Affidavit Death Joint Tenant Document With Deed

Description

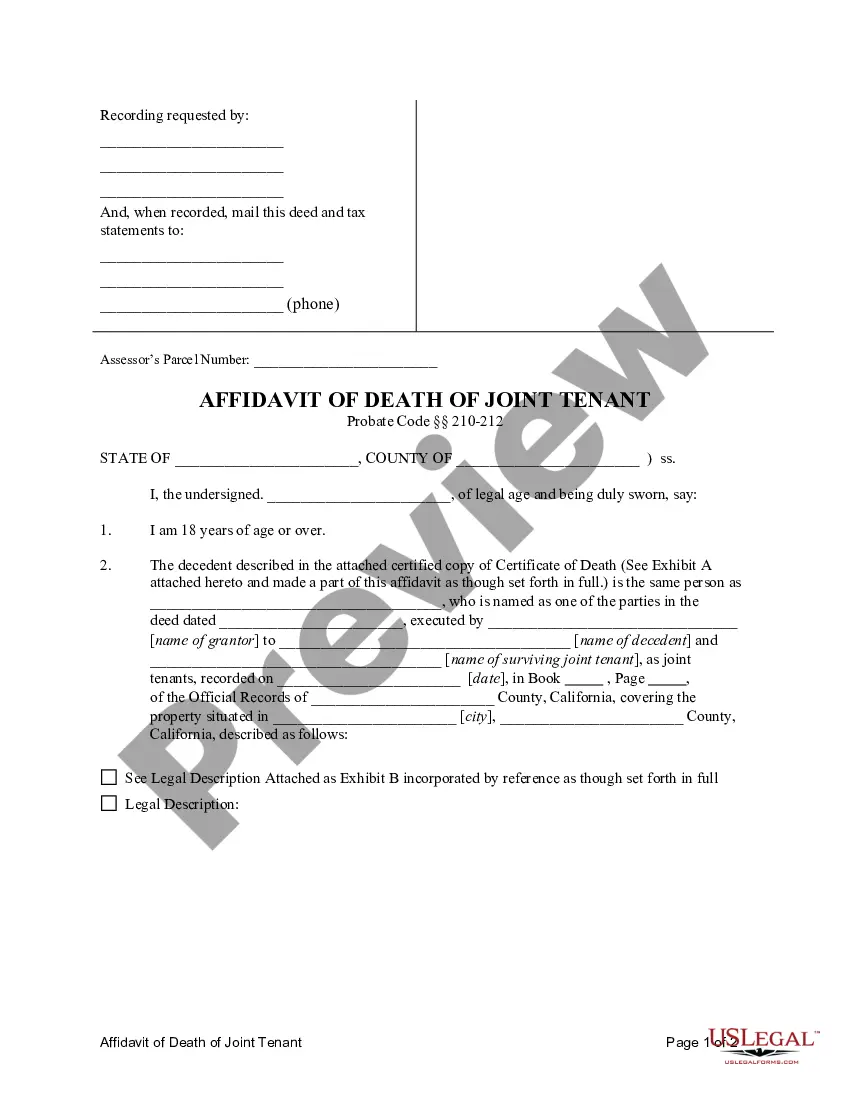

How to fill out California Affidavit Of Death Of Joint Tenant?

Whether for professional purposes or for personal issues, everyone inevitably encounters legal circumstances at some point in their lives.

Completing legal documents necessitates meticulous attention, starting with selecting the appropriate form template.

Pick the document format you desire and download the Affidavit Death Joint Tenant Document With Deed. Once it is downloaded, you can fill it out using editing software or print it and complete it manually. With a vast US Legal Forms catalog available, you don’t have to waste time searching for the right sample online. Utilize the library’s user-friendly navigation to find the suitable form for any situation.

- For instance, if you choose an incorrect version of the Affidavit Death Joint Tenant Document With Deed, it will be denied when you submit it.

- Thus, it is crucial to find a trustworthy source for legal documents such as US Legal Forms.

- If you require an Affidavit Death Joint Tenant Document With Deed template, follow these straightforward steps.

- Find the template you need by using the search bar or catalog browsing.

- Review the form’s details to confirm it suits your situation, state, and county.

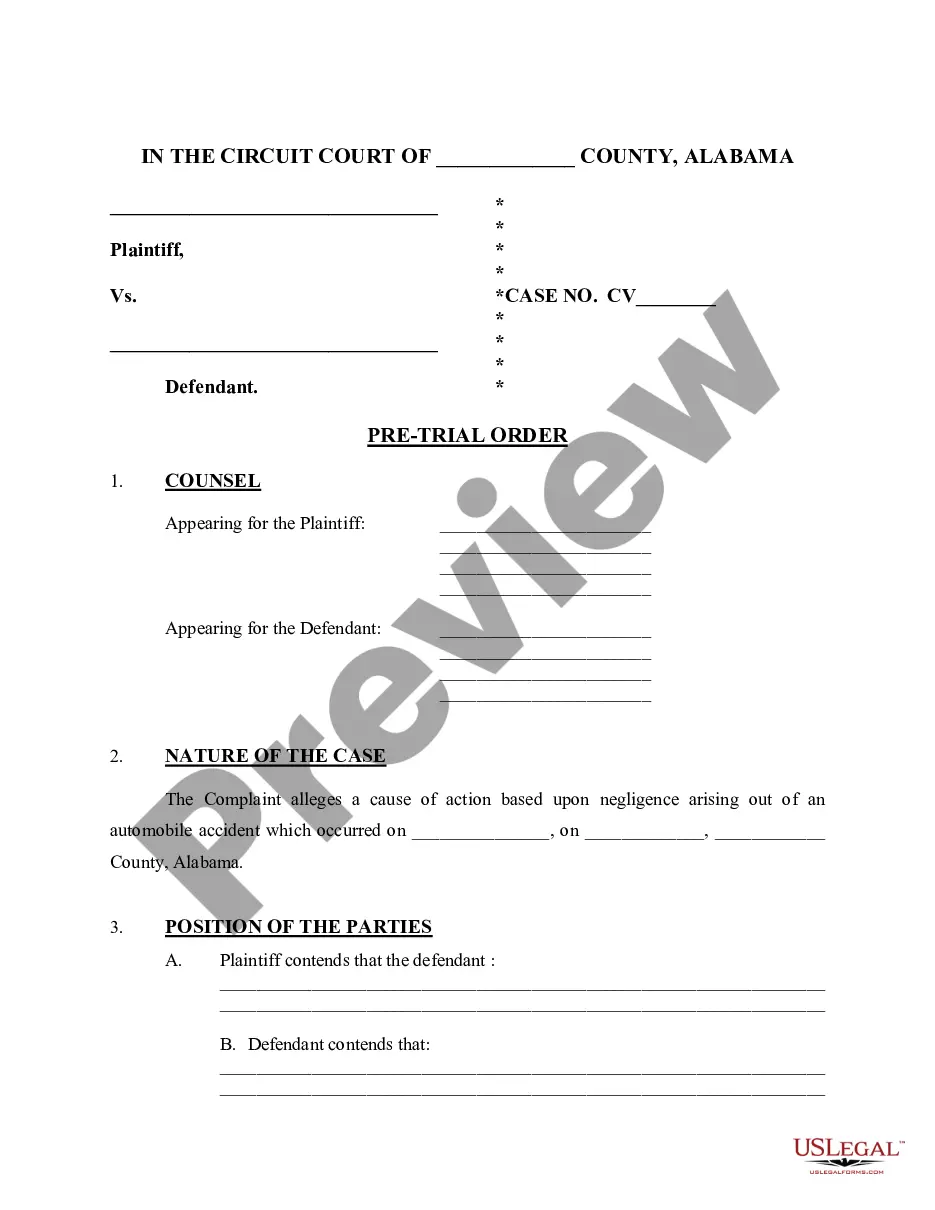

- Click on the form’s preview to view it.

- If it is the incorrect document, return to the search function to find the Affidavit Death Joint Tenant Document With Deed sample you require.

- Download the file when it aligns with your specifications.

- If you already hold a US Legal Forms account, simply click Log in to reach your previously saved files in My documents.

- If you do not have an account yet, you can download the form by selecting Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: you can use a credit card or PayPal account.

Form popularity

FAQ

An affidavit of survivorship should be filed in the county recorder's office where the property is located. This step officially documents the transfer of property ownership to the surviving joint tenant. Filing the Affidavit death joint tenant document with deed provides legal clarity and serves as a record of the event. It's important to check local regulations for any specific requirements.

When a joint tenant dies, the surviving tenant automatically inherits the deceased tenant's share of the property. This process simplifies the transfer of ownership, as it bypasses probate. To formalize this, the surviving tenant should prepare an Affidavit death joint tenant document with deed. This document helps establish clear title and protects the rights of the surviving tenant.

In California, you file an affidavit of death of joint tenant by first completing the required forms, which include the affidavit death joint tenant document with deed. Next, you must attach a certified copy of the death certificate. Finally, submit the completed forms to your local county recorder’s office, ensuring proper processing of the property title according to state laws.

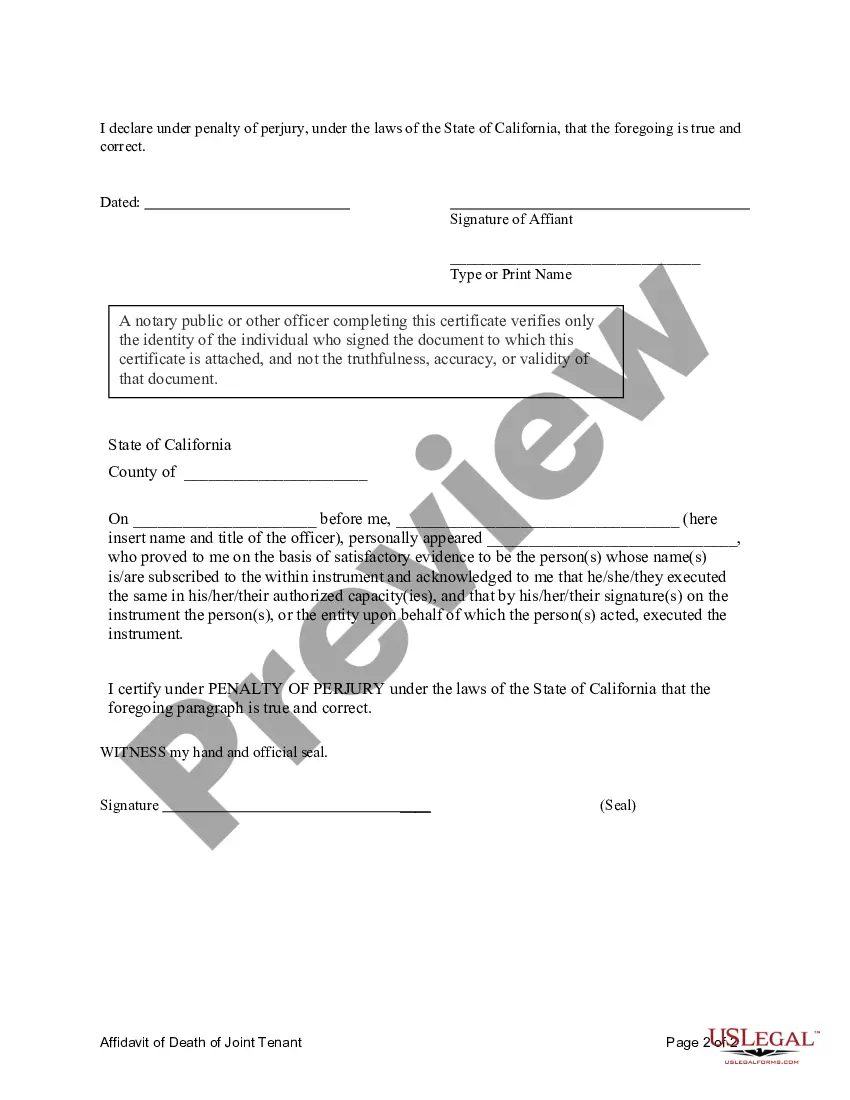

Yes, an affidavit of death generally needs to be notarized to ensure its authenticity and legal standing. Notarization adds an extra layer of protection by confirming the identities of the signers and the circumstances of the documents. As you prepare your affidavit death joint tenant document with deed, it is wise to have it notarized to facilitate acceptance by government agencies.

To file an affidavit of survivorship, you should first gather the necessary documents, which may include the death certificate and the original deed. After preparing the affidavit death joint tenant document with deed, file it with the local county recorder's office where the property is located. This filing legally recognizes the surviving tenant's ownership and ensures the property records are updated.

When a joint tenant dies, the property automatically transfers to the surviving joint tenant without the need for probate. This process occurs through the right of survivorship, which simplifies property transfer and avoids lengthy court processes. Therefore, having an affidavit death joint tenant document with deed can help clarify ownership and streamline this transition.

Submitting an Affidavit At the time of recording, present the completed affidavit (see below), a certified copy of the death certificate and a Preliminary Change of Ownership Report, which is also available at RR/CC offices in Norwalk, Lancaster, LAX Courthouse and Van Nuys, as well as the County Assessor's offices.

The Affidavit sets out the details of the deceased's passing and the value of the estate. You must provide a copy of the death certificate when you register the affidavit. Jointly owned property does not go through probate. Filing the Illinois Survivorship Affidavit is sufficient to transfer ownership to the survivor.

Affidavit-death forms are used to change the title on rea?l property after the death of a joint tenant, trustee or trustor. Information and forms are available from the Sacramento County Public Law Library. Blank forms may also be available at office supply stores.

Joint tenancy is a way for two or more people to own property in equal shares so that when one of the joint tenants dies, the property can pass to the surviving joint tenant(s) without having to go through probate court.