Amendment Form For Living Trust With Pour-over Will

Description

How to fill out California Amendment To Living Trust?

Regardless of whether for corporate reasons or personal matters, everyone must confront legal issues at some point in their life.

Completing legal documents demands meticulous care, starting from choosing the appropriate form template.

With a comprehensive US Legal Forms catalog at your disposal, you no longer need to waste time searching for the correct template online. Utilize the library’s user-friendly navigation to locate the suitable template for any circumstance.

- For instance, selecting an incorrect version of the Amendment Form For Living Trust With Pour-over Will will result in its rejection upon submission.

- Thus, it is vital to obtain a reliable source of legal documents like US Legal Forms.

- To procure a sample of the Amendment Form For Living Trust With Pour-over Will, follow these straightforward steps.

- Search for the required sample via the search bar or catalog navigation.

- Examine the form’s description to ensure it aligns with your circumstances, state, and locality.

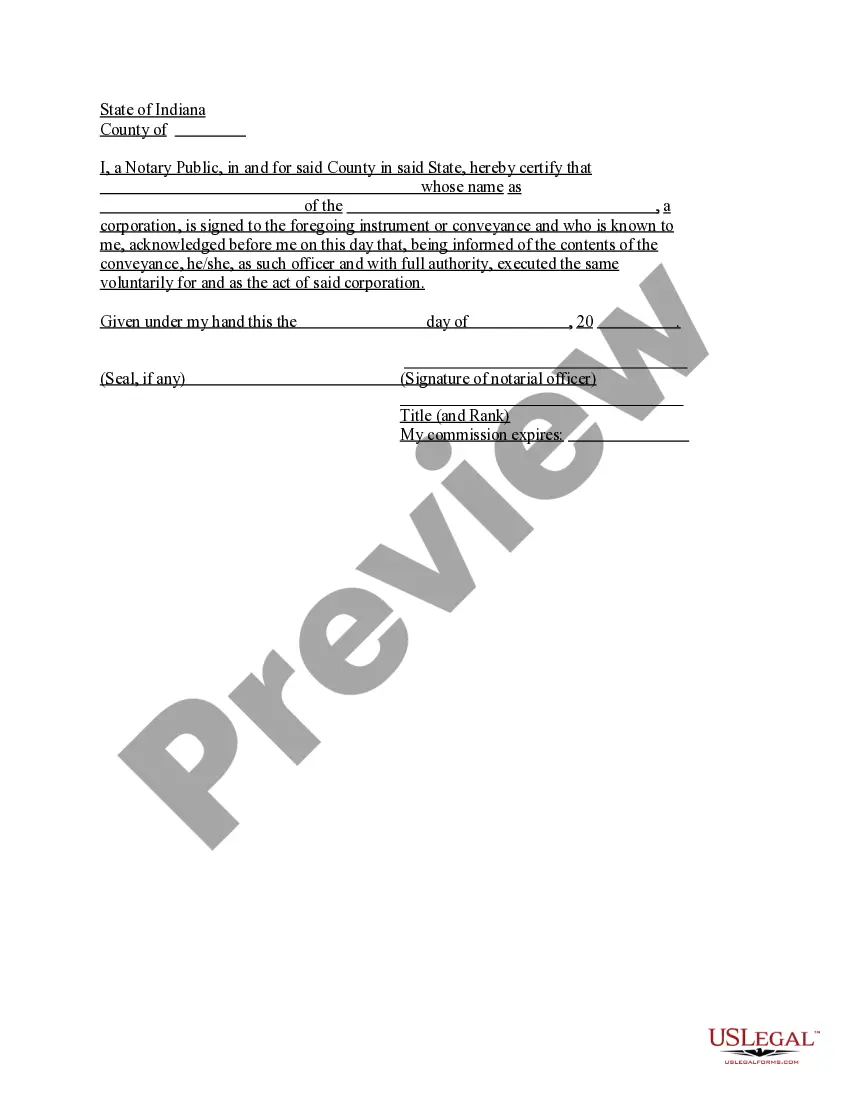

- Click on the form’s preview to review it.

- If it is the wrong document, return to the search function to find the Amendment Form For Living Trust With Pour-over Will sample you need.

- Acquire the template if it satisfies your requirements.

- If you already possess a US Legal Forms account, simply click Log in to access documents previously saved in My documents.

- If you do not yet have an account, you can obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: you can use a credit card or a PayPal account.

- Select the document format you prefer and download the Amendment Form For Living Trust With Pour-over Will.

- Once it is saved, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

If there is no amendment clause in the Trust Deed, any amendment has to be done with the permission of a Civil Court. Once the Civil Court has allowed permission for amendment, it is not open on the part of the Income Tax Officer or any other person to challenge such amendment.

The general rule is both grantors must die for a revocable trust to become irrevocable. However, there are legal ways to change the general rule for co-grantors. This means the parties that established the revocable trust have the legal power to set the rules for the trust.

A trust amendment that can be used to modify an existing California revocable trust instrument. This trust amendment allows a client to modify a revocable trust instrument without creating an entirely new trust instrument or restating an existing revocable trust instrument in its entirety.

It's important to know what you want to change and where in your trust document this information lives (such as the article number you're amending). Fill out the amendment form. Complete the entire form. It's important to be clear and detailed in describing your changes.

Attorney Assistance: Should you choose to seek the help of an attorney to amend an existing living trust, the fees typically range from $300 to $600. The exact cost may vary based on your location and the complexity of both the original trust and the amendment.