California Homestead Form With Decimals

Description

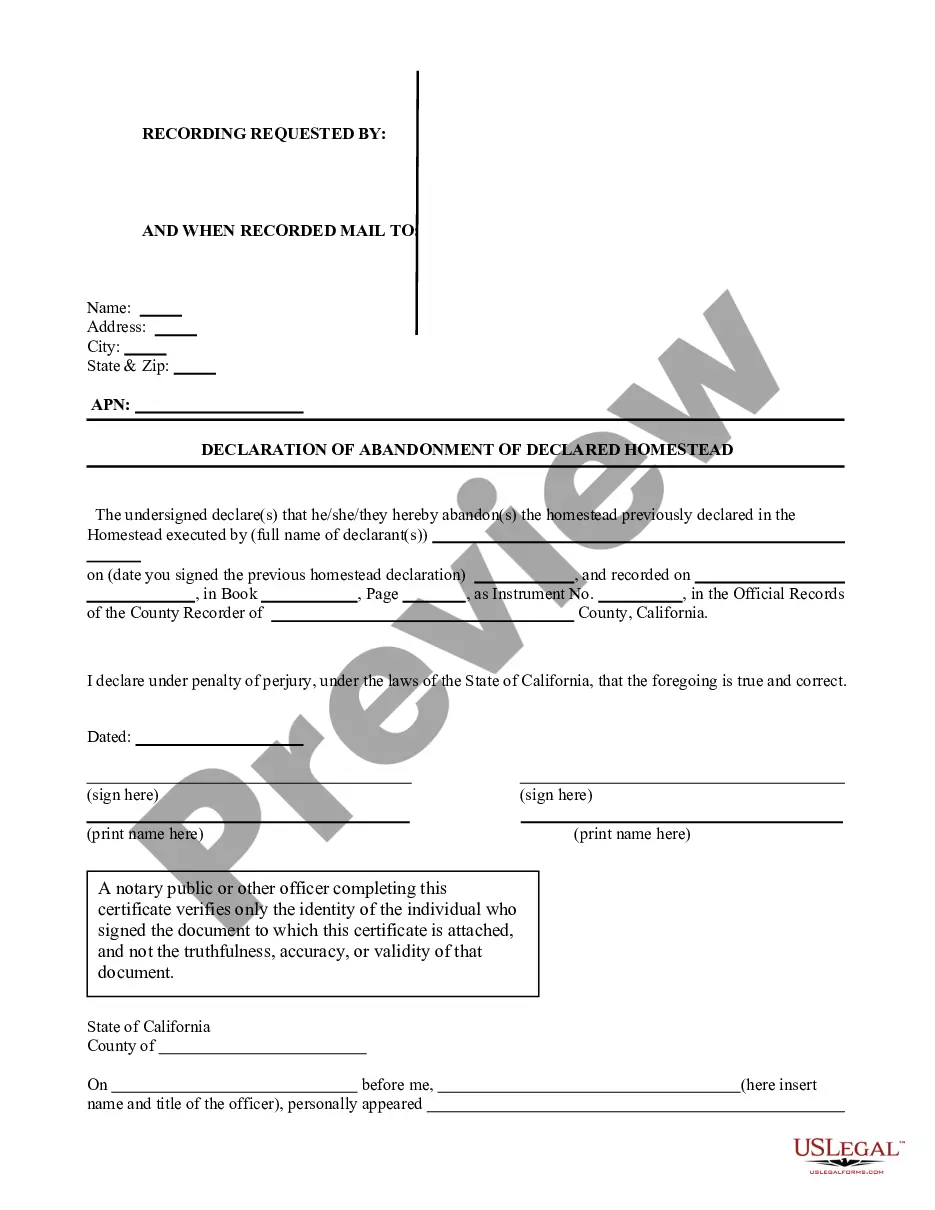

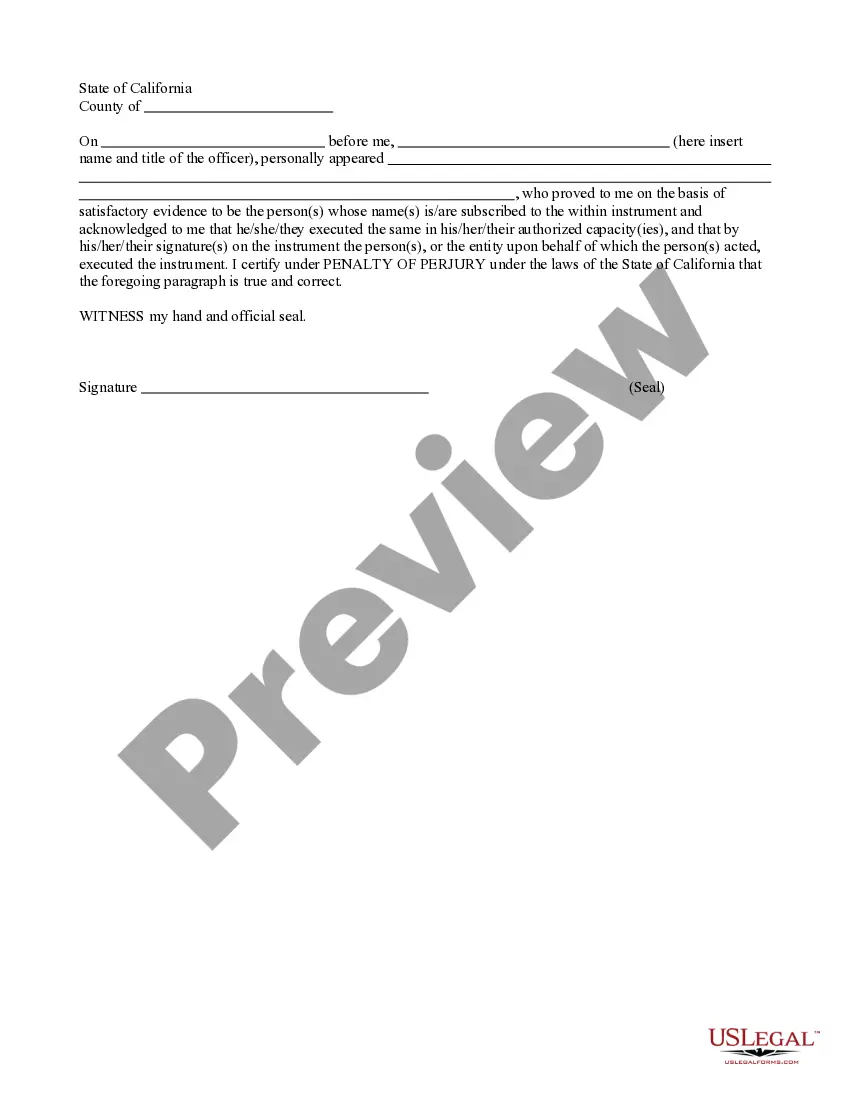

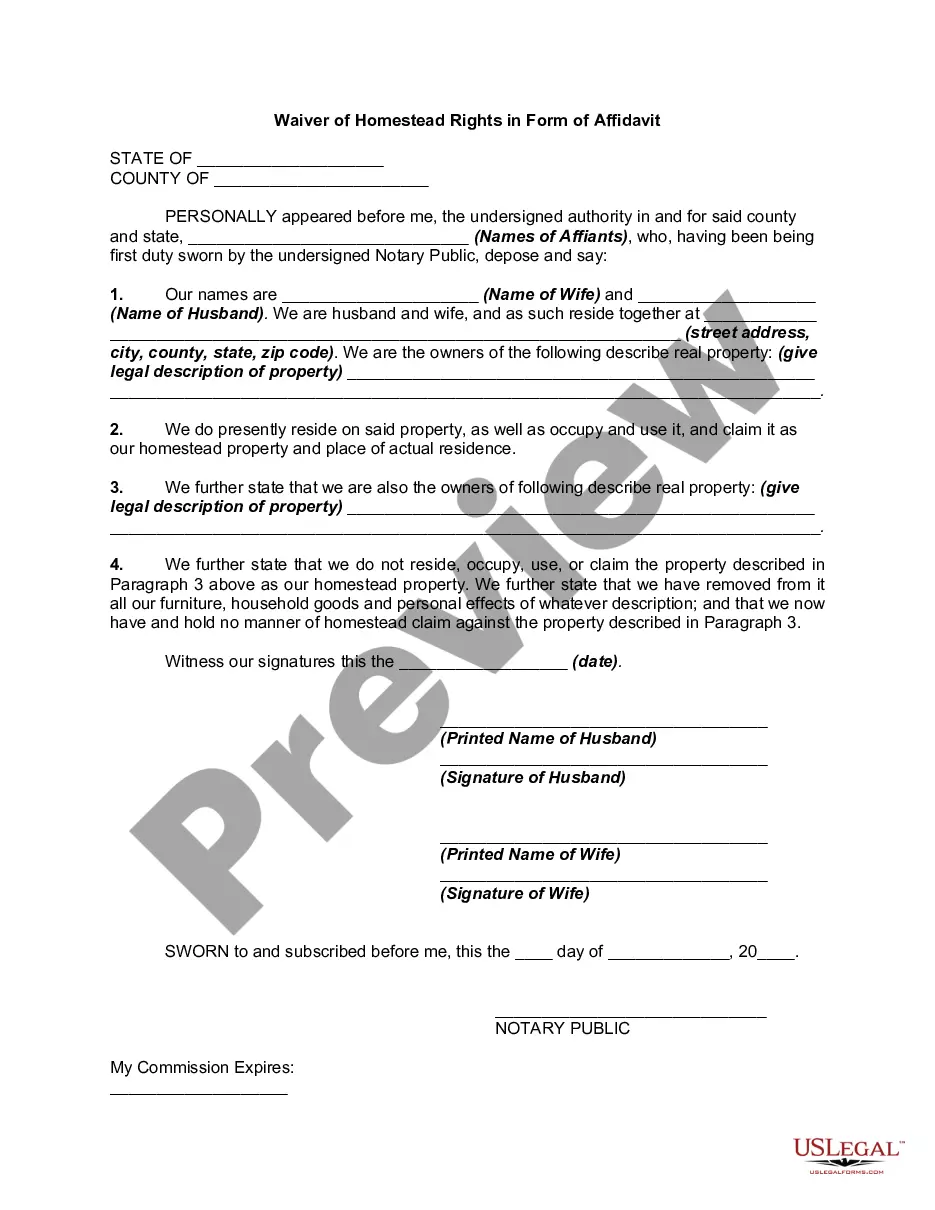

How to fill out California Declaration Of Abandonment Of Homestead Declaration?

Engaging with legal paperwork and protocols can be a lengthy addition to your overall day.

California Homestead Form With Decimals and similar documents often necessitate that you locate them and comprehend the most effective way to fill them out accurately.

For this reason, whether you are managing financial, legal, or personal matters, utilizing a thorough and functional online repository of forms readily available will significantly help.

US Legal Forms is the top online resource for legal templates, featuring over 85,000 state-specific documents and several tools that will assist you in completing your paperwork swiftly.

Simply Log In to your account, find California Homestead Form With Decimals, and download it instantly in the My documents section. You can also access previously saved documents.

- Browse the collection of relevant documents accessible to you with just one click.

- US Legal Forms provides you with state- and county-specific documents accessible at any time for download.

- Protect your document management procedures by employing a high-quality service that enables you to prepare any form within minutes without any extra or concealed fees.

Form popularity

FAQ

The articles of incorporation may be amended by written consent of all members entitled to vote on such amendment, as provided by section 606. If such unanimous written consent is given, no resolution of the board of directors proposing the amendment is necessary. [PL 1977, c. 525, §13 (NEW).]

Online: Go to their website under online services and follow the instructions provided on the interactive corporate services page to search and print a certified copy. A list of all filings for the Maine Corporation is provided. If the document is older it may not be available for online printing.

Maine's state fee to start an LLC is $175. Every year you own your Maine LLC, you'll also have to pay $85 to file an annual report. Beyond those two unavoidable fees, there are other expenses that could come up, like local business license fees and the cost of hiring a registered agent.

LLC ? The filing fee for reinstating an administratively dissolved LLC in Maine is $85. You also need to pay $150 as a penalty for every annual report you did not file. The limit for the penalty is $600. If you choose 24-hour processing, you need to pay another $50.

To start an LLC in Maine, you must file a Certificate of Formation with the Secretary of State and pay a $175 filing fee. LLCs must also pay an LLC annual fee and appoint a Registered Agent.

Every LLC or foreign LLC registered in Maine is required to submit an annual report that lists important information about the company, such as the following: Business name. Business address. Type of business.

You need to file an Annual Report in order to keep your LLC in compliance and in good standing with the state. You can file your LLC's Annual Report by mail or online. We recommend filing online since it's easier and the processing time is quicker. You will find instructions below for filing by mail and filing online.

An annual report is required to be filed every year in order to maintain a good standing status. The legal filing deadline is June 1st.