Amendment Form For Living Trust With Irs

Description

How to fill out California Amendment To Living Trust?

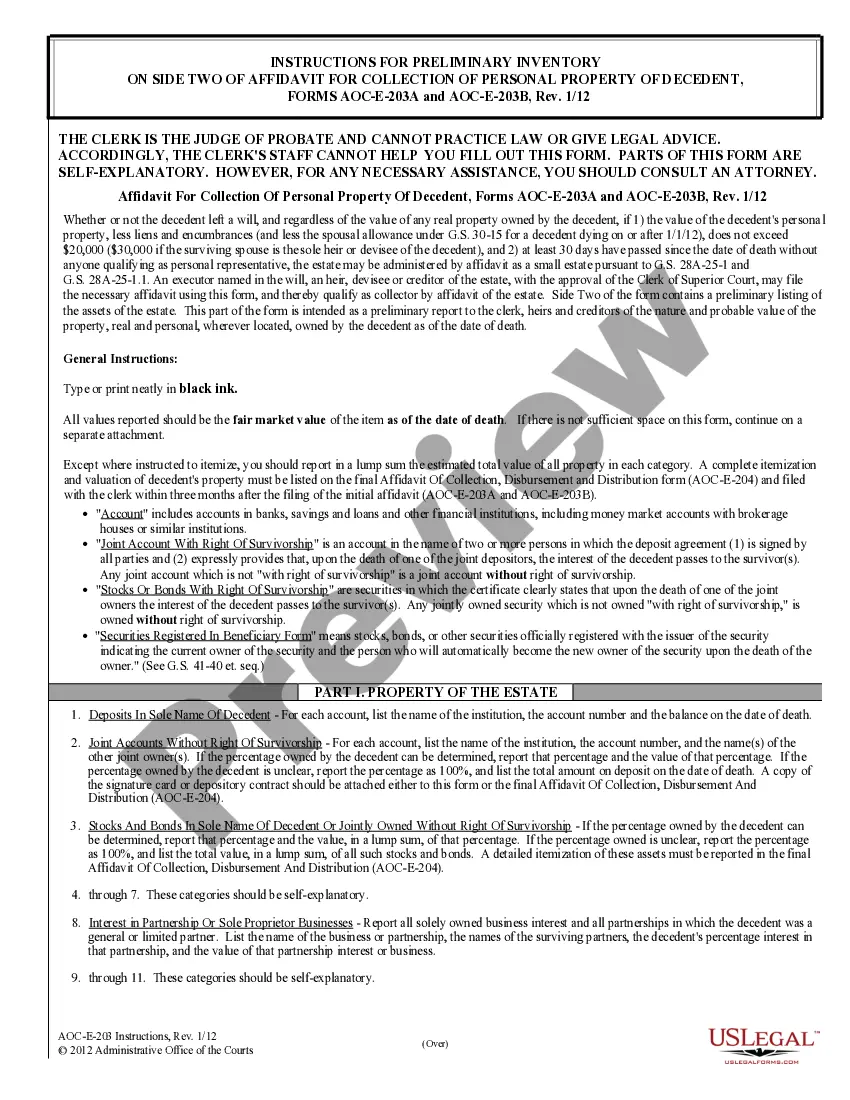

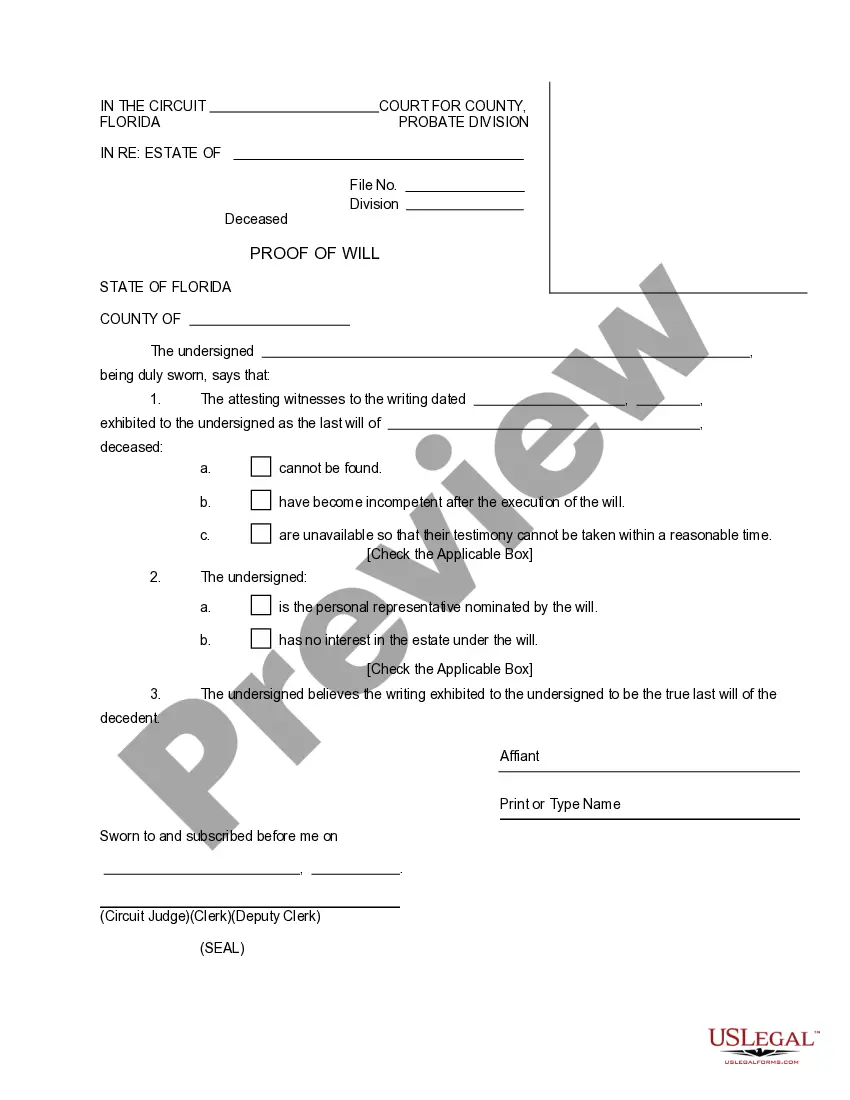

The Revision Form For Living Trust With Irs you see on this page is a reusable formal template crafted by expert attorneys in accordance with federal and state laws and regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal professionals with more than 85,000 validated, state-specific documents for any business and personal situation. It’s the fastest, easiest, and most trustworthy way to acquire the paperwork you require, as the service ensures bank-level data protection and anti-malware safeguards.

Select the format you prefer for your Revision Form For Living Trust With Irs (PDF, DOCX, RTF) and download the document to your device.

- Search for the document you require and verify it.

- Browse through the sample you looked for and preview it or examine the form description to ensure it meets your needs. If it doesn’t, utilize the search feature to find the correct one. Click Buy Now once you have found the template you require.

- Choose and Log In.

- Select the pricing plan that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and verify your subscription to continue.

- Obtain the editable template.

Form popularity

FAQ

In general, the due date for the first income tax return is the 15th day of the 4th month after the close of the first tax year of the related estate.

How to file an amended tax return Download Form 1040-X from the IRS website. Gather the necessary documents. ... Complete Form 1040-X: Add your personal information, details of what's changed, and your explanation for the changes. ... Submit your completed amended return: You can send it by mail or e-file.

Does Form 8855 e-file with the 1041? Making a 645 election on a 1041 does not prevent it from being e-filed, but printing, signatures, and paper-filing are required for Form 8855 (Election To Treat a Qualified Revocable Trust as Part of an Estate).

Use Form 1040X, Amended U.S. Individual Income Tax Return, to file an amended tax return. Be advised ? you can't e-file an amended return. A paper form must be mailed. File an amended tax return if there is a change in your filing status, income, deductions or credits.

Form 56 must also be filed whenever a fiduciary relationship changes. Filing IRS Form 56 notifies federal agencies and creditors to send mail regarding the estate to the fiduciary. The main purpose of this form is to establish the trustee or fiduciary as responsible for the accounts of an estate.