Unlike irrevocable trusts, revocable trusts do not shield assets from creditors or lawsuits. When creating a notice trust sample for religious purpose, consider whether you need stronger protection for the assets involved.

One common mistake parents make is failing to clearly define the purpose of the trust and how the funds should be used. If you're considering a notice trust sample for religious purpose, it's vital to specify how the funds will support your chosen activities or initiatives. This clarity prevents confusion and ensures that the trust serves its intended purpose.

A trust property can include a variety of assets such as real estate, bank accounts, investments, and personal belongings. For instance, if you create a notice trust sample for religious purpose, you might designate a property or financial account specifically for charitable activities related to your religious organization. This helps ensure that the assets are managed according to your intentions.

A basic example of a trust is when a parent places their home in a trust for their children. This arrangement helps manage the property and ensures it remains in the family. If you're considering similar arrangements, a Notice trust sample for religious purpose can provide clarity and guidance, ensuring your trust serves its intended purpose effectively.

A charity trust is specifically created to fund charitable activities. This type of trust requires that the assets be used exclusively for charitable purposes, such as supporting non-profit organizations or religious institutions. A well-drafted Notice trust sample for religious purpose can help ensure that your charity trust operates within legal guidelines and fulfills your charitable intentions.