California Living Trust Forms Withdrawal

Description

How to fill out California Living Trust For Individual, Who Is Single, Divorced Or Widow (or Widower) With Children?

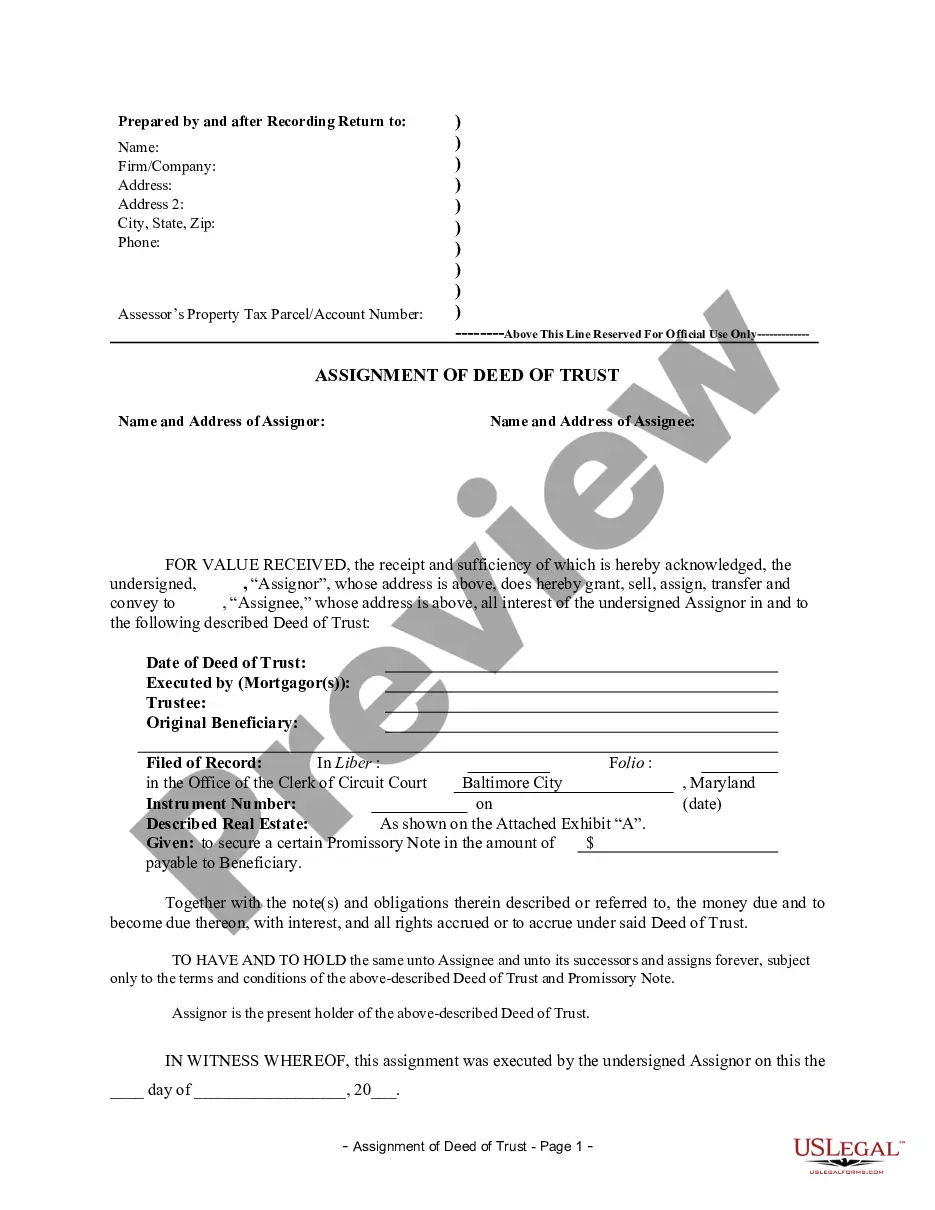

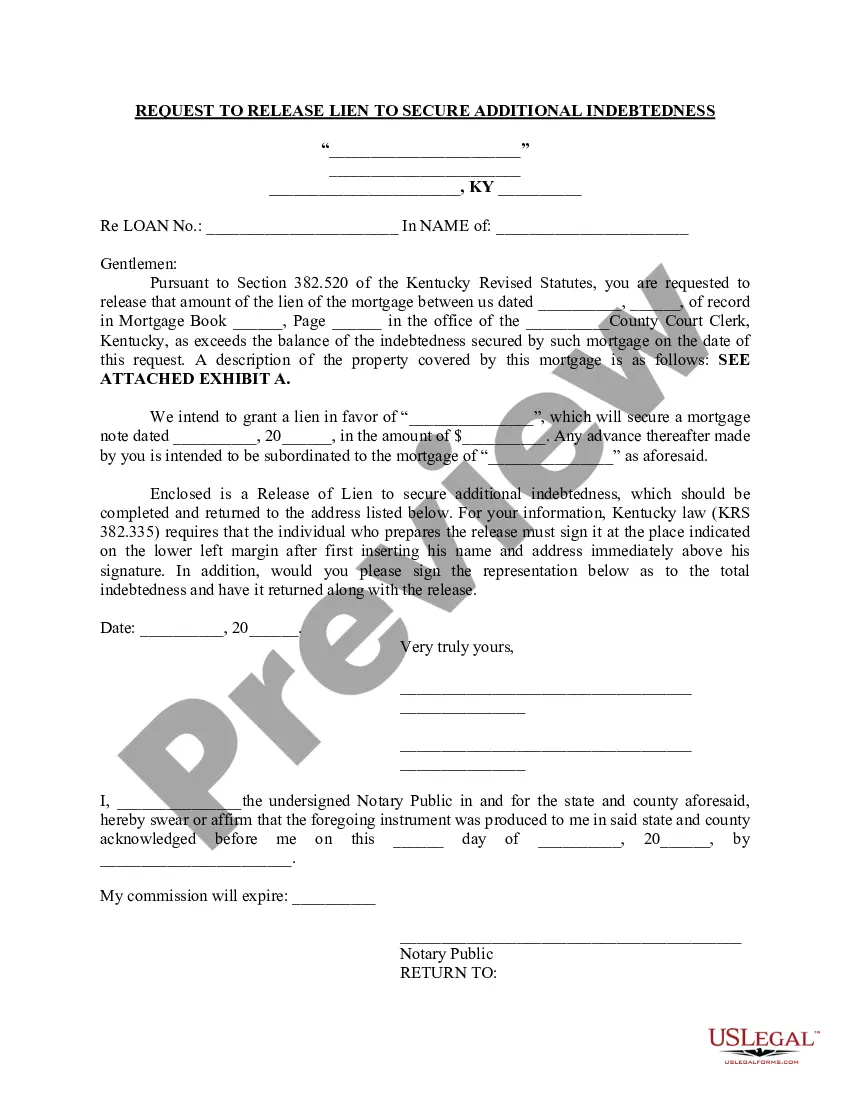

The California Living Trust Forms Withdrawal displayed on this page is a versatile legal template crafted by experienced attorneys in compliance with federal and regional regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 verified, state-specific documents for any commercial and personal scenario. It’s the fastest, simplest, and most reliable method to acquire the paperwork you require, as the service promises the utmost level of data security and anti-malware safeguards.

Complete and sign the document. Print out the template to fill it in manually. Alternatively, use an online multi-functional PDF editor to quickly and accurately complete and sign your form with a legally-binding electronic signature. Download your documents again if needed. Reaccess the same document anytime required. Open the My documents tab in your profile to redownload any previously acquired forms. Subscribe to US Legal Forms to have verified legal templates for all occasions at your fingertips.

- Search for the document you require and evaluate it.

- Browse the template you searched for and preview it or read the form description to confirm it meets your requirements. If it doesn’t, utilize the search function to find the suitable one. Hit Buy Now once you’ve located the template you need.

- Sign up and Log In.

- Choose the pricing plan that best fits your needs and create an account. Use PayPal or a credit card for a quick payment. If you have an existing account, Log In and check your subscription to continue.

- Acquire the fillable template.

- Choose the format you desire for your California Living Trust Forms Withdrawal (PDF, DOCX, RTF) and download the template to your device.

Form popularity

FAQ

The first step to revoking a living trust is to remove the assets from the trust. This involves retitling the assets back into your name. Next, you will need to fill out a formal revocation form stating your desire to terminate the trust. The revocation form will then need to be signed and notarized.

Just choose your preferred account on the ATM screen. If you use the credit card function on your Trust card at an ATM, this means you are taking a cash advance. Note that supplementary cardholders cannot take out a cash advance. If you use the debit card function, you are withdrawing cash from your savings account.

So can a trustee withdraw money from a trust they own? Yes, you could withdraw money from your own trust if you're the trustee. Since you have an interest in the trust and its assets, you could withdraw money as you see fit or as needed. You can also move assets in or out of the trust.

Here are the steps to setting up a Living Trust in California: Take an inventory of your assets. Select your trustee. Designate your Beneficiaries. Write up your Declaration of Trust. Sign your Trust in front of a Notary Public (optional). Transfer assets and property to the Trust.

How to Fill Out Revocable Living Trust Form Online | PDFRun - YouTube YouTube Start of suggested clip End of suggested clip Click on the fill. Online. Button this will redirect you to pdf runs online editor first enter theMoreClick on the fill. Online. Button this will redirect you to pdf runs online editor first enter the title of your revocable living trust then enter the current date. Next enter both the grantors.