California Assignment to Living Trust

What is this form?

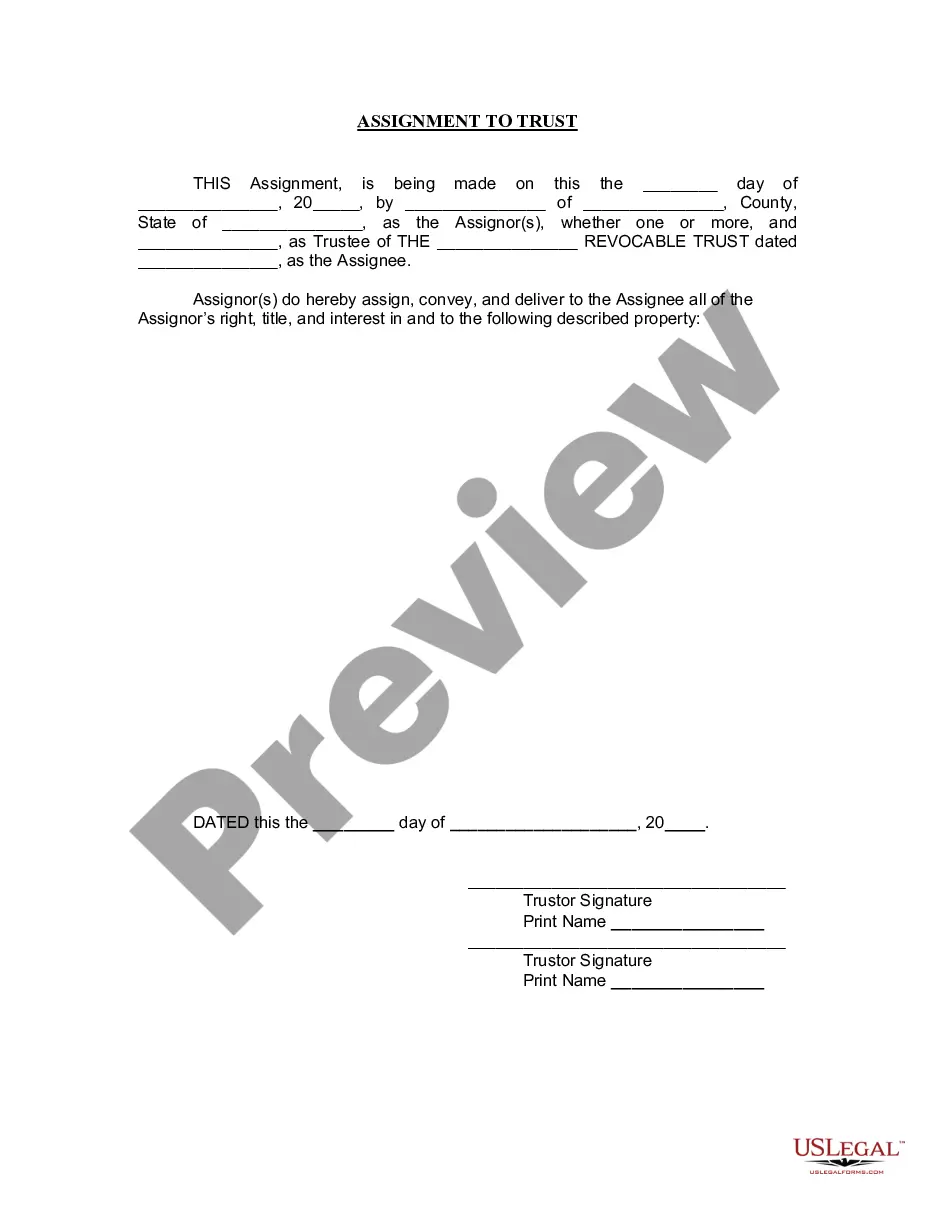

The Assignment to Living Trust form is a legal document used to assign all rights, title, and interest in specific property to a living trust. A living trust is established during a person's lifetime and is often utilized for effective estate planning. This form ensures that property is officially transferred to the trust, distinguishing it from other estate planning documents that may not involve property transfers. It is crucial that the Assignor signs this form before a notary public to validate the assignment.

Main sections of this form

- Assignor's name and address

- Trustee's name and title of the trust

- Description of the specific property being assigned

- Date of execution

- Signature of the Assignor

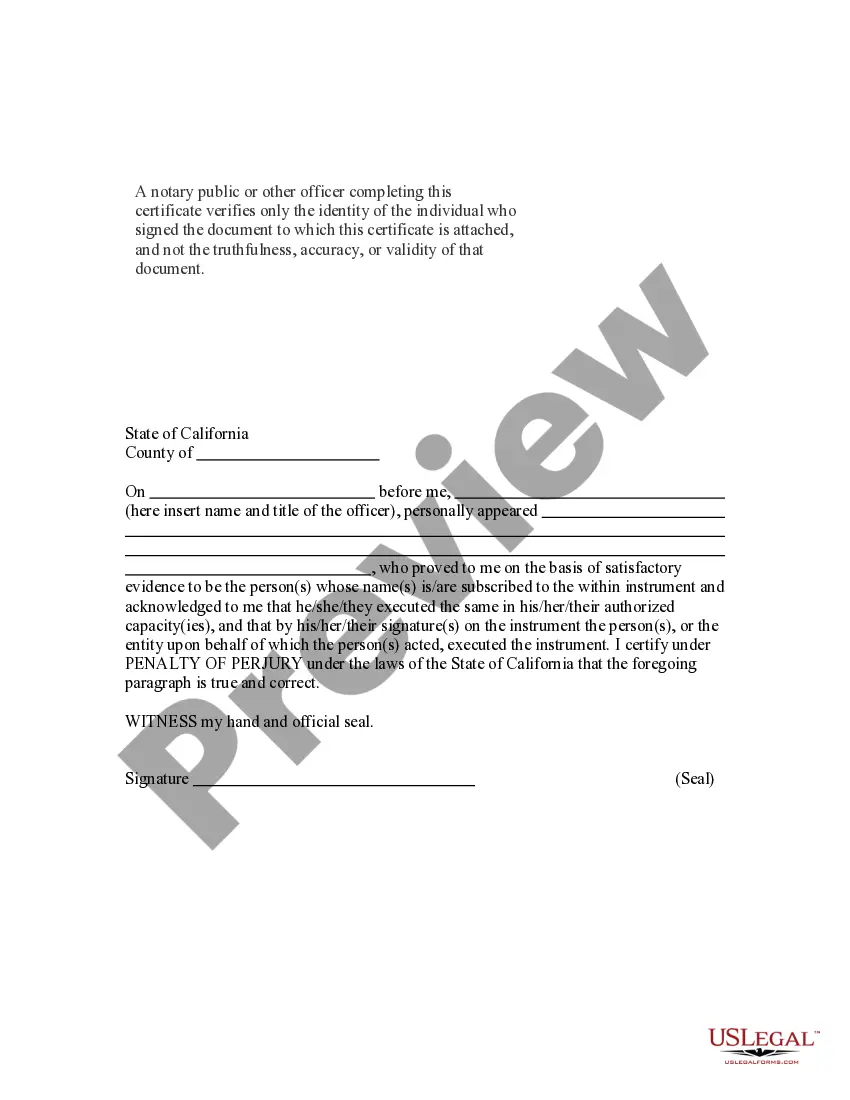

- Notary acknowledgment section

Common use cases

This form is necessary when an individual wants to transfer property ownership to their living trust. Common scenarios include transferring real estate, bank accounts, or other valuable assets into the trust to ensure they are managed according to the trustor's wishes during their lifetime and after their passing.

Who this form is for

- Individuals establishing a living trust

- Estate planners and attorneys assisting clients with trust arrangements

- Anyone looking to streamline the transfer of property for estate planning purposes

How to complete this form

- Identify the parties involved: the Assignor and the Trustee.

- Specify the property being assigned to the living trust.

- Enter the date of the assignment.

- Have the Assignor sign the form in the presence of a notary public.

- Complete the notary acknowledgment section to validate the assignment.

Is notarization required?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include a complete description of the property.

- Not having the form signed by the Assignor in front of a notary.

- Leaving sections of the form blank, especially key identifiers.

Benefits of using this form online

- Instant access to professionally drafted legal templates.

- Convenient download options for immediate use.

- Editable fields allow customization to fit individual circumstances.

Looking for another form?

Form popularity

FAQ

You can indeed write your own living trust in California. It is important that your document complies with state laws and includes all necessary provisions. To ensure the legality and effectiveness of your California Assignment to Living Trust, consider utilizing tools provided by US Legal Forms for guidance.

Transferring property to a living trust in California involves executing a deed that changes the title from your name to the trust's name. You must also file this deed with your county’s recorder’s office. For help with these steps, US Legal Forms offers templates that assist with your California Assignment to Living Trust.

One of the biggest mistakes parents make is failing to fund the trust properly. This means not transferring assets to the trust, which can render it ineffective. To avoid this, consider using a service like US Legal Forms to navigate the complexities of a California Assignment to Living Trust and ensure all assets are correctly assigned.

A handwritten living trust, known as a holographic trust, can be legal in California if it meets specific criteria. The trust must be in your handwriting, signed by you, and must clearly express your intentions. To avoid issues, consider using US Legal Forms for a properly drafted California Assignment to Living Trust.

Yes, you can create your own living trust in California. However, it requires careful consideration of legal requirements and state laws. Using a resource like US Legal Forms can guide you through the process to ensure your California Assignment to Living Trust meets all necessary standards.

In California, a living trust does not need to be filed with the court; however, certain actions may require filing documents, especially upon your passing. You maintain the privacy of your assets by keeping your trust out of public records. The California Assignment to Living Trust allows you to manage your property without the complexities of probate. To navigate these steps effectively, consider using US Legal Forms, which offers resources to help you with your trust administration.

To amend an existing living trust in California, you first need to create a written document that outlines the specific changes you wish to make. This amendment must be signed by you, and if your trust is irrevocable, you may need the consent of all beneficiaries. It is essential to properly date the amendment and refer to the original trust document to avoid any confusion. Utilizing a service like US Legal Forms can help streamline this process, ensuring that your amendment complies with legal standards regarding California Assignment to Living Trust.

Putting your house in a trust in California can have disadvantages. For instance, transferring a property can trigger reassessment for property taxes if not handled correctly. Additionally, while a California Assignment to Living Trust can simplify estate planning, it may also limit your flexibility if you need to sell the house later. It's vital to consider all implications before making this decision, and platforms like USLegalForms can guide you through the process.

Suze Orman emphasizes the importance of setting up a living trust for effective estate planning. She believes that a California Assignment to Living Trust helps individuals avoid probate, ensuring that their assets are transferred smoothly and privately upon death. This can significantly reduce stress for loved ones during difficult times. Additionally, establishing a living trust can offer more control over how your assets are distributed, enhancing peace of mind.

One downside of a living trust in California is the potential for ongoing maintenance and updates as circumstances change. Additionally, while a living trust helps avoid probate, it does not protect against estate taxes. Understanding California Assignment to Living Trust can navigate these issues effectively and ensure your estate plan is comprehensive.