Property Settlement Agreement California Withholding Notification

Description

How to fill out California Marital Legal Separation And Property Settlement Agreement Where No Children And Parties May Have Joint Property And / Or Debts And Divorce Action Filed?

You no longer have to waste time looking for legal documents to comply with your local state laws. US Legal Forms has gathered all of them in one location and made them easily accessible.

Our site provides over 85k templates for any individual and business legal needs, organized by state and area of application. All forms are correctly drafted and validated for authenticity, ensuring you receive an updated Property Settlement Agreement California Withholding Notification.

If you are familiar with our platform and possess an account, please ensure your subscription is active before retrieving any templates. Log In to your account, choose the document, and click Download. You can also access all previously acquired documents anytime by visiting the My documents section in your profile.

You can print your form to fill it out manually or upload the template if you prefer using an online editor. Creating official documentation under federal and state regulations is fast and straightforward with our platform. Experience US Legal Forms now to maintain your documents in order!

- If you're new to our platform, the procedure will require a few more steps.

- Here’s how new users can find the Property Settlement Agreement California Withholding Notification in our collection.

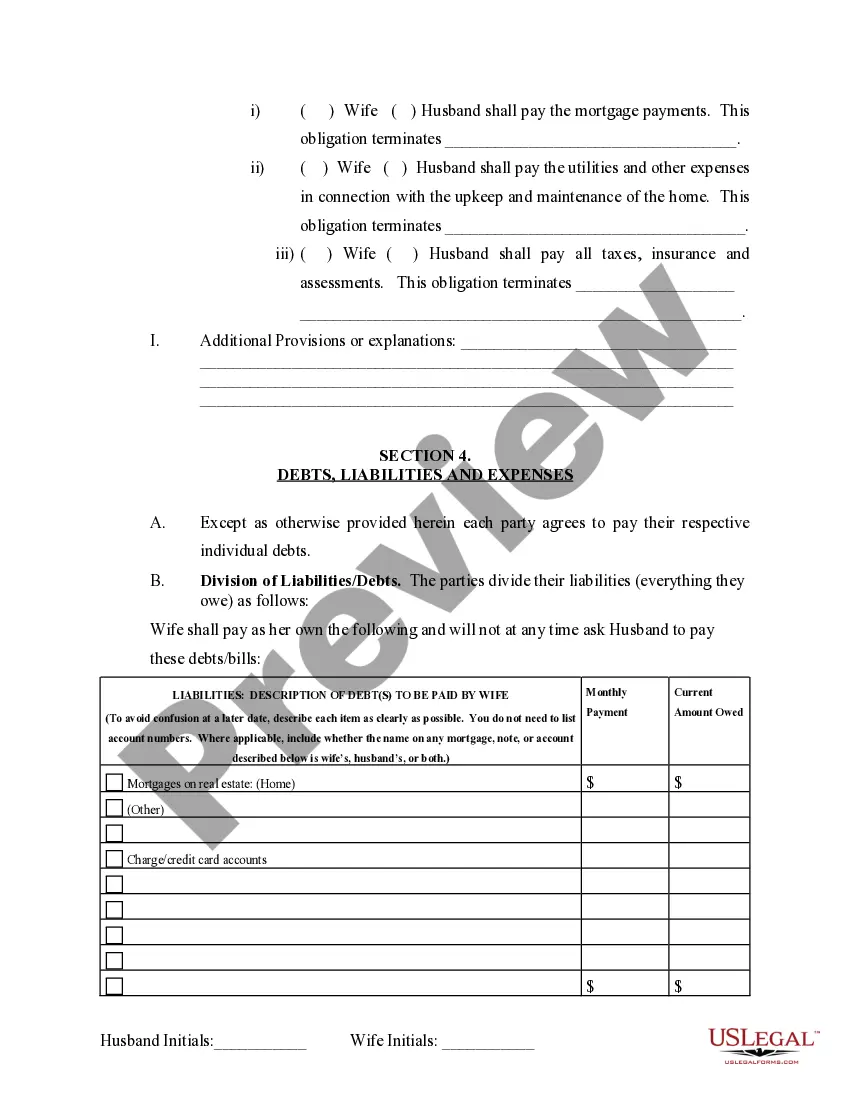

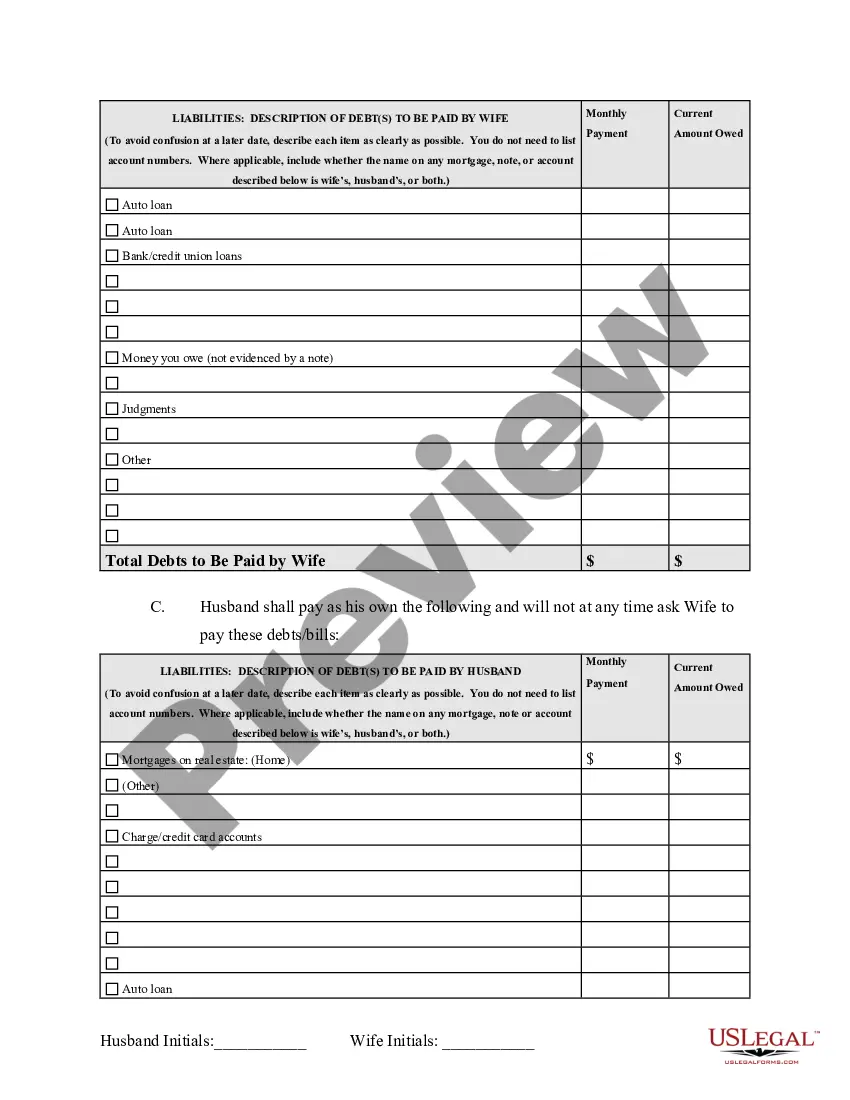

- Carefully review the page content to verify it includes the sample you seek.

- To assist, utilize the form description and preview options if available.

- Employ the Search bar above to look for another template if the previous one doesn't meet your needs.

- Click Buy Now next to the template title once you locate the suitable one.

- Select the most appropriate subscription plan and either register for an account or Log In.

- Complete your subscription payment with a credit card or through PayPal to proceed.

- Choose the file format for your Property Settlement Agreement California Withholding Notification and download it to your device.

Form popularity

FAQ

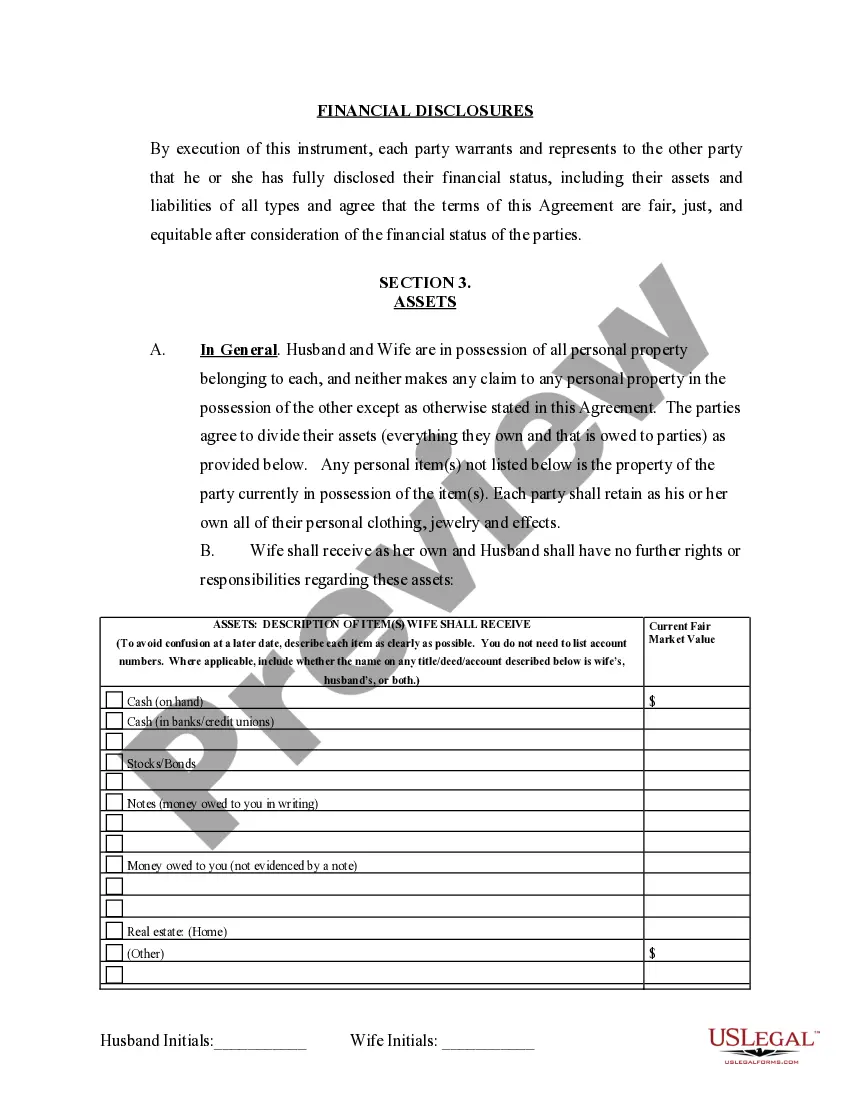

A. Purpose. Use Form 593: Certify the seller/transferor qualifies for a full, partial, or no withholding exemption. Estimate the amount of the seller's/transferor's loss or zero gain for withholding purposes and to calculate an alternative withholding calculation amount.

A seller/transferor that qualifies for a full, partial, or no withholding exemption must file Form 593. Any remitter (individual, business entity, trust, estate, or REEP) who withheld on the sale/transfer of California real property must file Form 593 to report the amount withheld.

» California Real Estate Withholding is prepayment of estimated income tax due the State of California on gain from the sale of California real property. If the amount withheld is more than the income tax liability, the state will refund the difference when you file a tax return for the taxable year.

How do i enter CA real estate withholding?Select Federal, then Deductions and Credits.Scroll down/ expand the list and find Estimates and Other Taxes Paid.Select Other Income Taxes.Scroll and select Withholding not already entered on W-2 or 1099.Answer the question Yes and Continue.More items...?

If you meet one of these requirements for the tax year, you MUST file a California tax return. If you were: Single / Head of Household, under 65: w/ no dependents, CA gross income $19,310, CA AGI $15,448.