Trust Account For Business

Description

Form popularity

FAQ

No, you cannot register a business as a trust in the traditional sense. A trust functions as a legal arrangement to manage assets, while a business is registered as an LLC, corporation, or other structure. However, you can structure your business ownership through a trust. This way, you can utilize a trust account for business to achieve your financial and estate planning goals.

Yes, putting your business in a trust can be a wise decision. It protects assets from creditors and simplifies the inheritance process. Moreover, a trust can create clear instructions for managing the business after your passing. By setting up a trust account for business, you enhance both asset protection and long-term planning.

You cannot directly turn your LLC into a trust, but you can transfer ownership of the LLC to a trust. This process involves creating the trust and assigning the LLC membership to it. This move provides added protection and facilitates easier management of assets. Consider using uslegalforms to simplify this transition and establish a trust account for business.

Yes, a trust can own 100% of an LLC. This structure allows the trust to have full control over the LLC's operations and assets. It also helps in preserving the business's value for beneficiaries while ensuring that the trust's terms are followed. Using a trust account for business can optimize your financial management and estate planning.

Placing your LLC in a trust provides greater asset protection and can help with estate planning. A trust keeps your business assets separate from personal assets, reducing risk in legal situations. Additionally, it allows for a smoother transition of ownership upon your passing. Ultimately, a trust account for business adds security and simplifies management for future generations.

Considering a trust for your business can be a smart decision, especially for asset protection and tax planning. A trust account for business helps separate personal assets from business ones, minimizing risk during legal disputes. Furthermore, it facilitates smoother transitions during ownership changes, as the structure remains intact. Evaluating this option can lead to more secure and streamlined business operations.

A trust account for business is a specialized account where funds are held for specific purposes, such as payroll or client deposits. This type of account helps maintain transparency and accountability in financial dealings. By using a trust account, you ensure funds are allocated correctly, preventing misuse. It's a crucial component in managing financial obligations responsibly.

Putting your business in a trust can provide many benefits, including asset protection and estate planning. A trust account for business allows you to manage and protect important assets while separating personal and business liabilities. Additionally, it can simplify the transfer of ownership when planning for succession. By exploring this option, you can secure your business's financial future.

Establishing a business trust can be a valuable decision for many entrepreneurs. It offers protection against personal liability and can help manage the business's assets more efficiently. Moreover, it can enhance financial planning and succession strategies. If you are considering this option, review resources on USLegalForms for insights that can support your decision.

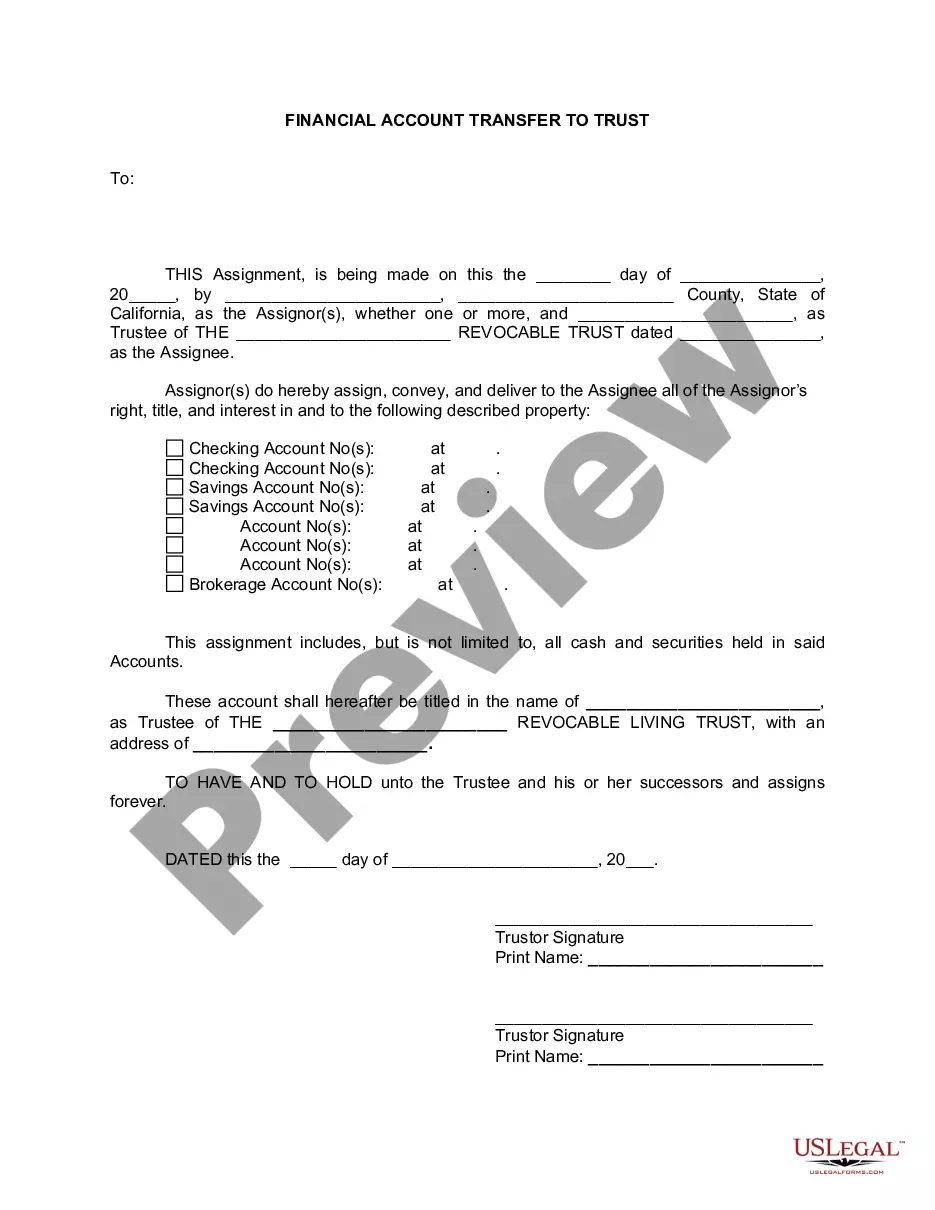

Setting up a trust account for business involves several steps. First, you should define the purpose of the trust and decide on the assets to include. Next, you will need to draft a trust agreement, specifying terms and beneficiaries. Utilizing platforms like USLegalForms can simplify this process, providing templates and guidance to ensure compliance with state laws.