Assignment Trust Form For Life Insurance

Description

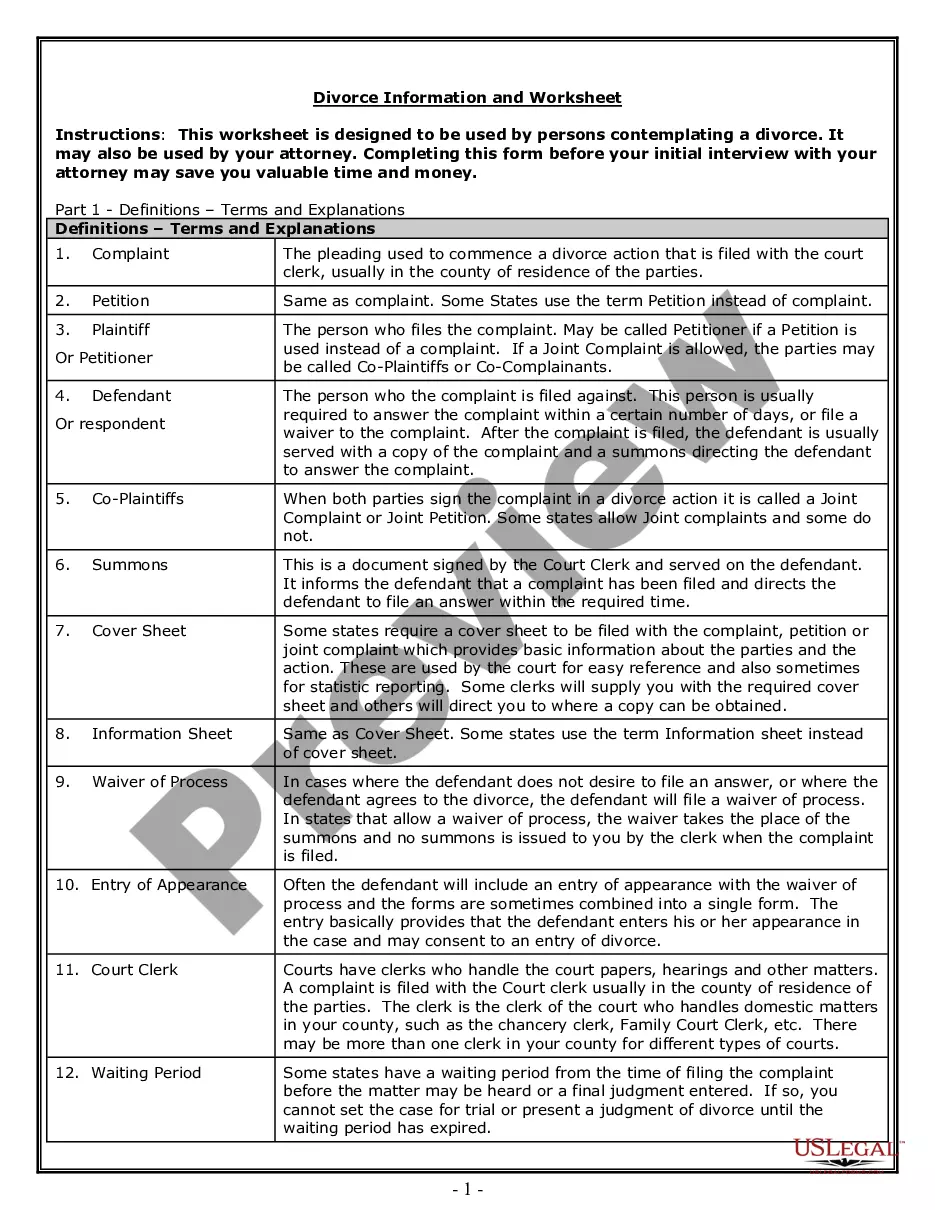

How to fill out California Assignment To Living Trust?

Whether for business purposes or for personal matters, everybody has to deal with legal situations at some point in their life. Filling out legal documents requires careful attention, beginning from picking the proper form sample. For example, if you choose a wrong edition of the Assignment Trust Form For Life Insurance, it will be declined once you send it. It is therefore crucial to have a reliable source of legal documents like US Legal Forms.

If you need to get a Assignment Trust Form For Life Insurance sample, follow these easy steps:

- Get the sample you need by utilizing the search field or catalog navigation.

- Examine the form’s description to ensure it fits your case, state, and county.

- Click on the form’s preview to view it.

- If it is the incorrect document, go back to the search function to locate the Assignment Trust Form For Life Insurance sample you require.

- Get the file when it meets your requirements.

- If you have a US Legal Forms profile, click Log in to access previously saved templates in My Forms.

- In the event you do not have an account yet, you may download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Pick your transaction method: use a bank card or PayPal account.

- Choose the document format you want and download the Assignment Trust Form For Life Insurance.

- After it is downloaded, you are able to complete the form with the help of editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you do not have to spend time seeking for the appropriate sample across the web. Take advantage of the library’s straightforward navigation to get the appropriate form for any situation.

Form popularity

FAQ

Name only living persons as beneficiaries, unless you are naming a trust, your estate or an organization. Do not name the same person or organization as both a primary and secondary beneficiary. Do not use the word ?or? when designating multiple beneficiaries. Do not impose any conditions on payment.

Name only living persons as beneficiaries, unless you are naming a trust, your estate or an organization. Do not name the same person or organization as both a primary and secondary beneficiary. Do not use the word ?or? when designating multiple beneficiaries. Do not impose any conditions on payment.

To put your life insurance into a trust, you'll need to create a trust deed; a legally binding document which outlines the parties that make up the trust, the trust terms, and the trust beneficiaries.

Most people do not need to place their life insurance in a trust. This is because life insurance trusts can be expensive to form and can create significant tax and legal ramifications. They can also add unnecessary complexities to estates.

Follow these four steps to set up a life insurance trust ing to your wishes. Work with an estate attorney. ... Choose a trustee. ... Select a life insurance trust beneficiary. ... Provide your financial professionals with copies of the trust.