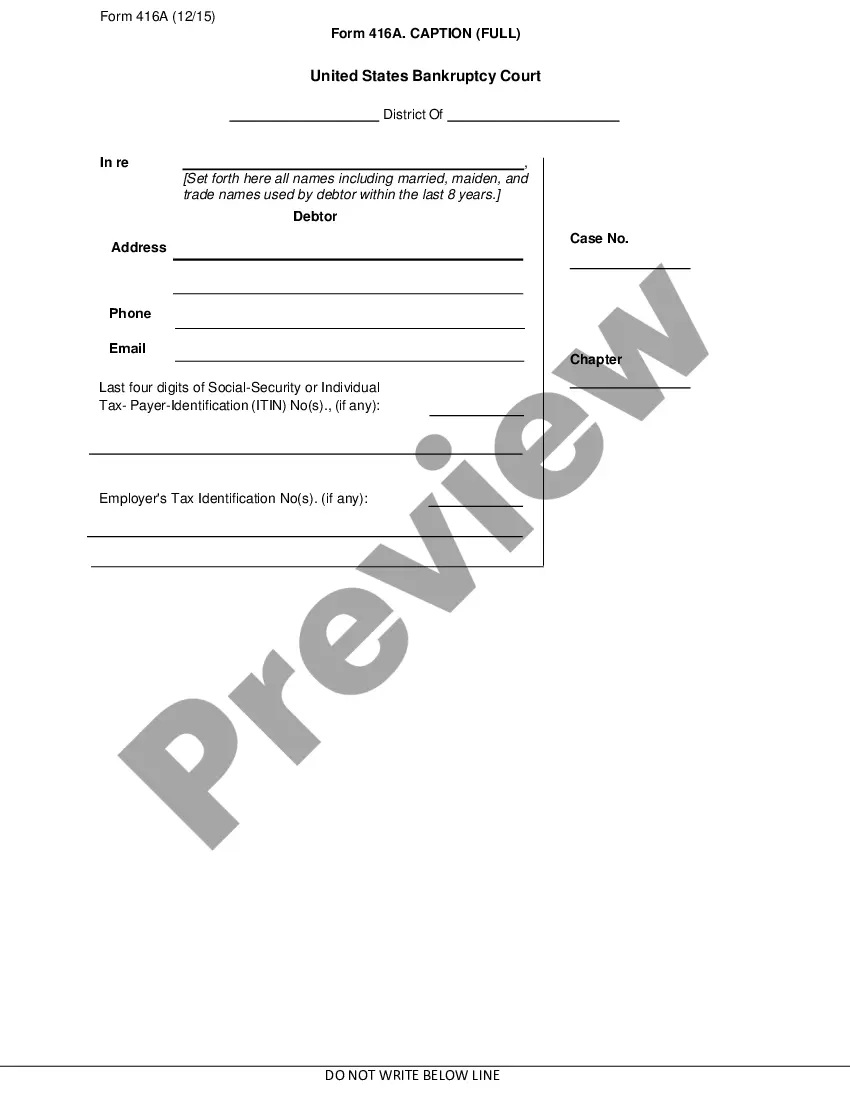

Ca Homestead Form For Florida

Description

How to fill out California Homestead Declaration For Single Person?

Creating legal documents from the beginning can occasionally be daunting.

Certain situations may require extensive research and significant financial investment.

If you’re looking for an easier and more cost-effective method of preparing the Ca Homestead Form For Florida or any other documents without unnecessary complications, US Legal Forms is always available to you.

Our digital repository of over 85,000 current legal forms covers nearly every facet of your financial, legal, and personal affairs.

Examine the form preview and descriptions to confirm that you have the document you need. Verify if the template you choose aligns with the laws and regulations of your state and county. Select the most suitable subscription plan to acquire the Ca Homestead Form For Florida. Download the form, then complete, certify, and print it. US Legal Forms has an impeccable reputation and over 25 years of experience. Join us today and make document completion a straightforward and efficient process!

- With just a few clicks, you can quickly access state- and county-specific documents carefully compiled for you by our legal professionals.

- Utilize our website whenever you require trustworthy and dependable services to effortlessly find and download the Ca Homestead Form For Florida.

- If you’re already familiar with our website and have created an account previously, just sign in to your account, find the form and download it or re-download it at any moment in the My documents section.

- Not signed up yet? No worries. It requires minimal time to establish your account and explore the library.

- However, before proceeding directly to download the Ca Homestead Form For Florida, consider these suggestions.

Form popularity

FAQ

A Declaration of Homestead may be declared and recorded by owners of real property on their principal place of residence to protect his/her home from forced sale in satisfaction of certain types of creditors' claims. Signatures on the Declaration of Homestead must be notarized.

The application for homestead exemption (Form DR- 501) and other exemption forms are on the Department's forms page and on most property appraisers' websites. Submit your homestead application to your county property apprsaiser. Click here for county property appraiser contact and website information.

Required Documentation for Homestead Exemption Copy of Florida Driver's License showing residential address. ... Florida Vehicle Registration or Florida Voter's Registration card, if registered. Social Security Number for each applicant and spouse even if the spouse does not own and/or reside on the property.

Filing for the Homestead Exemption can be done online. Homeowners may claim up to a $50,000 exemption on their primary residence. The first $25,000 of this exemption applies to all taxing authorities. The second $25,000 excludes school board taxes and applies to properties with assessed values greater than $50,000.