California Affidavit Form Ca Withholding

Description

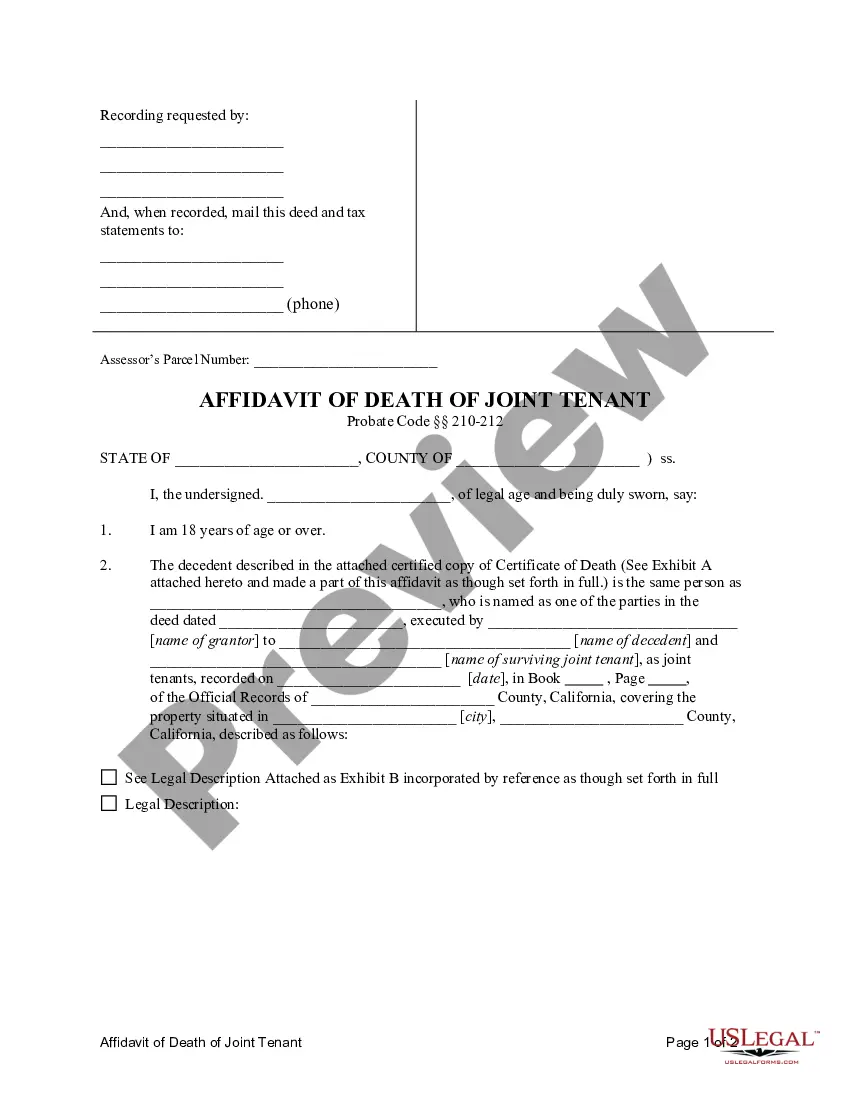

How to fill out California Affidavit Of Death Of Joint Tenant?

The California Affidavit Form Ca Withholding displayed on this page is a reusable legal template crafted by expert attorneys in accordance with federal and local statutes and regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with more than 85,000 authenticated, state-specific documents for any commercial and personal needs. It’s the fastest, easiest, and most reliable way to secure the forms you require, as the service assures the utmost level of data protection and anti-malware safety.

Register for US Legal Forms to have validated legal templates for all of life's situations readily available.

- Search for the document you require and examine it.

- Review the file you sought and preview it or check the form details to confirm it meets your requirements. If it does not, utilize the search bar to find the correct one. Click Buy Now once you have discovered the template you need.

- Register and Log In.

- Choose the pricing option that fits you best and create an account. Use PayPal or a credit card to make a quick payment. If you already possess an account, Log In and check your subscription to proceed.

- Obtain the editable template.

- Pick the format you desire for your California Affidavit Form Ca Withholding (PDF, Word, RTF) and save the document on your device.

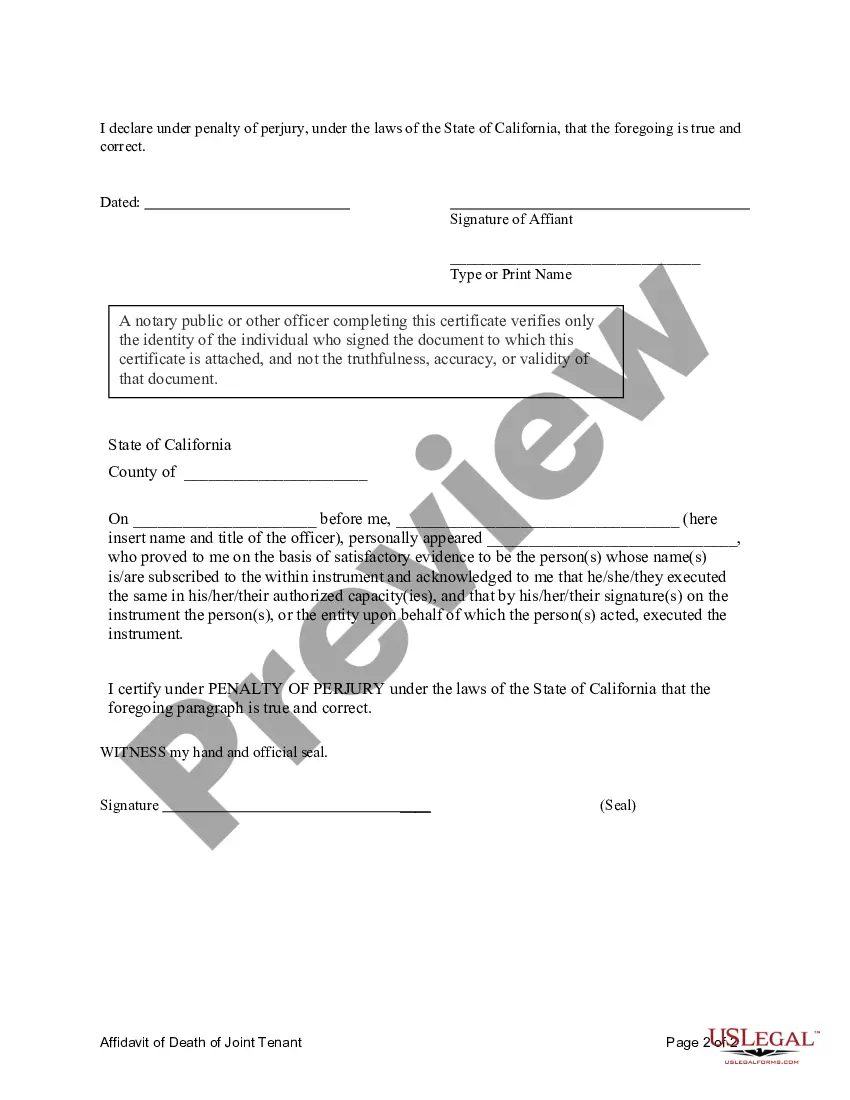

- Fill out and sign the document.

- Print the template to complete it by hand. Alternatively, use an online multifunctional PDF editor to swiftly and accurately fill out and sign your form with an eSignature.

- Download your documents again.

- Use the same document once more whenever necessary. Access the My documents tab in your profile to re-download any previously saved documents.

Form popularity

FAQ

State withholding is money that is withheld and sent to the State of California to pay California income taxes. It pays for state programs such as education, health and welfare, public safety, and the court justice system. California's elected representatives also meet every year to decide how this money will be spent.

Determine the additional withholding allowance for itemized deductions (AWAID) by applying the following guideline and subtract this amount from the gross annual wages: AWAID = $1,000 x Number of Itemized Allowances Claimed for Itemized Deductions on DE-4.

Wages paid to nonresidents of California for services performed inside the state are subject to withholding for state income tax; only wages paid to nonresidents of California for services performed outside the state are exempt from withholding. California does not distinguish between U.S. citizens, U.S. residents, and ...

Wages paid to nonresidents of California for services performed inside the state are subject to withholding for state income tax; only wages paid to nonresidents of California for services performed outside the state are exempt from withholding. California does not distinguish between U.S. citizens, U.S. residents, and ...

You must file the state form Employee's Withholding Allowance Certificate (DE 4) to determine the appropriate California PIT withholding. If you do not provide your employer with a withholding certificate, the employer must use Single with Zero withholding allowance.