Amendment To Living Trust Form With 2 Owners

Description

How to fill out California Amendment To Living Trust?

Handling legal paperwork can be daunting, even for the most experienced professionals.

If you are in search of an Amendment To Living Trust Form With 2 Owners and lack the time to seek out the correct and up-to-date version, the task may be challenging.

US Legal Forms accommodates any requirements you may have, from personal to business forms, all in one location.

Leverage sophisticated tools to complete and handle your Amendment To Living Trust Form With 2 Owners.

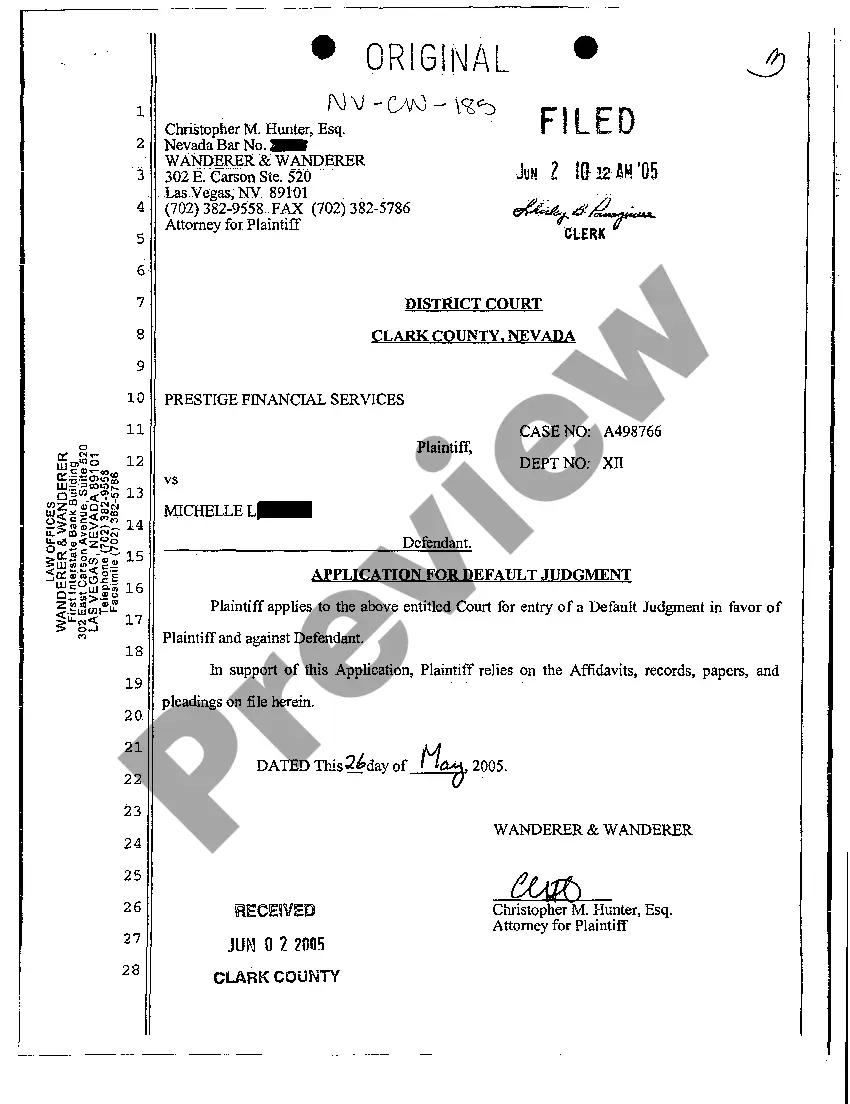

Once you have acquired the form you seek, follow these steps: Confirm that it is the correct form by previewing it and reviewing its description.

- Access a valuable repository of articles, guides, handbooks, and resources related to your situation and requirements.

- Save time and effort searching for the documents you need by utilizing US Legal Forms’ advanced search and Review tool to locate Amendment To Living Trust Form With 2 Owners and obtain it.

- If you possess a monthly subscription, Log In to your US Legal Forms account, search for the form, and retrieve it.

- Check the My documents tab to view the documents you have previously saved and manage your folders accordingly.

- If this is your first experience with US Legal Forms, register for an account to enjoy unlimited access to all the advantages of the library.

- Utilize a robust web form library that can significantly alter the experience for those aiming to manage these challenges efficiently.

- US Legal Forms stands as a leader in the realm of online legal forms, providing over 85,000 state-specific legal documents available at your convenience.

- Take advantage of state- or county-specific legal and business templates.

Form popularity

FAQ

A Trust amendment is a legal document changing one or more aspects of a revocable living Trust -- without revoking the entire structure. The goal of a living trust amendment is to help you make changes to beneficiaries, trustees, provisions, or modify any conditions to the Trust.

If there is no amendment clause in the Trust Deed, any amendment has to be done with the permission of a Civil Court. Once the Civil Court has allowed permission for amendment, it is not open on the part of the Income Tax Officer or any other person to challenge such amendment.

A trust amendment that can be used to modify an existing California revocable trust instrument. This trust amendment allows a client to modify a revocable trust instrument without creating an entirely new trust instrument or restating an existing revocable trust instrument in its entirety.

The trust deed lists the trustees. Therefore, to change an individual trustee, you need to amend the trust deed. Most trust deeds permit a change of trustee by way of a trustee resolution and entry into a deed of variation. A trustee resolution is a signed statement of the actions taken by the trustee.

Revising the terms of a trust is known as ?amending? the trust. An amendment is generally appropriate when there are only a few minor changes to make, like rewording a certain paragraph, changing the successor trustee, or modifying beneficiaries.